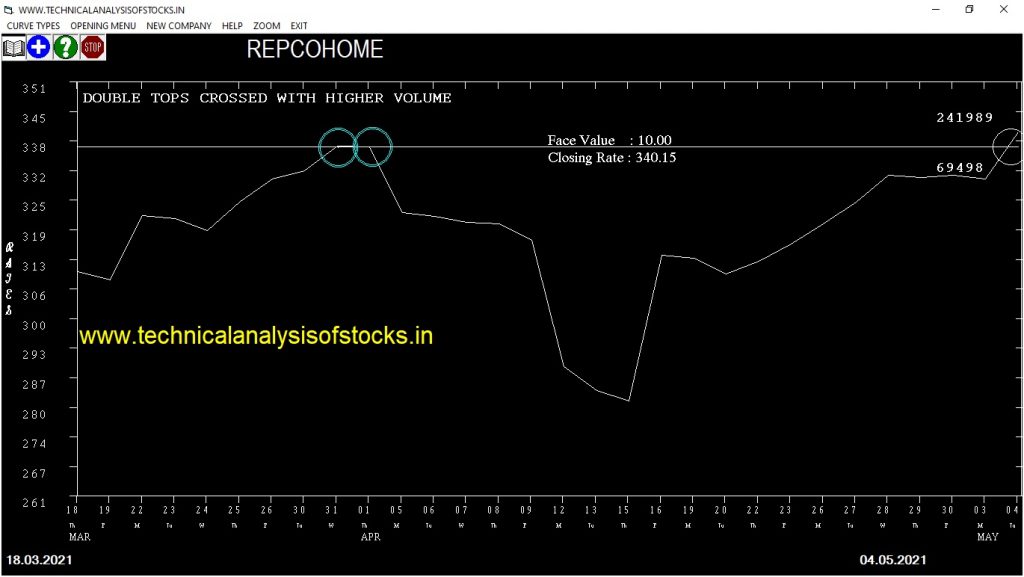

BUY REPCOHOME (NSE Symbol) Buy @ 342.25 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 319.70 Target : 360.80 (Short term)

HOT BUZZING STOCKS (05.05.2021)

NSE SYMBOL CLOSING RATE

NURECA 1269.90

TATASTLLP 987.45

AGARIND 167.20

JSWISPL 50.50

AYMSYNTEX 51.60

IZMO 75.10

LYKALABS 45.50

AVADHSUGAR 301.95

MAGADSUGAR 165.40

UTTAMSUGAR 141.85

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| KANSAINER | 13610 | 570.00 | 571.00 | 0.18 |

| BORORENEW | 24965 | 244.00 | 252.30 | 3.29 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| BURGERKING | 27225 | 129.00 | 129.00 | 0.00 |

| RAILTEL | 15416 | 120.05 | 119.30 | 0.63 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| RALLIS | 16329 | 289.00 | 268.27 | 306.10 | 288.75 | 291.00 | -0.78 |

| FORTIS | 59116 | 217.56 | 199.62 | 232.45 | 215.35 | 217.50 | -1.00 |

| ICICIGI (F&O) | 30856 | 1444.00 | 1397.59 | 1481.51 | 1443.20 | 1462.15 | -1.31 |

| MINDTREE (F&O) | 38177 | 2116.00 | 2059.92 | 2161.17 | 2115.60 | 2145.00 | -1.39 |

| FACT | 20787 | 115.56 | 102.57 | 126.50 | 115.50 | 117.10 | -1.39 |

| SCI | 18804 | 110.25 | 97.56 | 120.94 | 107.70 | 109.45 | -1.62 |

| VGUARD | 12819 | 225.00 | 206.74 | 240.13 | 223.80 | 227.80 | -1.79 |

| VENKEYS | 20117 | 1590.02 | 1541.33 | 1629.33 | 1580.80 | 1611.00 | -1.91 |

| JUBLPHARMA | 15338 | 805.14 | 770.45 | 833.35 | 804.75 | 824.50 | -2.45 |

| WOCKPHARMA | 50613 | 517.56 | 489.76 | 540.29 | 516.95 | 529.60 | -2.45 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| RAMCOCEM (F&O) | 15315 | 961.00 | 999.64 | 930.72 | 961.60 | 952.00 | 1.00 |

| GLAND | 12900 | 2639.39 | 2702.65 | 2589.56 | 2648.45 | 2620.00 | 1.07 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic / Intraday / Short term)

PERFECT PENNANT TRIANGLE (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

ALKEM (F&O),2.08%

LUPIN (F&O),2.42%

TECHM (F&O),2.83%

APLLTD (F&O),3.17%

SUVENPHAR,3.31%

AARTIDRUGS,3.41%

PFC (F&O),3.90%

PHOENIXLTD,6.07%

PEL (F&O),6.21%

RAMCOCEM (F&O),8.15%

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

RALLIS,0.78%

RELAXO,0.95%

FORTIS,1.00%

ICICIGI (F&O),1.31%

FACT,1.39%

MINDTREE (F&O),1.39%

SOLARA,1.39%

SCI,1.62%

VGUARD,1.79%

VENKEYS,1.91%

JUBLPHARMA,2.45%

WIPRO (F&O),2.60%

UPL (F&O),2.68%

MPHASIS (F&O),2.90%

OBEROIRLTY,2.98%

PRAJIND,2.98%

WOCKPHARMA,3.10%

DRREDDY (F&O),3.93%

BURGERKING,4.07%

GRANULES (F&O),4.16%

MAXHEALTH,4.19%

CEATLTD,4.66%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BANCOINDIA

HINDUNILVR (F&O)

OIL

ONGC (F&O)

TATASTLLP

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

SUNTECK

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

COLPAL (F&O)

DABUR (F&O)

MAJESCO

PNBGILTS

VOLTAS (F&O)

Higher Level Consolidation

CIPLA (F&O)

DABUR (F&O)

LTI (F&O)

TORNTPHARM (F&O)

ULTRACEMCO (F&O)

Lower Level Consolidation

APLAPOLLO

BAJAJ-AUTO (F&O)

COFORGE (F&O)

GIPCL

INDUSTOWER (F&O)

LTI (F&O)

PETRONET (F&O)

RAMCOCEM (F&O)

TORNTPHARM (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ANGELBRKG

CCL

FDC

NIACL

STLTECH

TATACOFFEE

GAP DOWN BREAKOUT STOCKS

EKC

TATACHEM (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

BLS

CADILAHC (F&O)

CSBBANK

GHCL

GNFC

GREENPANEL

GSPL

KESORAMIND

L&TFH (F&O)

LTI (F&O)

RAMCOCEM (F&O)

SBICARD

ZENSARTECH

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

IIFL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

ALLCARGO

CIPLA (F&O)

LUMAXTECH

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

BALPHARMA

INDRAMEDCO

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ANDHRAPAP

AXISBANK (F&O)

CANFINHOME

CAPLIPOINT

FEDERALBNK (F&O)

HEIDELBERG

MGL (F&O)

NTPC (F&O)

PEL (F&O)

PPL

STARPAPER

TNPL

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BERGEPAINT (F&O)

BURGERKING

COLPAL (F&O)

DLINKINDIA

GICHSGFIN

GRANULES (F&O)

HCLTECH (F&O)

HDFC (F&O)

HDFCLIFE (F&O)

IGL (F&O)

ITC (F&O)

L&TFH (F&O)

MAZDOCK

MIDHANI

PRESTIGE

SHILPAMED

TBZ

TECHM (F&O)

TITAN (F&O)

VIPIND

WESTLIFE

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HINDUNILVR (F&O) | 2407.65 | 2413.27 | 2401.00 | 2424.35 | 2436.67 | 2449.02 | 2461.41 |

| AJANTPHARM | 1864.50 | 1870.56 | 1859.77 | 1880.45 | 1891.30 | 1902.19 | 1913.11 |

| CGPOWER | 76.55 | 76.56 | 74.39 | 78.73 | 80.96 | 83.22 | 85.52 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| POLYMED | 1000.10 | 992.25 | 1000.14 | 984.88 | 977.05 | 969.25 | 961.48 |

| APTECHT | 203.65 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| BECTORFOOD | 355.60 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| IGL (F&O) | 503.20 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| COALINDIA (F&O) | 132.80 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| GAIL (F&O) | 31186406 | 143.75 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| MAGMA | 22446508 | 122.55 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| ALEMBICLTD | 15616819 | 129.95 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| INDIANB | 14628086 | 113.80 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| TATACOFFEE | 13805869 | 141.55 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| LXCHEM | 12347178 | 219.45 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| SBILIFE (F&O) | 10515809 | 982.90 | 984.39 | 976.56 | 991.75 | 999.64 | 1007.56 | 1015.51 |

| LAURUSLABS | 8877773 | 491.00 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| MARICO (F&O) | 7944787 | 460.75 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| HINDPETRO (F&O) | 7080182 | 241.50 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| BHARATFORG (F&O) | 5956470 | 631.80 | 637.56 | 631.27 | 643.57 | 649.92 | 656.31 | 662.73 |

| GREENPLY | 4232187 | 205.50 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| CCL | 3152614 | 301.55 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| BODALCHEM | 2966708 | 102.75 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| SHALBY | 1961008 | 133.05 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| APLLTD (F&O) | 1938333 | 1006.10 | 1008.06 | 1000.14 | 1015.51 | 1023.49 | 1031.50 | 1039.54 |

| AEGISCHEM | 1578436 | 323.15 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| CARBORUNIV | 1105107 | 588.65 | 594.14 | 588.06 | 599.95 | 606.09 | 612.26 | 618.46 |

| BOROLTD | 949296 | 207.45 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| TORNTPOWER (F&O) | 904377 | 404.05 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| ICIL | 851974 | 142.15 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| CARERATING | 836180 | 523.30 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| EASEMYTRIP | 724296 | 188.70 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| HOMEFIRST | 662382 | 511.05 | 511.89 | 506.25 | 517.30 | 523.00 | 528.74 | 534.50 |

| APOLLO | 662094 | 106.30 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| HINDALCO (F&O) | 29767756 | 362.55 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| M&MFIN (F&O) | 12292996 | 155.45 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| JINDALSTEL (F&O) | 11563827 | 435.75 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| RAIN | 10499206 | 179.20 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| RELIANCE (F&O) | 10083693 | 1916.60 | 1914.06 | 1925.02 | 1904.09 | 1893.20 | 1882.33 | 1871.50 |

| CIPLA (F&O) | 8347795 | 878.45 | 877.64 | 885.06 | 870.69 | 863.32 | 855.99 | 848.69 |

| FORTIS | 8059458 | 215.35 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| TATACONSUM (F&O) | 7400792 | 645.25 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| HINDCOPPER | 6992626 | 151.65 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| CADILAHC (F&O) | 6576325 | 569.15 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| SUNPHARMA (F&O) | 5604638 | 645.15 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| EKC | 5165690 | 119.75 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| EIDPARRY | 4461128 | 388.40 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| SUNTV (F&O) | 4309315 | 490.05 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| HINDZINC | 3787816 | 290.40 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| GLENMARK (F&O) | 3181758 | 558.15 | 558.14 | 564.06 | 552.53 | 546.66 | 540.83 | 535.03 |

| GRANULES (F&O) | 2745106 | 333.15 | 333.06 | 337.64 | 328.68 | 324.16 | 319.68 | 315.22 |

| TINPLATE | 2697675 | 204.90 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| ORIENTCEM | 2576664 | 109.05 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| WELCORP | 2344383 | 139.25 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| DELTACORP | 2251132 | 151.35 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| GREAVESCOT | 2168482 | 142.40 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| INDUSTOWER (F&O) | 2058334 | 253.05 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| GNFC | 1825221 | 358.60 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| KOPRAN | 1707082 | 179.40 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |