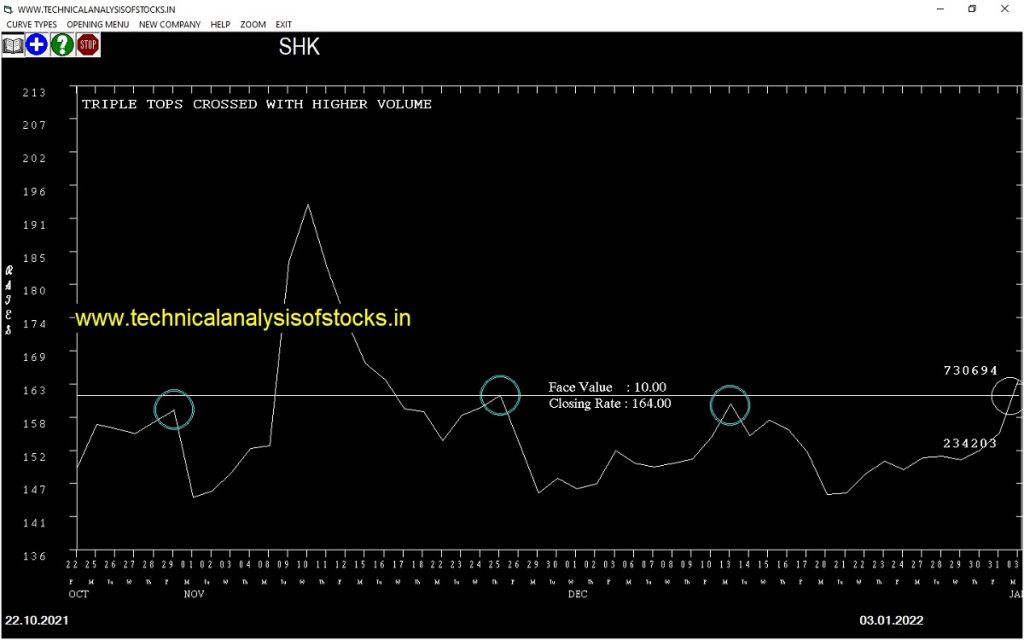

BUY SHK (NSE Symbol) Buy 165.75 or Above after cooling period. SIGNAL : TRIPLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 150.15 Target : 178.80 (Short term)

HOT BUZZING STOCKS (04.01.2022)

NSE SYMBOL CLOSING RATE

BANARBEADS 91.80

ARIHANTCAP 236.45

BALPHARMA 127.00

TTL 110.80

ARSSINFRA 40.00

GLOBAL 70.95

HBSL 71.50

BHARATWIRE 64.40

TRIGYN 181.60

DPWIRES 258.35

RSSOFTWARE 47.40

TVSELECT 193.35

BGRENERGY 94.35

SURYALAXMI 83.80

AARON 125.30

BANKA 82.35

TERASOFT 55.30

INDSWFTLAB 74.70

JBMA 1236.25

RAJTV 44.45

63MOONS 239.55

BIGBLOC 61.95

BORORENEW 655.45

RAMASTEEL 356.05

ZODIAC 63.05

AURIONPRO 310.25

AURUM 162.95

DCMNVL 291.60

INFOBEAN 437.40

JINDALPHOT 266.05

PITTIENG 246.25

EKC 251.70

IZMO 92.75

MARALOVER 108.60

SMARTLINK 242.25

WEBELSOLAR 164.35

HUBTOWN 69.85

SERVOTECH 79.40

ENERGYDEV 40.30

KARMAENG 40.35

MANAKCOAT 44.60

RTNINDIA 49.95

JETFREIGHT 51.05

OSWALAGRO 41.50

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| REDINGTON | 44103 | 146.70 | 146.80 | 0.07 |

| SCI | 14205 | 139.80 | 139.90 | 0.07 |

| MAHSEAMLES | 21307 | 517.80 | 518.70 | 0.17 |

| BHARATFORG (F&O) | 32949 | 707.00 | 710.90 | 0.55 |

| ASTERDM | 10254 | 177.20 | 178.30 | 0.62 |

| TRITURBINE | 10264 | 189.85 | 191.40 | 0.81 |

| SBIN (F&O) | 168001 | 464.00 | 470.80 | 1.44 |

| HDFC (F&O) | 61114 | 2594.00 | 2636.40 | 1.61 |

| KPRMILL | 34562 | 690.00 | 704.75 | 2.09 |

| HEMIPROP | 15941 | 129.70 | 132.70 | 2.26 |

| ACC (F&O) | 11932 | 2199.65 | 2251.35 | 2.30 |

| EVEREADY | 18048 | 309.35 | 320.40 | 3.45 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| STARHEALTH | 14527 | 784.00 | 779.50 | 0.58 |

| APLAPOLLO | 66381 | 980.00 | 949.15 | 3.25 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SWSOLAR | 24145 | 390.06 | 365.95 | 409.86 | 386.00 | 387.70 | -0.44 |

| HDFCLIFE (F&O) | 55428 | 656.64 | 625.31 | 682.17 | 650.50 | 654.00 | -0.54 |

| TRENT (F&O) | 17143 | 1056.25 | 1016.52 | 1088.46 | 1054.60 | 1068.00 | -1.27 |

| GUFICBIO | 19247 | 248.06 | 228.88 | 263.93 | 244.45 | 248.70 | -1.74 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| SIEMENS (F&O) | 13720 | 2364.39 | 2424.35 | 2317.17 | 2366.80 | 2339.80 | 1.14 |

| EQUITAS | 29275 | 110.25 | 123.70 | 100.05 | 111.35 | 110.05 | 1.17 |

| SIGACHI | 10026 | 395.02 | 420.04 | 375.58 | 397.15 | 391.20 | 1.50 |

| BURGERKING | 17497 | 141.02 | 156.17 | 129.46 | 142.25 | 140.00 | 1.58 |

| SIGACHI | 10026 | 395.02 | 420.04 | 375.58 | 397.15 | 390.00 | 1.80 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| CUB (F&O) | 0.87% |

| CASTROLIND | 1.17% |

| SUNTV (F&O) | 1.40% |

| PRICOLLTD | 2.11% |

| ASTERDM | 3.08% |

| TATACOFFEE | 3.71% |

| CENTENKA | 4.78% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SCI | 0.07% |

| STOVEKRAFT | 0.14% |

| GRASIM (F&O) | 0.39% |

| SWSOLAR | 0.44% |

| IOC (F&O) | 0.49% |

| HDFCLIFE (F&O) | 0.54% |

| M&MFIN (F&O) | 0.89% |

| INDIANB | 0.95% |

| SRTRANSFIN (F&O) | 1.01% |

| CONCOR (F&O) | 1.13% |

| RKFORGE | 1.18% |

| TRENT (F&O) | 1.27% |

| SIEMENS (F&O) | 1.60% |

| BRIGADE | 1.69% |

| GUFICBIO | 1.74% |

| SONACOMS | 1.99% |

| EQUITAS | 2.20% |

| POWERGRID (F&O) | 2.24% |

| SMLISUZU | 2.40% |

| METROBRAND | 2.49% |

| LODHA | 2.53% |

| DIXON (F&O) | 2.59% |

| RIIL | 2.67% |

| STARHEALTH | 2.87% |

| BURGERKING | 2.92% |

| PAYTM | 3.08% |

| BAJAJCON | 3.25% |

| ZEEL (F&O) | 3.33% |

| SIGACHI | 3.47% |

| MINDAIND | 4.12% |

| APOLLOHOSP (F&O) | 4.20% |

| BOMDYEING | 4.25% |

| IBULHSGFIN (F&O) | 4.28% |

| IBREALEST | 4.28% |

| RAYMOND | 4.35% |

| RAMKY | 4.60% |

| PHOENIXLTD | 4.89% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

SUMICHEM Sell @ 385.15 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIGREEN

APLLTD (F&O)

ASTRAMICRO

BEL (F&O)

GPIL

GRAPHITE

ITI

KEC

LATENTVIEW

MAHINDCIE

MOIL

MON100

NTPC (F&O)

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

TECHM (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ASHOKLEY (F&O)

DEEPAKNTR (F&O)

DMART

ECLERX

EICHERMOT (F&O)

EXIDEIND (F&O)

GREAVESCOT

MANALIPETC

NRBBEARING

PRAJIND

PTC

TATAMOTORS (F&O)

TATAMTRDVR

VARROC

WEBELSOLAR

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

CHEMPLASTS

FINCABLES

ICICITECH

KRBL

SRIPIPES

VISAKAIND

BEARISH ENGULFING PATTERN

APOLLOPIPE

DSSL

SONATSOFTW

VAIBHAVGBL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

IZMO

JINDALPHOT

PITTIENG

SMARTLINK

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

ARIHANTCAP

AURUM

BALPHARMA

BBOX

INDSWFTLAB

TATAINVEST

TTL

TVSELECT

BULLISH BELLHOLD PATTERN

AARVI

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

ASIANTILES

STAR (F&O)

BLISSGVS

SPANDANA

IOLCP

GULFOILLUB

BANDHANBNK (F&O

JUBLPHARMA

AMARAJABAT (F&O)

AARTIDRUGS

INDOSTAR

DFMFOODS

APLLTD (F&O)

HEROMOTOCO (F&O

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

APLLTD (F&O)

PIDILITIND (F&O)

HINDUNILVR (F&O)

MASTEK

WEBELSOLAR

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

GREAVESCOT

INDIANB

JYOTHYLAB

PRICOLLTD

RAMKY

REDINGTON

VGUARD

VIPIND

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NEOGEN

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BALKRISIND (F&O) | 2327.45 | 2328.06 | 2316.02 | 2338.97 | 2351.07 | 2363.21 | 2375.37 |

| ICICILOVOL | 141.58 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| TATACONSUM (F&O) | 748.00 | 749.39 | 742.56 | 755.87 | 762.76 | 769.68 | 776.63 |

| NAM-INDIA (F&O) | 355.30 | 356.27 | 351.56 | 360.82 | 365.58 | 370.38 | 375.20 |

| BRITANNIA (F&O) | 3617.55 | 3630.06 | 3615.02 | 3643.32 | 3658.42 | 3673.55 | 3688.72 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CUMMINSIND (F&O) | 942.25 | 937.89 | 945.56 | 930.72 | 923.10 | 915.52 | 907.97 |

| SIEMENS (F&O) | 2366.80 | 2364.39 | 2376.56 | 2353.43 | 2341.31 | 2329.23 | 2317.17 |

| DHAMPURSUG | 307.30 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| CAPACITE | 172.90 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| PRAJIND | 337.70 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| RBLBANK (F&O) | 68772516 | 132.75 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| TATAMOTORS (F&O) | 32748423 | 497.60 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| SAIL (F&O) | 24678644 | 110.10 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| ZOMATO | 22518241 | 141.35 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| ASHOKLEY (F&O) | 19018355 | 127.70 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| NATIONALUM (F&O) | 16026094 | 103.15 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| ABCAPITAL | 13428542 | 129.55 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| SBIN (F&O) | 13124509 | 470.80 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| ICICIBANK (F&O) | 9653095 | 764.70 | 770.06 | 763.14 | 776.63 | 783.61 | 790.62 | 797.66 |

| IBREALEST | 9275063 | 162.50 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| VEDL (F&O) | 9043533 | 353.80 | 356.27 | 351.56 | 360.82 | 365.58 | 370.38 | 375.20 |

| AXISBANK (F&O) | 8550860 | 696.35 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| FSL (F&O) | 8212360 | 188.20 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| IEX (F&O) | 7876078 | 258.20 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| CANBK (F&O) | 7790751 | 205.45 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| BSOFT (F&O) | 6117415 | 566.95 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

| HINDCOPPER | 5969893 | 127.75 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| INDUSINDBK (F&O) | 5594214 | 912.30 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| M&MFIN (F&O) | 5143474 | 152.25 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| FORTIS | 4720831 | 309.50 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| HDFCBANK (F&O) | 4534592 | 1519.65 | 1521.00 | 1511.27 | 1530.00 | 1539.79 | 1549.62 | 1559.47 |

| TATASTEEL (F&O) | 3865803 | 1142.45 | 1147.52 | 1139.06 | 1155.42 | 1163.93 | 1172.48 | 1181.05 |

| INDIACEM (F&O) | 3672830 | 200.30 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| PFC (F&O) | 3492097 | 122.80 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| DLINKINDIA | 3353495 | 184.40 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| DHANI | 1797185 | 161.05 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| IRB | 992505 | 221.75 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| ANDHRSUGAR | 790448 | 129.05 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| DBL | 608259 | 432.70 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| KABRAEXTRU | 327685 | 462.50 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| TANLA | 296134 | 1839.00 | 1838.27 | 1849.00 | 1828.48 | 1817.80 | 1807.15 | 1796.54 |

| KEI | 207951 | 1139.50 | 1139.06 | 1147.52 | 1131.21 | 1122.81 | 1114.45 | 1106.12 |

| AXISCADES | 198355 | 103.75 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| VAIBHAVGBL | 193726 | 571.30 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| INDOCO | 152221 | 439.40 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |