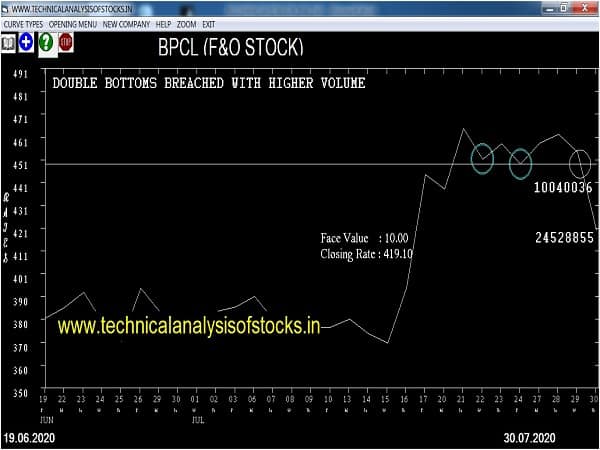

SELL BPCL (NSE Code) Sell Below 415.15 after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH HIGHER VOLUME. Stop Loss : 440.80 Target : 395.20 (Short term)

HOT BUZZING STOCKS (31.07.2020)

NSE SYMBOL CLOSING RATE

KREBSBIO 82.95

MPSLTD 355.10

BORORENEW 77.75

TANLA 114.45

DCAL 187.10

HERITGFOOD 296.45

CAMLINFINE 70.65

FRETAIL 115.95

FSC 158.10

EVEREADY 124.85

GTPL 89.00

OMAXE 79.70

TAKE 40.80

BORORENEW 77.75

TANLA 114.45

DCAL 187.10

HERITGFOOD 296.45

CAMLINFINE 70.65

FRETAIL 115.95

FSC 158.10

EVEREADY 124.85

GTPL 89.00

OMAXE 79.70

TAKE 40.80

INDIAMART 2598.35

ITDCEM 46.95

Strategy : INSIDE CANDLES (Intraday/Short term)

OIL Sell @ 96 or below

GRANULES Sell @ 276 or below

JBCHEPHARM Sell @ 716 or below

Strategy : CUP & HANDLE (Short Term)

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BLISSGVS

CHALET

TORNTPOWER (F&O)

Higher Level Consolidation

BRITANNIA (F&O)

DHAMPURSUG

Lower Level Consolidation

BLISSGVS

BRITANNIA (F&O)

JYOTHYLAB

TITAN (F&O)

Strategy : BREAKOUT STOCKS

GAP UP BREAKOUT STOCKS

DCAL

DRREDDY (F&O)

FRETAIL

FSC

LUPIN (F&O)

MASTEK

WIPRO (F&O)

GAP DOWN BREAKOUT STOCKS

APOLLO

BPCL (F&O)

INOXLEISUR

PVR (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

INDIGO

TANLA

BEARISH ENGULFING

BHARTIARTL

CHAMBLFERT

COROMANDEL

DBCORP

GRSE

IBVENTURES

ITC

JSLHISAR

SRF

SRTRANSFIN

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELL HOLD STOCKS

BULLISH BELL HOLD PATTERN

NIL

BEARISH BELL HOLD PATTERN

GLOBUSSPR

GRSE

HCG

INDHOTEL

Strategy : GARTLEY SIGNAL (W & M Patterns) (INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AMBUJACEM (F&O)

APOLLOHOSP (F&O)

MFSL (F&O)

SWANENERGY

TCS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

AMARAJABAT (F&O)

ERIS

VBL

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ICICIPRULI (F&O) | 452.90 | 456.89 | 451.56 | 462.02 | 467.41 | 472.83 | 478.28 |

| EXIDEIND (F&O) | 153.95 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| HDFCAMC | 2411.75 | 2413.27 | 2401.00 | 2424.35 | 2436.67 | 2449.02 | 2461.41 |

| FLFL | 120.85 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| BERGEPAINT (F&O) | 526.40 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PETRONET (F&O) | 244.60 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| TITAN (F&O) | 1041.85 | 1040.06 | 1048.14 | 1032.53 | 1024.51 | 1016.52 | 1008.57 |

| APLLTD | 986.50 | 984.39 | 992.25 | 977.05 | 969.25 | 961.48 | 953.74 |

| UBL (F&O) | 965.05 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| ASTRAMICRO | 107.15 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| VEDL (F&O) | 90692980 | 110.90 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| WIPRO (F&O) | 25847766 | 284.10 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| SUNPHARMA (F&O) | 17535910 | 509.95 | 511.89 | 506.25 | 517.30 | 523.00 | 528.74 | 534.50 |

| GLENMARK (F&O) | 14081785 | 441.40 | 446.27 | 441.00 | 451.34 | 456.66 | 462.02 | 467.41 |

| LAURUSLABS | 4892393 | 790.25 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| LUPIN (F&O) | 4113394 | 890.40 | 892.52 | 885.06 | 899.55 | 907.06 | 914.60 | 922.18 |

| DIVISLAB (F&O) | 3392980 | 2,562.35 | 2,562.89 | 2,550.25 | 2,574.27 | 2,586.97 | 2,599.70 | 2,612.46 |

| MINDTREE (F&O) | 2992360 | 1,083.80 | 1,089.00 | 1,080.77 | 1,096.72 | 1,105.01 | 1,113.33 | 1,121.69 |

| SPARC | 2449865 | 174.80 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| SBILIFE (F&O) | 2422599 | 913.55 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| BAJAJCON | 2328497 | 170.45 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| FORTIS | 2177669 | 138.50 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| JUBLFOOD (F&O) | 1642165 | 1,770.30 | 1,774.52 | 1,764.00 | 1,784.17 | 1,794.74 | 1,805.35 | 1,815.98 |

| ALEMBICLTD | 1383624 | 78.95 | 81.00 | 78.77 | 83.22 | 85.52 | 87.85 | 90.20 |

| EVEREADY | 1376814 | 124.85 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| MFSL (F&O) | 1299113 | 562.60 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| LIBERTSHOE | 1285758 | 138.45 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| AJANTPHARM | 884737 | 1,512.40 | 1,521.00 | 1,511.27 | 1,530.00 | 1,539.79 | 1,549.62 | 1,559.47 |

| GUFICBIO | 854389 | 90.55 | 92.64 | 90.25 | 95.01 | 97.47 | 99.95 | 102.46 |

| MASTEK | 853611 | 522.85 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

| ERIS | 720977 | 469.40 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| SHOPERSTOP | 706590 | 161.90 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| UNICHEMLAB | 553922 | 213.60 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| INDIAMART | 547574 | 2,598.35 | 2,601.00 | 2,588.27 | 2,612.46 | 2,625.25 | 2,638.07 | 2,650.92 |

| KRBL | 476972 | 258.55 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| BRIGADE | 475322 | 142.10 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| NCLIND | 427291 | 79.80 | 81.00 | 78.77 | 83.22 | 85.52 | 87.85 | 90.20 |

| JKIL | 390381 | 92.95 | 95.06 | 92.64 | 97.47 | 99.95 | 102.46 | 105.01 |

| BBTC | 371831 | 1,232.75 | 1,233.77 | 1,225.00 | 1,241.94 | 1,250.76 | 1,259.62 | 1,268.51 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| BHARTIARTL (F&O) | 44491235 | 552.70 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| IOC (F&O) | 43622365 | 88.55 | 87.89 | 90.25 | 85.61 | 83.31 | 81.04 | 78.81 |

| MANAPPURAM (F&O) | 30612099 | 164.20 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| HDFCLIFE (F&O) | 27847477 | 635.10 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |

| ZEEL (F&O) | 24878974 | 140.20 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| BPCL (F&O) | 24528855 | 419.10 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| IBULHSGFIN (F&O) | 23531234 | 199.70 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| TATASTEEL (F&O) | 10399075 | 366.60 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |

| TVSMOTOR (F&O) | 6072262 | 402.15 | 400.00 | 405.02 | 395.21 | 390.26 | 385.33 | 380.44 |

| CHAMBLFERT | 5903877 | 156.65 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| BANKBEES | 1466325 | 217.39 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| SRF (F&O) | 937199 | 3,760.20 | 3,751.56 | 3,766.89 | 3,738.13 | 3,722.86 | 3,707.62 | 3,692.41 |

| DYNPRO | 633063 | 200.50 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| KAJARIACER | 489227 | 405.75 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| GDL | 382180 | 79.85 | 78.77 | 81.00 | 76.60 | 74.43 | 72.29 | 70.18 |

| JYOTHYLAB | 358650 | 119.95 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| SIS | 342464 | 341.25 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |