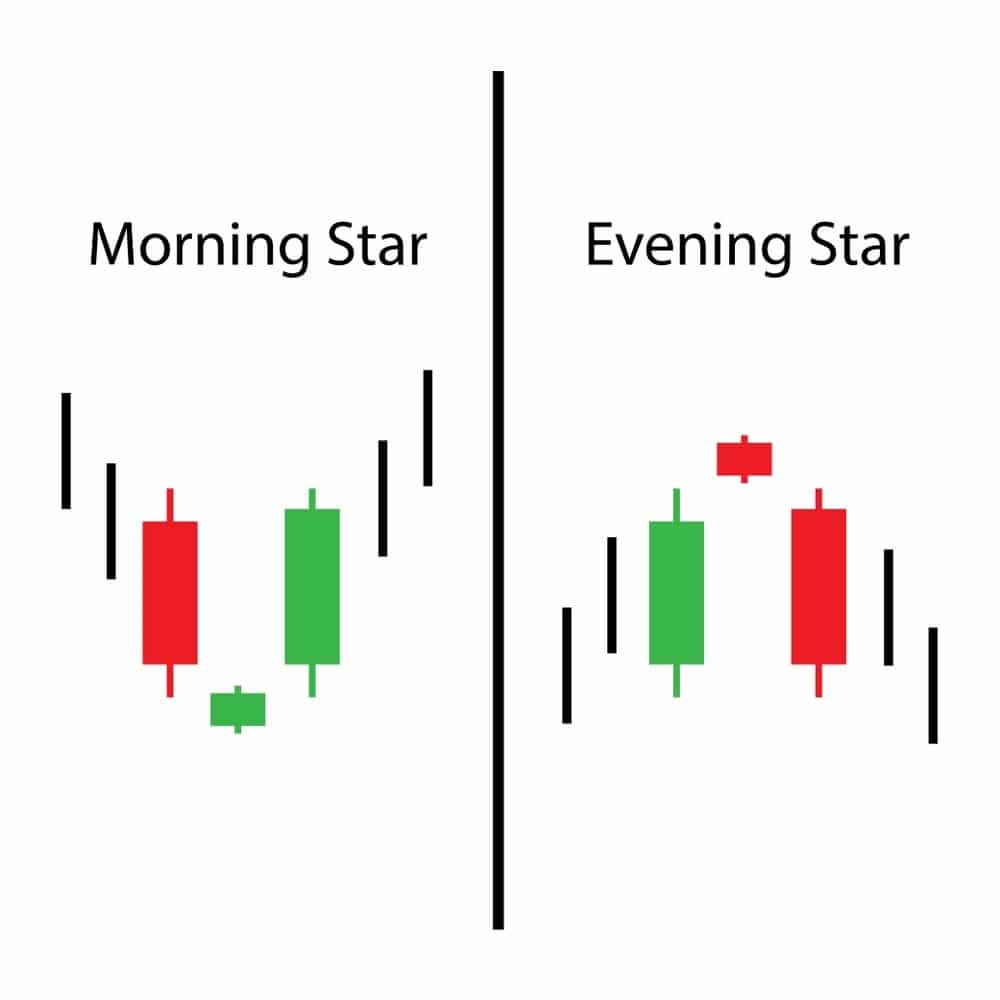

Are you getting tired of a downtrending market? Are you wondering when it is going to end? If so, the morning star candlestick pattern is one formation to watch for. This pattern is a strong indication of a bullish turn on the way.

This pattern begins in a bearish market, with the first candlestick seeming to continue this with a long black stick. The second day begins at a significant gap down, but may be any color so long as it is short. This type of candlestick is commonly called a star. A star is suggestive of market ambivalence and possibly a bottom floor for prices. The third and final day has a long white candlestick that extends past the midpoint of the first day’s candlestick.

The ‘V’ pattern of this candlestick pattern is easy to interpret. The market has been in a steady downturn, but it hits its lowest point and begins the long climb back upward. Clearly, sellers are losing strength while the buyers are rallying. Because of this, the morning star pattern is considered a strong indicator of a bullish reversal in the future.

Your Next Move

Your next move when you see the morning star pattern should be to buy while the price is still low. Because this is a three day pattern, the reversal that it suggests is even more likely to happen; in fact, many traders see the third day as confirmation of the first two days. However, if you want to wait for confirmation on the fourth trading day, it will likely present itself.

Confirmation

Confirmation of this pattern can include any kind of bullish move, such as a sizeable gap up at the opening of the fourth trading day, a higher close, or a white candlestick of any length. The higher the third and fourth day compared to the first, the more likely this reversal is to happen. Again, confirmation is nice, but not necessary.

Variations

There are a few variations of the morning star candlestick pattern that can be significant. First, if the second day of the pattern has a white candlestick, a reversal is all the more likely. Second, the further into the first day’s candlestick the third day penetrates, the more indicative of an uptrend this pattern is.

Similar Pattern

The morning star is a confirmation of the reversal-indicating bullish doji star. This is why the formation does not require confirmation; it is confirmation in itself of another pattern. It is similar to the abandoned baby, except that with the abandoned baby, the third day both opens below and closes above the first day’s candlestick. Because this is very rare, the morning star is both less rare and less strong of an indicator. However, the morning star is certainly a strong indicator of a reversal on its own.

If you are looking to get in on some great stock at a bargain basement price, the morning star pattern is an important one to look for. While this formation may be unusual, that makes it all the more significant. If you ignore this stock, you are setting yourself up to miss out on a healthy profit.