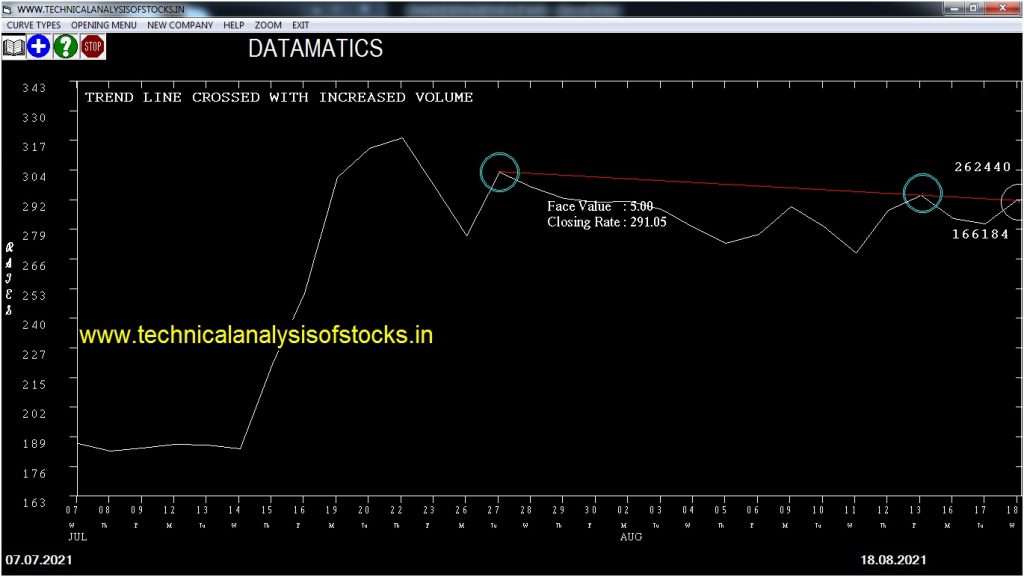

BUY DATAMATICS (NSE Symbol) Buy@ 293.25 or Above after cooling period SIGNAL : TREND LINE CROSSED WITH INCREASED VOLUME. Stop Loss : 272.40 Target : 310.50 (Short term)

HOT BUZZING STOCKS (20.08.2021)

NSE SYMBOL CLOSING RATE

JOCIL 256.80

SHREYAS 262.50

NELCO 517.35

INTENTECH 77.25

INDOTHAI 85.50

20MICRONS 54.35

LYKALABS 75.90

MINDTECK 93.00

PRIMESECU 83.90

VINEETLAB 80.15

PITTIENG 171.30

MARALOVER 77.95

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| ADANIENT (F&O) | 88757 | 1456.60 | 1460.00 | 0.23 |

| INDUSTOWER (F&O) | 46348 | 217.00 | 218.60 | 0.73 |

| AMBUJACEM (F&O) | 85308 | 405.00 | 409.40 | 1.07 |

| ACC (F&O) | 62911 | 2327.95 | 2356.30 | 1.20 |

| LALPATHLAB (F&O) | 57744 | 3913.20 | 4004.15 | 2.27 |

| VGUARD | 19971 | 240.50 | 248.10 | 3.06 |

| EMAMILTD | 33080 | 577.80 | 597.45 | 3.29 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| SONACOMS | 89779 | 474.00 | 473.75 | 0.05 |

| GHCL | 10319 | 342.20 | 341.15 | 0.31 |

| DIXON | 31483 | 4116.10 | 4099.35 | 0.41 |

| SBIN (F&O) | 265793 | 421.70 | 419.70 | 0.48 |

| KOTAKBANK (F&O) | 97474 | 1762.15 | 1749.70 | 0.71 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| NAUKRI (F&O) | 53127 | 5494.52 | 5404.95 | 5566.11 | 5482.10 | 5485.00 | -0.05 |

| MUTHOOTFIN (F&O) | 29973 | 1482.25 | 1435.23 | 1520.24 | 1479.40 | 1482.05 | -0.18 |

| HDFCAMC (F&O) | 23838 | 2997.56 | 2930.98 | 3051.04 | 2995.90 | 3001.60 | -0.19 |

| NAUKRI (F&O) | 53127 | 5494.52 | 5404.95 | 5566.11 | 5482.10 | 5498.80 | -0.30 |

| ASTRAL | 16580 | 2081.64 | 2026.01 | 2126.45 | 2071.15 | 2089.70 | -0.90 |

| LALPATHLAB (F&O) | 57744 | 4016.39 | 3939.53 | 4077.98 | 4004.15 | 4050.00 | -1.15 |

| DEEPAKNTR (F&O) | 36458 | 2139.06 | 2082.68 | 2184.47 | 2134.30 | 2163.00 | -1.34 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| AXISBANK (F&O) | 121359 | 749.39 | 783.61 | 722.63 | 754.40 | 752.50 | 0.25 |

| HEROMOTOCO (F&O) | 40781 | 2756.25 | 2820.85 | 2705.35 | 2763.60 | 2751.25 | 0.45 |

| PFC (F&O) | 18392 | 126.56 | 140.95 | 115.62 | 128.20 | 127.50 | 0.55 |

| JUSTDIAL | 10468 | 961.00 | 999.64 | 930.72 | 962.35 | 954.05 | 0.86 |

| GODREJPROP (F&O) | 27179 | 1501.56 | 1549.62 | 1463.79 | 1507.10 | 1494.10 | 0.86 |

| IBULHSGFIN (F&O) | 119486 | 240.25 | 259.89 | 225.11 | 241.35 | 239.00 | 0.97 |

| IEX | 48861 | 400.00 | 425.18 | 380.44 | 404.00 | 399.80 | 1.04 |

| CYIENT | 27574 | 937.89 | 976.07 | 907.97 | 941.35 | 927.55 | 1.47 |

| DEEPAKNTR (F&O) | 36458 | 2127.52 | 2184.47 | 2082.68 | 2134.30 | 2101.00 | 1.56 |

| DIVISLAB (F&O) | 51473 | 4900.00 | 4985.40 | 4832.67 | 4910.45 | 4831.00 | 1.62 |

| WOCKPHARMA | 12012 | 478.52 | 506.00 | 457.12 | 479.75 | 470.00 | 2.03 |

| PVR (F&O) | 25288 | 1387.56 | 1433.80 | 1351.24 | 1388.40 | 1356.05 | 2.33 |

| SUNPHARMA (F&O) | 63213 | 777.02 | 811.84 | 749.77 | 782.90 | 764.10 | 2.40 |

| EQUITAS | 12664 | 121.00 | 135.07 | 110.31 | 123.65 | 120.60 | 2.47 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ASTRAL | 0.90% |

| CAMS | 2.06% |

| SUNPHARMA (F&O) | 2.74% |

| CAMS | 2.97% |

| TRENT (F&O) | 3.25% |

| LINCOLN | 4.70% |

| PRINCEPIPE | 6.26% |

| IBULHSGFIN (F&O) | 6.63% |

| RAILTEL | 7.03% |

| PRESTIGE | 7.95% |

| JINDALSAW | 9.47% |

| ISGEC | 12.61% |

| SHILPAMED | 14.35% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MUTHOOTFIN (F&O) | 0.18% |

| HDFCAMC (F&O) | 0.19% |

| NAUKRI (F&O) | 0.30% |

| JUSTDIAL | 0.68% |

| HAPPSTMNDS | 0.92% |

| DIVISLAB (F&O) | 0.99% |

| MOTILALOFS | 1.23% |

| VOLTAS (F&O) | 1.49% |

| SYNGENE | 1.51% |

| COROMANDEL (F&O) | 1.80% |

| HEROMOTOCO (F&O) | 1.85% |

| ABFRL (F&O) | 1.94% |

| AXISBANK (F&O) | 1.94% |

| DATAMATICS | 2.03% |

| HAVELLS (F&O) | 2.09% |

| HEIDELBERG | 2.12% |

| PIDILITIND (F&O) | 2.19% |

| SBICARD | 2.40% |

| MFSL (F&O) | 2.40% |

| SWSOLAR | 2.42% |

| SUNPHARMA (F&O) | 2.43% |

| WHIRLPOOL | 2.61% |

| BIOCON (F&O) | 2.69% |

| ZOMATO | 2.82% |

| GODREJIND | 2.92% |

| CAMS | 2.97% |

| PEL (F&O) | 3.28% |

| DEEPAKNTR (F&O) | 3.45% |

| MINDACORP | 3.57% |

| PVR (F&O) | 3.60% |

| ITC (F&O) | 3.73% |

| GODREJPROP (F&O) | 3.79% |

| PFC (F&O) | 3.82% |

| SBIN (F&O) | 3.98% |

| KOTAKBANK (F&O) | 4.02% |

| RAYMOND | 4.07% |

| EQUITAS | 4.33% |

| GUJGASLTD (F&O) | 4.34% |

| SUNTECK | 4.53% |

| WOCKPHARMA | 4.59% |

| SUMICHEM | 4.95% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

CYBERTECH Sell @ 160 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ALEMBICLTD

CROMPTON

EIHOTEL

FINCABLES

GOLDENTOBC

GRINFRA

SAKAR

SHOPERSTOP

SUPRAJIT

TVSMOTOR (F&O)

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

ASTRAL

DBL

FORCEMOT

GOLDENTOBC

HDFCLIFE (F&O)

KAMDHENU

MAHLOG

STLTECH

TATACOFFEE

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AXISBANK (F&O)

BERGEPAINT (F&O)

CENTURYPLY

DEEPAKNTR (F&O)

FSL

JUSTDIAL

PIDILITIND (F&O)

RAJESHEXPO

SUNPHARMA (F&O)

VOLTAS (F&O)

Higher Level Consolidation

AXISBANK (F&O)

HDFCLIFE (F&O)

KOTAKBANK (F&O)

NTPC (F&O)

SBILIFE (F&O)

Lower Level Consolidation

AXISBANK (F&O)

BERGEPAINT (F&O)

DIVISLAB (F&O)

HDFCLIFE (F&O)

JUSTDIAL

MON100

PEL (F&O)

TATAMETALI

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

UTIAMC

GAP DOWN BREAKOUT STOCKS

REDINGTON

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BSE

BEARISH ENGULFING

POLYCAB

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

MINDTECK

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

MCDOWELL-N (F&O)

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

SVPGLOB

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BEPL

BRITANNIA (F&O)

CASTROLIND

COLPAL (F&O)

DBCORP

GAIL (F&O)

GET&D

GICRE

HDFCBANK (F&O)

INDUSINDBK (F&O)

JINDWORLD

JYOTHYLAB

KRBL

MAZDOCK

MSTCLTD

RECLTD (F&O)

SIS

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BIOCON (F&O)

HDFCLIFE (F&O)

LUPIN (F&O)

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CARBORUNIV | 708.95 | 715.56 | 708.89 | 721.90 | 728.64 | 735.40 | 742.19 |

| NAVINFLUOR (F&O) | 3733.90 | 3736.27 | 3721.00 | 3749.69 | 3765.01 | 3780.36 | 3795.74 |

| SUVENPHAR | 562.20 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| KANSAINER | 634.70 | 637.56 | 631.27 | 643.57 | 649.92 | 656.31 | 662.73 |

| SYNGENE | 629.50 | 631.27 | 625.00 | 637.24 | 643.57 | 649.92 | 656.31 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ORIENTCEM | 157.90 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| RUCHI | 1113.70 | 1105.56 | 1113.89 | 1097.81 | 1089.54 | 1081.31 | 1073.10 |

| KPITTECH | 360.90 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| DIVISLAB (F&O) | 4910.45 | 4900.00 | 4917.52 | 4884.96 | 4867.50 | 4850.06 | 4832.67 |

| THYROCARE | 1310.25 | 1305.02 | 1314.06 | 1296.65 | 1287.66 | 1278.70 | 1269.78 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| CANBK (F&O) | 34481078 | 157.15 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| CUB (F&O) | 4459490 | 149.45 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| CADILAHC (F&O) | 3185524 | 542.80 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| JUBLFOOD (F&O) | 2529037 | 4040.40 | 4048.14 | 4032.25 | 4062.03 | 4077.98 | 4093.95 | 4109.96 |

| BAJFINANCE (F&O) | 2153730 | 6544.10 | 6561.00 | 6540.77 | 6577.97 | 6598.26 | 6618.58 | 6638.93 |

| SWSOLAR | 1938545 | 276.45 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| EICHERMOT (F&O) | 1901521 | 2589.65 | 2601.00 | 2588.27 | 2612.46 | 2625.25 | 2638.07 | 2650.92 |

| GPPL | 1371716 | 104.40 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| CLEAN | 1365679 | 1544.65 | 1550.39 | 1540.56 | 1559.47 | 1569.36 | 1579.27 | 1589.22 |

| VGUARD | 1277494 | 248.10 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| ACC (F&O) | 965286 | 2356.30 | 2364.39 | 2352.25 | 2375.37 | 2387.57 | 2399.80 | 2412.06 |

| HAL | 855153 | 1120.15 | 1122.25 | 1113.89 | 1130.08 | 1138.49 | 1146.94 | 1155.42 |

| ICICIGI (F&O) | 854268 | 1484.40 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| GUFICBIO | 833001 | 206.95 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| BSE | 776394 | 1133.80 | 1139.06 | 1130.64 | 1146.94 | 1155.42 | 1163.93 | 1172.48 |

| COFORGE (F&O) | 758653 | 4975.85 | 4987.89 | 4970.25 | 5003.06 | 5020.75 | 5038.48 | 5056.24 |

| MINDACORP | 736842 | 130.35 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| UTIAMC | 729476 | 1129.40 | 1130.64 | 1122.25 | 1138.49 | 1146.94 | 1155.42 | 1163.93 |

| BDL | 726160 | 388.35 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

| ULTRACEMCO (F&O) | 724989 | 7601.45 | 7612.56 | 7590.77 | 7630.57 | 7652.42 | 7674.30 | 7696.21 |

| LALPATHLAB (F&O) | 716975 | 4004.15 | 4016.39 | 4000.56 | 4030.23 | 4046.12 | 4062.03 | 4077.98 |

| COROMANDEL (F&O) | 617351 | 848.70 | 855.56 | 848.27 | 862.46 | 869.81 | 877.20 | 884.62 |

| DALBHARAT | 532378 | 1902.95 | 1903.14 | 1892.25 | 1913.11 | 1924.05 | 1935.03 | 1946.04 |

| METROPOLIS (F&O) | 522613 | 2797.35 | 2809.00 | 2795.77 | 2820.85 | 2834.14 | 2847.47 | 2860.82 |

| MOTILALOFS | 475376 | 813.10 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| VEDL (F&O) | 36805826 | 295.90 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| IBULHSGFIN (F&O) | 17137291 | 241.35 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| HINDALCO (F&O) | 12169397 | 426.95 | 425.39 | 430.56 | 420.46 | 415.35 | 410.27 | 405.22 |

| IBREALEST | 7603361 | 144.50 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| MANAPPURAM (F&O) | 5701408 | 165.50 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| SONACOMS | 3623680 | 473.75 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| APOLLOHOSP (F&O) | 2941548 | 4787.90 | 4778.27 | 4795.56 | 4763.38 | 4746.14 | 4728.93 | 4711.75 |

| KOTAKBANK (F&O) | 2763653 | 1749.70 | 1743.06 | 1753.52 | 1733.51 | 1723.11 | 1712.75 | 1702.41 |

| RAIN | 2546991 | 214.50 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| GREAVESCOT | 2390974 | 131.60 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| JINDALSAW | 2368977 | 120.95 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| WELCORP | 1917867 | 114.85 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| ALLCARGO | 1533589 | 220.40 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| ZENSARTECH | 1469543 | 446.05 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| JSL | 1423346 | 148.05 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SPARC | 1382468 | 289.65 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| IRB | 1303485 | 161.00 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| GICRE | 1233692 | 150.50 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| GABRIEL | 1206510 | 146.85 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| NIITLTD | 1088689 | 328.20 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| CAMLINFINE | 1082042 | 167.20 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| ELECON | 904236 | 171.35 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| OIL | 857655 | 163.55 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| WINDLAS | 828719 | 388.30 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| DHANI | 798269 | 196.50 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |