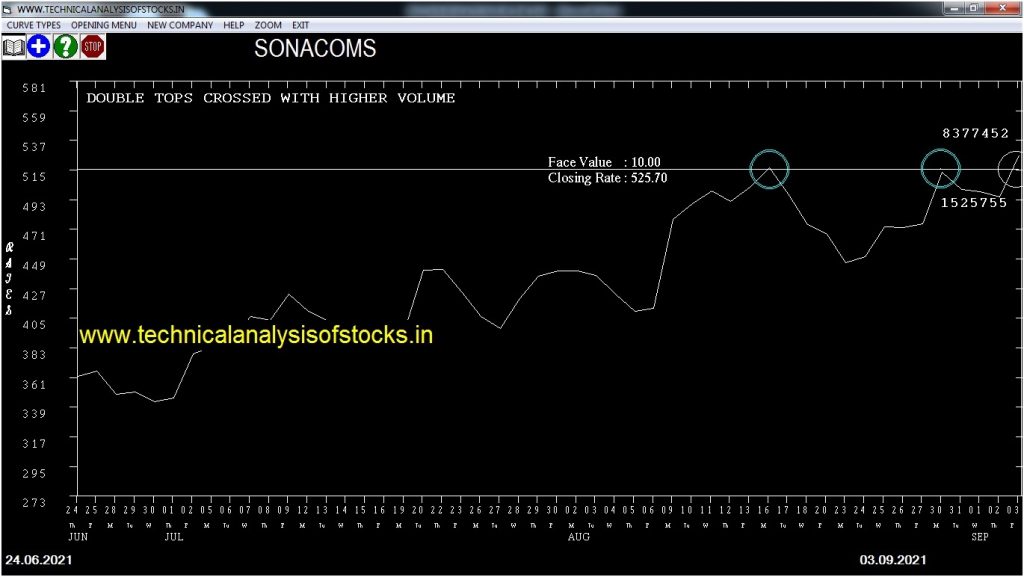

BUY SONACOMS (NSE Symbol) Buy@ 529 or Above after cooling period SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 500.90 Target : 552 (Short term)

HOT BUZZING STOCKS (06.09.2020)

NSE SYMBOL CLOSING RATE

AYMSYNTEX 98.60

ABAN 43.00

HINDOILEXP 180.85

ZENTEC 153.80

INDSWFTLAB 70.40

KANORICHEM 164.90

SHREYAS 315.20

BSL 63.10

TRIGYN 115.75

CLEDUCATE 143.35

GOKEX 198.20

GOLDENTOBC 102.25

INTENTECH 75.95

EMAMIREAL 74.95

HPL 72.00

PFOCUS 72.10

CONSOFINVT 159.55

KRISHANA 169.60

RUSHIL 273.20

XPROINDIA 395.70

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| INOXWIND | 10091 | 112.00 | 112.20 | 0.18 |

| STLTECH | 17233 | 273.00 | 273.85 | 0.31 |

| BIOCON (F&O) | 37343 | 362.35 | 363.50 | 0.32 |

| INDUSTOWER (F&O) | 55448 | 222.85 | 225.65 | 1.24 |

| JKTYRE | 44808 | 153.15 | 155.35 | 1.42 |

| JINDALSTEL (F&O) | 87155 | 385.50 | 392.60 | 1.81 |

| JUSTDIAL | 49100 | 974.00 | 992.45 | 1.86 |

| ESTER | 10905 | 139.95 | 142.80 | 2.00 |

| JKTYRE | 44808 | 151.25 | 155.35 | 2.64 |

| IRB | 69472 | 170.80 | 176.05 | 2.98 |

| ORIENTCEM | 15326 | 157.00 | 162.25 | 3.24 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| CASTROLIND | 14065 | 138.06 | 123.83 | 149.99 | 136.05 | 136.20 | -0.11 |

| WOCKPHARMA | 14979 | 425.39 | 400.20 | 446.04 | 420.85 | 424.00 | -0.75 |

| MSTCLTD | 10612 | 272.25 | 252.14 | 288.86 | 271.00 | 274.00 | -1.11 |

| MAITHANALL | 14761 | 992.25 | 953.74 | 1023.49 | 992.00 | 1004.50 | -1.26 |

| RELAXO | 18747 | 1207.56 | 1165.10 | 1241.94 | 1204.20 | 1220.00 | -1.31 |

| BSOFT | 20465 | 415.14 | 390.26 | 435.55 | 414.70 | 421.85 | -1.72 |

| SONATSOFTW | 15045 | 862.89 | 826.98 | 892.07 | 855.85 | 873.00 | -2.00 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| JKLAKSHMI | 16491 | 702.25 | 735.40 | 676.34 | 707.85 | 697.05 | 1.53 |

| PETRONET (F&O) | 22861 | 228.77 | 247.94 | 214.00 | 229.80 | 225.45 | 1.89 |

| SAIL (F&O) | 117670 | 121.00 | 135.07 | 110.31 | 122.45 | 120.05 | 1.96 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MAITHANALL | 1.26% |

| NMDC (F&O) | 1.84% |

| PRINCEPIPE | 2.05% |

| EMAMILTD | 2.67% |

| SONATSOFTW | 3.35% |

| WELCORP | 3.54% |

| HINDCOPPER | 4.11% |

| LAURUSLABS | 4.54% |

| LAURUSLABS | 4.91% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| FINPIPE | 0.03% |

| CASTROLIND | 0.11% |

| PETRONET (F&O) | 0.41% |

| WOCKPHARMA | 0.75% |

| JKLAKSHMI | 1.09% |

| MSTCLTD | 1.11% |

| RELAXO | 1.31% |

| JSWSTEEL (F&O) | 1.42% |

| JKIL | 1.60% |

| BSOFT | 1.72% |

| IPCALAB (F&O) | 1.92% |

| SONATSOFTW | 2.00% |

| SUNTV (F&O) | 2.09% |

| TORNTPOWER (F&O) | 2.16% |

| JKPAPER | 2.21% |

| SAIL (F&O) | 2.25% |

| TVSMOTOR (F&O) | 2.30% |

| SEQUENT | 2.31% |

| BALRAMCHIN | 2.42% |

| GLAND | 2.48% |

| AVANTIFEED | 2.76% |

| FSL | 2.91% |

| INTELLECT | 2.98% |

| RALLIS | 3.26% |

| IOLCP | 3.28% |

| KSCL | 3.28% |

| CENTURYPLY | 3.32% |

| FORTIS | 3.34% |

| ICIL | 3.43% |

| JINDALSAW | 3.59% |

| GATI | 3.82% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

SHYAMMETL Buy @ 400 or Above

SBIN (F&O) Sell @ 430.55 or Below

ICICIGI (F&O) Sell @ 1670.75 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

APLAPOLLO

BRIGADE

KALPATPOWR

POWERINDIA

SCI

SHOPERSTOP

UBL (F&O)

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

APOLLO

RPSGVENT

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BALRAMCHIN

CADILAHC (F&O)

GPPL

GRAPHITE

HINDZINC

JKLAKSHMI

MOTHERSUMI (F&O)

PEL (F&O)

POWERGRID (F&O)

PVR (F&O)

SIS

SUPRAJIT

WELSPUNIND

Higher Level Consolidation

BANDHANBNK (F&O)

CADILAHC (F&O)

EIDPARRY

GPPL

HINDZINC

JSWSTEEL (F&O)

PVR (F&O)

RALLIS

SHYAMMETL

SUPRAJIT

TATAMTRDVR

Lower Level Consolidation

ASHOKLEY (F&O)

BAJAJ-AUTO (F&O)

BALRAMCHIN

HCLTECH (F&O)

HDFC (F&O)

INDUSINDBK (F&O)

INTELLECT

JKLAKSHMI

PEL (F&O)

PETRONET (F&O)

PFC (F&O)

PVR (F&O)

RALLIS

SCI

SHYAMMETL

SUPRAJIT

SURYAROSNI

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

EXIDEIND (F&O)

ICIL

KITEX

KSCL

LTTS (F&O)

ORIENTCEM

RAILTEL

SHK

TINPLATE

VBL

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

ICICILOVOL

SUVEN

BEARISH ENGULFING

ABCAPITAL

GRANULES (F&O)

HUHTAMAKI

JAGSNPHARM

JINDWORLD

KRISHANA

XPROINDIA

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

POWERGRID (F&O)

ASHOKLEY (F&O)

VIMTALABS

FDC

STAR (F&O)

GUJALKALI

GLENMARK (F&O)

GRANULES (F&O)

JTEKTINDIA

RALLIS

GUJGASLTD (F&O)

HINDCOPPER

WELCORP

GICRE

AVANTIFEED

BURGERKING

FSL

NIITLTD

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

TATAMTRDVR

MIDHANI

INTELLECT

PHILIPCARB

COALINDIA (F&O)

KIMS

AMARAJABAT (F&O)

LUPIN (F&O)

APOLLOTYRE (F&O)

DVL

PFC (F&O)

KOTAKBANK (F&O)

GREAVESCOT

ORIENTELEC

POLYPLEX

CLEAN

FCL

SONATSOFTW

CCL

SUDARSCHEM

EASEMYTRIP

PRINCEPIPE

JUBLPHARMA

GSPL

TATAPOWER (F&O)

EIDPARRY

ROUTE

GRASIM (F&O)

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

BECTORFOOD

FDC

SYNGENE (F&O)

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

ASIANPAINT (F&O)

HAPPSTMNDS

LTTS (F&O)

PIDILITIND (F&O)

QUICKHEAL

SEAMECLTD

VIDHIING

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

DHANI

GHCL

INOXWIND

JKTYRE

JSL

MAITHANALL

PRINCEPIPE

SELAN

SONACOMS

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

BANCOINDIA

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BSL

KANORICHEM

TRIGYN

BEARISH MARUBOZU PATTERN

XPROINDIA

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

HINDOILEXP

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ATULAUTO

BALMLAWRIE

BEPL

GAIL (F&O)

GLENMARK (F&O)

GMDCLTD

HDFC (F&O)

HDFCLIFE (F&O)

ICICIGI (F&O)

NATCOPHARM

STARCEMENT

SELL RECOMMENDATION IF THE MARKET IS BEARISH

COROMANDEL (F&O)

ENGINERSIN

EPL

EXIDEIND (F&O)

KNRCON

L&TFH (F&O)

LUPIN (F&O)

MIDHANI

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| GANGAFORGE | 142.95 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| NELCO | 585.25 | 588.06 | 582.02 | 593.84 | 599.95 | 606.09 | 612.26 |

| INFY (F&O) | 1700.65 | 1701.56 | 1691.27 | 1711.03 | 1721.39 | 1731.77 | 1742.19 |

| RAMCOCEM (F&O) | 1046.70 | 1048.14 | 1040.06 | 1055.72 | 1063.86 | 1072.03 | 1080.23 |

| WIPRO (F&O) | 655.10 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SEQUENT | 233.30 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| BHARATFORG (F&O) | 791.30 | 791.02 | 798.06 | 784.39 | 777.40 | 770.45 | 763.52 |

| PFC (F&O) | 128.55 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| INDIANB | 125.45 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| TATVA | 2048.90 | 2047.56 | 2058.89 | 2037.28 | 2026.01 | 2014.77 | 2003.56 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ONGC (F&O) | 21326802 | 123.10 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| BEL (F&O) | 17390220 | 198.60 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| IOC (F&O) | 15271194 | 113.10 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| RELIANCE (F&O) | 14151629 | 2388.50 | 2388.77 | 2376.56 | 2399.80 | 2412.06 | 2424.35 | 2436.67 |

| COALINDIA (F&O) | 12734022 | 146.35 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| JINDALSTEL (F&O) | 11542927 | 392.60 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| TINPLATE | 8920934 | 299.15 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| IRB | 8617187 | 176.05 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| ZEEL (F&O) | 8531340 | 176.40 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| BPCL (F&O) | 8186035 | 491.30 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| HINDPETRO (F&O) | 5925615 | 275.95 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| INDUSTOWER (F&O) | 5852027 | 225.65 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| ICICIPRULI (F&O) | 5187411 | 697.75 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| FORTIS | 4043787 | 287.30 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| HAVELLS (F&O) | 2720191 | 1430.45 | 1434.52 | 1425.06 | 1443.28 | 1452.79 | 1462.33 | 1471.90 |

| DHANI | 2683738 | 203.05 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| JINDALSAW | 2464183 | 122.40 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| SPENCERS | 2362717 | 106.50 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| EICHERMOT (F&O) | 2305890 | 2802.60 | 2809.00 | 2795.77 | 2820.85 | 2834.14 | 2847.47 | 2860.82 |

| RELIGARE | 2142591 | 156.55 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| MCX | 2132511 | 1592.90 | 1600.00 | 1590.02 | 1609.21 | 1619.25 | 1629.33 | 1639.43 |

| FCL | 2041058 | 110.25 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| APTUS | 1886892 | 375.80 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| RAILTEL | 1820954 | 129.40 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| CHENNPETRO | 1697054 | 111.15 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| HDFCLIFE (F&O) | 15600504 | 734.40 | 729.00 | 735.77 | 722.63 | 715.92 | 709.25 | 702.60 |

| IEX | 10984126 | 539.25 | 534.77 | 540.56 | 529.26 | 523.53 | 517.82 | 512.15 |

| ALEMBICLTD | 1768865 | 115.60 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| TIRUMALCHM | 729308 | 200.50 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| ACE | 729056 | 237.60 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| GET&D | 618919 | 134.50 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| CAMLINFINE | 611319 | 170.05 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| EQUITAS | 504328 | 123.50 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| FIEMIND | 466090 | 1072.30 | 1064.39 | 1072.56 | 1056.78 | 1048.66 | 1040.58 | 1032.53 |

| CAPACITE | 454592 | 149.90 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| MSTCLTD | 442154 | 271.00 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| APTECHT | 441767 | 296.70 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| CAMS | 378965 | 3725.35 | 3721.00 | 3736.27 | 3707.62 | 3692.41 | 3677.23 | 3662.08 |

| SHREEPUSHK | 324351 | 210.55 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| EXXARO | 316473 | 130.10 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| GAEL | 309832 | 180.05 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| SHALBY | 295846 | 198.25 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| ABB | 202306 | 1848.70 | 1838.27 | 1849.00 | 1828.48 | 1817.80 | 1807.15 | 1796.54 |

| LIBERTSHOE | 184994 | 178.45 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| REPCOHOME | 178591 | 295.05 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| JKIL | 171701 | 206.40 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| VRLLOG | 151287 | 329.35 | 328.52 | 333.06 | 324.16 | 319.68 | 315.22 | 310.80 |