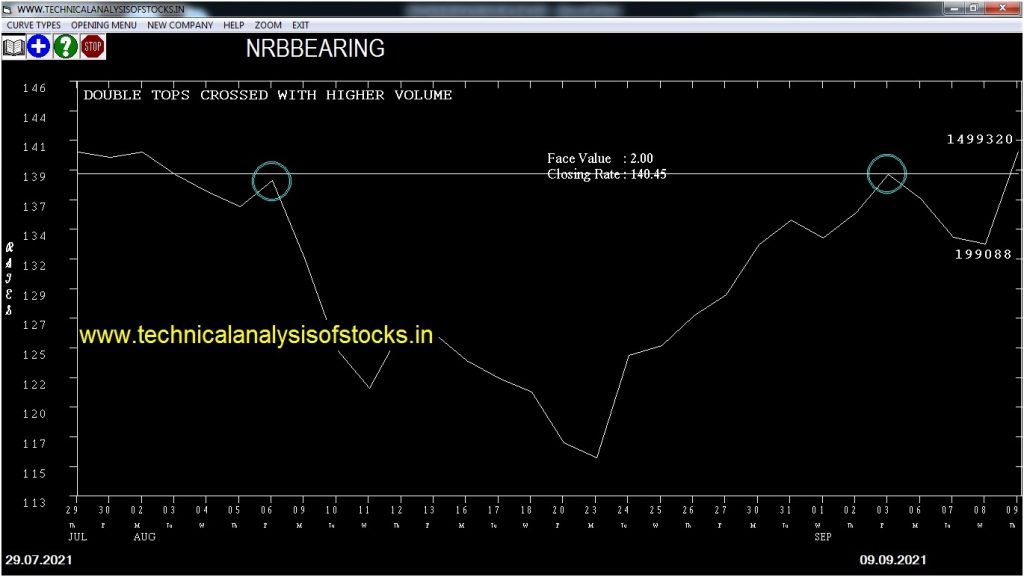

BUY NRBBEARING (NSE Symbol) Buy@ 141 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 126.60 Target : 153.05 (Short term)

HOT BUZZING STOCKS (13.09.2020)

NSE SYMBOL CLOSING RATE

SYMBOL RATE

ROML 94.20

BROOKS 144.25

FSC 72.10

SHEMAROO 137.20

SECURKLOUD 168.15

MAJESCO 88.95

UJJIVAN 157.35

FRETAIL 50.50

PITTIENG 166.10

ZENTEC 205.10

PFOCUS 87.55

FLFL 53.90

NGIL 93.20

LYKALABS 75.40

TRF 119.50

AHLADA 148.40

SHREYAS 346.60

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NH | 12390 | 537.55 | 538.70 | 0.21 |

| MARICO (F&O) | 68632 | 572.00 | 575.00 | 0.52 |

| SHYAMMETL | 27451 | 402.80 | 407.20 | 1.08 |

| KIRIINDUS | 10327 | 529.40 | 539.80 | 1.93 |

| WELCORP | 25634 | 121.35 | 124.95 | 2.88 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| WINDLAS | 15043 | 387.50 | 385.75 | 0.45 |

| GICRE | 11392 | 145.00 | 144.20 | 0.55 |

| MOTILALOFS | 14650 | 793.10 | 785.35 | 0.99 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| HGINFRA | 22002 | 606.39 | 576.29 | 630.95 | 602.15 | 602.45 | -0.05 |

| UBL (F&O) | 29098 | 1600.00 | 1551.17 | 1639.43 | 1599.95 | 1608.25 | -0.52 |

| MANAPPURAM (F&O) | 15555 | 165.77 | 150.14 | 178.80 | 165.05 | 166.25 | -0.73 |

| CIPLA (F&O) | 36179 | 953.27 | 915.52 | 983.90 | 949.30 | 960.00 | -1.13 |

| GUFICBIO | 11917 | 203.06 | 185.73 | 217.45 | 199.70 | 202.05 | -1.18 |

| HCG | 10359 | 244.14 | 225.11 | 259.89 | 241.70 | 244.65 | -1.22 |

| AUBANK (F&O) | 24010 | 1181.64 | 1139.63 | 1215.66 | 1173.75 | 1190.00 | -1.38 |

| MFSL (F&O) | 31457 | 1089.00 | 1048.66 | 1121.69 | 1085.35 | 1100.75 | -1.42 |

| SAIL (F&O) | 72618 | 123.77 | 110.31 | 135.07 | 122.20 | 125.20 | -2.45 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| ICICIBANK (F&O) | 137588 | 715.56 | 749.02 | 689.41 | 720.25 | 717.20 | 0.42 |

| NIACL | 11303 | 156.25 | 172.18 | 144.07 | 159.25 | 156.25 | 1.88 |

| PIIND (F&O) | 22300 | 3393.06 | 3464.53 | 3336.73 | 3407.05 | 3329.00 | 2.29 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| EIHOTEL | 2.57% |

| CREDITACC | 2.91% |

| SONATSOFTW | 3.46% |

| NMDC (F&O) | 3.59% |

| GSFC | 3.74% |

| LAURUSLABS | 3.94% |

| CARTRADE | 3.99% |

| LAURUSLABS | 4.31% |

| MAXHEALTH | 4.55% |

| EIDPARRY | 4.67% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HGINFRA | 0.05% |

| UBL (F&O) | 0.52% |

| TATASTEEL (F&O) | 0.59% |

| MCDOWELL-N (F&O) | 0.73% |

| MANAPPURAM (F&O) | 0.73% |

| DMART | 0.74% |

| SCI | 0.86% |

| TATAINVEST | 0.95% |

| CIPLA (F&O) | 1.13% |

| GUFICBIO | 1.18% |

| HCG | 1.22% |

| AUBANK (F&O) | 1.38% |

| MFSL (F&O) | 1.42% |

| PIIND (F&O) | 1.46% |

| ACC (F&O) | 1.60% |

| JSWSTEEL (F&O) | 1.71% |

| TCS (F&O) | 1.79% |

| GODREJCP (F&O) | 1.81% |

| EIDPARRY | 1.84% |

| SUNTV (F&O) | 1.91% |

| AARTIIND (F&O) | 1.91% |

| VIPIND | 1.96% |

| NIACL | 2.01% |

| ICICIBANK (F&O) | 2.02% |

| SUDARSCHEM | 2.11% |

| SONATSOFTW | 2.11% |

| HINDALCO (F&O) | 2.25% |

| BAJFINANCE (F&O) | 2.26% |

| INDIANB | 2.32% |

| WOCKPHARMA | 2.37% |

| SAIL (F&O) | 2.45% |

| NBVENTURES | 2.57% |

| TATACOFFEE | 2.61% |

| BAJAJFINSV (F&O) | 2.68% |

| KSCL | 2.68% |

| ITDC | 2.93% |

| ABB | 2.97% |

| ABFRL (F&O) | 3.01% |

| AVANTIFEED | 3.17% |

| ADANIENT (F&O) | 3.36% |

| UTIAMC | 3.42% |

| MAXHEALTH | 3.76% |

| OBEROIRLTY | 3.81% |

| IBULHSGFIN (F&O) | 3.85% |

| REPCOHOME | 3.98% |

| VRLLOG | 4.02% |

| EMAMILTD | 4.36% |

| BSOFT | 4.51% |

| WINDLAS | 4.94% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES (Intraday/Short term)

KOLTEPATIL Sell @ 290 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

ICICIBANK (F&O) Sell @ 715.50 or Below

RELIANCE (F&O) Sell @ 2425.55 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BALMLAWRIE

BANCOINDIA

CENTURYPLY

CHEMPLASTS

DLF (F&O)

EASEMYTRIP

ISEC

LINDEINDIA

MANINDS

MHRIL

PARAGMILK

POWERINDIA

RELAXO

ROUTE

SWSOLAR

VGUARD

VOLTAS (F&O)

VSSL

ZOMATO

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

GMBREW

INTELLECT

MANGLMCEM

PIONDIST

PTC

SHALBY

TDPOWERSYS

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMARAJABAT (F&O)

ASIANPAINT (F&O)

BDL

BERGEPAINT (F&O)

BLISSGVS

CADILAHC (F&O)

DEEPAKNTR (F&O)

DMART

DRREDDY (F&O)

GSPL

HDFCBANK (F&O)

HEROMOTOCO (F&O)

ICICILOVOL

INOXLEISUR

JUSTDIAL

KPITTECH

KSCL

LALPATHLAB (F&O)

LTTS (F&O)

M&M (F&O)

MCDOWELL-N (F&O)

MON100

SBIN (F&O)

STARCEMENT

TATACOMM

VISHAL

Higher Level Consolidation

BAJAJFINSV (F&O)

BERGEPAINT (F&O)

BPCL (F&O)

CADILAHC (F&O)

DMART

DRREDDY (F&O)

EIDPARRY

FINPIPE

HDFCLIFE (F&O)

HEROMOTOCO (F&O)

HINDUNILVR (F&O)

JSWSTEEL (F&O)

M&M (F&O)

MGL (F&O)

SBIN (F&O)

TATASTEEL (F&O)

ULTRACEMCO (F&O)

Lower Level Consolidation

AVANTIFEED

BAJAJFINSV (F&O)

BDL

BERGEPAINT (F&O)

CADILAHC (F&O)

DRREDDY (F&O)

EIDPARRY

GODREJPROP (F&O)

GUJALKALI

ITC (F&O)

JSWSTEEL (F&O)

JUSTDIAL

KSCL

LAURUSLABS

M&M (F&O)

MANINDS

MGL (F&O)

RADICO

RBLBANK (F&O)

SAIL (F&O)

SBIN (F&O)

SRTRANSFIN (F&O)

STARCEMENT

TATACOMM

TATASTEEL (F&O)

TNPL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BASML

FSC

IIFLWAM

LINCOLN

LXCHEM

NGIL

ROML

SHEMAROO

GAP DOWN BREAKOUT STOCKS

SBILIFE (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

GOACARBON

GTPL

HITECH

INDSWFTLAB

LYKALABS

PRICOLLTD

SECURKLOUD

SHYAMMETL

SUBROS

TTKPRESTIG

BEARISH ENGULFING

AHLADA

MINDACORP

SHREYAS

TBZ

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

AEGISCHEM

IOLCP

GLS

SUPRAJIT

AUBANK (F&O)

WOCKPHARMA

M&M (F&O)

GUJGASLTD (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

PIDILITIND (F&O)

GODREJAGRO

HDFC (F&O)

MARICO (F&O)

PETRONET (F&O)

BRITANNIA (F&O)

GODREJCP (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

MPSLTD

NIITLTD

UJJIVAN

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

SHREYAS

WELSPUNIND

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

GATI

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

FSC

ROML

BEARISH MARUBOZU PATTERN

AHLADA

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

FLFL

HITECH

INDSWFTLAB

LYKALABS

MAJESCO

MARICO (F&O)

SONATSOFTW

BEARISH BELLHOLD PATTERN

SHREYAS

VISHAL

WALCHANNAG

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

ALPHAGEO

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BEPL

COALINDIA (F&O)

DHANUKA

ESCORTS (F&O)

GAIL (F&O)

HDFCLIFE (F&O)

HINDZINC

ICICIGI (F&O)

MIRZAINT

STARCEMENT

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CAPACITE

ENGINERSIN

ITI

L&TFH (F&O)

LUPIN (F&O)

MIDHANI

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| AMARAJABAT (F&O) | 721.35 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

| BHARATFORG (F&O) | 773.85 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| LUPIN (F&O) | 981.80 | 984.39 | 976.56 | 991.75 | 999.64 | 1007.56 | 1015.51 |

| CIPLA (F&O) | 949.30 | 953.27 | 945.56 | 960.52 | 968.28 | 976.07 | 983.90 |

| WIPRO (F&O) | 662.35 | 663.06 | 656.64 | 669.18 | 675.66 | 682.17 | 688.72 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TATAMETALI | 1030.20 | 1024.00 | 1032.02 | 1016.52 | 1008.57 | 1000.64 | 992.75 |

| IOLCP | 552.15 | 546.39 | 552.25 | 540.83 | 535.03 | 529.26 | 523.53 |

| TNPETRO | 113.50 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| PTC | 101.35 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| INDIACEM | 181.95 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ASHOKLEY (F&O) | 39201010 | 125.30 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| ONGC (F&O) | 27242637 | 122.15 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| BHARTIARTL (F&O) | 19419892 | 686.15 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| PFC (F&O) | 12500381 | 135.20 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| INDHOTEL (F&O) | 9813885 | 150.80 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| ZEEL (F&O) | 8692351 | 183.00 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| GREAVESCOT | 6799422 | 141.40 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| INDUSTOWER (F&O) | 6586351 | 242.30 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| LXCHEM | 5974763 | 516.75 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| ASTERDM | 4307334 | 227.25 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| JSL | 4294187 | 164.05 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| ZENTEC | 4215901 | 205.10 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| MARICO (F&O) | 4180525 | 575.00 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

| HINDOILEXP | 3729575 | 193.95 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| OIL | 3657307 | 194.90 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| REDINGTON | 3090995 | 145.45 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| BSE | 2555004 | 1241.60 | 1242.56 | 1233.77 | 1250.76 | 1259.62 | 1268.51 | 1277.42 |

| ZENSARTECH | 2330770 | 467.80 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| COROMANDEL (F&O) | 2171045 | 814.40 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| BLS | 2049275 | 245.00 | 248.06 | 244.14 | 251.89 | 255.87 | 259.89 | 263.93 |

| NOCIL | 1741905 | 283.55 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| DCAL | 1562311 | 200.50 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| ASIANTILES | 1237568 | 161.10 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| SEQUENT | 1220502 | 236.15 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| PRINCEPIPE | 1189466 | 718.70 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SBILIFE (F&O) | 10115407 | 1173.20 | 1173.06 | 1181.64 | 1165.10 | 1156.58 | 1148.09 | 1139.63 |

| IBREALEST | 6699815 | 144.05 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| WELSPUNIND | 4484396 | 133.15 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| CANFINHOME | 4215589 | 624.75 | 618.77 | 625.00 | 612.87 | 606.69 | 600.55 | 594.44 |

| ICICIPRULI (F&O) | 1399121 | 696.70 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| ALLCARGO | 1391328 | 238.75 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| KEI | 1100983 | 793.80 | 791.02 | 798.06 | 784.39 | 777.40 | 770.45 | 763.52 |

| PRESTIGE | 1053295 | 429.25 | 425.39 | 430.56 | 420.46 | 415.35 | 410.27 | 405.22 |

| CHAMBLFERT | 749946 | 305.85 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| MOIL | 704508 | 163.75 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| ALEMBICLTD | 663204 | 114.40 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| INDIGO (F&O) | 633432 | 1911.60 | 1903.14 | 1914.06 | 1893.20 | 1882.33 | 1871.50 | 1860.70 |

| MHRIL | 609774 | 232.70 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| NEOGEN | 439697 | 1157.80 | 1156.00 | 1164.52 | 1148.09 | 1139.63 | 1131.21 | 1122.81 |

| JKLAKSHMI | 399044 | 714.40 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| MOTILALOFS | 386662 | 785.35 | 784.00 | 791.02 | 777.40 | 770.45 | 763.52 | 756.63 |

| DLINKINDIA | 369638 | 137.25 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| CENTURYPLY | 323384 | 411.20 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| SHREYAS | 320104 | 346.60 | 342.25 | 346.89 | 337.81 | 333.23 | 328.68 | 324.16 |

| VRLLOG | 293637 | 338.40 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| PNCINFRA | 288529 | 359.80 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| PANACEABIO | 238764 | 297.00 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| WINDLAS | 226032 | 385.75 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| DOLLAR | 210890 | 384.85 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |

| BAJAJELEC | 207582 | 1324.45 | 1323.14 | 1332.25 | 1314.72 | 1305.67 | 1296.65 | 1287.66 |