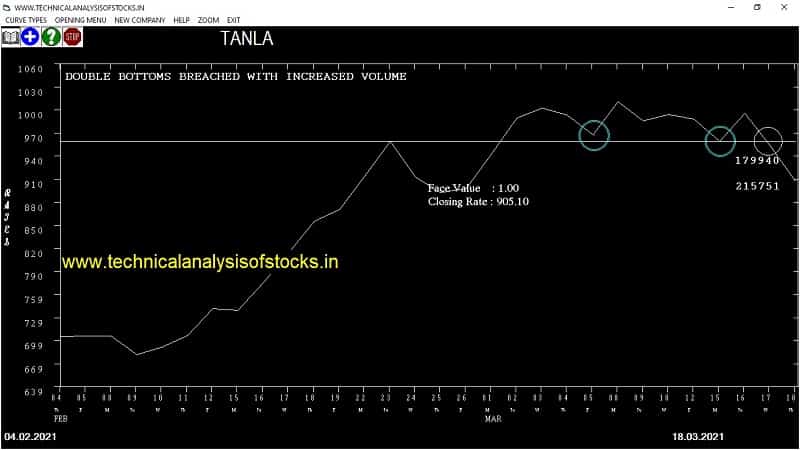

SELL TANLA (NSE Symbol) Sell @ 900 or Below after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH INCREASED VOLUME. Stop Loss : 937.40 Target : 870.70 (Short term)

HOT BUZZING STOCKS (19.03.2021)

NSE SYMBOL CLOSING RATE

VISHNU 229.45

JINDALPHOT 55.65

HOVS 49.90

SHREYANIND 106.40

HSIL 158.15

INDSWFTLAB 78.60

NAHARINDUS 51.20

ASHAPURMIN 110.15

FSC 84.15

EDELWEISS 80.15

ONMOBILE 101.10

V2RETAIL 125.90

GREENPANEL 165.75

NAHARSPING 106.70

RAMKY 76.15

RUSHIL 262.90

TEJASNET 167.65

IIFL 313.65

JINDALPOLY 784.00

TANLA 905.10

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| ADANIENT (F&O) | 56225 | 872.85 | 871.05 | 0.21 |

| IPCALAB | 14469 | 1871.00 | 1864.60 | 0.34 |

| TATAMOTORS (F&O) | 422219 | 309.60 | 307.00 | 0.85 |

| BEML | 42473 | 1325.00 | 1306.65 | 1.40 |

| MUTHOOTFIN (F&O) | 37334 | 1265.85 | 1241.05 | 2.00 |

| HINDPETRO (F&O) | 67540 | 238.70 | 233.65 | 2.16 |

| IRB | 21199 | 113.75 | 111.20 | 2.29 |

| HINDZINC | 17518 | 293.70 | 286.35 | 2.57 |

| BEML | 42473 | 1342.00 | 1306.65 | 2.71 |

| GSPL | 16703 | 268.55 | 261.05 | 2.87 |

| NAVINFLUOR (F&O) | 22287 | 2573.90 | 2491.90 | 3.29 |

| CIPLA (F&O) | 71821 | 780.00 | 755.15 | 3.29 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| DALBHARAT | 24769 | 1580.06 | 1531.53 | 1619.25 | 1572.50 | 1574.00 | -0.10 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| GRASIM (F&O) | 52552 | 1387.56 | 1433.80 | 1351.24 | 1387.80 | 1361.05 | 1.93 |

| NMDC (F&O) | 30203 | 132.25 | 146.94 | 121.06 | 132.25 | 128.50 | 2.84 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NMDC,5.60%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

DALBHARAT,0.10%

GRASIM,1.46%

GODREJIND,2.10%

TORNTPOWER,2.82%

CUMMINSIND,4.13%

AMBUJACEM,4.71%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES (Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

ALKEM (F&O) Buy @ 2639.40 or Above

GUJALKALI Buy @ 342.25 or Above

RAIN Buy @ 147 or Above

TATAMETALI Buy @ 749.40 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AKG

CAPTRUST

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

CAPTRUST

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

EMAMILTD

PIDILITIND (F&O)

Higher Level Consolidation

COROMANDEL

RAJESHEXPO

Lower Level Consolidation

DABUR (F&O)

HINDALCO (F&O)

MARUTI (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

ASTRAL

RECLTD (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

ASIANPAINT

DIVISLAB

HEIDELBERG

UJJIVAN

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

IIFL

TANLA

Strategy : BELL HOLD STOCKS

BULLISH BELL HOLD PATTERN

VISHNU

BEARISH BELLHOLD PATTERN

KIOCL

REPCOHOME

V2RETAIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AEGISCHEM

BAJAJFINSV (F&O)

BAJFINANCE (F&O)

BPCL (F&O)

CANBK (F&O)

CSBBANK

ELGIEQUIP

GATI

GPPL

IBREALEST

JINDALSTEL (F&O)

JMCPROJECT

M&M (F&O)

NCLIND

NTPC (F&O)

PNBHOUSING

POLYCAB

SADBHAV

SRTRANSFIN (F&O)

SWANENERGY

TATAMOTORS (F&O)

TNPL

UPL (F&O)

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BALKRISIND (F&O)

BERGEPAINT (F&O)

BSE

CASTROLIND

CESC

CHEMCON

HDFCAMC (F&O)

IRCON

ISEC

ITI

JTEKTINDIA

JYOTHYLAB

KANSAINER

LAURUSLABS

MANINDS

MARKSANS

MARUTI (F&O)

NLCINDIA

PURVA

SHALPAINTS

SRF (F&O)

TAKE

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TECHNOE | 292.95 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| TATACOMM | 1166.20 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| SUVENPHAR | 472.90 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| DALBHARAT | 1572.50 | 1580.06 | 1570.14 | 1589.22 | 1599.20 | 1609.21 | 1619.25 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PNCINFRA | 242.00 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| CGCL | 353.90 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| SHARDACROP | 308.30 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| ICRA | 2786.90 | 2782.56 | 2795.77 | 2770.78 | 2757.63 | 2744.51 | 2731.43 |

| MFSL (F&O) | 862.60 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ITC (F&O) | 91993104 | 217.65 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| FORTIS | 7162945 | 188.45 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| MSTCLTD | 3998289 | 327.25 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| IEX | 3874730 | 357.40 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| INDIANB | 3451622 | 119.00 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| SBICARD | 2886658 | 1000.40 | 1008.06 | 1000.14 | 1015.51 | 1023.49 | 1031.50 | 1039.54 |

| WELCORP | 2766138 | 133.60 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| BALRAMCHIN | 2581943 | 201.40 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| GRAPHITE | 2473575 | 518.90 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

| CUMMINSIND (F&O) | 1822115 | 858.30 | 862.89 | 855.56 | 869.81 | 877.20 | 884.62 | 892.07 |

| BAJAJCON | 1610957 | 269.10 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| TATACOMM | 1558538 | 1166.20 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| BAJAJ-AUTO (F&O) | 1285600 | 3664.50 | 3675.39 | 3660.25 | 3688.72 | 3703.91 | 3719.14 | 3734.40 |

| ADANITRANS | 901859 | 771.20 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| GPIL | 794738 | 622.60 | 625.00 | 618.77 | 630.95 | 637.24 | 643.57 | 649.92 |

| APTECHT | 714180 | 212.40 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| TCNSBRANDS | 652510 | 516.80 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| SHREYANIND | 597245 | 106.40 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| ROSSARI | 511091 | 1018.00 | 1024.00 | 1016.02 | 1031.50 | 1039.54 | 1047.62 | 1055.72 |

| VARROC | 445483 | 394.75 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| PNBHOUSING | 378805 | 383.30 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| POLYMED | 363446 | 829.85 | 833.77 | 826.56 | 840.58 | 847.84 | 855.13 | 862.46 |

| AEGISCHEM | 303525 | 288.05 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| ASALCBR | 204023 | 415.15 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| TATAPOWER (F&O) | 102669579 | 100.55 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| ASHOKLEY (F&O) | 48024851 | 113.20 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| CANBK (F&O) | 20262104 | 146.60 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| NTPC (F&O) | 20023557 | 103.80 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| GAIL (F&O) | 17963294 | 135.10 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| BEL (F&O) | 15117744 | 129.80 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| PFC (F&O) | 14668468 | 132.00 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| COALINDIA (F&O) | 14401450 | 137.05 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| INFY (F&O) | 10961755 | 1337.10 | 1332.25 | 1341.39 | 1323.80 | 1314.72 | 1305.67 | 1296.65 |

| WIPRO (F&O) | 10082931 | 410.15 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| RELIANCE (F&O) | 9528809 | 2009.10 | 2002.56 | 2013.77 | 1992.39 | 1981.24 | 1970.13 | 1959.04 |

| TATACHEM (F&O) | 8695141 | 715.15 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| APOLLOTYRE (F&O) | 8433612 | 217.05 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| HCLTECH (F&O) | 8269566 | 947.75 | 945.56 | 953.27 | 938.36 | 930.72 | 923.10 | 915.52 |

| FSL | 8235593 | 110.95 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| EXIDEIND (F&O) | 4997498 | 188.40 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| HINDCOPPER | 4392236 | 119.95 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| GRANULES (F&O) | 3901628 | 305.80 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| TECHM (F&O) | 3738712 | 996.20 | 992.25 | 1000.14 | 984.88 | 977.05 | 969.25 | 961.48 |

| IRCTC (F&O) | 3667455 | 1766.65 | 1764.00 | 1774.52 | 1754.39 | 1743.93 | 1733.51 | 1723.11 |

| TCS (F&O) | 3656306 | 3036.50 | 3025.00 | 3038.77 | 3012.77 | 2999.06 | 2985.38 | 2971.74 |

| LICHSGFIN (F&O) | 3403019 | 408.20 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| MEGH | 3271614 | 106.05 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| IGL (F&O) | 3135894 | 487.00 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| RAILTEL | 3090902 | 130.90 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |