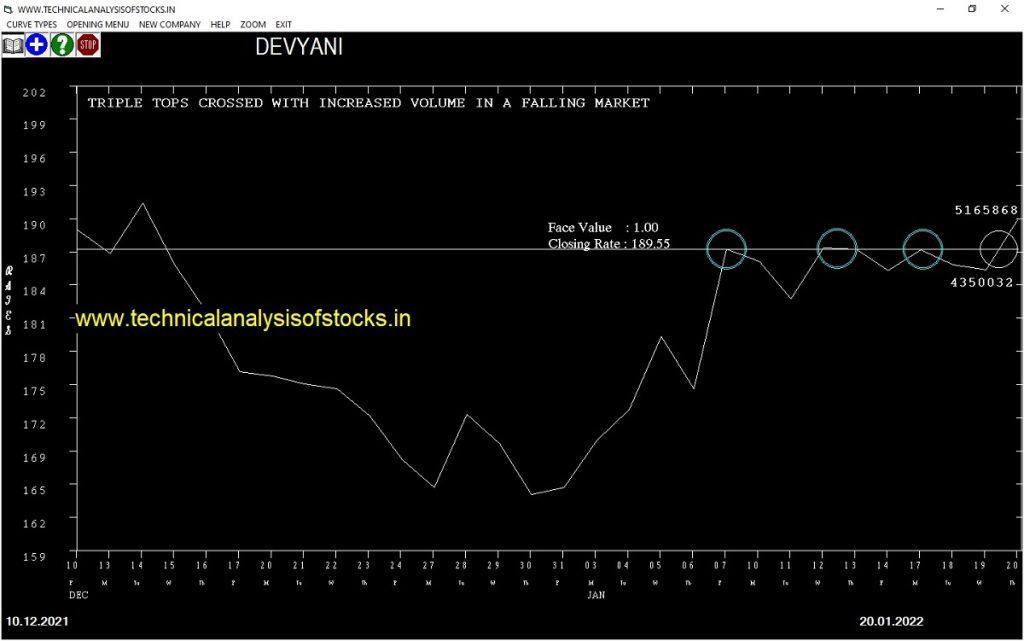

BUY DEVYANI (NSE Symbol) 192.50 or Above after cooling period. SIGNAL : TRIPLE TOPS CROSSED WITH INCREASED VOLUME IN A FALLING MARKET. Stop Loss : 175.65 Target : 206.55 (Short term)

HOT BUZZING STOCKS (21.01.2022)

NSE SYMBOL CLOSING RATE

INTENTECH 106.10

IFBAGRO 861.35

CTE 100.95

BIOFILCHEM 85.80

COFFEEDAY 80.40

INDOTECH 261.00

SHIVAMILLS 191.60

SHREYAS 274.35

TVSELECT 211.65

LAGNAM 107.10

SIGIND 55.35

ADSL 159.75

JBMA 1568.95

NAGREEKEXP 48.30

NAZARA 2618.95

JINDALPHOT 388.25

KELLTONTEC 129.45

OLECTRA 811.45

EKC 257.00

FLEXITUFF 42.15

SMARTLINK 185.65

TEXMOPIPES 95.90

ANANTRAJ 82.35

HOVS 62.25

IZMO 99.20

JETFREIGHT 85.60

TRIDENT 64.45

MARALOVER 132.15

RTNINDIA 58.20

BORORENEW 659.10

SPMLINFRA 53.05

PRAXIS 69.00

CEBBCO 55.55

MOKSH 42.60

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| COALINDIA (F&O) | 117311 | 165.77 | 150.14 | 178.80 | 165.05 | 166.45 | -0.85 |

| JSWSTEEL (F&O) | 58270 | 682.52 | 650.58 | 708.54 | 682.50 | 691.55 | -1.33 |

| MOTILALOFS | 11054 | 968.77 | 930.72 | 999.64 | 966.95 | 979.80 | -1.33 |

| CHEMPLASTS | 11297 | 618.77 | 588.36 | 643.57 | 614.60 | 624.05 | -1.54 |

| DEVYANI | 42778 | 192.52 | 175.65 | 206.54 | 189.55 | 192.85 | -1.74 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| PIDILITIND (F&O) | 24221 | 2665.14 | 2728.70 | 2615.07 | 2675.95 | 2650.00 | 0.97 |

| KPITTECH | 79231 | 682.52 | 715.20 | 656.97 | 685.25 | 675.10 | 1.48 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ICIL | 3.09% |

| PRINCEPIPE | 3.38% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ESCORTS (F&O) | 0.76% |

| COALINDIA (F&O) | 0.85% |

| JSWSTEEL (F&O) | 1.33% |

| MOTILALOFS | 1.33% |

| CHEMPLASTS | 1.54% |

| DEVYANI | 1.74% |

| PIDILITIND (F&O) | 1.81% |

| GPIL | 2.51% |

| EIDPARRY | 2.52% |

| SAPPHIRE | 2.77% |

| M&M (F&O) | 3.29% |

| SWSOLAR | 3.36% |

| MIRZAINT | 3.66% |

| PRSMJOHNSN | 3.85% |

| SPARC | 3.89% |

| DCAL | 4.06% |

| RBLBANK (F&O) | 4.13% |

| CEATLTD | 4.19% |

| TRITURBINE | 4.52% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HAVELLS (F&O) BUY @ 1314. Or ABOVE

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

63MOONS

ANUP

ATUL (F&O)

COASTCORP

COROMANDEL (F&O)

CREDITACC

DLF (F&O)

ELECON

FACT

FSL (F&O)

GATI

GET&D

GICHSGFIN

GODREJPROP (F&O)

GOKEX

HEMIPROP

HINDOILEXP

INDIACEM (F&O)

INDIAMART (F&O)

KALPATPOWR

NELCO

NRBBEARING

OBEROIRLTY (F&O)

PFC (F&O)

RAIN

SUPRIYA

SWSOLAR

TCI

TECHM (F&O)

TNPL

UFLEX

ULTRACEMCO (F&O)

VOLTAS (F&O)

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

BAJAJELEC

ESCORTS (F&O)

Lower Level Consolidation

GICRE

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AARVI

COFFEEDAY

GREENPANEL

HIL

INDOTECH

KELLTONTEC

MARALOVER

NAZARA

OPTIEMUS

SPMLINFRA

TDPOWERSYS

GAP DOWN BREAKOUT STOCKS

DCMNVL

ICICIGI (F&O)

INFY (F&O)

MASTEK

OFSS (F&O)

PTC

RALLIS

STLTECH

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

TRIDENT

BEARISH ENGULFING PATTERN

ALKALI

GENESYS

ICICIPHARM

MINDAIND

THOMASCOOK

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

ADSL

BIOFILCHEM

INTENTECH

SPMLINFRA

TEXMOPIPES

BEARISH MARUBOZU PATTERN

ALKALI

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ANANTRAJ

COFFEEDAY

EKC

NAZARA

PONNIERODE

SHIVAMILLS

SHREYAS

SIGIND

TRIDENT

UGROCAP

BEARISH BELLHOLD PATTERN

GODREJCP (F&O)

ONGC (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns) (INTRADAY)

BUY RECOMMENDATION AT LOWER LEVELS

DBL

MENONBE

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

STAR (F&O)

UJJIVAN

SPANDANA

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

VERTOZ

IOLCP

AMARAJABAT (F&O)

BANDHANBNK (F&O)

HUHTAMAKI

MAHLIFE

CREDITACC

AARTIDRUGS

WHIRLPOOL (F&O)

MAHEPC

JAYBARMARU

INDOSTAR

DFMFOODS

APLLTD (F&O)

AUROPHARMA (F&O)

ASHAPURMIN

EPL

BIOCON (F&O)

KPRMILL

CUB (F&O)

M&MFIN (F&O)

MGL (F&O)

CHEMCON

HDFCAMC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

PAYTM

ZENSARTECH

NAUKRI (F&O)

LTI (F&O)

PERSISTENT (F&O)

GMBREW

ALLCARGO

HCLTECH (F&O)

BERGEPAINT (F&O)

MPHASIS (F&O)

SPANDANA

ASHOKA

GLENMARK (F&O)

RAMCOCEM (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

TRIVENI

AVADHSUGAR

RBLBANK (F&O)

POONAWALLA

TRENT (F&O)

TATAPOWER (F&O)

SUPRIYA

CMSINFO

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ANDHRSUGAR

DHANI

GPIL

MAYURUNIQ

RADICO

SIRCA

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

GSFC

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| FINPIPE | 195.10 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| VBL | 939.90 | 945.56 | 937.89 | 952.79 | 960.52 | 968.28 | 976.07 |

| COROMANDEL (F&O) | 788.25 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| AARVI | 101.80 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| GUJGASLTD (F&O) | 701.15 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| EIDPARRY | 508.40 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| ANANDRATHI | 605.05 | 600.25 | 606.39 | 594.44 | 588.36 | 582.31 | 576.29 |

| ALLCARGO | 360.90 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| MANINDS | 104.60 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| PFIZER (F&O) | 4747.55 | 4743.77 | 4761.00 | 4728.93 | 4711.75 | 4694.60 | 4677.48 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| POWERGRID (F&O) | 22627758 | 214.65 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| BEL (F&O) | 6759397 | 212.35 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| HINDCOPPER | 6368032 | 133.90 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| JINDALSTEL (F&O) | 5606748 | 418.20 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| DEVYANI | 5165868 | 189.55 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| MINDACORP | 4573263 | 207.50 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| TINPLATE | 4012872 | 370.80 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| APOLLOHOSP (F&O) | 2747887 | 4644.80 | 4658.06 | 4641.02 | 4672.80 | 4689.90 | 4707.04 | 4724.20 |

| SYNGENE (F&O) | 2344637 | 608.00 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| JSL | 2294440 | 216.45 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| KELLTONTEC | 2054848 | 129.45 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| RUPA | 1951964 | 548.20 | 552.25 | 546.39 | 557.86 | 563.78 | 569.73 | 575.71 |

| JKPAPER | 1777464 | 232.25 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| ANGELONE | 1767363 | 1486.70 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| RAYMOND | 1705584 | 789.40 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| ASTERDM | 1555432 | 198.60 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| WELCORP | 1403404 | 185.80 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| SRTRANSFIN (F&O) | 1293003 | 1220.95 | 1225.00 | 1216.27 | 1233.15 | 1241.94 | 1250.76 | 1259.62 |

| INOXWIND | 1254366 | 132.10 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| GUJALKALI | 1190321 | 745.40 | 749.39 | 742.56 | 755.87 | 762.76 | 769.68 | 776.63 |

| PRSMJOHNSN | 1116322 | 153.10 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| BRIGADE | 1111886 | 517.75 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

| IIFLSEC | 1078706 | 101.40 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| MANINFRA | 738818 | 120.90 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| MEDPLUS | 734732 | 1290.00 | 1296.00 | 1287.02 | 1304.36 | 1313.41 | 1322.48 | 1331.58 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZOMATO | 23290545 | 125.20 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| ZEEL (F&O) | 10663352 | 308.45 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| TCS (F&O) | 6176776 | 3826.55 | 3813.06 | 3828.52 | 3799.54 | 3784.14 | 3768.77 | 3753.44 |

| INFY (F&O) | 5533463 | 1823.70 | 1816.89 | 1827.56 | 1807.15 | 1796.54 | 1785.96 | 1775.40 |

| APOLLOTYRE (F&O) | 5357697 | 226.25 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| JAMNAAUTO | 3914607 | 105.90 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| PRECWIRE | 3790284 | 117.00 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| HEMIPROP | 3407497 | 152.40 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| BSOFT (F&O) | 3023445 | 502.10 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| SUNPHARMA (F&O) | 2886894 | 820.00 | 819.39 | 826.56 | 812.66 | 805.54 | 798.46 | 791.41 |

| HINDUNILVR (F&O) | 2829711 | 2261.80 | 2256.25 | 2268.14 | 2245.51 | 2233.68 | 2221.88 | 2210.10 |

| LAURUSLABS (F&O) | 2792725 | 485.25 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| ICICIGI (F&O) | 2296373 | 1386.40 | 1378.27 | 1387.56 | 1369.68 | 1360.45 | 1351.24 | 1342.06 |

| DBL | 2218423 | 371.30 | 370.56 | 375.39 | 365.95 | 361.18 | 356.44 | 351.74 |

| ZENSARTECH | 1996907 | 461.50 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| FILATEX | 1944083 | 127.40 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| TATACOMM | 1714708 | 1449.80 | 1444.00 | 1453.52 | 1435.23 | 1425.78 | 1416.35 | 1406.95 |

| FORTIS | 1645821 | 280.25 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| PCBL | 1619931 | 235.80 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| KHAICHEM | 1110420 | 105.15 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| LUPIN (F&O) | 965567 | 939.50 | 937.89 | 945.56 | 930.72 | 923.10 | 915.52 | 907.97 |

| JKTYRE | 890438 | 137.55 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| BAJAJ-AUTO (F&O) | 874508 | 3308.75 | 3306.25 | 3320.64 | 3293.54 | 3279.20 | 3264.90 | 3250.62 |

| RIIL | 865396 | 953.10 | 945.56 | 953.27 | 938.36 | 930.72 | 923.10 | 915.52 |

| AMARAJABAT (F&O) | 862512 | 633.10 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |