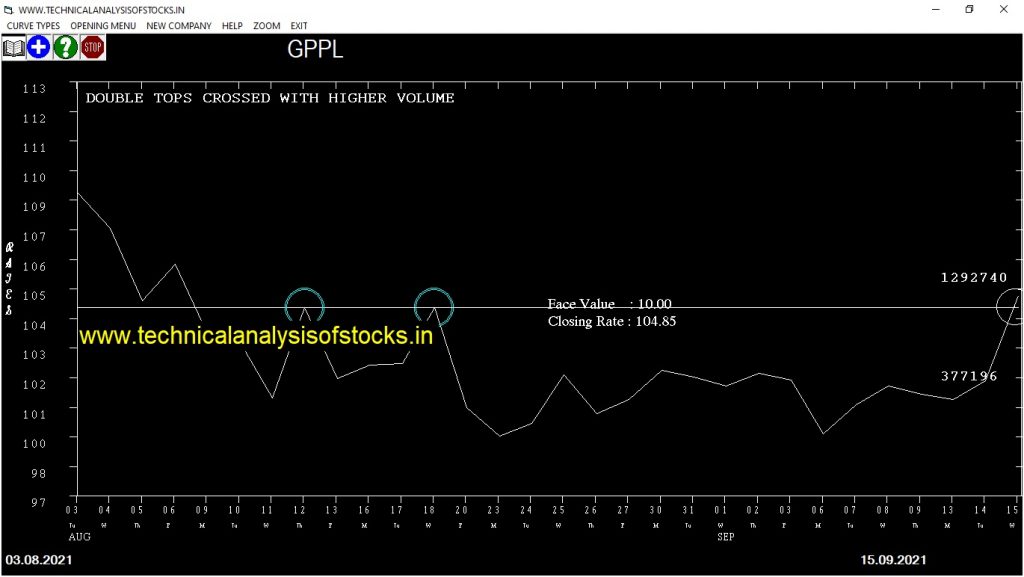

BUY GPPL (NSE Symbol) Buy@ 105.05 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 92.70 Target : 115.50 (Short term)

HOT BUZZING STOCKS (16.09.2020)

NSE SYMBOL CLOSING RATE

| 20MICRONS | 64.80 |

| AMIORG | 1122.00 |

| VARROC | 313.05 |

| DSSL | 139.15 |

| SBCL | 232.70 |

| BLS | 276.35 |

| BROOKS | 150.30 |

| MFL | 814.40 |

| ROML | 136.70 |

| JINDALPHOT | 109.25 |

| VISHNU | 767.15 |

| XPROINDIA | 411.65 |

| LXCHEM | 598.10 |

| KPIGLOBAL | 131.85 |

| SANGAMIND | 153.95 |

| TRF | 120.50 |

| AUTOIND | 60.30 |

| MANALIPETC | 98.35 |

| MCL | 40.25 |

| AGRITECH | 70.10 |

| MCDHOLDING | 60.60 |

| VISHAL | 117.85 |

| SIMPLEXINF | 44.75 |

| TEXMOPIPES | 52.25 |

| DIGISPICE | 52.50 |

| BESTAGRO | 742.75 |

| ISFT | 131.50 |

| NGIL | 97.10 |

| SHIL | 422.10 |

| ZENTEC | 214.80 |

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| BURGERKING | 18665 | 161.50 | 162.25 | 0.46 |

| RITES | 13075 | 278.00 | 279.30 | 0.47 |

| M&MFIN (F&O) | 28088 | 171.00 | 172.65 | 0.96 |

| GODREJPROP (F&O) | 27384 | 1612.95 | 1633.20 | 1.24 |

| BALMLAWRIE | 13833 | 136.75 | 138.90 | 1.55 |

| MFSL (F&O) | 55723 | 1112.65 | 1130.85 | 1.61 |

| TATACHEM (F&O) | 66168 | 844.00 | 858.80 | 1.72 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| VGUARD | 22739 | 255.55 | 252.85 | 1.07 |

| KAJARIACER | 11969 | 1162.50 | 1149.75 | 1.11 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| INDIACEM | 22163 | 185.64 | 169.08 | 199.42 | 185.00 | 185.60 | -0.32 |

| RITES | 13075 | 280.56 | 260.15 | 297.41 | 279.30 | 281.00 | -0.61 |

| MARUTI (F&O) | 40109 | 6909.77 | 6809.65 | 6989.64 | 6909.00 | 6958.00 | -0.71 |

| JINDALSTEL (F&O) | 43890 | 405.02 | 380.44 | 425.18 | 401.90 | 404.80 | -0.72 |

| LINDEINDIA | 24727 | 2743.14 | 2679.40 | 2794.37 | 2735.10 | 2755.00 | -0.73 |

| CIPLA (F&O) | 42123 | 953.27 | 915.52 | 983.90 | 952.95 | 960.00 | -0.74 |

| PEL (F&O) | 57467 | 2652.25 | 2589.56 | 2702.65 | 2649.95 | 2674.95 | -0.94 |

| CUB (F&O) | 10489 | 156.25 | 141.09 | 168.92 | 155.90 | 157.40 | -0.96 |

| LICHSGFIN (F&O) | 30680 | 425.39 | 400.20 | 446.04 | 420.50 | 425.10 | -1.09 |

| CUB (F&O) | 10489 | 156.25 | 141.09 | 168.92 | 155.90 | 157.95 | -1.31 |

| MAXHEALTH | 30176 | 395.02 | 370.75 | 414.93 | 393.60 | 398.85 | -1.33 |

| IPCALAB (F&O) | 61720 | 2639.39 | 2576.85 | 2689.67 | 2627.85 | 2664.30 | -1.39 |

| ASTRAL (F&O) | 16795 | 2127.52 | 2071.29 | 2172.80 | 2124.10 | 2160.00 | -1.69 |

| GODREJAGRO | 13503 | 669.52 | 637.88 | 695.29 | 663.20 | 674.90 | -1.76 |

| SONATSOFTW | 17321 | 855.56 | 819.80 | 884.62 | 852.95 | 873.00 | -2.35 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| JUSTDIAL | 13252 | 984.39 | 1023.49 | 953.74 | 987.95 | 981.00 | 0.70 |

| TATACONSUM (F&O) | 50490 | 870.25 | 907.06 | 841.42 | 871.55 | 864.95 | 0.76 |

| ABB | 19056 | 1903.14 | 1957.08 | 1860.70 | 1905.90 | 1890.20 | 0.82 |

| AXISBANK (F&O) | 107102 | 791.02 | 826.15 | 763.52 | 791.40 | 782.05 | 1.18 |

| JYOTHYLAB | 10296 | 175.56 | 192.42 | 162.64 | 177.80 | 175.10 | 1.52 |

| NMDC (F&O) | 37868 | 153.14 | 168.92 | 141.09 | 154.25 | 151.00 | 2.11 |

| MANAPPURAM (F&O) | 17200 | 165.77 | 182.16 | 153.22 | 167.70 | 163.50 | 2.50 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| VBL | 1.11% |

| POLYCAB (F&O) | 2.04% |

| NMDC (F&O) | 2.07% |

| KALPATPOWR | 3.35% |

| CUB (F&O) | 3.59% |

| SONATSOFTW | 3.70% |

| HDFCLIFE (F&O) | 3.93% |

| CARTRADE | 4.26% |

| MCX (F&O) | 4.39% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HDFCLIFE (F&O) | 0.19% |

| NMDC (F&O) | 0.29% |

| INDIACEM | 0.32% |

| KALPATPOWR | 0.41% |

| IGARASHI | 0.50% |

| LUPIN (F&O) | 0.55% |

| MARUTI (F&O) | 0.71% |

| JINDALSTEL (F&O) | 0.72% |

| LINDEINDIA | 0.73% |

| PEL (F&O) | 0.94% |

| ABB | 1.00% |

| AXISBANK (F&O) | 1.01% |

| CIPLA (F&O) | 1.05% |

| LICHSGFIN (F&O) | 1.09% |

| MANAPPURAM (F&O) | 1.16% |

| JUSTDIAL | 1.21% |

| ACC (F&O) | 1.24% |

| ASIANPAINT (F&O) | 1.26% |

| CUB (F&O) | 1.31% |

| MAXHEALTH | 1.33% |

| IPCALAB (F&O) | 1.39% |

| MUTHOOTFIN (F&O) | 1.40% |

| SRTRANSFIN (F&O) | 1.59% |

| KSCL | 1.63% |

| ASTRAL (F&O) | 1.69% |

| GODREJAGRO | 1.76% |

| DIXON (F&O) | 1.78% |

| TATACONSUM (F&O) | 2.00% |

| ICICIGI (F&O) | 2.13% |

| WIPRO (F&O) | 2.17% |

| IPL | 2.31% |

| SONATSOFTW | 2.35% |

| JYOTHYLAB | 2.36% |

| BAJFINANCE (F&O) | 2.49% |

| INDIAMART (F&O) | 2.69% |

| OBEROIRLTY | 2.70% |

| ZOMATO | 2.94% |

| CCL | 3.04% |

| VIPIND | 3.08% |

| WELSPUNIND | 3.20% |

| BRIGADE | 3.58% |

| TATACOFFEE | 3.59% |

| SPENCERS | 3.86% |

| SUDARSCHEM | 4.05% |

| MCX (F&O) | 4.37% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

PVR (F&O) Sell @ 1406.25 or Below

OFSS (F&O) Sell @ 4865.05 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ACE

CHOLAFIN (F&O)

DEEPAKNTR (F&O)

EIDPARRY

EIHOTEL

EQUITAS

FCL

GRSE

HSIL

IGL (F&O)

KITEX

MAHLIFE

SBILIFE (F&O)

SPAL

WHIRLPOOL

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

VIPIND

VSSL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

APTUS

JYOTHYLAB

LUPIN (F&O)

UTIAMC

Higher Level Consolidation

LUPIN (F&O)

SUMICHEM

VGUARD

Lower Level Consolidation

ACC (F&O)

APTUS

JUSTDIAL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BALPHARMA

BDL

DSSL

FORCEMOT

KALYANKJIL

KPIGLOBAL

LXCHEM

MCDHOLDING

MFL

PPAP

RBLBANK (F&O)

ROML

SANGAMIND

SHREYAS

TEXMOPIPES

TVSELECT

VISHNU

GAP DOWN BREAKOUT STOCKS

BESTAGRO

ISFT

KANPRPLA

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

ADVANIHOTR

BSOFT

PNBGILTS

RECLTD (F&O)

BEARISH ENGULFING

ANDHRSUGAR

NGIL

SHIL

ZENTEC

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

TATACOFFEE

TORNTPOWER (F&O)

ALEMBICLTD

SHYAMMETL

HAPPSTMNDS

BANCOINDIA

OFSS (F&O)

NUVOCO

MAZDOCK

XCHANGING

KPITTECH

JINDALSTEL (F&O)

CROMPTON

NIACL

CAPACITE

NH

GHCL

INDIANB

BLISSGVS

HINDALCO (F&O)

GICHSGFIN

HDFCLIFE (F&O)

EXIDEIND (F&O)

UTIAMC

HINDPETRO (F&O)

RELIANCE (F&O)

ABCAPITAL

UFLEX

GESHIP

REFEX

JUBLFOOD (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

CHAMBLFERT

GPPL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

CASTROLIND

LODHA

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

BFUTILITIE

GATI

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

WSTCSTPAPR

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

AMIORG

KANPRPLA

BEARISH MARUBOZU PATTERN

NGIL

SHIL

ZENTEC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

20MICRONS

BLS

BROOKS

NTPC (F&O)

VARROC

BEARISH BELLHOLD PATTERN

TANLA

TNPETRO

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASHOKLEY (F&O)

BANKBARODA (F&O)

GLENMARK (F&O)

ICICIGI (F&O)

IGL (F&O)

INDIACEM

MIRZAINT

PARAGMILK

REDINGTON

STARCEMENT

SELL RECOMMENDATION IF THE MARKET IS BEARISH

GRANULES (F&O)

PETRONET (F&O)

SADBHAV

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| THYROCARE | 1284.60 | 1287.02 | 1278.06 | 1295.35 | 1304.36 | 1313.41 | 1322.48 |

| DIXON | 4271.75 | 4273.89 | 4257.56 | 4288.10 | 4304.49 | 4320.90 | 4337.35 |

| JSWSTEEL (F&O) | 696.65 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| ICICILIQ | 999.99 | 1000.14 | 992.25 | 1007.56 | 1015.51 | 1023.49 | 1031.50 |

| DALBHARAT | 2455.95 | 2462.64 | 2450.25 | 2473.82 | 2486.27 | 2498.75 | 2511.26 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ATULAUTO | 201.05 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| POONAWALLA | 180.90 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| AUBANK (F&O) | 1135.90 | 1130.64 | 1139.06 | 1122.81 | 1114.45 | 1106.12 | 1097.81 |

| SHOPERSTOP | 251.15 | 248.06 | 252.02 | 244.26 | 240.37 | 236.51 | 232.68 |

| SIEMENS (F&O) | 2208.75 | 2197.27 | 2209.00 | 2186.66 | 2174.98 | 2163.33 | 2151.72 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BHARTIARTL (F&O) | 55750090 | 725.50 | 729.00 | 722.27 | 735.40 | 742.19 | 749.02 | 755.87 |

| ONGC (F&O) | 42437332 | 128.45 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| COALINDIA (F&O) | 24591822 | 161.05 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| SBIN (F&O) | 22181568 | 443.85 | 446.27 | 441.00 | 451.34 | 456.66 | 462.02 | 467.41 |

| CANBK (F&O) | 19003954 | 161.60 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| ASHOKLEY (F&O) | 17861664 | 128.35 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| POWERGRID (F&O) | 15048179 | 177.90 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| BEL (F&O) | 11746173 | 207.80 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| RBLBANK (F&O) | 11283437 | 179.40 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| IEX | 11076524 | 599.20 | 600.25 | 594.14 | 606.09 | 612.26 | 618.46 | 624.69 |

| MOTHERSUMI (F&O) | 9608983 | 228.25 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| RECLTD (F&O) | 9309667 | 161.30 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| BANDHANBNK (F&O) | 7987616 | 291.15 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| NOCIL | 7526965 | 305.35 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| VIJAYA | 7226253 | 640.50 | 643.89 | 637.56 | 649.92 | 656.31 | 662.73 | 669.18 |

| M&MFIN (F&O) | 6694968 | 172.65 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| HCLTECH (F&O) | 6063895 | 1273.25 | 1278.06 | 1269.14 | 1286.37 | 1295.35 | 1304.36 | 1313.41 |

| SUNTECK | 5119924 | 425.50 | 430.56 | 425.39 | 435.55 | 440.78 | 446.04 | 451.34 |

| INDIANB | 4222833 | 133.85 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| BSOFT | 3976090 | 425.70 | 430.56 | 425.39 | 435.55 | 440.78 | 446.04 | 451.34 |

| FILATEX | 3936683 | 112.05 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| TATACHEM (F&O) | 3384102 | 858.80 | 862.89 | 855.56 | 869.81 | 877.20 | 884.62 | 892.07 |

| OIL | 3174569 | 205.85 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| TITAN (F&O) | 2795995 | 2119.85 | 2127.52 | 2116.00 | 2137.99 | 2149.57 | 2161.17 | 2172.80 |

| INDIACEM | 2790513 | 185.00 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZEEL (F&O) | 200295409 | 255.90 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| ZENTEC | 6049865 | 214.80 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| VGUARD | 2060627 | 252.85 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| JAICORPLTD | 1721912 | 133.40 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| ACE | 1330342 | 269.10 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| TNPETRO | 1256862 | 123.30 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| ADVENZYMES | 721363 | 393.75 | 390.06 | 395.02 | 385.33 | 380.44 | 375.58 | 370.75 |

| AWHCL | 540502 | 433.75 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| ASIANTILES | 517497 | 155.65 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| SHEMAROO | 360095 | 146.75 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| EKC | 323645 | 126.10 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| VIMTALABS | 241901 | 292.20 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| SVPGLOB | 224414 | 144.55 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| BECTORFOOD | 202673 | 413.55 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| ESTER | 200406 | 148.80 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SHIL | 179235 | 422.10 | 420.25 | 425.39 | 415.35 | 410.27 | 405.22 | 400.20 |

| GOLDIAM | 169115 | 981.00 | 976.56 | 984.39 | 969.25 | 961.48 | 953.74 | 946.04 |

| IGARASHI | 168379 | 529.15 | 529.00 | 534.77 | 523.53 | 517.82 | 512.15 | 506.50 |

| JINDALPOLY | 166599 | 1047.40 | 1040.06 | 1048.14 | 1032.53 | 1024.51 | 1016.52 | 1008.57 |