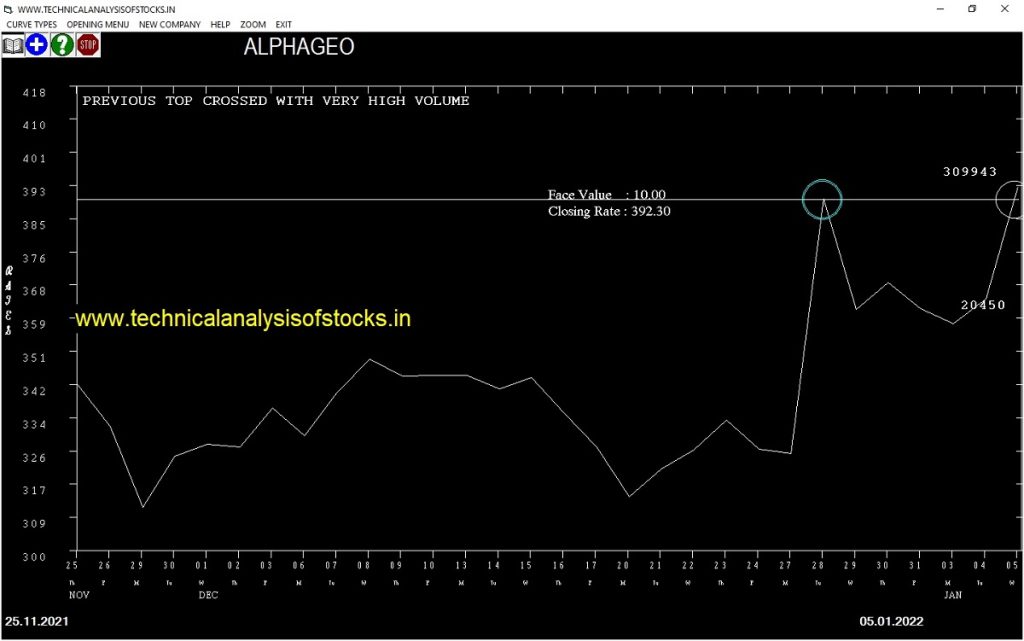

BUY ALPHAGEO (NSE Symbol) Buy 395 or Above after cooling period. SIGNAL : PREVIOUS TOP CROSSED WITH VERY HIGH VOLUME. Stop Loss : 370.75 Target : 414.90 (Short term)

HOT BUZZING STOCKS (06.01.2022)

NSE SYMBOL CLOSING RATE

LAGNAM 74.90

SHREYANIND 120.65

PONNIERODE 265.15

DELTAMAGNT 87.60

NDTV 125.65

ARCHIDPLY 46.35

BGRENERGY 97.80

ASAL 761.45

AURIONPRO 335.15

CREATIVE 520.95

63MOONS 264.05

DHRUV 61.05

DIGJAMLMTD 283.95

GOODLUCK 370.55

KPIGLOBAL 361.00

RAMASTEEL 392.50

SASTASUNDR 508.80

BAJAJFINSV (F&O) 17988.40

ZODIAC 69.50

MARATHON 108.85

PRAXIS 47.55

HOVS 64.60

HPL 81.60

JETFREIGHT 56.25

MRO-TEK 63.75

GOKULAGRO 69.15

HBSL 71.30

BHAGYANGR 51.70

SMARTLINK 218.65

WEBELSOLAR 148.35

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| TRENT (F&O) | 30008 | 1068.00 | 1070.85 | 0.27 |

| ABSLAMC | 10706 | 538.00 | 540.75 | 0.51 |

| CENTURYPLY | 19784 | 635.00 | 639.65 | 0.73 |

| ELECON | 27469 | 195.30 | 197.45 | 1.09 |

| RADICO | 58132 | 1252.00 | 1266.75 | 1.16 |

| CUB (F&O) | 30456 | 139.80 | 144.30 | 3.12 |

| PRICOLLTD | 12280 | 118.40 | 122.60 | 3.43 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| MON100 | 10182 | 119.55 | 119.54 | 0.01 |

| DIXON (F&O) | 63670 | 5337.10 | 5312.95 | 0.45 |

| BAJAJCON | 14394 | 196.50 | 193.90 | 1.34 |

| SIGACHI | 11664 | 393.20 | 386.80 | 1.65 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SUNTV (F&O) | 14327 | 511.89 | 484.24 | 534.50 | 506.70 | 511.45 | -0.94 |

| CASTROLIND | 13198 | 126.56 | 112.95 | 137.99 | 124.15 | 125.50 | -1.09 |

| SHYAMMETL | 11077 | 346.89 | 324.16 | 365.58 | 343.35 | 348.90 | -1.62 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| ZEEL (F&O) | 52566 | 315.06 | 337.47 | 297.71 | 319.05 | 315.50 | 1.11 |

| POLICYBZR | 29318 | 937.89 | 976.07 | 907.97 | 942.70 | 931.00 | 1.24 |

| SUVENPHAR | 13078 | 489.52 | 517.30 | 467.87 | 490.25 | 481.95 | 1.69 |

| GUFICBIO | 10213 | 240.25 | 259.89 | 225.11 | 240.30 | 235.10 | 2.16 |

| ABB | 17664 | 2220.77 | 2278.92 | 2174.98 | 2226.20 | 2175.30 | 2.29 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SUNTV (F&O) | 0.94% |

| INOXLEISUR | 1.90% |

| INOXLEISUR | 2.07% |

| DATAMATICS | 3.02% |

| TATACOFFEE | 3.33% |

| TEGA | 4.72% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HAVELLS (F&O) | 0.84% |

| CASTROLIND | 1.09% |

| ABB | 1.47% |

| SHYAMMETL | 1.62% |

| VBL | 1.67% |

| SUVENPHAR | 1.88% |

| RAYMOND | 1.90% |

| PGEL | 2.19% |

| SONACOMS | 2.28% |

| JYOTHYLAB | 2.34% |

| LODHA | 2.70% |

| KNRCON | 2.80% |

| JAMNAAUTO | 3.12% |

| GOKEX | 3.23% |

| FSL (F&O) | 3.41% |

| GUFICBIO | 3.62% |

| RATEGAIN | 4.26% |

| IBREALEST | 4.53% |

| BAJAJELEC | 4.53% |

| APOLLOHOSP (F&O) | 4.56% |

| ZEEL (F&O) | 4.59% |

| GOCOLORS | 4.75% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

PFC (F&O) SELL @ 123.75 or Below

SUMICHEM SELL @ 380 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

COROMANDEL (F&O) SELL @ 770.05 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

RAMASTEEL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BSE

INOXLEISUR

PRINCEPIPE

PURVA

Higher Level Consolidation

BIOCON (F&O)

BURGERKING

INFY (F&O)

Lower Level Consolidation

BSE

METROPOLIS (F&O)

PRINCEPIPE

PURVA

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

63MOONS

AARON

ASAL

AUBANK (F&O)

BAJFINANCE (F&O)

CREATIVE

DELTAMAGNT

HIKAL

INTLCONV

KPIGLOBAL

MSTCLTD

PONNIERODE

RAMASTEEL

GAP DOWN BREAKOUT STOCKS

TAJGVK

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

LAGNAM

RPPINFRA

BEARISH ENGULFING PATTERN

BLUESTARCO

FINCABLES

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

AURIONPRO

BGRENERGY

HBSL

LAGNAM

SASTASUNDR

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

BAJAJFINSV (F&O)

GOKULAGRO

GOODLUCK

BEARISH BELLHOLD PATTERN

DIXON (F&O)

ICICITECH

PRINCEPIPE

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

BGRENERGY

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

ASIANTILES

STAR (F&O)

BLISSGVS

SPANDANA

IOLCP

GULFOILLUB

BANDHANBNK (F&O

JUBLPHARMA

AMARAJABAT (F&O)

AARTIDRUGS

INDOSTAR

DFMFOODS

APLLTD (F&O)

HEROMOTOCO (F&O)

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

SURYAROSNI

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

CIPLA (F&O)

ULTRACEMCO (F&O)

GLENMARK (F&O)

RELIANCE (F&O)

DEEPAKNTR (F&O)

DATAMATICS

LT (F&O)

JSL

MUTHOOTFIN (F&O)

PIDILITIND (F&O)

MINDACORP

FLUOROCHEM

EICHERMOT (F&O)

MAPMYINDIA

KPRMILL

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

EQUITAS

PAISALO

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TCS (F&O) | 3860.95 | 3875.06 | 3859.52 | 3888.70 | 3904.30 | 3919.93 | 3935.59 |

| TCI | 771.45 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| BHARTIARTL (F&O) | 700.00 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| NAUKRI (F&O) | 5617.95 | 5625.00 | 5606.27 | 5640.94 | 5659.73 | 5678.55 | 5697.40 |

| UBL (F&O) | 1577.55 | 1580.06 | 1570.14 | 1589.22 | 1599.20 | 1609.21 | 1619.25 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TVSELECT | 187.10 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| PRSMJOHNSN | 129.90 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| PNBHOUSING | 489.50 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| MUTHOOTFIN (F&O) | 1533.45 | 1530.77 | 1540.56 | 1521.76 | 1512.02 | 1502.31 | 1492.64 |

| APEX | 296.70 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SAIL (F&O) | 40582366 | 113.00 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| BANDHANBNK (F&O) | 22673520 | 263.45 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| ASHOKLEY (F&O) | 17150006 | 131.75 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| IOC (F&O) | 14249336 | 117.25 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| GAIL (F&O) | 12163177 | 136.05 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| CANBK (F&O) | 11554362 | 211.00 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| AXISBANK (F&O) | 11312955 | 726.90 | 729.00 | 722.27 | 735.40 | 742.19 | 749.02 | 755.87 |

| JINDALSTEL (F&O) | 9891594 | 406.40 | 410.06 | 405.02 | 414.93 | 420.04 | 425.18 | 430.35 |

| IBREALEST | 8888820 | 162.10 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| HDFCBANK (F&O) | 7166319 | 1564.85 | 1570.14 | 1560.25 | 1579.27 | 1589.22 | 1599.20 | 1609.21 |

| BPCL (F&O) | 6741998 | 394.70 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| DEVYANI | 6642011 | 178.90 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| JSWSTEEL (F&O) | 6342812 | 694.50 | 695.64 | 689.06 | 701.90 | 708.54 | 715.20 | 721.90 |

| TATASTEEL (F&O) | 6186176 | 1177.60 | 1181.64 | 1173.06 | 1189.65 | 1198.29 | 1206.96 | 1215.66 |

| ADANIPORTS (F&O) | 5409002 | 754.90 | 756.25 | 749.39 | 762.76 | 769.68 | 776.63 | 783.61 |

| CMSINFO | 5332766 | 240.00 | 240.25 | 236.39 | 244.02 | 247.94 | 251.89 | 255.87 |

| INDIACEM (F&O) | 5288236 | 206.80 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| NMDC (F&O) | 4986657 | 138.60 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| KOTAKBANK (F&O) | 4208167 | 1922.15 | 1925.02 | 1914.06 | 1935.03 | 1946.04 | 1957.08 | 1968.16 |

| CHOLAFIN (F&O) | 4130279 | 568.00 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

| MINDACORP | 3999221 | 203.45 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| REDINGTON | 3255902 | 148.85 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| ASHOKA | 3010416 | 107.90 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| BAJFINANCE (F&O) | 2583262 | 7670.80 | 7678.14 | 7656.25 | 7696.21 | 7718.15 | 7740.13 | 7762.13 |

| KRBL | 2537850 | 263.60 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZOMATO | 15874857 | 133.95 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| BALRAMCHIN | 8410788 | 417.50 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| INFY (F&O) | 6995719 | 1844.65 | 1838.27 | 1849.00 | 1828.48 | 1817.80 | 1807.15 | 1796.54 |

| FSL (F&O) | 4752247 | 180.25 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| TECHM (F&O) | 3138050 | 1737.55 | 1732.64 | 1743.06 | 1723.11 | 1712.75 | 1702.41 | 1692.11 |

| FORTIS | 2681296 | 293.90 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| MIRZAINT | 1832146 | 143.40 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| TRIVENI | 1740342 | 242.40 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| PAYTM | 1731917 | 1288.35 | 1287.02 | 1296.00 | 1278.70 | 1269.78 | 1260.88 | 1252.02 |

| DHAMPURSUG | 1427398 | 333.50 | 333.06 | 337.64 | 328.68 | 324.16 | 319.68 | 315.22 |

| WELCORP | 1286097 | 180.25 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| MAXHEALTH | 1268951 | 408.05 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| KPITTECH | 1052466 | 594.20 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| ANDHRSUGAR | 945418 | 134.85 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| NYKAA | 904762 | 2043.00 | 2036.27 | 2047.56 | 2026.01 | 2014.77 | 2003.56 | 1992.39 |

| INDIGO (F&O) | 903873 | 1977.75 | 1969.14 | 1980.25 | 1959.04 | 1947.99 | 1936.97 | 1925.98 |

| NIITLTD | 896170 | 475.60 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| SONACOMS | 859528 | 738.45 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| BAJAJCON | 829000 | 193.90 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| DLINKINDIA | 745917 | 171.55 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| COFORGE (F&O) | 696187 | 5939.50 | 5929.00 | 5948.27 | 5912.72 | 5893.51 | 5874.33 | 5855.18 |

| AVADHSUGAR | 684368 | 526.55 | 523.27 | 529.00 | 517.82 | 512.15 | 506.50 | 500.89 |

| EKC | 646155 | 240.15 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| SPANDANA | 621319 | 415.00 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| APOLLO | 571688 | 169.00 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |