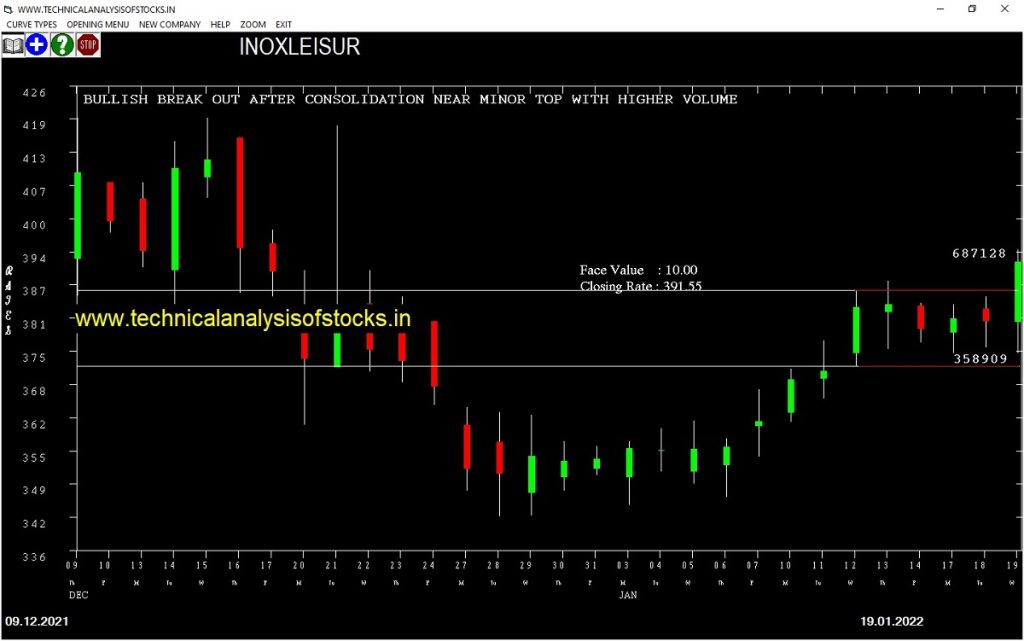

BUY INOXLEISUR (NSE Symbol) 395 or Above after cooling period. SIGNAL : BULLISH BREAK OUT AFTER CONSOLIDATION NEAR MINOR TOP WITH HIGHER VOLUME. Stop Loss : 370.75 Target : 414.95 (Short term)

HOT BUZZING STOCKS (20.01.2022)

NSE SYMBOL CLOSING RATE

PRECWIRE 122.75

SHIVATEX 296.00

ONMOBILE 153.75

INDNIPPON 620.75

INDOTECH 237.30

KELLTONTEC 123.30

JINDALPHOT 369.80

NAZARA 2494.25

RAMASTEEL 387.60

GENESYS 447.05

JPOLYINVST 397.70

ONWARDTEC 371.15

PALREDTEC 260.80

SPMLINFRA 50.55

AARVI 97.20

ALKALI 143.50

FLEXITUFF 40.15

MARALOVER 125.90

BCONCEPTS 71.00

JETFREIGHT 81.55

PRAXIS 65.75

SAGCEM 280.00

MBLINFRA 41.80

TRIDENT 61.40

DCMNVL 331.10

AJMERA 417.40

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| ELGIEQUIP | 61531 | 373.00 | 373.85 | 0.23 |

| INOXLEISUR | 24371 | 386.00 | 391.55 | 1.42 |

| PTC | 12601 | 111.20 | 112.85 | 1.46 |

| GATI | 25438 | 211.80 | 216.50 | 2.17 |

| JAICORPLTD | 84639 | 139.00 | 143.20 | 2.93 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| HEG | 24808 | 1755.10 | 1740.60 | 0.83 |

| CENTURYTEX | 14116 | 977.10 | 964.30 | 1.33 |

| PETRONET (F&O) | 17486 | 222.50 | 218.20 | 1.97 |

| PARAS | 17629 | 718.65 | 698.40 | 2.90 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| ASAHIINDIA | 15620 | 588.06 | 558.42 | 612.26 | 583.75 | 586.00 | -0.39 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| SAIL (F&O) | 118803 | 102.52 | 115.50 | 92.69 | 104.65 | 104.25 | 0.38 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| IPCALAB (F&O) | 4.96% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| BBTC | 0.33% |

| DMART | 0.37% |

| ASAHIINDIA | 0.39% |

| KAJARIACER | 0.83% |

| QUESS | 1.10% |

| SHARDACROP | 2.03% |

| GUJALKALI | 2.57% |

| ORIENTELEC | 2.95% |

| DEVYANI | 3.41% |

| SAPPHIRE | 3.67% |

| TITAN (F&O) | 3.80% |

| SAIL (F&O) | 3.97% |

| MANAPPURAM (F&O) | 4.07% |

| TATACOMM | 4.16% |

| PETRONET (F&O) | 4.45% |

| GUFICBIO | 4.50% |

| MIRZAINT | 4.58% |

| NIITLTD | 4.71% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIGREEN

ALKALI

BALPHARMA

CARTRADE

HERCULES

HUHTAMAKI

KKCL

MAPMYINDIA

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

PGIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ESCORTS (F&O)

NIACL

Higher Level Consolidation

ESCORTS (F&O)

Lower Level Consolidation

ESCORTS (F&O)

INOXLEISUR

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

AFFLE

DEEPAKFERT

HAPPSTMNDS

ICICIPRULI (F&O)

JUSTDIAL

KPITTECH

LTI (F&O)

LTTS (F&O)

SCI

ZOMATO

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

ALPA

IPCALAB (F&O)

NAHARPOLY

BEARISH ENGULFING PATTERN

ARROWGREEN

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

INDNIPPON

BEARISH MARUBOZU PATTERN

AJMERA

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

DEEPAKFERT

HDFCAMC (F&O)

ICICITECH

INFY (F&O)

NAUKRI (F&O)

SONACOMS

STARHEALTH

TCS (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

COFFEEDAY

ONMOBILE

SPLIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

STAR (F&O)

UJJIVAN

SPANDANA

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

VERTOZ

IOLCP

AMARAJABAT (F&O)

BANDHANBNK (F&O)

HUHTAMAKI

MAHLIFE

CREDITACC

AARTIDRUGS

WHIRLPOOL (F&O)

MAHEPC

JAYBARMARU

INDOSTAR

DFMFOODS

APLLTD (F&O)

AUROPHARMA (F&O)

ASHAPURMIN

EPL

BIOCON (F&O)

KPRMILL

CUB (F&O)

M&MFIN (F&O)

MGL (F&O)

CHEMCON

HDFCAMC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

PAYTM

SPANDANA

LTI (F&O)

COFORGE (F&O)

MINDTREE (F&O)

HCLTECH (F&O)

DRREDDY (F&O)

PEL (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

GANECOS

KITEX

GREENPANEL

INDIACEM (F&O)

JKPAPER

SUNTECK

GAIL (F&O)

RBLBANK (F&O)

PRAJIND

M&M (F&O)

CHAMBLFERT (F&O)

GREAVESCOT

ANGELONE

HAL (F&O)

LUMAXTECH

IOC (F&O)

CMSINFO

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

NIL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

AURIONPRO

MAHLIFE

WELCORP

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

LODHA

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| JYOTHYLAB | 141.20 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| CUB (F&O) | 143.95 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| LTI (F&O) | 6697.05 | 6703.52 | 6683.06 | 6720.64 | 6741.14 | 6761.68 | 6782.25 |

| TATACOFFEE | 217.90 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| INDHOTEL (F&O) | 207.45 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BLISSGVS | 100.95 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| PANAMAPET | 310.80 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| MAHSEAMLES | 529.65 | 529.00 | 534.77 | 523.53 | 517.82 | 512.15 | 506.50 |

| CGPOWER | 180.60 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| KNRCON | 309.85 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 36751594 | 248.50 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| ONGC (F&O) | 36648534 | 170.25 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| GAIL (F&O) | 19930096 | 147.95 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| BANDHANBNK (F&O) | 15109493 | 303.60 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| ADANIPOWER | 13729230 | 113.90 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| HEMIPROP | 13636355 | 157.75 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| IEX (F&O) | 11484514 | 260.05 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| DELTACORP (F&O) | 7960603 | 293.75 | 297.56 | 293.27 | 301.74 | 306.10 | 310.49 | 314.90 |

| CANBK (F&O) | 7422599 | 228.40 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| TINPLATE | 7129379 | 362.50 | 365.77 | 361.00 | 370.38 | 375.20 | 380.06 | 384.95 |

| GMDCLTD | 3998480 | 104.65 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| CHAMBLFERT (F&O) | 3815393 | 482.85 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| RAYMOND | 3779522 | 758.95 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| INDUSTOWER (F&O) | 3683574 | 270.70 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| SHALPAINTS | 3659929 | 140.75 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| SEQUENT | 2869709 | 180.85 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| GAEL | 2786684 | 195.95 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| PRAJIND | 2394104 | 427.90 | 430.56 | 425.39 | 435.55 | 440.78 | 446.04 | 451.34 |

| RELIGARE | 2300846 | 137.60 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| ARVIND | 2243534 | 150.85 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| RIIL | 2164633 | 974.85 | 976.56 | 968.77 | 983.90 | 991.75 | 999.64 | 1007.56 |

| GATI | 2006417 | 216.50 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| BFUTILITIE | 1967300 | 435.75 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| GNFC | 1946719 | 488.95 | 489.52 | 484.00 | 494.81 | 500.39 | 506.00 | 511.63 |

| KOTHARIPET | 1928081 | 116.25 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZOMATO | 27812341 | 129.20 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| IBREALEST | 10376235 | 159.80 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| IGL (F&O) | 9365040 | 438.60 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |

| PAYTM | 7289774 | 997.35 | 992.25 | 1000.14 | 984.88 | 977.05 | 969.25 | 961.48 |

| ADANIPORTS (F&O) | 5843870 | 744.20 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| INFY (F&O) | 5747770 | 1867.05 | 1859.77 | 1870.56 | 1849.92 | 1839.18 | 1828.48 | 1817.80 |

| BSOFT (F&O) | 5539545 | 512.90 | 511.89 | 517.56 | 506.50 | 500.89 | 495.31 | 489.76 |

| BAJFINANCE (F&O) | 5000317 | 7571.80 | 7569.00 | 7590.77 | 7551.04 | 7529.33 | 7507.64 | 7485.99 |

| M&MFIN (F&O) | 4338180 | 160.10 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| JAMNAAUTO | 3068927 | 110.65 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| APOLLOHOSP (F&O) | 2404880 | 4515.95 | 4505.77 | 4522.56 | 4491.24 | 4474.50 | 4457.79 | 4441.11 |

| KPITTECH | 2392297 | 699.15 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| HINDUNILVR (F&O) | 2145255 | 2309.90 | 2304.00 | 2316.02 | 2293.16 | 2281.20 | 2269.27 | 2257.38 |

| BURGERKING | 2024308 | 137.15 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| JUSTDIAL | 1646916 | 815.10 | 812.25 | 819.39 | 805.54 | 798.46 | 791.41 | 784.39 |

| ASIANPAINT (F&O) | 1495218 | 3280.40 | 3277.56 | 3291.89 | 3264.90 | 3250.62 | 3236.38 | 3222.17 |

| CUMMINSIND (F&O) | 1298605 | 964.55 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| GODREJPROP (F&O) | 1249679 | 1851.20 | 1849.00 | 1859.77 | 1839.18 | 1828.48 | 1817.80 | 1807.15 |

| SONACOMS | 1244871 | 739.35 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| WELCORP | 1230749 | 181.60 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| BEPL | 1227853 | 148.55 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| FILATEX | 1144738 | 130.55 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| MINDTREE (F&O) | 982665 | 4226.20 | 4225.00 | 4241.27 | 4210.87 | 4194.66 | 4178.48 | 4162.33 |

| AEGISCHEM | 966641 | 219.80 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| AFFLE | 938688 | 1388.35 | 1387.56 | 1396.89 | 1378.95 | 1369.68 | 1360.45 | 1351.24 |