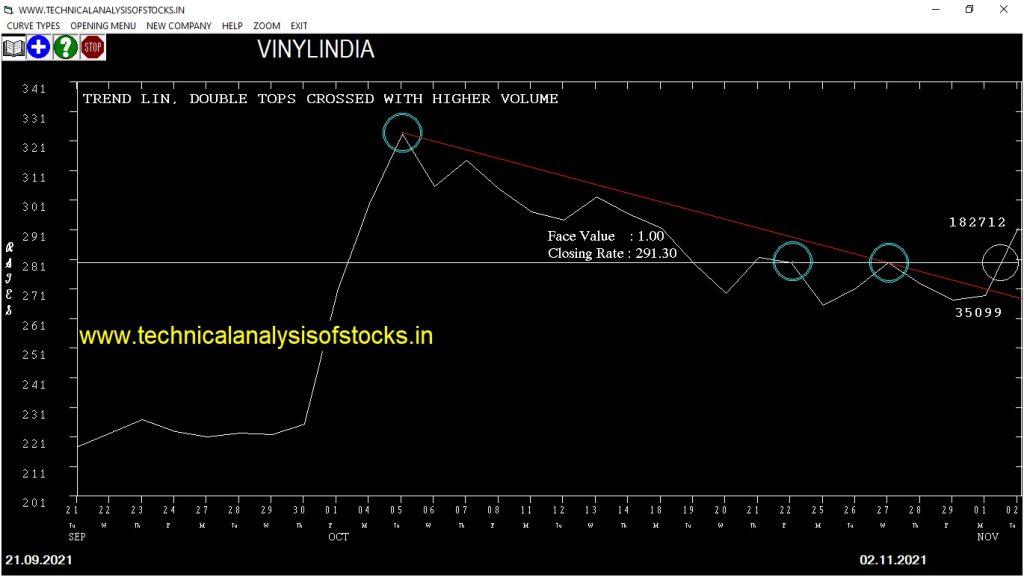

BUY VINYLINDIA (NSE Symbol) Buy@ 293.25 or Above after cooling period. SIGNAL : TREND LINE, DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 272.30 Target : 310.50 (Short term)

HOT BUZZING STOCKS (03.11.2021)

NSE SYMBOL CLOSING RATE

KEYFINSERV 89.10

ALLCARGO 328.70

MINDTECK 99.00

INDSWFTLAB 67.15

CREATIVE 405.45

GOKEX 237.50

IIFL 357.05

JUBLINDS 588.00

NAHARSPING 540.85

PAR 231.10

SASTASUNDR 394.85

INFOBEAN 397.35

NAHARCAP 335.70

NDL 87.30

RTNINDIA 43.15

SANGAMIND 314.50

VISHNU 850.35

XELPMOC 433.25

BASML 64.35

NAHARINDUS 130.70

PITTIENG 179.20

TI 75.90

TTML 57.95

TVSELECT 170.60

ZUARIGLOB 138.10

DCM 78.15

LYKALABS 103.45

RAMKY 156.25

GOKULAGRO 57.15

DAMODARIND 45.85

PARAS 836.95

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| CENTURYTEX | 29029 | 857.3 | 861.9 | 0.53 |

| BATAINDIA (F&O) | 24743 | 2032 | 2044 | 0.6 |

| NUVOCO | 21150 | 541.3 | 549.3 | 1.46 |

| APLAPOLLO | 25353 | 823.8 | 843.9 | 2.38 |

| ASALCBR | 11000 | 573.9 | 589.9 | 2.72 |

| HOMEFIRST | 31717 | 723.3 | 744.3 | 2.83 |

| PRESTIGE | 56325 | 448.5 | 463.6 | 3.26 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| ASTRAL (F&O) | 35340 | 2233 | 2175 | 2279 | 2227 | 2228 | -0.07 |

| BALRAMCHIN | 16317 | 337.6 | 315.2 | 356.1 | 334.3 | 334.9 | -0.19 |

| SUPRAJIT | 12147 | 370.6 | 347.1 | 389.9 | 366.4 | 368 | -0.44 |

| MINDAIND | 36477 | 798.1 | 763.5 | 826.2 | 797.7 | 801.9 | -0.53 |

| IEX (F&O) | 177185 | 749.4 | 715.9 | 776.6 | 745 | 750.5 | -0.74 |

| MFSL (F&O) | 24898 | 984.4 | 946 | 1016 | 983.7 | 993.9 | -1.04 |

| MAXHEALTH | 17306 | 346.9 | 324.2 | 365.6 | 342.6 | 346.8 | -1.21 |

| POLYCAB (F&O) | 32992 | 2377 | 2317 | 2424 | 2371 | 2400 | -1.22 |

| CYIENT | 23355 | 1114 | 1073 | 1147 | 1106 | 1121 | -1.36 |

| MINDTREE (F&O) | 60947 | 4727 | 4643 | 4793 | 4711 | 4778 | -1.42 |

| KANSAINER | 15519 | 570 | 540.8 | 593.8 | 568.9 | 582 | -2.3 |

| INOXLEISUR | 24720 | 430.6 | 405.2 | 451.3 | 428.7 | 438.8 | -2.36 |

| NAUKRI (F&O) | 30681 | 6143 | 6048 | 6218 | 6136 | 6289 | -2.49 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| WELCORP | 10597 | 129.4 | 143.9 | 118.3 | 129.8 | 127.4 | 1.89 |

| CAMS | 19151 | 2970 | 3037 | 2917 | 2972 | 2900 | 2.41 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| KNRCON | 1.00% |

| SRF (F&O) | 2.90% |

| OIL | 3.39% |

| MPHASIS (F&O) | 3.89% |

| CAMS | 3.91% |

| GREAVESCOT | 4.40% |

| FCL | 4.65% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ASTRAL (F&O) | 0.07% |

| BALRAMCHIN | 0.19% |

| SUPRAJIT | 0.44% |

| MINDAIND | 0.53% |

| IEX (F&O) | 0.74% |

| MFSL (F&O) | 1.04% |

| EIDPARRY | 1.16% |

| MAXHEALTH | 1.21% |

| POLYCAB (F&O) | 1.22% |

| HDFCLIFE (F&O) | 1.35% |

| CYIENT | 1.36% |

| MINDTREE (F&O) | 1.42% |

| KEI | 1.52% |

| ARVINDFASN | 1.54% |

| KPRMILL | 1.60% |

| PVR (F&O) | 1.89% |

| INOXLEISUR | 1.91% |

| EQUITAS | 2.05% |

| UFLEX | 2.18% |

| KANSAINER | 2.30% |

| BSE | 2.34% |

| BSOFT | 2.44% |

| NAUKRI (F&O) | 2.49% |

| JUBLINGREA | 2.65% |

| BEML | 2.67% |

| RELAXO | 2.95% |

| NOCIL | 3.43% |

| IBULHSGFIN (F&O) | 3.47% |

| ZEEL (F&O) | 3.55% |

| EPL | 3.93% |

| TATACOFFEE | 3.98% |

| LTI (F&O) | 4.60% |

| ADVENZYMES | 4.77% |

| ZENSARTECH | 4.97% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

CUMMINSIND (F&O) Buy @ 915.05 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

CC (F&O)

APLLTD (F&O)

ASTERDM

AXISBANK (F&O)

BEL (F&O)

BSE

CHAMBLFERT

DCMNVL

DRREDDY (F&O)

ELECON

GOKEX

HIMATSEIDE

INDIANB

INFY (F&O)

IRCTC (F&O)

ISEC

JKLAKSHMI

KCP

KKCL

KOTAKBANK (F&O)

LT (F&O)

MCDOWELL-N (F&O)

MMP

PRSMJOHNSN

SAGCEM

SALASAR

SIEMENS (F&O)

UJJIVAN

VSSL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

HEG

KPRMILL

SHREEPUSHK

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ALLCARGO

BOROLTD

BORORENEW

BURGERKING

GATI

IIFL

KPITTECH

PHOENIXLTD

POLYCAB

RBLBANK (F&O)

TATAMTRDVR

TATAPOWER (F&O)

TRENT (F&O)

GAP DOWN BREAKOUT STOCKS

PIIND (F&O)

SEQUENT

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

ADVENZYMES

GMDCLTD

GRAVITA

INDOCO

SKIPPER

TIRUMALCHM

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NAHARINDUS

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

JSWSTEEL (F&O)

NMDC (F&O)

TATASTEEL (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASIANTILES

AARTIDRUGS

BLISSGVS

APLLTD (F&O)

JAYBARMARU

STAR

JUBLPHARMA

GRANULES (F&O)

IOLCP

RAMCOSYS

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

COALINDIA (F&O)

LAURUSLABS

SUVENPHAR

TATAMETALI

CADILAHC (F&O)

AFFLE

HCLTECH (F&O)

CLEAN

CAMS

ABSLAMC

WELCORP

AMIORG

ONGC (F&O)

TINPLATE

RAILTEL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

TATAMOTORS (F&O)

MCDOWELL-N (F&O)

CANBK (F&O)

SBIN (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

AGARIND

APLAPOLLO

ASTERDM

AWHCL

BODALCHEM

CAMLINFINE

CENTURYTEX

CHEMCON

COCHINSHIP

CSBBANK

DBL

DHAMPURSUG

FACT

GESHIP

GICRE

GTPL

HARRMALAYA

HERANBA

HINDOILEXP

KIRIINDUS

MAHLOG

MOLDTKPAC

NAVNETEDUL

ONMOBILE

PLASTIBLEN

RIIL

SHREEPUSHK

SOBHA

SUDARSCHEM

SUVEN

VGUARD

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

ISEC

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| IPCALAB | 2127.55 | 2139.06 | 2127.52 | 2149.57 | 2161.17 | 2172.80 | 2184.47 |

| BALAMINES | 3353.05 | 3364.00 | 3349.52 | 3376.83 | 3391.37 | 3405.94 | 3420.54 |

| ADANIGREEN | 1174.25 | 1181.64 | 1173.06 | 1189.65 | 1198.29 | 1206.96 | 1215.66 |

| ICICIPRULI (F&O) | 631.50 | 637.56 | 631.27 | 643.57 | 649.92 | 656.31 | 662.73 |

| CASTROLIND | 141.50 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| MGL (F&O) | 1016.10 | 1016.02 | 1024.00 | 1008.57 | 1000.64 | 992.75 | 984.88 |

| RITES | 282.00 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| DMART | 4597.05 | 4590.06 | 4607.02 | 4575.43 | 4558.53 | 4541.66 | 4524.82 |

| CONCOR (F&O) | 668.60 | 663.06 | 669.52 | 656.97 | 650.58 | 644.21 | 637.88 |

| BEML | 1614.95 | 1610.02 | 1620.06 | 1600.80 | 1590.81 | 1580.85 | 1570.93 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 91597155 | 228.50 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| BANKBARODA (F&O) | 61862153 | 102.30 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| CANBK (F&O) | 38958818 | 224.25 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| FEDERALBNK (F&O) | 28226648 | 101.95 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| IBULHSGFIN (F&O) | 14060153 | 224.95 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| M&MFIN (F&O) | 7479381 | 197.10 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| TVSMOTOR (F&O) | 6921074 | 698.00 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| TATAMTRDVR | 6873624 | 261.05 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| JAMNAAUTO | 4404607 | 102.55 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| MANAPPURAM (F&O) | 4212632 | 198.25 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| PRICOLLTD | 3703813 | 113.15 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| MINDACORP | 3409333 | 171.85 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| BRIGADE | 3134338 | 501.80 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| CHOLAFIN (F&O) | 2877599 | 609.80 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| ORIENTCEM | 2424999 | 171.45 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| LICHSGFIN (F&O) | 2324123 | 425.20 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

| GSFC | 2319923 | 138.05 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| BURGERKING | 2238776 | 159.85 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| TRITURBINE | 2153461 | 211.00 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| VRLLOG | 2056198 | 398.35 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| PEL (F&O) | 1721025 | 2700.00 | 2704.00 | 2691.02 | 2715.66 | 2728.70 | 2741.77 | 2754.87 |

| INOXWIND | 1510073 | 130.45 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| RAYMOND | 1459942 | 485.95 | 489.52 | 484.00 | 494.81 | 500.39 | 506.00 | 511.63 |

| MSTCLTD | 1386277 | 391.10 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| FORTIS | 1377790 | 248.45 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SAIL (F&O) | 49404142 | 122.35 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| NMDC (F&O) | 11077501 | 141.85 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| JINDALSTEL (F&O) | 9190392 | 418.90 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| TATASTEEL (F&O) | 7216137 | 1313.65 | 1305.02 | 1314.06 | 1296.65 | 1287.66 | 1278.70 | 1269.78 |

| HINDALCO (F&O) | 5953912 | 468.40 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| HINDPETRO (F&O) | 4143739 | 303.45 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| JSWSTEEL (F&O) | 3204544 | 672.85 | 669.52 | 676.00 | 663.39 | 656.97 | 650.58 | 644.21 |

| ARVIND | 2983343 | 139.50 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| TECHM (F&O) | 2041689 | 1490.60 | 1482.25 | 1491.89 | 1473.38 | 1463.79 | 1454.24 | 1444.72 |

| CROMPTON | 1989405 | 477.10 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| GNFC | 1277695 | 487.20 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| GRAVITA | 1217287 | 214.60 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| GRASIM (F&O) | 1117548 | 1744.05 | 1743.06 | 1753.52 | 1733.51 | 1723.11 | 1712.75 | 1702.41 |

| INDOCO | 958261 | 457.25 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| SPENCERS | 894674 | 129.80 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| AARTIIND (F&O) | 870706 | 958.20 | 953.27 | 961.00 | 946.04 | 938.36 | 930.72 | 923.10 |

| ASTRAMICRO | 834703 | 233.35 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| SIS | 606512 | 437.55 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |

| KEC | 604616 | 452.55 | 451.56 | 456.89 | 446.49 | 441.22 | 435.98 | 430.78 |

| GSPL | 600351 | 316.10 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| LGBBROSLTD | 473784 | 536.15 | 534.77 | 540.56 | 529.26 | 523.53 | 517.82 | 512.15 |

| NAUKRI (F&O) | 439175 | 6135.95 | 6123.06 | 6142.64 | 6106.57 | 6087.04 | 6067.55 | 6048.09 |

| MAHSEAMLES | 430686 | 500.10 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| NCLIND | 425553 | 235.15 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| ADVENZYMES | 421491 | 369.10 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |