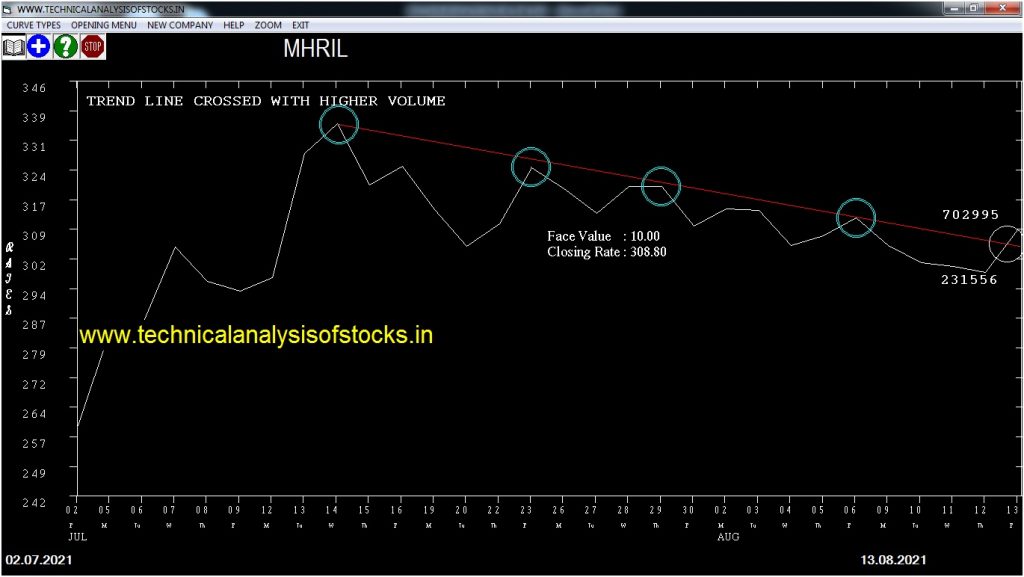

BUY MHRIL (NSE Symbol) Buy @ 310.65 or Above after cooling period. SIGNAL : TREND LINE CROSSED WITH HIGHER VOLUME. Stop Loss : 289.15 Target : 328.35 (Short term)

HOT BUZZING STOCKS (16.08.2021)

NSE SYMBOL CLOSING RATE

TDPOWERSYS 224.50

HINDOILEXP 169.45

THEMISMED 1134.50

NELCO 493.95

AGARIND 337.70

DPWIRES 243.85

HEXATRADEX 192.70

SANGAMIND 153.50

BSL 64.40

KPIGLOBAL 135.25

INDOTHAI 74.20

HINDCON 70.10

HPL 71.15

CTE 59.45

BANSWRAS 181.35

LYKALABS 80.05

ISFT 111.55

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| TITAN (F&O) | 55991 | 1831.60 | 1837.90 | 0.34 |

| TIINDIA | 28555 | 1214.00 | 1233.85 | 1.61 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| DRREDDY (F&O) | 73614 | 4666.50 | 4652.20 | 0.31 |

| BRITANNIA (F&O) | 32100 | 3606.25 | 3579.55 | 0.75 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| INDIGO (F&O) | 66977 | 1681.00 | 1630.96 | 1721.39 | 1676.60 | 1699.75 | -1.38 |

| GRINFRA | 43859 | 1670.77 | 1620.87 | 1711.03 | 1662.10 | 1703.35 | -2.48 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| BAJFINANCE (F&O) | 61446 | 6142.64 | 6237.88 | 6067.55 | 6156.55 | 6136.05 | 0.33 |

| DIVISLAB (F&O) | 40401 | 4935.06 | 5020.75 | 4867.50 | 4948.70 | 4831.00 | 2.38 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| DIVISLAB (F&O) | 0.83% |

| LTTS (F&O) | 3.26% |

| SUNPHARMA (F&O) | 3.35% |

| SHILPAMED | 4.38% |

| PRINCEPIPE | 5.19% |

| INOXLEISUR | 5.61% |

| CSBBANK | 5.65% |

| ORIENTELEC | 7.19% |

| HINDALCO (F&O) | 7.23% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| INDIGO (F&O) | 1.38% |

| TATASTEEL (F&O) | 1.38% |

| HAVELLS (F&O) | 1.43% |

| ICICIBANK (F&O) | 1.79% |

| BAJFINANCE (F&O) | 1.84% |

| BRITANNIA (F&O) | 1.94% |

| LTTS (F&O) | 2.48% |

| GRINFRA | 2.48% |

| ITC (F&O) | 2.51% |

| JUSTDIAL | 2.54% |

| GUJGASLTD (F&O) | 2.55% |

| SUNPHARMA (F&O) | 3.03% |

| BALRAMCHIN | 3.03% |

| HINDOILEXP | 3.16% |

| QUESS | 3.65% |

| M&MFIN (F&O) | 3.67% |

| DEEPINDS | 3.67% |

| BAJAJFINSV (F&O) | 4.24% |

| SONATSOFTW | 4.37% |

| BRIGADE | 4.59% |

| DRREDDY (F&O) | 4.79% |

| PEL (F&O) | 4.88% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

JUSTDIAL Sell @ 954 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ALEMBICLTD

ANGELBRKG

ARIHANTSUP

ASHIANA

BAJAJFINSV (F&O)

BALMLAWRIE

BOROLTD

BSE

CAMS

CANFINHOME

CAPACITE

CAPLIPOINT

COSMOFILMS

HINDZINC

IEX

INDHOTEL (F&O)

INDIACEM

JINDALPOLY

JKIL

JUBLFOOD (F&O)

KALPATPOWR

LTTS (F&O)

MUTHOOTFIN (F&O)

NRBBEARING

ORIENTCEM

PNCINFRA

RHIM

SBICARD

SHREYAS

SIRCA

STOVEKRAFT

TAJGVK

TEMBO

VETO

VGUARD

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIENT (F&O)

BASF

TATAINVEST

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ASIANPAINT (F&O)

BAJFINANCE (F&O)

BERGEPAINT (F&O)

COLPAL (F&O)

MON100

SBICARD

ULTRACEMCO (F&O)

Higher Level Consolidation

BRITANNIA (F&O)

COLPAL (F&O)

HDFCAMC (F&O)

ICICIBANK (F&O)

ICICIGI (F&O)

JKLAKSHMI

MON100

PETRONET (F&O)

SBICARD

UPL (F&O)

Lower Level Consolidation

ASIANPAINT (F&O)

HDFCLIFE (F&O)

HINDUNILVR (F&O)

JUSTDIAL

MON100

RAJESHEXPO

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BROOKS

GNFC

MSTCLTD

PITTIENG

REDINGTON

SHREEPUSHK

GAP DOWN BREAKOUT STOCKS

APOLLO

AUROPHARMA (F&O)

NUCLEUS

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

TATASTEEL (F&O)

BEARISH ENGULFING

CLSEL

HCG

HUHTAMAKI

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

TDPOWERSYS

BEARISH MARUBOZU PATTERN

BANSWRAS

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

ARIES

HARRMALAYA

MARKSANS

SEQUENT

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ALEMBICLTD

BALMLAWRIE

BANKBARODA (F&O)

HDFCBANK (F&O)

IBULHSGFIN (F&O)

IOC (F&O)

MCDOWELL-N (F&O)

MGL (F&O)

NATCOPHARM

SBICARD

TATAMOTORS (F&O)

TNPL

UFO

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BIOCON (F&O)

HDFCLIFE (F&O)

L&TFH (F&O)

LUPIN (F&O)

POWERGRID (F&O)

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BIRLACORPN | 1378.75 | 1387.56 | 1378.27 | 1396.19 | 1405.55 | 1414.93 | 1424.35 |

| GLS | 757.75 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| HINDUNILVR (F&O) | 2404.50 | 2413.27 | 2401.00 | 2424.35 | 2436.67 | 2449.02 | 2461.41 |

| WONDERLA | 236.25 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| SUVENPHAR | 542.95 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TAJGVK | 128.25 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| BAJAJCON | 261.90 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

| SIS | 467.45 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| SPARC | 280.20 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| MINDACORP | 132.15 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BHARTIARTL (F&O) | 20690579 | 637.05 | 637.56 | 631.27 | 643.57 | 649.92 | 656.31 | 662.73 |

| TATACONSUM (F&O) | 7956492 | 807.45 | 812.25 | 805.14 | 818.98 | 826.15 | 833.35 | 840.58 |

| ALLCARGO | 7542342 | 213.70 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| HCLTECH (F&O) | 7270809 | 1119.45 | 1122.25 | 1113.89 | 1130.08 | 1138.49 | 1146.94 | 1155.42 |

| CADILAHC (F&O) | 6662740 | 558.45 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| LT (F&O) | 5439442 | 1668.40 | 1670.77 | 1660.56 | 1680.16 | 1690.42 | 1700.71 | 1711.03 |

| DABUR (F&O) | 5318962 | 588.30 | 594.14 | 588.06 | 599.95 | 606.09 | 612.26 | 618.46 |

| JKTYRE | 4516088 | 161.35 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| CUMMINSIND (F&O) | 4501067 | 975.55 | 976.56 | 968.77 | 983.90 | 991.75 | 999.64 | 1007.56 |

| TCS (F&O) | 4363584 | 3463.40 | 3466.27 | 3451.56 | 3479.26 | 3494.02 | 3508.81 | 3523.63 |

| JUBLINGREA | 4150838 | 719.35 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

| JSL | 4015378 | 159.25 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| REDINGTON | 2925475 | 346.45 | 346.89 | 342.25 | 351.39 | 356.09 | 360.82 | 365.58 |

| ASHOKA | 2836759 | 104.90 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| SONACOMS | 2797664 | 501.80 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| CHAMBLFERT | 2474012 | 331.70 | 333.06 | 328.52 | 337.47 | 342.08 | 346.72 | 351.39 |

| VINYLINDIA | 1858371 | 209.25 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| SIEMENS (F&O) | 1677457 | 2244.75 | 2256.25 | 2244.39 | 2267.01 | 2278.92 | 2290.87 | 2302.85 |

| WOCKPHARMA | 1674028 | 512.10 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| KNRCON | 1558126 | 285.80 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| MOIL | 1244899 | 181.60 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| JSLHISAR | 1200750 | 292.80 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| AWHCL | 1137255 | 383.45 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| CENTURYTEX | 1091484 | 788.75 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| VISHAL | 996571 | 115.05 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ASHOKLEY (F&O) | 36478969 | 130.30 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| IBREALEST | 7312043 | 149.80 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| M&MFIN (F&O) | 5246750 | 151.35 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| EICHERMOT (F&O) | 4134045 | 2546.80 | 2537.64 | 2550.25 | 2526.33 | 2513.77 | 2501.25 | 2488.76 |

| RECLTD (F&O) | 3359125 | 146.85 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| GRANULES (F&O) | 2720057 | 360.70 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| SEQUENT | 2718819 | 252.65 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| MAXHEALTH | 2180426 | 318.75 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| EASEMYTRIP | 1596575 | 472.05 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| IRB | 1494051 | 160.70 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| RELIGARE | 1367128 | 147.65 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SUDARSCHEM | 1208297 | 643.85 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| JAICORPLTD | 1093944 | 136.85 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| NOCIL | 1081944 | 264.30 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| SCHNEIDER | 942959 | 122.90 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| JTEKTINDIA | 926717 | 108.45 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| WELCORP | 853878 | 127.05 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| SHALBY | 677596 | 191.85 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| PRESTIGE | 640859 | 338.80 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| MOTILALOFS | 608754 | 823.85 | 819.39 | 826.56 | 812.66 | 805.54 | 798.46 | 791.41 |

| SWSOLAR | 576102 | 270.55 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| GPPL | 570162 | 101.70 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| STLTECH | 557739 | 285.50 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| ITI | 540040 | 121.30 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| RAILTEL | 495248 | 131.60 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |