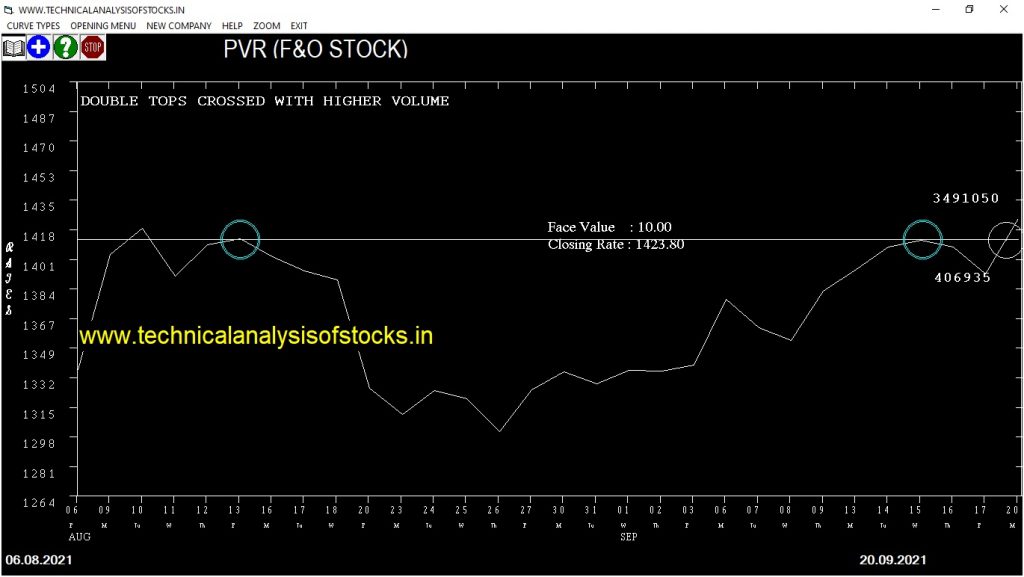

BUY PVR (NSE Symbol) Buy@ 1425.05 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 1379 Target : 1462.30 (Short term)

HOT BUZZING STOCKS (21.09.2020)

NSE SYMBOL CLOSING RATE

| NDTV | 79.85 |

| TCIDEVELOP | 393.70 |

| SHRADHA | 58.55 |

| NELCO | 535.65 |

| SUULD | 590.35 |

| XPROINDIA | 476.45 |

| GOLDENTOBC | 101.45 |

| JAIPURKURT | 62.30 |

| MRO-TEK | 64.65 |

| MCDHOLDING | 70.05 |

| PFOCUS | 82.55 |

| ZENTEC | 184.25 |

| LXCHEM | 512.85 |

| BLS | 274.40 |

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NEOGEN | 83522 | 1224.00 | 1266.30 | 3.34 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| EXIDEIND (F&O) | 50051 | 180.20 | 180.10 | 0.06 |

| CARTRADE | 21417 | 1423.15 | 1414.35 | 0.62 |

| INDIAMART (F&O) | 46831 | 8166.75 | 8099.85 | 0.83 |

| TATACONSUM (F&O) | 45883 | 864.95 | 857.00 | 0.93 |

| CAMS | 39947 | 3590.80 | 3557.40 | 0.94 |

| ZOMATO | 128576 | 135.60 | 134.30 | 0.97 |

| CUB (F&O) | 10300 | 151.30 | 149.70 | 1.07 |

| MON100 | 11441 | 111.50 | 110.26 | 1.12 |

| LICHSGFIN (F&O) | 39731 | 412.20 | 404.40 | 1.93 |

| BSE | 21566 | 1187.15 | 1157.85 | 2.53 |

| UJJIVAN | 13132 | 157.70 | 153.50 | 2.74 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| POLYCAB (F&O) | 106669 | 2487.52 | 2426.78 | 2536.37 | 2482.65 | 2503.00 | -0.82 |

| MAZDOCK | 28999 | 260.02 | 240.37 | 276.25 | 257.10 | 262.35 | -2.04 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| MON100 | 11441 | 110.25 | 123.70 | 100.05 | 110.26 | 108.50 | 1.60 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ALEMBICLTD | 3.86% |

| ANURAS | 4.88% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ITDC | 0.05% |

| POLYCAB (F&O) | 0.82% |

| ALEMBICLTD | 1.72% |

| MAZDOCK | 2.04% |

| KEC | 2.06% |

| WELCORP | 3.23% |

| MON100 | 3.38% |

| EXIDEIND (F&O) | 3.58% |

| TATACONSUM (F&O) | 3.73% |

| CAMS | 3.78% |

| GAEL | 4.33% |

| HINDZINC | 4.50% |

| ASTRAL (F&O) | 4.65% |

| JUBLPHARMA | 4.83% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BHARTIARTL (F&O)

CESC

ZENTEC

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

EXIDEIND (F&O)

GREENPLY

Lower Level Consolidation

RELIANCE (F&O)

SCHNEIDER

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

RAILTEL

GAP DOWN BREAKOUT STOCKS

APEX

BALMLAWRIE

DHANI

EICHERMOT (F&O)

HINDALCO (F&O)

HINDCOPPER

LUPIN (F&O)

LXCHEM

MON100

NMDC (F&O)

SAIL (F&O)

TATACHEM (F&O)

TATASTEEL (F&O)

VEDL (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BIGBLOC

ICICIGI (F&O)

WHIRLPOOL

BEARISH ENGULFING

GTPL

IZMO

MAFANG

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

GET&D

SWANENERGY

GICRE

FORTIS

SUDARSCHEM

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

SECURKLOUD

BAJAJFINSV (F&O)

BRITANNIA (F&O)

AARTIDRUGS

RELIANCE (F&O)

NAZARA

ONGC (F&O)

KEI

AMARAJABAT (F&O)

GODREJPROP (F&O)

BAJFINANCE (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

NIL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

INDIACEM

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NELCO

WHIRLPOOL

BEARISH BELLHOLD PATTERN

GANESHHOUC

HUHTAMAKI

JINDALSTEL (F&O)

NUCLEUS

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS)

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASHOKA

HDFCLIFE (F&O)

ICICIGI (F&O)

JTEKTINDIA

JYOTHYLAB

KOTAKBANK (F&O)

MOIL

SRTRANSFIN (F&O)

STARCEMENT

SYNGENE

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CAPACITE

MIDHANI

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NGIL | 107.90 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| PAR | 157.20 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| SBICARD | 1072.30 | 1072.56 | 1064.39 | 1080.23 | 1088.46 | 1096.72 | 1105.01 |

| RAJESHEXPO | 580.40 | 582.02 | 576.00 | 587.77 | 593.84 | 599.95 | 606.09 |

| JBCHEPHARM | 1748.80 | 1753.52 | 1743.06 | 1763.12 | 1773.63 | 1784.17 | 1794.74 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| AHLEAST | 184.00 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| ITI | 117.50 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| JKTYRE | 149.70 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SCI | 114.05 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| WABAG | 346.75 | 342.25 | 346.89 | 337.81 | 333.23 | 328.68 | 324.16 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| RAILTEL | 5990552 | 133.70 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| EIHOTEL | 4897695 | 110.80 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| PVR (F&O) | 3491050 | 1423.80 | 1425.06 | 1415.64 | 1433.80 | 1443.28 | 1452.79 | 1462.33 |

| TAJGVK | 3390172 | 137.00 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| KOLTEPATIL | 3180207 | 310.05 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| MANALIPETC | 3169673 | 105.35 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| ALLCARGO | 2672384 | 244.30 | 248.06 | 244.14 | 251.89 | 255.87 | 259.89 | 263.93 |

| HINDUNILVR (F&O) | 2671330 | 2800.35 | 2809.00 | 2795.77 | 2820.85 | 2834.14 | 2847.47 | 2860.82 |

| KEI | 2113627 | 866.55 | 870.25 | 862.89 | 877.20 | 884.62 | 892.07 | 899.55 |

| INOXLEISUR | 2085403 | 313.35 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| CLEAN | 1097867 | 1927.35 | 1936.00 | 1925.02 | 1946.04 | 1957.08 | 1968.16 | 1979.26 |

| DLINKINDIA | 762179 | 138.90 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| ARVINDFASN | 643105 | 257.00 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| DMART | 438432 | 4355.90 | 4356.00 | 4339.52 | 4370.33 | 4386.87 | 4403.44 | 4420.04 |

| AMRUTANJAN | 395614 | 772.95 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| PAR | 322976 | 157.20 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| EPL | 318887 | 245.90 | 248.06 | 244.14 | 251.89 | 255.87 | 259.89 | 263.93 |

| SUNDRMFAST | 259915 | 924.70 | 930.25 | 922.64 | 937.42 | 945.09 | 952.79 | 960.52 |

| SHREYAS | 220494 | 395.90 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| TIINDIA | 200925 | 1513.70 | 1521.00 | 1511.27 | 1530.00 | 1539.79 | 1549.62 | 1559.47 |

| NELCO | 177541 | 535.65 | 540.56 | 534.77 | 546.12 | 551.97 | 557.86 | 563.78 |

| BUTTERFLY | 174127 | 924.55 | 930.25 | 922.64 | 937.42 | 945.09 | 952.79 | 960.52 |

| NGIL | 173071 | 107.90 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| IGARASHI | 154070 | 522.35 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 21535092 | 134.30 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| ZOMATO | 19799941 | 134.30 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| TATAMOTORS (F&O) | 19632688 | 298.95 | 297.56 | 301.89 | 293.41 | 289.14 | 284.91 | 280.70 |

| SBIN (F&O) | 18376916 | 437.45 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |

| CANBK (F&O) | 13718062 | 154.95 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| DELTACORP | 10947216 | 223.45 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| IOC (F&O) | 9170924 | 114.60 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| RBLBANK (F&O) | 8793082 | 174.00 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| MOTHERSUMI (F&O) | 8521734 | 216.40 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| BPCL (F&O) | 7372138 | 420.40 | 420.25 | 425.39 | 415.35 | 410.27 | 405.22 | 400.20 |

| HINDPETRO (F&O) | 6278700 | 272.50 | 272.25 | 276.39 | 268.27 | 264.19 | 260.15 | 256.13 |

| GAIL (F&O) | 5998449 | 149.80 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| DLF (F&O) | 5888573 | 323.00 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| ADANIPORTS (F&O) | 5570433 | 748.90 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| INDUSTOWER (F&O) | 5364134 | 263.05 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

| PFC (F&O) | 4894867 | 133.45 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| IEX | 4894296 | 582.50 | 582.02 | 588.06 | 576.29 | 570.30 | 564.34 | 558.42 |

| EXIDEIND (F&O) | 4784908 | 180.10 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| IRCTC (F&O) | 4695511 | 3707.90 | 3705.77 | 3721.00 | 3692.41 | 3677.23 | 3662.08 | 3646.96 |

| AMBUJACEM (F&O) | 4182620 | 409.80 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| TIRUMALCHM | 3914150 | 270.95 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| BANDHANBNK (F&O) | 3408098 | 281.20 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| RELIGARE | 3205065 | 169.90 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| BIOCON (F&O) | 3169722 | 360.40 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| UPL (F&O) | 3082145 | 705.60 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |