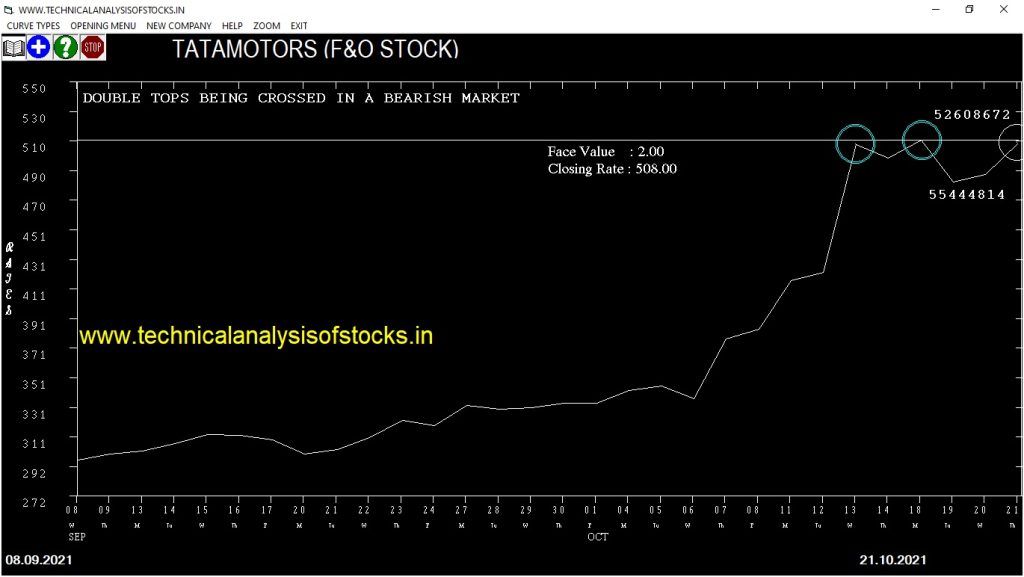

BUY TATAMOTORS (NSE Symbol) Buy@ 511.90 or Above after cooling period. SIGNAL : DOUBLE TOPS BEING CROSSED IN A BEARISH MARKET. Stop Loss : 484.25 Target : 534.50 (Short term)

HOT BUZZING STOCKS (22.10.2021)

NSE SYMBOL CLOSING RATE

SHOPERSTOP 336.70

ARIHANT 44.15

PARAS 1089.40

TATAMTRDVR 255.55

EMAMIREAL 67.85

AAKASH 192.15

JINDALPHOT 173.35

LYKALABS 93.50

PRIMESECU 110.25

GANESHHOUC 202.00

GENESYS 265.15

TTML 50.55

PAR 228.40

PNBHOUSING 520.30

ASAL 81.75

BORORENEW 446.85

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| TORNTPOWER (F&O) | 30002 | 502.80 | 496.10 | 1.35 |

| AUROPHARMA (F&O) | 55654 | 718.90 | 705.90 | 1.84 |

| SANSERA | 30967 | 791.00 | 775.05 | 2.06 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| INOXLEISUR | 11928 | 420.25 | 395.21 | 440.78 | 419.70 | 425.00 | -1.26 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| CAMS | 30896 | 3066.39 | 3134.43 | 3012.77 | 3071.80 | 3020.00 | 1.69 |

| MARUTI (F&O) | 46786 | 7569.00 | 7674.30 | 7485.99 | 7575.25 | 7436.55 | 1.83 |

| INOXLEISUR | 11928 | 415.14 | 440.78 | 395.21 | 419.70 | 410.00 | 2.31 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MUTHOOTFIN (F&O) | 3.81% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| INOXLEISUR | 1.12% |

| MAXHEALTH | 2.09% |

| MARUTI (F&O) | 2.31% |

| BURGERKING | 2.40% |

| KNRCON | 2.63% |

| TATAMOTORS (F&O) | 3.12% |

| RITES | 3.33% |

| INDUSTOWER (F&O) | 4.06% |

| CAMS | 4.47% |

| INDIGO (F&O) | 4.53% |

| KPITTECH | 4.74% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIPOWER

BARBEQUE

BCLIND

BEL (F&O)

BEPL

BFUTILITIE

BURGERKING

DATAMATICS

DLINKINDIA

ELECON

GRAVITA

INDIACEM

INDIAMART

IRCTC (F&O)

JAICORPLTD

JTEKTINDIA

JUBLINGREA

KAYA

OPTIEMUS

PFC (F&O)

RECLTD (F&O)

SHYAMMETL

SUULD

TITAN (F&O)

TNPL

ULTRACEMCO (F&O)

VAIBHAVGBL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

MINDAIND

RAJESHEXPO

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

IRB

VARROC

GAP DOWN BREAKOUT STOCKS

ASIANTILES

HAVELLS (F&O)

TEJASNET

VOLTAS (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

GANESHHOUC

GENESYS

BEARISH ENGULFING

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

EMAMIREAL

GANESHHOUC

BEARISH MARUBOZU PATTERN

ICICILIQ

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BRITANNIA (F&O)

CADILAHC (F&O)

CHENNPETRO

HEIDELBERG

HINDUNILVR (F&O)

IBULHSGFIN (F&O)

KESORAMIND

MOIL

RITES

SUNTV (F&O)

TATASTLLP

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CHEMCON

HDFCAMC (F&O)

L&TFH (F&O)

MGL (F&O)

NATCOPHARM

PETRONET (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

CUMMINSIND (F&O)

BAJAJCON

HDFCLIFE (F&O)

AEGISCHEM

DABUR (F&O)

ULTRACEMCO (F&O)

GRAPHITE

LAOPALA

ORIENTCEM

LALPATHLAB (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

BODALCHEM

IBULHSGFIN (F&O)

DIXON (F&O)

CANBK (F&O)

DHANI

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

NIL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

BORORENEW

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TORNTPHARM (F&O) | 3012.55 | 3025.00 | 3011.27 | 3037.25 | 3051.04 | 3064.86 | 3078.71 |

| MARICO (F&O) | 565.30 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

| NTPC (F&O) | 147.90 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| RKFORGE | 1211.15 | 1216.27 | 1207.56 | 1224.39 | 1233.15 | 1241.94 | 1250.76 |

| COALINDIA (F&O) | 182.40 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PRINCEPIPE | 718.00 | 715.56 | 722.27 | 709.25 | 702.60 | 695.99 | 689.41 |

| KSCL | 527.25 | 523.27 | 529.00 | 517.82 | 512.15 | 506.50 | 500.89 |

| SPANDANA | 535.95 | 534.77 | 540.56 | 529.26 | 523.53 | 517.82 | 512.15 |

| ADVENZYMES | 383.00 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |

| GICHSGFIN | 155.45 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAMOTORS (F&O) | 52608672 | 508.00 | 511.89 | 506.25 | 517.30 | 523.00 | 528.74 | 534.50 |

| CANBK (F&O) | 28400298 | 199.60 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| IBREALEST | 13334446 | 159.60 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| ASHOKLEY (F&O) | 13035269 | 141.05 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| BPCL (F&O) | 9887576 | 451.05 | 451.56 | 446.27 | 456.66 | 462.02 | 467.41 | 472.83 |

| IRCTC (F&O) | 9272239 | 4573.25 | 4590.06 | 4573.14 | 4604.71 | 4621.69 | 4638.70 | 4655.73 |

| RBLBANK (F&O) | 8761910 | 196.95 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| ARVIND | 5831890 | 132.10 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| M&MFIN (F&O) | 5360423 | 191.75 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| CHOLAFIN (F&O) | 4177273 | 614.15 | 618.77 | 612.56 | 624.69 | 630.95 | 637.24 | 643.57 |

| WELSPUNIND | 4039669 | 151.75 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| MANAPPURAM (F&O) | 3556307 | 199.75 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| TCI | 3553286 | 574.70 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

| FORTIS | 3499536 | 265.10 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| STAR | 3326396 | 557.10 | 558.14 | 552.25 | 563.78 | 569.73 | 575.71 | 581.72 |

| CROMPTON | 2499907 | 463.90 | 467.64 | 462.25 | 472.83 | 478.28 | 483.76 | 489.27 |

| MAZDOCK | 2358076 | 279.00 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| SRTRANSFIN (F&O) | 2339585 | 1490.85 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| CASTROLIND | 2183411 | 143.80 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| GSFC | 2104590 | 126.25 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| GRANULES (F&O) | 2096103 | 325.25 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| CANFINHOME | 1681526 | 699.05 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| RAILTEL | 1559456 | 131.90 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| GRASIM (F&O) | 1369162 | 1745.80 | 1753.52 | 1743.06 | 1763.12 | 1773.63 | 1784.17 | 1794.74 |

| SRF (F&O) | 1309633 | 2268.85 | 2280.06 | 2268.14 | 2290.87 | 2302.85 | 2314.86 | 2326.90 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| IEX | 18379679 | 757.95 | 756.25 | 763.14 | 749.77 | 742.93 | 736.13 | 729.36 |

| NMDC (F&O) | 14743150 | 145.95 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| INDHOTEL (F&O) | 14286402 | 213.95 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| HINDALCO (F&O) | 14173662 | 493.75 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| OIL | 12381349 | 217.00 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| HINDCOPPER | 10395166 | 136.70 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| AMBUJACEM (F&O) | 9834178 | 379.90 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| RELIANCE (F&O) | 9613812 | 2622.50 | 2613.77 | 2626.56 | 2602.30 | 2589.56 | 2576.85 | 2564.17 |

| INFY (F&O) | 8779629 | 1753.65 | 1753.52 | 1764.00 | 1743.93 | 1733.51 | 1723.11 | 1712.75 |

| TATASTEEL (F&O) | 8357573 | 1314.70 | 1314.06 | 1323.14 | 1305.67 | 1296.65 | 1287.66 | 1278.70 |

| INDUSTOWER (F&O) | 7048354 | 295.80 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| WELCORP | 5112503 | 128.50 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| TCS (F&O) | 4871211 | 3532.50 | 3525.39 | 3540.25 | 3512.32 | 3497.51 | 3482.74 | 3468.00 |

| LAURUSLABS | 4388343 | 572.25 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| DEEPAKNTR (F&O) | 4179873 | 2432.40 | 2425.56 | 2437.89 | 2414.47 | 2402.20 | 2389.96 | 2377.75 |

| VOLTAS (F&O) | 3270210 | 1192.05 | 1190.25 | 1198.89 | 1182.23 | 1173.65 | 1165.10 | 1156.58 |

| TATACHEM (F&O) | 3169781 | 1003.80 | 1000.14 | 1008.06 | 992.75 | 984.88 | 977.05 | 969.25 |

| JUBLFOOD (F&O) | 2760487 | 3868.75 | 3859.52 | 3875.06 | 3845.92 | 3830.43 | 3814.97 | 3799.54 |

| SONACOMS | 2746143 | 625.15 | 625.00 | 631.27 | 619.08 | 612.87 | 606.69 | 600.55 |

| STLTECH | 2624434 | 276.50 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| MAHINDCIE | 2564537 | 279.50 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| RAIN | 2465799 | 229.30 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| HINDZINC | 2189697 | 342.05 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| REDINGTON | 2000050 | 143.85 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| LXCHEM | 1668842 | 475.20 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |