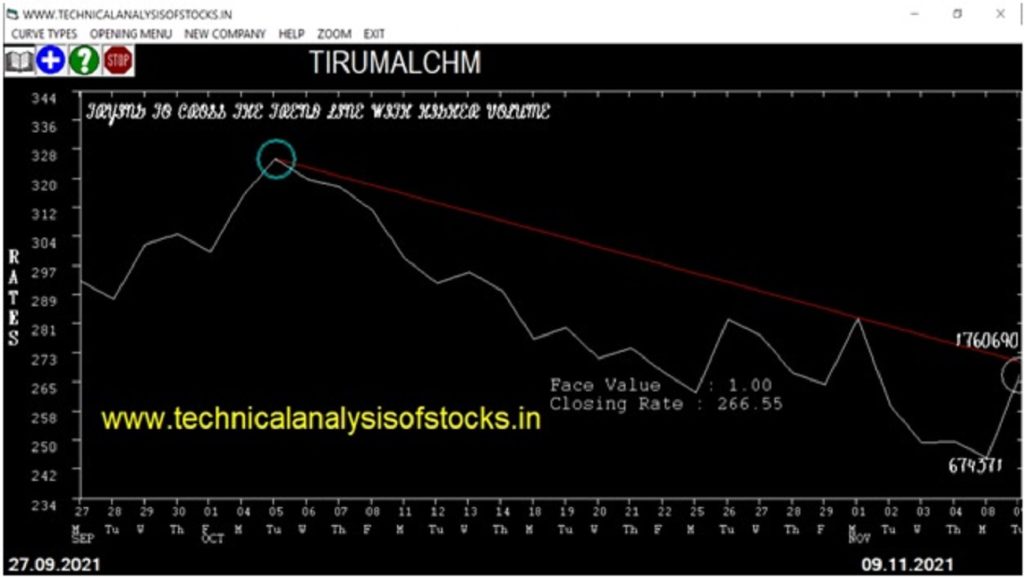

BUY TIRUMALCHM (NSE Symbol) Buy@ 268.15 or Above after cooling period SIGNAL : TRYING TO CROSS THE TREND LINE WITH HIGHER VOLUME. Stop Loss : 248.20 Target : 284.65 (Short term)

HOT BUZZING STOCKS (10.11.2021)

NSE SYMBOL CLOSING RATE

SYMBOL RATE

SHK 183.50

LFIC 96.15

3IINFOLTD 57.85

TEXMOPIPES 57.00

BCG 83.00

BSL 98.70

DCMNVL 323.40

JINDALPHOT 281.45

SASTASUNDR 479.85

ACRYSIL 810.40

AUTOIND 69.45

GOKULAGRO 69.45

KOPRAN 235.70

KPIGLOBAL 198.85

NITINSPIN 281.15

PARAS 813.55

SUULD 248.30

ZENTEC 221.00

ADANIPOWER 109.70

BASML 72.75

DBREALTY 46.40

NAGREEKEXP 41.10

BHARATWIRE 59.15

ZOMATO 137.65

RTNINDIA 46.65

TTML 70.25

TARC 51.15

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| SRF (F&O) | 107229 | 2171.95 | 2172.45 | 0.02 |

| ARVINDFASN | 20131 | 342.00 | 342.30 | 0.09 |

| HINDCOPPER | 26351 | 132.75 | 133.10 | 0.26 |

| ADANIPORTS (F&O) | 57702 | 734.50 | 737.35 | 0.39 |

| HEROMOTOCO (F&O) | 49095 | 2702.85 | 2714.35 | 0.42 |

| BIRLACORPN | 14125 | 1602.95 | 1610.40 | 0.46 |

| DEEPAKNTR (F&O) | 59176 | 2350.00 | 2363.35 | 0.56 |

| ABB | 28527 | 2170.00 | 2185.05 | 0.69 |

| COFORGE (F&O) | 32705 | 5345.00 | 5381.95 | 0.69 |

| BIRLACORPN | 14125 | 1599.10 | 1610.40 | 0.70 |

| INDIANB | 57691 | 177.80 | 179.05 | 0.70 |

| BEL (F&O) | 117176 | 218.85 | 220.80 | 0.88 |

| GREAVESCOT | 40676 | 138.30 | 140.20 | 1.36 |

| ABB | 28527 | 2153.75 | 2185.05 | 1.43 |

| TINPLATE | 15568 | 303.25 | 308.50 | 1.70 |

| TATACHEM (F&O) | 60908 | 930.00 | 947.90 | 1.89 |

| TINPLATE | 15568 | 302.00 | 308.50 | 2.11 |

| SMLISUZU | 17592 | 749.00 | 771.80 | 2.95 |

| BSOFT | 85947 | 420.95 | 434.40 | 3.10 |

| APTECHT | 46365 | 383.95 | 397.50 | 3.41 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| CHEMPLASTS | 20885 | 642.00 | 622.10 | 3.20 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| BAJAJFINSV (F&O) | 38725 | 18191.27 | 18032.07 | 18317.23 | 18172.50 | 18174.00 | -0.01 |

| HDFC (F&O) | 105242 | 2943.06 | 2877.08 | 2996.06 | 2941.60 | 2947.90 | -0.21 |

| COLPAL (F&O) | 20134 | 1540.56 | 1492.64 | 1579.27 | 1539.25 | 1547.00 | -0.50 |

| MAHINDCIE | 11080 | 280.56 | 260.15 | 297.41 | 279.25 | 281.00 | -0.63 |

| FCL | 20310 | 129.39 | 115.62 | 140.95 | 128.55 | 129.40 | -0.66 |

| DRREDDY (F&O) | 30198 | 4795.56 | 4711.75 | 4862.63 | 4792.35 | 4834.95 | -0.89 |

| NAUKRI (F&O) | 25729 | 6221.27 | 6126.12 | 6297.24 | 6219.15 | 6289.00 | -1.12 |

| SPENCERS | 22928 | 138.06 | 123.83 | 149.99 | 136.35 | 137.90 | -1.14 |

| TORNTPOWER (F&O) | 19434 | 534.77 | 506.50 | 557.86 | 529.80 | 536.00 | -1.17 |

| HCLTECH (F&O) | 148010 | 1173.06 | 1131.21 | 1206.96 | 1172.80 | 1191.45 | -1.59 |

| BIOCON (F&O) | 17021 | 351.56 | 328.68 | 370.38 | 347.00 | 352.50 | -1.59 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| GODREJCP (F&O) | 27584 | 953.27 | 991.75 | 923.10 | 960.30 | 951.50 | 0.92 |

| LAURUSLABS | 76060 | 489.52 | 517.30 | 467.87 | 490.60 | 486.00 | 0.94 |

| GAIL (F&O) | 50589 | 150.06 | 165.68 | 138.13 | 150.65 | 149.00 | 1.10 |

| JSL | 22902 | 189.06 | 206.54 | 175.65 | 191.35 | 189.00 | 1.23 |

| DHANI | 19266 | 178.89 | 195.90 | 165.85 | 182.10 | 179.15 | 1.62 |

| ANGELBRKG | 30534 | 1233.77 | 1277.42 | 1199.49 | 1234.80 | 1211.00 | 1.93 |

| HDFCAMC (F&O) | 13655 | 2665.14 | 2728.70 | 2615.07 | 2672.90 | 2621.00 | 1.94 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| LUPIN (F&O) | 1.88% |

| DRREDDY (F&O) | 2.62% |

| GAIL (F&O) | 2.75% |

| ANGELBRKG | 2.85% |

| HAVELLS (F&O) | 2.87% |

| SONACOMS | 2.99% |

| GLAND | 3.44% |

| AUBANK (F&O) | 3.59% |

| GAIL (F&O) | 3.72% |

| MPHASIS (F&O) | 4.33% |

| ARVIND | 4.97% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HDFC (F&O) | 0.21% |

| SONATSOFTW | 0.50% |

| COLPAL (F&O) | 0.50% |

| IPCALAB (F&O) | 0.58% |

| MAHINDCIE | 0.63% |

| FCL | 0.66% |

| CARBORUNIV | 0.77% |

| DRREDDY (F&O) | 0.89% |

| LUPIN (F&O) | 1.12% |

| NAUKRI (F&O) | 1.12% |

| SPENCERS | 1.14% |

| TORNTPOWER (F&O) | 1.17% |

| NIITLTD | 1.17% |

| BHARTIARTL (F&O) | 1.35% |

| TATACOFFEE | 1.51% |

| HDFCAMC (F&O) | 1.54% |

| CIPLA (F&O) | 1.58% |

| BIOCON (F&O) | 1.59% |

| HCLTECH (F&O) | 1.59% |

| SUMICHEM | 1.69% |

| BAJAJ-AUTO (F&O) | 1.73% |

| SUNPHARMA (F&O) | 1.90% |

| MSTCLTD | 1.93% |

| REDINGTON | 2.00% |

| DCAL | 2.20% |

| AXISBANK (F&O) | 2.28% |

| INDIGO (F&O) | 2.31% |

| JKTYRE | 2.31% |

| ZENSARTECH | 2.46% |

| RECLTD (F&O) | 2.55% |

| CADILAHC (F&O) | 2.73% |

| AFFLE | 3.02% |

| OIL | 3.02% |

| CUMMINSIND (F&O) | 3.04% |

| FSL | 3.14% |

| LTI (F&O) | 3.27% |

| IRCTC (F&O) | 3.39% |

| SBICARD | 3.39% |

| GODREJCP (F&O) | 3.46% |

| GLAND | 3.52% |

| CHAMBLFERT | 4.39% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

JKIL Sell @ 182.25 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AARTIDRUGS

ATULAUTO

EICHERMOT (F&O)

SUVENPHAR

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

HCLTECH (F&O)

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

SRF (F&O)

TVSMOTOR (F&O)

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

EIDPARRY

SUULD

BEARISH ENGULFING

MAHSEAMLES

SRTRANSFIN (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BCG

SUULD

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

LINDEINDIA

MOTILALOFS

PRESTIGE

TRIGYN

BEARISH BELLHOLD PATTERN

GSPL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10% lower than 52 Week low level

UJJIVAN

IOLCP

EPL

RAMCOSYS

JUBLPHARMA

AARTIDRUGS

BIOCON (F&O)

GRANULES (F&O)

AMARAJABAT (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

RALLIS

BAJAJCON

DBL

NTPC (F&O)

BPCL (F&O)

REPCOHOME

ITC (F&O)

ABSLAMC

KRBL

SEQUENT

FILATEX

CAMLINFINE

NOCIL

FSL

CANFINHOME (F&O)

WELSPUNIND

BAJAJFINSV (F&O)

GAIL (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

CICIBANK (F&O)

LT (F&O)

SOBHA

SUNTV (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ADANIPOWER

BSOFT

GMMPFAUDLR

MSTCLTD

NUCLEUS

REFEX

SAKSOFT

SMLISUZU

ZENTEC

ZOMATO

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

TANLA

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

HINDALCO (F&O)

ISEC

NAVNETEDUL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SUNTV (F&O) | 581.10 | 582.02 | 576.00 | 587.77 | 593.84 | 599.95 | 606.09 |

| SPAL | 341.15 | 342.25 | 337.64 | 346.72 | 351.39 | 356.09 | 360.82 |

| NAUKRI (F&O) | 6219.15 | 6221.27 | 6201.56 | 6237.88 | 6257.64 | 6277.42 | 6297.24 |

| MCX | 1838.75 | 1849.00 | 1838.27 | 1858.84 | 1869.63 | 1880.45 | 1891.30 |

| ICICIBANK (F&O) | 786.55 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CAPACITE | 178.00 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| KIRLOSENG | 201.85 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| CHENNPETRO | 121.75 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| CHAMBLFERT | 356.85 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| MANINDS | 105.30 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 103894620 | 241.90 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| ASHOKLEY (F&O) | 31041778 | 149.85 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| ZOMATO | 26457361 | 137.65 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| TVSMOTOR (F&O) | 25844281 | 731.45 | 735.77 | 729.00 | 742.19 | 749.02 | 755.87 | 762.76 |

| IBULHSGFIN (F&O) | 22506548 | 243.65 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| BEL (F&O) | 17252200 | 220.80 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| ZEEL (F&O) | 17183572 | 324.60 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| M&M (F&O) | 15376349 | 892.15 | 892.52 | 885.06 | 899.55 | 907.06 | 914.60 | 922.18 |

| BANDHANBNK (F&O) | 13258081 | 306.90 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| INDHOTEL (F&O) | 11701669 | 219.85 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| IRCTC (F&O) | 9656004 | 856.00 | 862.89 | 855.56 | 869.81 | 877.20 | 884.62 | 892.07 |

| ADANIPOWER | 8696567 | 109.70 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| BSOFT | 5809548 | 434.40 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| INDIACEM | 5753281 | 223.10 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| ADANIENT (F&O) | 4713708 | 1635.45 | 1640.25 | 1630.14 | 1649.57 | 1659.73 | 1669.93 | 1680.16 |

| SOBHA | 3533836 | 907.05 | 907.52 | 900.00 | 914.60 | 922.18 | 929.78 | 937.42 |

| GATI | 3506814 | 176.60 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| PARAS | 3269902 | 813.55 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| TATACHEM (F&O) | 3150110 | 947.90 | 953.27 | 945.56 | 960.52 | 968.28 | 976.07 | 983.90 |

| CONCOR (F&O) | 2999385 | 701.45 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| BHARATFORG (F&O) | 2985897 | 834.05 | 841.00 | 833.77 | 847.84 | 855.13 | 862.46 | 869.81 |

| SONACOMS | 2961288 | 684.95 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| LXCHEM | 2785166 | 423.60 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

| GUJGASLTD (F&O) | 2273782 | 645.25 | 650.25 | 643.89 | 656.31 | 662.73 | 669.18 | 675.66 |

| VRLLOG | 2237671 | 515.25 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| JINDALSTEL (F&O) | 11324467 | 413.30 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| POONAWALLA | 9408416 | 169.80 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| KRBL | 3720116 | 281.60 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| FILATEX | 3708015 | 105.15 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| SRTRANSFIN (F&O) | 2525791 | 1616.05 | 1610.02 | 1620.06 | 1600.80 | 1590.81 | 1580.85 | 1570.93 |

| SHYAMMETL | 2070304 | 349.90 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |

| TNPETRO | 1429567 | 121.50 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| BRITANNIA (F&O) | 1399094 | 3621.60 | 3615.02 | 3630.06 | 3601.80 | 3586.81 | 3571.85 | 3556.92 |

| UFO | 1292163 | 118.85 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| JSL | 1211525 | 191.35 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| INOXLEISUR | 1112806 | 442.20 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| SEQUENT | 1004132 | 184.55 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| VBL | 893091 | 966.10 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| SWSOLAR | 801685 | 443.20 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| GRSE | 705013 | 258.25 | 256.00 | 260.02 | 252.14 | 248.19 | 244.26 | 240.37 |

| SVPGLOB | 687969 | 131.50 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| INOXWIND | 660778 | 135.55 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| KPRMILL | 648999 | 517.55 | 511.89 | 517.56 | 506.50 | 500.89 | 495.31 | 489.76 |

| UGROCAP | 564947 | 165.70 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| SALZERELEC | 556934 | 197.65 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| MAXVIL | 360077 | 147.90 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| GUJALKALI | 358348 | 737.00 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| TRIVENI | 331129 | 201.00 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| CARBORUNIV | 305535 | 858.35 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| MAHSEAMLES | 282704 | 503.80 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |