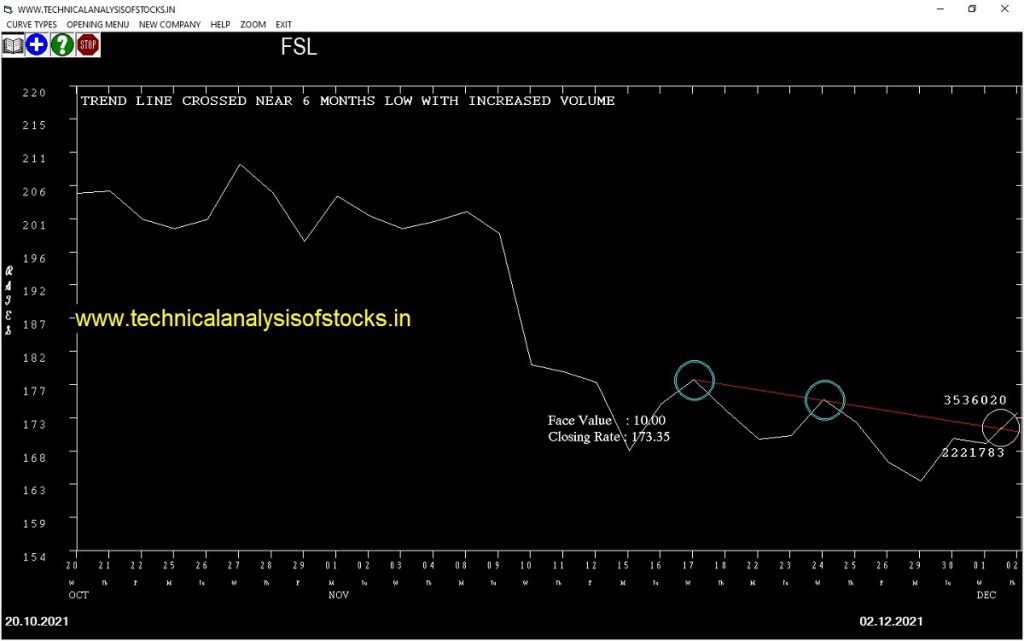

BUY FSL (NSE Symbol) Buy@ 175.55 or Above after cooling period. SIGNAL : TREND LINE CROSSED NEAR 6 MONTHS LOW WITH INCREASED VOLUME. Stop Loss : 159.50 Target : 189 (Short term)

HOT BUZZING STOCKS (03.12.2021)

NSE SYMBOL CLOSING RATE

TARMAT 66.00

APEX 297.50

RPPINFRA 60.80

MONTECARLO 615.10

ASHAPURMIN 100.80

TEXMOPIPES 67.75

MINDTECK 125.70

SCHAND 119.75

LAGNAM 52.55

CREST 143.90

GENESYS 328.95

GLOBUSSPR 1139.60

ISMTLTD 43.05

MUKTAARTS 63.05

OPTIEMUS 349.90

PITTIENG 228.90

TVSELECT 168.05

XPROINDIA 859.70

3IINFOLTD 97.75

AURIONPRO 272.60

BEDMUTHA 50.45

GOKEX 278.55

IRB 226.20

KOPRAN 276.50

KPIGLOBAL 260.65

LYKALABS 180.80

PARAS 747.45

RAMKY 158.85

SANGAMIND 257.95

SBCL 344.95

TTML 124.05

ZUARI 108.30

63MOONS 115.95

KHADIM 260.10

PANACEABIO 225.40

RAMASTEEL 233.90

EKC 153.20

EQUIPPP 88.05

DBREALTY 41.50

RTNINDIA 45.95

OMAXAUTO 45.10

TRIDENT 46.95

MARSHALL 62.90

AURUM 173.25

JINDALPHOT 376.25

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| LTTS (F&O) | 37815 | 5488.80 | 5518.60 | 0.54 |

| AARTIIND (F&O) | 33317 | 969.00 | 977.20 | 0.84 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| WIPRO (F&O) | 103641 | 650.25 | 619.08 | 675.66 | 646.80 | 648.95 | -0.33 |

| RELIANCE (F&O) | 248052 | 2487.52 | 2426.78 | 2536.37 | 2482.85 | 2502.00 | -0.77 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| RELIANCE (F&O) | 0.77% |

| NATCOPHARM | 2.67% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| WIPRO (F&O) | 0.33% |

| KIRLOSENG | 0.94% |

| SIEMENS (F&O) | 1.46% |

| HDFCAMC (F&O) | 1.57% |

| MINDAIND | 2.30% |

| BSOFT | 2.78% |

| KIMS | 2.93% |

| IBREALEST | 2.99% |

| AEGISCHEM | 3.21% |

| ABB | 3.40% |

| HINDZINC | 3.51% |

| PRICOLLTD | 4.07% |

| RIIL | 4.29% |

| APOLLOHOSP (F&O) | 4.50% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

SCHNEIDER Buy @ 107.60 Or Above

JKIL Buy @ 169.00 Or Above

HEG Buy @ 1795.65 Or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BAJAJELEC

BRIGADE

BURGERKING

CASTROLIND

CHALET

COLPAL (F&O)

CYIENT

FINPIPE

GRINDWELL

GSPL

INDIANB

IPL

ISEC

JAMNAAUTO

KIRLFER

KNRCON

KOLTEPATIL

KPRMILL

LAOPALA

MAXVIL

NH

NIACL

NIITLTD

NUVOCO

ORIENTELEC

SHILPAMED

SJS

SOBHA

SONATSOFTW

SUNTECK

SUULD

SWSOLAR

TATAMOTORS (F&O)

TATAMTRDVR

UJJIVAN

VRLLOG

WABAG

ZENSARTECH

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AEGISCHEM

MAHSEAMLES

PGIL

ZENTEC

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AURIONPRO

DCMNVL

GREAVESCOT

IRB

JMCPROJECT

KDDL

KOPRAN

LYKALABS

MINDTECK

MUKTAARTS

SATIN

SCHAND

TEXMOPIPES

XPROINDIA

GAP DOWN BREAKOUT STOCKS

APOLLOPIPE

AURUM

JINDALPHOTE

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

AJANTPHARM

ANANTRAJ

EQUIPPP

FSL

KRSNAA

BEARISH ENGULFING

MARSHALL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

3IINFOLTD

EQUIPPP

MINDTECK

MONTECARLO

PANACEABIO

BEARISH MARUBOZU PATTERN

ICICILIQ

MARSHALL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

APEX

DHRUV

FAIRCHEMOR

HBLPOWER

HDFC (F&O)

JUBLFOOD (F&O)

PARAS

RPPINFRA

TARMAT

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

IOLCP

STAR

CREDITACC

AMARAJABAT (F&O)

AARTIDRUGS

EPL

CUB (F&O)

AUROPHARMA (F&O)

APLLTD (F&O

GRANULES (F&O)

AARTIIND (F&O

UNICHEMLAB

DHANI

GEPIL

BANDHANBNK (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

ASHOKLEY (F&O)

AXISBANK (F&O)

ICICIBANK (F&O)

HEMIPROP

GSFC

GPIL

SWSOLAR

PRINCEPIPE

CANFINHOME (F&O)

TATAMTRDVR

JKPAPER

GRANULES (F&O)

JSL

WOCKPHARMA

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

MONTECARLO

HINDZINC

SYNGENE (F&O)

WELCORP

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ACE

ADSL

ANGELONE

ASIANTILES

AVADHSUGAR

BBL

CARTRADE

CENTURYTEX

CHENNPETRO

DHAMPURSUG

DHANI

DLINKINDIA

GABRIEL

GATI

GET&D

GTPL

HGINFRA

HINDCOPPER

IOLCP

ITDC

JKTYRE

MIDHANI

MSTCLTD

PHILIPCARB

PURVA

SHOPERSTOP

SMLISUZU

SUVENPHAR

TIRUMALCHM

TNPETRO

VINYLINDIA

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CANBK (F&O) | 207.15 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| KEC | 432.50 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| TATAMOTORS (F&O) | 479.10 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| BHARATFORG (F&O) | 705.85 | 708.89 | 702.25 | 715.20 | 721.90 | 728.64 | 735.40 |

| COFORGE (F&O) | 5414.15 | 5420.64 | 5402.25 | 5436.34 | 5454.79 | 5473.26 | 5491.77 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TATACOMM | 1275.80 | 1269.14 | 1278.06 | 1260.88 | 1252.02 | 1243.18 | 1234.38 |

| FINCABLES | 568.40 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| AFFLE | 1114.00 | 1113.89 | 1122.25 | 1106.12 | 1097.81 | 1089.54 | 1081.31 |

| TEJASNET | 448.45 | 446.27 | 451.56 | 441.22 | 435.98 | 430.78 | 425.60 |

| SHK | 146.55 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| IBULHSGFIN (F&O) | 45482433 | 256.40 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| POWERGRID (F&O) | 25319133 | 214.50 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| NMDC (F&O) | 25288901 | 141.60 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| COALINDIA (F&O) | 15647910 | 159.30 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| IOC (F&O) | 13790719 | 120.65 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| TATASTEEL (F&O) | 9128681 | 1112.40 | 1113.89 | 1105.56 | 1121.69 | 1130.08 | 1138.49 | 1146.94 |

| REDINGTON | 8896816 | 151.00 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| SCI | 8856579 | 157.20 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| ADANIPORTS (F&O) | 8478638 | 739.10 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| POONAWALLA | 6547478 | 196.80 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| BPCL (F&O) | 6224888 | 378.85 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| KIRLOSENG | 6179561 | 191.85 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| SUNPHARMA (F&O) | 4896650 | 766.25 | 770.06 | 763.14 | 776.63 | 783.61 | 790.62 | 797.66 |

| BEML | 4776097 | 1893.85 | 1903.14 | 1892.25 | 1913.11 | 1924.05 | 1935.03 | 1946.04 |

| HDFC (F&O) | 4570690 | 2807.80 | 2809.00 | 2795.77 | 2820.85 | 2834.14 | 2847.47 | 2860.82 |

| WELCORP | 4053581 | 170.20 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| HCLTECH (F&O) | 4011279 | 1184.70 | 1190.25 | 1181.64 | 1198.29 | 1206.96 | 1215.66 | 1224.39 |

| DELTACORP | 3871644 | 253.45 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| M&MFIN (F&O) | 3624510 | 162.50 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| FSL | 3536020 | 173.35 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| GUJGASLTD (F&O) | 3017845 | 686.65 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| MANAPPURAM (F&O) | 2913802 | 170.15 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| HINDCOPPER | 2673917 | 118.25 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| TECHM (F&O) | 2664202 | 1629.65 | 1630.14 | 1620.06 | 1639.43 | 1649.57 | 1659.73 | 1669.93 |

| IRB | 2474672 | 226.20 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| VEDL (F&O) | 14527577 | 337.90 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| KPITTECH | 2007792 | 489.20 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| GOCOLORS | 1296939 | 1260.45 | 1260.25 | 1269.14 | 1252.02 | 1243.18 | 1234.38 | 1225.61 |

| MON100 | 1243187 | 118.16 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| PAYTM | 1089716 | 1600.85 | 1600.00 | 1610.02 | 1590.81 | 1580.85 | 1570.93 | 1561.03 |

| NYKAA | 1078937 | 2438.20 | 2437.89 | 2450.25 | 2426.78 | 2414.47 | 2402.20 | 2389.96 |

| RAYMOND | 945512 | 614.95 | 612.56 | 618.77 | 606.69 | 600.55 | 594.44 | 588.36 |

| TRITURBINE | 823259 | 182.45 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| INOXLEISUR | 775274 | 364.65 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| RIIL | 644363 | 711.20 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| ICIL | 451780 | 229.65 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| SVPGLOB | 438534 | 110.45 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| LODHA | 366504 | 1434.50 | 1425.06 | 1434.52 | 1416.35 | 1406.95 | 1397.59 | 1388.26 |

| AURUM | 284838 | 173.25 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| TVTODAY | 271297 | 418.40 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| LINDEINDIA | 248798 | 2478.35 | 2475.06 | 2487.52 | 2463.87 | 2451.48 | 2439.11 | 2426.78 |

| CAPACITE | 244294 | 163.90 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| CHALET | 243779 | 228.90 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| CAMS | 240920 | 2975.05 | 2970.25 | 2983.89 | 2958.12 | 2944.53 | 2930.98 | 2917.46 |

| DENORA | 204357 | 434.35 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |