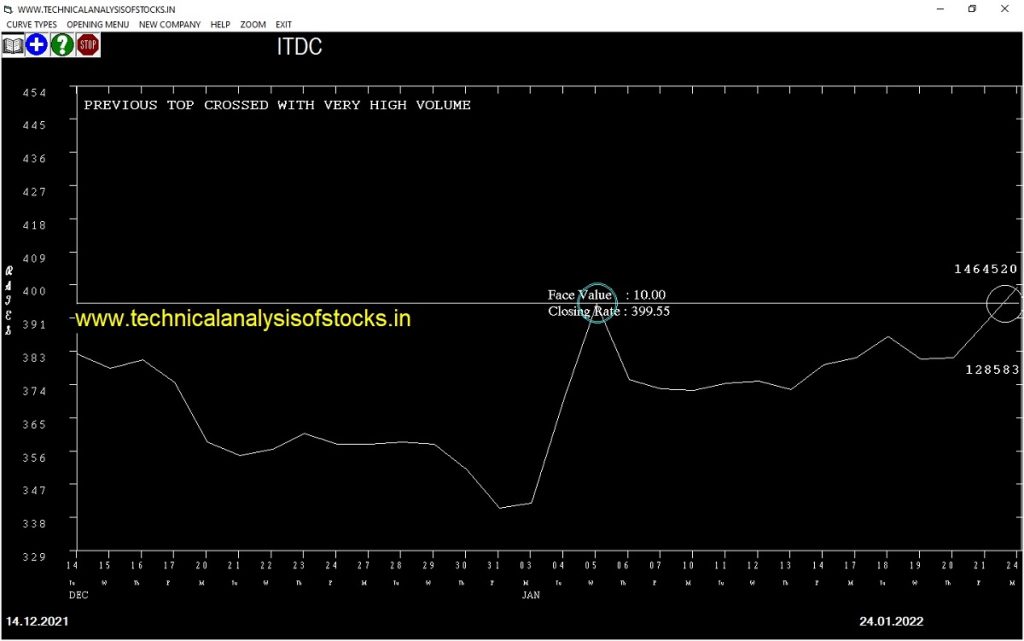

BUY ITDC (NSE Symbol) Buy @400 or Above after cooling period. SIGNAL : PREVIOUS TOP CROSSED WITH VERY HIGH VOLUME. Stop Loss : 375.60 Target : 420.05 (Short term)

HOT BUZZING STOCKS (25.01.2022)

NSE SYMBOL CLOSING RATE

3IINFOLTD 77.50

ARROWGREEN 132.05

LAMBODHARA 110.80

PRAXIS 68.85

RTNINDIA 54.45

AMDIND 47.70

BCONCEPTS 74.35

BLS 208.05

FOODSIN 111.65

NDL 157.35

NETWORK18 82.10

POONAWALLA 265.05

TEXMOPIPES 90.65

V2RETAIL 147.75

ADSL 145.75

ARVSMART 218.15

AURIONPRO 327.45

BGRENERGY 99.00

DONEAR 71.35

EKC 235.20

GENESYS 412.10

INDOTECH 271.40

IRB 221.00

JINDALPHOT 387.30

JINDALPOLY 1054.00

MONARCH 153.20

NITINSPIN 280.70

ONWARDTEC 339.75

PITTIENG 266.60

PNBHOUSING 439.40

PONNIERODE 258.85

TEJASNET 395.00

ADANIGREEN 1837.85

ARCHIDPLY 54.15

CREATIVE 654.10

DCM 112.20

DEEPAKFERT 486.70

EASEMYTRIP 539.80

JBMA 1549.70

JPOLYINVST 416.50

KELLTONTEC 116.85

KHADIM 269.95

KOPRAN 287.90

NAHARINDUS 137.85

NAZARA 2386.50

PRECOT 336.35

SASTASUNDR 465.00

SSWL 745.85

TANLA 1781.35

TREJHARA 105.55

WEBELSOLAR 133.05

AKG 43.95

COFFEEDAY 69.10

GOKEX 367.70

KOTHARIPET 94.25

CYBERTECH 198.60

GMDCLTD 96.00

GREAVESCOT 210.15

INDNIPPON 524.85

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

|---|---|---|---|---|

| NH | 14041 | 630.90 | 629.35 | 0.25 |

| PIDILITIND (F&O) | 50178 | 2650.00 | 2640.35 | 0.37 |

| PRSMJOHNSN | 11651 | 136.05 | 135.15 | 0.67 |

| CROMPTON (F&O) | 29460 | 416.30 | 412.60 | 0.90 |

| IIFL | 11583 | 301.10 | 297.35 | 1.26 |

| VBL | 33760 | 913.70 | 900.65 | 1.45 |

| EXIDEIND (F&O) | 37544 | 175.50 | 173.00 | 1.45 |

| TIINDIA | 24687 | 1748.40 | 1714.60 | 1.97 |

| DEVYANI | 72249 | 173.95 | 170.55 | 1.99 |

| SONATSOFTW | 20912 | 837.95 | 818.55 | 2.37 |

| GUFICBIO | 13154 | 241.05 | 235.35 | 2.42 |

| FCL | 31349 | 151.55 | 147.90 | 2.47 |

| RAJESHEXPO | 11515 | 845.05 | 821.70 | 2.84 |

| GSPL (F&O) | 33243 | 305.05 | 296.45 | 2.90 |

| CENTURYPLY | 17209 | 628.55 | 610.20 | 3.01 |

| DATAPATTNS | 24288 | 742.45 | 720.45 | 3.05 |

| INDIANB | 24752 | 139.15 | 134.55 | 3.42 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| JINDWORLD | 25427 | 328.52 | 306.40 | 346.72 | 327.75 | 329.00 | -0.38 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| VRLLOG | 12933 | 441.00 | 467.41 | 420.46 | 444.70 | 438.00 | 1.51 |

| CSBBANK | 40247 | 240.25 | 259.89 | 225.11 | 242.50 | 238.00 | 1.86 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| JINDWORLD | 0.38% |

| NH | 2.80% |

| AAVAS | 3.09% |

| PIDILITIND (F&O) | 3.19% |

| APTUS | 4.01% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ALKALI

GODHA

HIKAL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

GODHA

IFBIND

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

SHARDACROP

GAP DOWN BREAKOUT STOCKS

CARBORUNIV

GHCL

INFY (F&O)

JSWSTEEL (F&O)

LALPATHLAB (F&O)

PARAS

RAMCOIND

TECHM (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

NIL

BEARISH ENGULFING PATTERN

ANDHRAPAP

BCONCEPTS

CLSEL

DVL

GANESHBE

GNA

ICICIBANKN

ICICIPHARM

JINDALPHOT

JPOLYINVST

KOPRAN

LICNFNHGP

MANGALAM

MARSHALL

MON100

PALREDTEC

PGIL

PIDILITIND (F&O)

PRAXIS

REPCOHOME

SHEMAROO

SIGIND

SPMLINFRA

VERTOZ

WONDERLA

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

ADANIGREEN

ARVSMART

BCONCEPTS

CEBBCO

DEEPAKFERT

EASEMYTRIP

GENESYS

GMDCLTD

INDOTECH

LAMBODHARA

PONNIERODE

PRAXIS

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

5PAISA

CHEMCON

COFFEEDAY

COFORGE (F&O)

CYBERTECH

GOKEX

GRASIM (F&O)

ICICIALPLV

ICICIPHARM

INDIAGLYCO

IZMO

KOPRAN

LATENTVIEW

LXCHEM

SASTASUNDR

SPMLINFRA

TEXMOPIPES

VTL

WSTCSTPAPR

Strategy : GARTLEY SIGNAL(W & M Patterns) (INTRADAY)

BUY RECOMMENDATION AT LOWER LEVELS

JAMNAAUTO

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL,

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

NIL

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

NIL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

ADANIGREEN

ANGELONE

DEEPAKFERT

EIHOTEL

IIFLNIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ICICILIQ | 999.99 | 1000.14 | 992.25 | 1007.56 | 1015.51 | 1023.49 | 1031.50 |

| METROBRAND | 597.45 | 600.25 | 594.14 | 606.09 | 612.26 | 618.46 | 624.69 |

| MEDPLUS | 1233.00 | 1233.77 | 1225.00 | 1241.94 | 1250.76 | 1259.62 | 1268.51 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SANDHAR | 239.95 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| PNBGILTS | 63.45 | 62.02 | 64.00 | 60.09 | 58.17 | 56.28 | 54.42 |

| SESHAPAPER | 154.20 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| IOC (F&O) | 120.35 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BANDHANBNK (F&O) | 33321083 | 307.85 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| CIPLA (F&O) | 4992078 | 892.10 | 892.52 | 885.06 | 899.55 | 907.06 | 914.60 | 922.18 |

| LUPIN (F&O) | 2304612 | 922.00 | 922.64 | 915.06 | 929.78 | 937.42 | 945.09 | 952.79 |

| ITDC | 1464520 | 399.55 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| ABB | 276068 | 2408.40 | 2413.27 | 2401.00 | 2424.35 | 2436.67 | 2449.02 | 2461.41 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAMOTORS (F&O) | 25228959 | 478.45 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| IEX (F&O) | 17907289 | 240.05 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| ITC (F&O) | 17354942 | 211.80 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| ASHOKLEY (F&O) | 15983816 | 132.80 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| VEDL (F&O) | 10949389 | 312.10 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| CANBK (F&O) | 10454987 | 208.70 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| RELIANCE (F&O) | 10092511 | 2377.90 | 2376.56 | 2388.77 | 2365.57 | 2353.43 | 2341.31 | 2329.23 |

| NIFTYBEES | 9706128 | 185.79 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| IBULHSGFIN (F&O) | 9229234 | 209.25 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| PAYTM | 7942445 | 917.45 | 915.06 | 922.64 | 907.97 | 900.45 | 892.96 | 885.51 |

| INFY (F&O) | 7116712 | 1736.80 | 1732.64 | 1743.06 | 1723.11 | 1712.75 | 1702.41 | 1692.11 |

| NMDC (F&O) | 6822893 | 133.95 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| BEL (F&O) | 6675179 | 197.30 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| HDFCBANK (F&O) | 5934254 | 1486.65 | 1482.25 | 1491.89 | 1473.38 | 1463.79 | 1454.24 | 1444.72 |

| REDINGTON | 5887136 | 152.80 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| HCLTECH (F&O) | 5878438 | 1124.90 | 1122.25 | 1130.64 | 1114.45 | 1106.12 | 1097.81 | 1089.54 |

| MANAPPURAM (F&O) | 5637013 | 149.05 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| LICHSGFIN (F&O) | 5550090 | 338.15 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| ADANIPORTS (F&O) | 5349759 | 702.45 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| BPCL (F&O) | 5334037 | 373.10 | 370.56 | 375.39 | 365.95 | 361.18 | 356.44 | 351.74 |

| M&MFIN (F&O) | 4934271 | 150.30 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| PFC (F&O) | 4756401 | 117.45 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| AMBUJACEM (F&O) | 4250468 | 352.85 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| RECLTD (F&O) | 4195506 | 129.25 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| PRICOLLTD | 3555271 | 126.90 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |