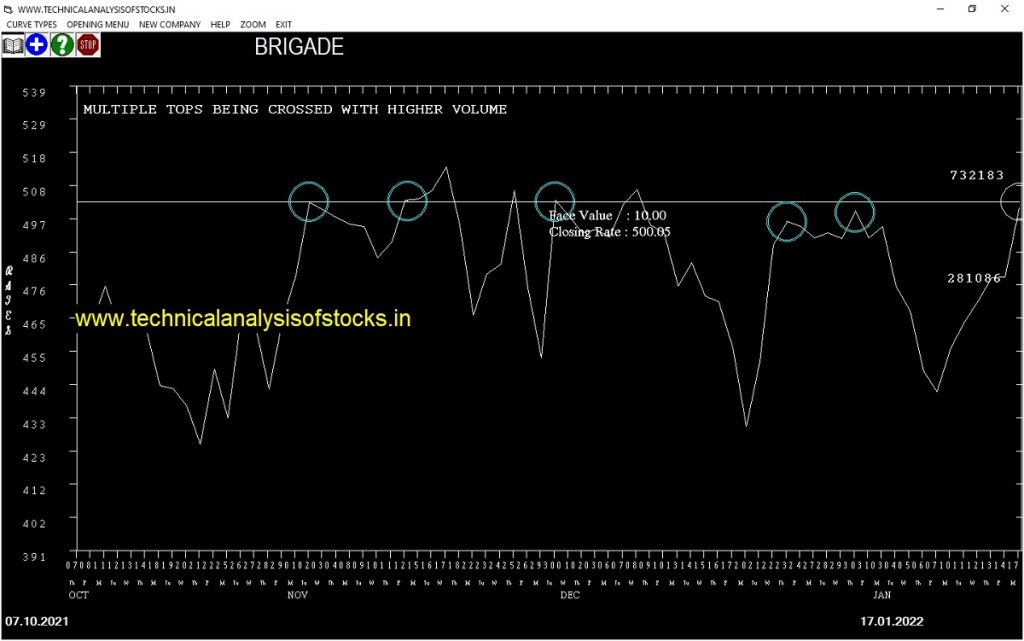

BUY BRIGADE (NSE Symbol) 500.65 or Above after cooling period. SIGNAL : MULTIPLE TOPS BEING CROSSED WITH HIGHER VOLUME. Stop Loss : 473.30 Target : 523 (Short term)

HOT BUZZING STOCKS (18.01.2022)

NSE SYMBOL CLOSING RATE

SALONA 316.95

KHAICHEM 91.35

PRECWIRE 96.80

SPLIL 65.85

COASTCORP 513.20

WINDMACHIN 47.85

INDNIPPON 574.10

SHIVAMILLS 164.60

FOODSIN 109.65

KELLTONTEC 103.00

ALKALI 130.20

LAGNAM 90.45

HARRMALAYA 188.80

63MOONS 354.90

ARCHIDPLY 56.70

GENESYS 405.55

GILLANDERS 71.40

KPIGLOBAL 454.00

MFL 810.75

NELCO 902.70

ONWARDTEC 355.00

WEBELSOLAR 146.05

AJMERA 428.10

AURIONPRO 372.15

GODHA 106.25

PALREDTEC 236.60

PITTIENG 278.80

BEDMUTHA 82.20

KHADIM 290.65

BPL 67.60

SOUTHWEST 161.60

TEXMOPIPES 96.10

TREJHARA 121.40

DIGISPICE 47.65

BHARATWIRE 78.40

EXIDEIND (F&O) 182.50

IZMO 95.45

BIGBLOC 72.25

TRIDENT 68.00

CEBBCO 56.55

ONEPOINT 96.00

SPMLINFRA 45.90

HECPROJECT 40.65

DCMNVL 366.80

RAMASTEEL 351.60

TANLA 1958.65

TEJASNET 483.70

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| FACT | 23512 | 142.85 | 146.55 | 2.52 |

| VTL | 13450 | 2655.00 | 2729.25 | 2.72 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| VEDL (F&O) | 122692 | 330.05 | 325.80 | 1.30 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| JKTYRE | 14331 | 141.02 | 126.63 | 153.06 | 138.45 | 138.50 | -0.04 |

| MIRZAINT | 53116 | 165.77 | 150.14 | 178.80 | 163.30 | 164.40 | -0.67 |

| INDIACEM (F&O) | 47888 | 252.02 | 232.68 | 268.01 | 251.25 | 253.70 | -0.98 |

| XCHANGING | 10770 | 118.27 | 105.12 | 129.33 | 118.20 | 120.65 | -2.07 |

| UTTAMSUGAR | 12888 | 232.56 | 214.00 | 247.94 | 231.80 | 237.00 | -2.24 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| IBULHSGFIN (F&O) | 42886 | 221.27 | 240.13 | 206.74 | 222.55 | 218.20 | 1.95 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| PETRONET (F&O) | 2.11% |

| DEVYANI | 3.24% |

| SYNGENE (F&O) | 3.84% |

| ANANDRATHI | 4.10% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| JKTYRE | 0.04% |

| SUPRIYA | 0.13% |

| MIRZAINT | 0.67% |

| ARIES | 0.74% |

| INDIACEM (F&O) | 0.98% |

| IBULHSGFIN (F&O) | 1.15% |

| KAJARIACER | 1.25% |

| HDFCAMC (F&O) | 1.64% |

| TEGA | 1.77% |

| CHEMPLASTS | 2.07% |

| XCHANGING | 2.07% |

| ZEEL (F&O) | 2.13% |

| GREENPANEL | 2.22% |

| UTTAMSUGAR | 2.24% |

| INDIANB | 2.44% |

| POWERGRID (F&O) | 2.45% |

| APTECHT | 2.56% |

| KPITTECH | 2.89% |

| MANAPPURAM (F&O) | 2.98% |

| BEML | 3.08% |

| CYIENT | 3.09% |

| ASTERDM | 3.10% |

| TITAN (F&O) | 3.45% |

| APLLTD (F&O) | 3.66% |

| SPARC | 3.96% |

| BORORENEW | 4.44% |

| DHANI | 4.55% |

| HEG | 4.60% |

| PANAMAPET | 4.82% |

| ANANDRATHI | 4.85% |

TStrategy : TRIANGLE PATTERN (Intraday/Short term)

SHALBY BUY @ 154 or ABOVE

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

GAIL (F&O) SELL @ 144 or Below

HINDALCO (F&O) SELL @ 506.25 or Below

TVSMOTOR (F&O) SELL @ 656.65 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ASHOKA

AVANTIFEED

BSE

CDSL

CSBBANK

DPWIRES

ISEC

MAZDOCK

POLYCAB (F&O)

RAMASTEEL

SALASAR

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ITI

MAZDOCK

Higher Level Consolidation

CROMPTON (F&O)

ESCORTS (F&O)

PETRONET (F&O)

SBICARD (F&O)

Lower Level Consolidation

AMBUJACEM (F&O)

CYBERTECH

ESCORTS (F&O)

ITC (F&O)

JKTYRE

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

CASTROLIND

HSIL

JKPAPER

METROBRAND

ONMOBILE

PRAJIND

SJS

GAP DOWN BREAKOUT STOCKS

HCLTECH (F&O)

HIKAL

VEDL (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

MAHASTEEL

SIS

BEARISH ENGULFING PATTERN

ALEMBICLTD

GRINDWELL

SANGAMIND

TANLA

VIJAYA

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

MFL

SALONA

WEBELSOLAR

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

BPL

FORTIS

METROBRAND

PRECWIRE

BEARISH BELLHOLD PATTERN

ANANTRAJ

IGARASHI

NDRAUTO

PRSMJOHNSN

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

STAR (F&O)

UJJIVAN

SPANDANA

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

VERTOZ

IOLCP

AMARAJABAT (F&O)

BANDHANBNK (F&O)

HUHTAMAKI

MAHLIFE

CREDITACC

AARTIDRUGS

WHIRLPOOL (F&O)

MAHEPC

JAYBARMARU

INDOSTAR

DFMFOODS

APLLTD (F&O)

AUROPHARMA (F&O)

ASHAPURMIN

EPL

BIOCON (F&O)

KPRMILL

CUB (F&O)

M&MFIN (F&O)

MGL (F&O)

CHEMCON

HDFCAMC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

DBL

CADILAHC (F&O)

AUROPHARMA (F&O)

ESCORTS (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

GODREJPROP (F&O)

ASTERDM

HDFCLIFE (F&O)

TRIGYN

MCDOWELL-N (F&O)

WELCORP

DEVYANI

GSFC

GNFC

TATAMTRDVR

TATASTEEL (F&O)

DLF (F&O)

EICHERMOT (F&O)

AMBUJACEM (F&O)

JAICORPLTD

APOLLOTYRE (F&O)

RIIL

BHARTIARTL (F&O)

DEEPAKNTR (F&O)

CHOLAFIN (F&O)

OBEROIRLTY (F&O)

RELIANCE (F&O)

SBILIFE (F&O)

COROMANDEL (F&O)

CANFINHOME (F&O)

AUBANK (F&O)

CDSL

UPL (F&O)

GAIL (F&O)

FLUOROCHEM

MARUTI (F&O)

TINPLATE

PIDILITIND (F&O)

HINDPETRO (F&O)

HAL (F&O)

ONGC (F&O)

LT (F&O)

PRAJIND

ABFRL (F&O)

BAJAJFINSV (F&O)

M&MFIN (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

SHIVAMILLS

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

63MOONS

TANLA

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

LODHA

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| INDIGO (F&O) | 2165.25 | 2173.89 | 2162.25 | 2184.47 | 2196.17 | 2207.90 | 2219.66 |

| OBEROIRLTY (F&O) | 975.65 | 976.56 | 968.77 | 983.90 | 991.75 | 999.64 | 1007.56 |

| ARIHANTSUP | 184.90 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| SHYAMMETL | 353.40 | 356.27 | 351.56 | 360.82 | 365.58 | 370.38 | 375.20 |

| PRINCEPIPE | 736.15 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| EMAMILTD | 500.00 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| SCHNEIDER | 116.05 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| CLEAN | 2534.90 | 2525.06 | 2537.64 | 2513.77 | 2501.25 | 2488.76 | 2476.30 |

| NRBBEARING | 180.65 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| MAZDOCK | 277.40 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ONGC (F&O) | 32577835 | 165.85 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| TATAMOTORS (F&O) | 27942414 | 525.00 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| MOTHERSUMI (F&O) | 13939031 | 189.55 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| EXIDEIND (F&O) | 13157000 | 182.50 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| BOMDYEING | 8480804 | 117.25 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| LICHSGFIN (F&O) | 7240364 | 389.50 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

| JSWSTEEL (F&O) | 5920282 | 699.40 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| TATAMTRDVR | 4330683 | 265.10 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| PRICOLLTD | 4128719 | 134.00 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| RELINFRA | 3772409 | 105.55 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| WELCORP | 3735114 | 195.15 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| M&M (F&O) | 3617269 | 900.80 | 907.52 | 900.00 | 914.60 | 922.18 | 929.78 | 937.42 |

| MINDACORP | 2845212 | 200.85 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| ICICIPRULI (F&O) | 2806939 | 615.65 | 618.77 | 612.56 | 624.69 | 630.95 | 637.24 | 643.57 |

| FILATEX | 2617272 | 140.10 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| AMARAJABAT (F&O) | 2541854 | 657.65 | 663.06 | 656.64 | 669.18 | 675.66 | 682.17 | 688.72 |

| SCI | 2282032 | 142.15 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| FACT | 2157679 | 146.55 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| DHAMPURSUG | 2150245 | 378.25 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| NIITLTD | 2026561 | 489.65 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| OIL | 1901213 | 224.65 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| NBVENTURES | 1880766 | 122.40 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| AEGISCHEM | 1824511 | 236.10 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| RATEGAIN | 1806638 | 493.90 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| SPARC | 1775504 | 321.00 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| NATIONALUM (F&O) | 30540288 | 110.25 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| VEDL (F&O) | 13870740 | 325.80 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| SEQUENT | 7118125 | 187.45 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| LAURUSLABS (F&O) | 3038253 | 507.70 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| WELSPUNIND | 1853677 | 148.15 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| DBL | 1715921 | 377.00 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| IRB | 902444 | 243.75 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| VISHAL | 810139 | 136.75 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| STAR (F&O) | 700140 | 444.55 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| TEJASNET | 562883 | 483.70 | 478.52 | 484.00 | 473.30 | 467.87 | 462.48 | 457.12 |

| BEML | 463204 | 1862.40 | 1859.77 | 1870.56 | 1849.92 | 1839.18 | 1828.48 | 1817.80 |

| TANLA | 395427 | 1958.65 | 1958.06 | 1969.14 | 1947.99 | 1936.97 | 1925.98 | 1915.02 |

| DOLLAR | 383927 | 610.05 | 606.39 | 612.56 | 600.55 | 594.44 | 588.36 | 582.31 |

| DCAL | 340265 | 210.95 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| GPIL | 327114 | 274.90 | 272.25 | 276.39 | 268.27 | 264.19 | 260.15 | 256.13 |

| APEX | 286709 | 324.20 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| SUPRAJIT | 271577 | 426.45 | 425.39 | 430.56 | 420.46 | 415.35 | 410.27 | 405.22 |

| ASAHIINDIA | 257250 | 561.90 | 558.14 | 564.06 | 552.53 | 546.66 | 540.83 | 535.03 |

| LALPATHLAB (F&O) | 251203 | 3502.60 | 3495.77 | 3510.56 | 3482.74 | 3468.00 | 3453.29 | 3438.61 |

| FDC | 242185 | 301.80 | 297.56 | 301.89 | 293.41 | 289.14 | 284.91 | 280.70 |

| SUVENPHAR | 221677 | 537.90 | 534.77 | 540.56 | 529.26 | 523.53 | 517.82 | 512.15 |

| IPL | 218913 | 321.75 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| IGARASHI | 203946 | 492.85 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| HUHTAMAKI | 202607 | 218.20 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| GET&D | 195413 | 136.50 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |