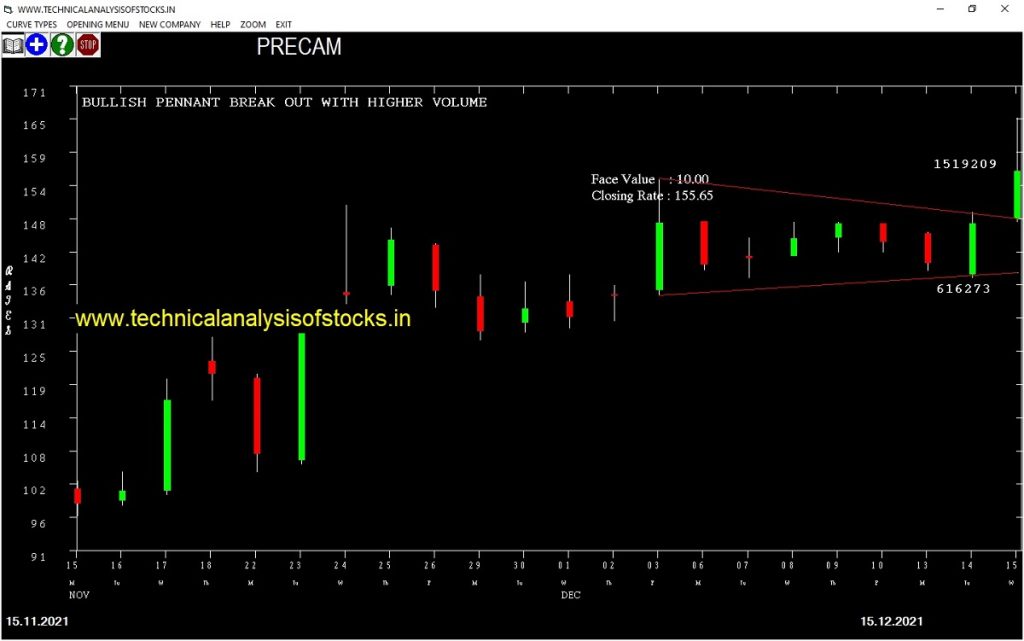

BUY PRECAM (NSE Symbol) Buy@ 156.25 or Above after cooling period SIGNAL : BULLISH PENNANT BREAK OUT WITH HIGHER VOLUME. Stop Loss : 141.10 Target : 168.90 (Short term)

HOT BUZZING STOCKS (16.12.2021)

NSE SYMBOL CLOSING RATE

AXISCADES 97.90

TOTAL 97.90

TVSELECT 195.90

KAPSTON 97.00

BSL 129.10

MARALOVER 95.50

DAMODARIND 50.35

BORORENEW 688.25

GANESHHOUC 199.60

JAIPURKURT 92.45

SASTASUNDR 470.55

GOODLUCK 298.75

SHIL 424.00

63MOONS 206.55

EQUIPPP 128.50

LYKALABS 210.95

MINDTECK 162.35

RTNINDIA 61.25

SRPL 48.65

TRIDENT 55.10

HUBTOWN 43.55

MARSHALL 52.10

ISMTLTD 54.50

ANANTRAJ 73.85

ZENTEC 233.25

SECURKLOUD 156.75

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| ACE | 18276 | 231.75 | 231.80 | 0.02 |

| PRECAM | 30772 | 154.40 | 155.65 | 0.80 |

| FORTIS | 28120 | 285.45 | 289.25 | 1.31 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| GAIL (F&O) | 30979 | 132.00 | 132.00 | 0.00 |

| LAOPALA | 13930 | 401.65 | 400.05 | 0.40 |

| LXCHEM | 12089 | 419.05 | 417.25 | 0.43 |

| JUBLFOOD (F&O) | 23385 | 3695.20 | 3677.70 | 0.48 |

| TATAMTRDVR | 37134 | 254.50 | 253.00 | 0.59 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| GABRIEL | 19115 | 144.00 | 129.46 | 156.17 | 143.90 | 144.10 | -0.14 |

| COLPAL (F&O) | 23402 | 1453.52 | 1406.95 | 1491.14 | 1449.00 | 1469.25 | -1.40 |

| INDUSINDBK (F&O) | 77442 | 945.56 | 907.97 | 976.07 | 938.55 | 952.00 | -1.43 |

| NH | 24074 | 606.39 | 576.29 | 630.95 | 601.85 | 612.00 | -1.69 |

| CHAMBLFERT (F&O) | 58633 | 415.14 | 390.26 | 435.55 | 410.55 | 417.95 | -1.80 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| HINDUNILVR (F&O) | 56299 | 2316.02 | 2375.37 | 2269.27 | 2320.95 | 2301.00 | 0.86 |

| HAL (F&O) | 14254 | 1278.06 | 1322.48 | 1243.18 | 1286.55 | 1271.40 | 1.18 |

| DABUR (F&O) | 29315 | 570.02 | 599.95 | 546.66 | 573.30 | 566.00 | 1.27 |

| TCS (F&O) | 109534 | 3570.06 | 3643.32 | 3512.32 | 3570.35 | 3522.00 | 1.35 |

| POONAWALLA | 21593 | 210.25 | 228.65 | 196.10 | 213.10 | 209.00 | 1.92 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| EMAMILTD | 1.59% |

| CHAMBLFERT (F&O) | 1.80% |

| FINPIPE | 2.22% |

| BIOCON (F&O) | 3.33% |

| RECLTD (F&O) | 4.70% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| GABRIEL | 0.14% |

| ELGIEQUIP | 0.19% |

| TVTODAY | 0.35% |

| COLPAL (F&O) | 1.20% |

| CHAMBLFERT (F&O) | 1.40% |

| INDUSINDBK (F&O) | 1.43% |

| NH | 1.69% |

| DABUR (F&O) | 1.69% |

| HINDUNILVR (F&O) | 1.85% |

| DMART | 1.95% |

| UFLEX | 2.01% |

| MAZDOCK | 2.08% |

| IPCALAB (F&O) | 2.10% |

| CARBORUNIV | 2.19% |

| HAL (F&O) | 2.34% |

| ESCORTS (F&O) | 2.45% |

| TCS (F&O) | 2.45% |

| RADICO | 2.67% |

| MINDTREE (F&O) | 2.81% |

| PARAGMILK | 2.83% |

| IGL (F&O) | 2.93% |

| GAIL (F&O) | 3.03% |

| MOTILALOFS | 3.12% |

| RITES | 3.15% |

| MARICO (F&O) | 3.94% |

| NRBBEARING | 4.23% |

| ZOMATO | 4.45% |

| DHANI | 4.69% |

| POONAWALLA | 4.83% |

| RAJESHEXPO | 4.93% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

BURGERKING Sell @ 154 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIGREEN

AGARIND

BALRAMCHIN

BSOFT (F&O)

CREDITACC

DFMFOODS

LINCOLN

POLICYBZR

PRICOLLTD

SANGHVIMOV

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ESCORTS (F&O)

JINDWORLD

NAHARPOLY

YAARII

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

CASTROLIND

CIPLA (F&O)

Higher Level Consolidation

CIPLA (F&O)

INDIGO (F&O)

TINPLATE

Lower Level Consolidation

CIPLA (F&O)

PARAGMILK

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BORORENEW

KOPRAN

KPRMILL

LYKALABS

TNPETRO

GAP DOWN BREAKOUT STOCKS

PAYTM

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

SUNPHARMA (F&O)

BEARISH ENGULFING

GESHIP

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

EQUIPPP

KIOCL

BEARISH MARUBOZU PATTERN

ANANTRAJ

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

GOODLUCK

TRIDENT

BEARISH BELLHOLD PATTERN

BAJFINANCE (F&O)

BEDMUTHA

DCBBANK

EQUITASBNK

JAGSNPHARM

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

UJJIVAN

STAR

BLISSGVS

IOLCP

GULFOILLUB

BANDHANBNK (F&O

JUBLPHARMA

AMARAJABAT (F&O)

AARTIDRUGS

INDOSTAR

DFMFOODS

APLLTD (F&O)

HEROMOTOCO (F&O

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIACL

POLICYBZR

GICRE

HINDPETRO (F&O)

HAL (F&O)

MAHINDCIE

INDIGO (F&O)

VGUARD

LICHSGFIN (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

GSFC

MAXHEALTH

AARTIIND (F&O)

UFLEX

DIXON (F&O)

GRANULES (F&O)

KAJARIACER

KPRMILL

TANLA

IBULHSGFIN (F&O)

NAVINFLUOR (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ASAHIINDIA

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

CASTROLIND

SAGCEM

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NDL | 123.55 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| TECHM (F&O) | 1641.60 | 1650.39 | 1640.25 | 1659.73 | 1669.93 | 1680.16 | 1690.42 |

| HINDUNILVR (F&O) | 2320.95 | 2328.06 | 2316.02 | 2338.97 | 2351.07 | 2363.21 | 2375.37 |

| RAMCOCEM (F&O) | 998.75 | 1000.14 | 992.25 | 1007.56 | 1015.51 | 1023.49 | 1031.50 |

| HDFCLIFE (F&O) | 672.85 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BFUTILITIE | 409.50 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| IRCTC (F&O) | 851.20 | 848.27 | 855.56 | 841.42 | 834.18 | 826.98 | 819.80 |

| HAL (F&O) | 1286.55 | 1278.06 | 1287.02 | 1269.78 | 1260.88 | 1252.02 | 1243.18 |

| KPIGLOBAL | 301.05 | 297.56 | 301.89 | 293.41 | 289.14 | 284.91 | 280.70 |

| PHOENIXLTD | 1027.80 | 1024.00 | 1032.02 | 1016.52 | 1008.57 | 1000.64 | 992.75 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TVSMOTOR (F&O) | 14240307 | 673.80 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| 3IINFOLTD | 8154089 | 116.65 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| SUNPHARMA (F&O) | 6231786 | 775.10 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| GATI | 4136828 | 174.70 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| CHAMBLFERT (F&O) | 3769709 | 410.55 | 415.14 | 410.06 | 420.04 | 425.18 | 430.35 | 435.55 |

| EIHOTEL | 3605876 | 138.25 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| FCL | 3110317 | 143.20 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| FORTIS | 2838556 | 289.25 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| TORNTPOWER (F&O) | 2282818 | 598.60 | 600.25 | 594.14 | 606.09 | 612.26 | 618.46 | 624.69 |

| CROMPTON (F&O) | 1799117 | 430.85 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| TNPETRO | 1348128 | 108.55 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| ASAHIINDIA | 1082504 | 494.55 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| PRECWIRE | 1068679 | 369.50 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| GNFC | 1006244 | 431.55 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| SUNTECK | 930419 | 454.60 | 456.89 | 451.56 | 462.02 | 467.41 | 472.83 | 478.28 |

| APLAPOLLO | 865268 | 1082.85 | 1089.00 | 1080.77 | 1096.72 | 1105.01 | 1113.33 | 1121.69 |

| PIIND (F&O) | 823364 | 3087.55 | 3094.14 | 3080.25 | 3106.51 | 3120.45 | 3134.43 | 3148.44 |

| ELGIEQUIP | 800546 | 320.40 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| EMAMILTD | 745277 | 546.30 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| UGROCAP | 706761 | 199.75 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| CENTURYTEX | 685001 | 863.85 | 870.25 | 862.89 | 877.20 | 884.62 | 892.07 | 899.55 |

| KITEX | 601181 | 182.40 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| NRBBEARING | 600249 | 167.95 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| BORORENEW | 585623 | 688.25 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| NDL | 566412 | 123.55 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ONGC (F&O) | 10361033 | 143.95 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| GAIL (F&O) | 6288678 | 132.00 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| DEVYANI | 5920720 | 185.40 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| CANBK (F&O) | 5799757 | 211.25 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| BSE | 5493201 | 2222.75 | 2220.77 | 2232.56 | 2210.10 | 2198.36 | 2186.66 | 2174.98 |

| M&MFIN (F&O) | 5020407 | 157.30 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| ADANIPORTS (F&O) | 4673906 | 745.50 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| TATAMTRDVR | 4180807 | 253.00 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| ZENTEC | 4141602 | 233.25 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| DELTACORP (F&O) | 3914750 | 287.35 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| POONAWALLA | 3439821 | 213.10 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| CHOLAFIN (F&O) | 2809173 | 541.85 | 540.56 | 546.39 | 535.03 | 529.26 | 523.53 | 517.82 |

| WELCORP | 2347356 | 180.65 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| SEQUENT | 2012848 | 174.80 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| IGL (F&O) | 1932782 | 496.35 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| AUROPHARMA (F&O) | 1865950 | 692.95 | 689.06 | 695.64 | 682.86 | 676.34 | 669.85 | 663.39 |

| BAJFINANCE (F&O) | 1817528 | 6847.25 | 6826.89 | 6847.56 | 6809.65 | 6789.03 | 6768.45 | 6747.89 |

| LUPIN (F&O) | 1634938 | 918.85 | 915.06 | 922.64 | 907.97 | 900.45 | 892.96 | 885.51 |

| GUJGASLTD (F&O) | 1535512 | 648.50 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| GLENMARK (F&O) | 1464166 | 502.85 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| EKC | 1319738 | 176.10 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| TRIVENI | 1304915 | 220.40 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| NOCIL | 1186986 | 235.30 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| KPITTECH | 1080257 | 503.55 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| IRB | 964047 | 214.70 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |