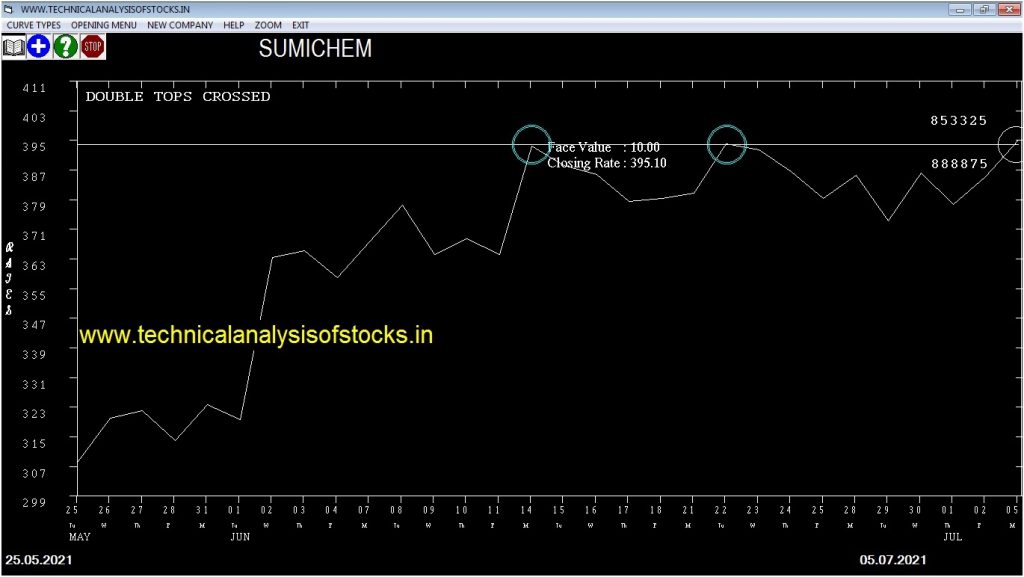

BUY SUMICHEM (NSE Symbol) Buy @ 400 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED. Stop Loss : 375.60 Target : 420 (Short term)

HOT BUZZING STOCKS (06.07.2021)

NSE SYMBOL CLOSING RATE

APEX 396.10

XELPMOC 407.85

HFCL 87.10

PANACHE 86.50

EASEMYTRIP 429.65

TVSELECT 189.20

COFFEEDAY 45.15

GENESYS 158.50

GOKEX 170.20

HMVL 87.35

VINEETLAB 89.55

GILLANDERS 54.85

VENUSREM 425.25

DCMNVL 141.10

INSPIRISYS 56.85

VISHNU 607.70

WEBELSOLAR 74.70

KOPRAN 249.65

RAMASTEEL 151.65

AHLADA 202.95

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NBVENTURES | 41482 | 116.00 | 116.25 | 0.22 |

| SBICARD | 69339 | 985.50 | 988.35 | 0.29 |

| JKLAKSHMI | 15670 | 594.70 | 599.30 | 0.77 |

| MAITHANALL | 13454 | 1093.90 | 1103.25 | 0.85 |

| JKLAKSHMI | 15670 | 593.00 | 599.30 | 1.05 |

| RELIANCE (F&O) | 175055 | 2126.50 | 2150.20 | 1.10 |

| RUPA | 24851 | 499.00 | 504.75 | 1.14 |

| GODREJPROP (F&O) | 51170 | 1422.00 | 1443.60 | 1.50 |

| BEPL | 31180 | 183.40 | 186.35 | 1.58 |

| JKLAKSHMI | 15670 | 588.25 | 599.30 | 1.84 |

| GODREJPROP (F&O) | 51170 | 1416.45 | 1443.60 | 1.88 |

| SPANDANA | 26035 | 689.70 | 709.30 | 2.76 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| FINPIPE | 19208 | 180.55 | 179.75 | 0.45 |

| GSPL | 10062 | 326.35 | 322.40 | 1.23 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| CAPLIPOINT | 33387 | 689.06 | 656.97 | 715.20 | 686.30 | 687.60 | -0.19 |

| STAR | 21919 | 805.14 | 770.45 | 833.35 | 804.80 | 810.00 | -0.65 |

| CAMS | 18139 | 2848.89 | 2783.95 | 2901.06 | 2839.35 | 2860.00 | -0.73 |

| AXISBANK (F&O) | 74308 | 763.14 | 729.36 | 790.62 | 760.35 | 765.95 | -0.74 |

| DIXON | 28306 | 4624.00 | 4541.66 | 4689.90 | 4609.45 | 4644.90 | -0.77 |

| GODREJAGRO | 35823 | 656.64 | 625.31 | 682.17 | 655.10 | 661.15 | -0.92 |

| APOLLOTYRE (F&O) | 14553 | 232.56 | 214.00 | 247.94 | 228.80 | 231.00 | -0.96 |

| GLENMARK (F&O) | 20908 | 663.06 | 631.58 | 688.72 | 662.10 | 672.00 | -1.50 |

| RAMCOSYS | 10611 | 637.56 | 606.69 | 662.73 | 636.25 | 646.60 | -1.63 |

| SHAKTIPUMP | 12802 | 791.02 | 756.63 | 818.98 | 784.90 | 798.80 | -1.77 |

| TINPLATE | 11938 | 225.00 | 206.74 | 240.13 | 223.35 | 227.70 | -1.95 |

| ABFRL | 22233 | 221.27 | 203.16 | 236.27 | 219.05 | 223.60 | -2.08 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| MCDOWELL-N (F&O) | 27973 | 656.64 | 688.72 | 631.58 | 660.85 | 659.00 | 0.28 |

| ASIANPAINT (F&O) | 47086 | 3011.27 | 3078.71 | 2958.12 | 3014.80 | 2985.00 | 0.99 |

| SBILIFE (F&O) | 15397 | 1008.06 | 1047.62 | 977.05 | 1009.85 | 998.00 | 1.17 |

| ADANIPORTS (F&O) | 135960 | 708.89 | 742.19 | 682.86 | 710.05 | 701.70 | 1.18 |

| ASIANPAINT (F&O) | 47086 | 3011.27 | 3078.71 | 2958.12 | 3014.80 | 2976.25 | 1.28 |

| INTELLECT | 15393 | 722.27 | 755.87 | 695.99 | 724.10 | 714.45 | 1.33 |

| AMARAJABAT (F&O) | 25264 | 749.39 | 783.61 | 722.63 | 749.75 | 737.25 | 1.67 |

| TITAN (F&O) | 26075 | 1743.06 | 1794.74 | 1702.41 | 1749.90 | 1719.75 | 1.72 |

| LICHSGFIN (F&O) | 24923 | 467.64 | 494.81 | 446.49 | 471.55 | 462.55 | 1.91 |

| M&M (F&O) | 41752 | 791.02 | 826.15 | 763.52 | 791.75 | 773.10 | 2.36 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| STAR | 0.65% |

| TITAN (F&O) | 1.06% |

| GLENMARK (F&O) | 1.50% |

| TINPLATE | 1.95% |

| M&MFIN (F&O) | 2.40% |

| MCDOWELL-N (F&O) | 2.97% |

| ZEEL (F&O) | 3.52% |

| GRAPHITE | 4.30% |

| SHAKTIPUMP | 4.73% |

| SMSPHARMA | 4.77% |

| FINCABLES | 5.55% |

| WABAG | 5.65% |

| BEML | 7.16% |

| ALEMBICLTD | 7.49% |

| THYROCARE | 8.04% |

| JAICORPLTD | 8.22% |

| GATI | 8.60% |

| UTIAMC | 9.05% |

| ADVENZYMES | 9.47% |

| DODLA | 12.51% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| EXIDEIND (F&O) | 0.03% |

| CAPLIPOINT | 0.19% |

| RAIN | 0.22% |

| LUMAXTECH | 0.54% |

| CAMS | 0.73% |

| AXISBANK (F&O) | 0.74% |

| DIXON | 0.77% |

| ASIANPAINT (F&O) | 0.80% |

| LICHSGFIN (F&O) | 0.89% |

| GODREJAGRO | 0.92% |

| APOLLOTYRE (F&O) | 0.96% |

| SBILIFE (F&O) | 0.98% |

| CSBBANK | 1.08% |

| RAJESHEXPO | 1.24% |

| APLLTD (F&O) | 1.30% |

| HINDZINC | 1.36% |

| RAMCOSYS | 1.63% |

| GUJGASLTD (F&O) | 1.70% |

| SHAKTIPUMP | 1.77% |

| MSTCLTD | 1.85% |

| TCS (F&O) | 1.87% |

| CASTROLIND | 1.94% |

| HINDPETRO (F&O) | 2.00% |

| COROMANDEL | 2.04% |

| RITES | 2.06% |

| ABFRL | 2.08% |

| MCDOWELL-N (F&O) | 2.14% |

| M&M (F&O) | 2.17% |

| KOLTEPATIL | 2.50% |

| ICICIGI (F&O) | 2.58% |

| AMARAJABAT (F&O) | 2.67% |

| BHAGERIA | 2.93% |

| ACE | 2.95% |

| GODREJIND | 3.18% |

| BHARTIARTL (F&O) | 3.43% |

| PEL (F&O) | 3.56% |

| HCG | 3.67% |

| ASHOKLEY (F&O) | 3.68% |

| TATAMTRDVR | 3.71% |

| PRESTIGE | 3.89% |

| GRAPHITE | 4.02% |

| MOIL | 4.02% |

| SUNTECK | 4.27% |

| BSOFT | 4.28% |

| UTIAMC | 4.61% |

| LTI (F&O) | 4.62% |

| RAYMOND | 4.79% |

| ADANIPORTS (F&O) | 4.87% |

| ITI | 4.88% |

| MINDAIND | 4.88% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

RECLTD (F&O) Sell @ 144 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BEL (F&O)

HAPPSTMNDS

HEXATRADEX

JINDALPOLY

JSWENERGY

LTI (F&O)

POWERMECH

SEQUENT

UFLEX

VERTOZ

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BANDHANBNK (F&O)

IGL (F&O)

ITC (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMARAJABAT (F&O)

APLLTD (F&O)

ASIANPAINT (F&O)

BHARTIARTL (F&O)

CADILAHC (F&O)

CANFINHOME

HCLTECH (F&O)

IOC (F&O)

ITC (F&O)

LTTS (F&O)

MAFANG

NLCINDIA

PEL (F&O)

RALLIS

TCS (F&O)

Higher Level Consolidation

AARTIIND (F&O)

ASIANTILES

BHARTIARTL (F&O)

BIOCON (F&O)

CADILAHC (F&O)

FINPIPE

GABRIEL

GSPL

HCLTECH (F&O)

HEIDELBERG

HINDUNILVR (F&O)

INDIGO (F&O)

KAJARIACER

KOTAKBANK (F&O)

LTTS (F&O)

NTPC (F&O)

SBILIFE (F&O)

SWANENERGY

Lower Level Consolidation

ABFRL

AMARAJABAT (F&O)

BAJAJCON

BEML

BERGEPAINT (F&O)

DHANI

EXIDEIND (F&O)

GUJGASLTD (F&O)

HCLTECH (F&O)

HDFCLIFE (F&O)

HEROMOTOCO (F&O)

HINDZINC

IOC (F&O)

ITC (F&O)

LASA

LICHSGFIN (F&O)

M&M (F&O)

MANINFRA

MAXIND

MCDOWELL-N (F&O)

RAIN

RALLIS

RAYMOND

RBLBANK (F&O)

TATAMTRDVR

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AXISBANK (F&O)

BEPL

CCL

GOKEX

ISGEC

NAUKRI (F&O)

ORIENTCEM

TAJGVK

TATACOFFEE

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

CSBBANK

BEARISH ENGULFING

CARBORUNIV

JSL

UTIAMC

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

APEX

KOPRAN

XELPMOC

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

CESC

MAGADSUGAR

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

PONNIERODE

SELL RECOMMENDATION AT HIGHER LEVELS

APEX

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASTRON

BAJAJ-AUTO (F&O)

BDL

BERGEPAINT (F&O)

COALINDIA (F&O)

COCHINSHIP

COLPAL (F&O)

MANAPPURAM (F&O)

MCDOWELL-N (F&O)

MGL (F&O)

MUNJALAU

PURVA

SIS

STARCEMENT

SUVEN

SWSOLAR

TAKE

TCS (F&O)

TECHM (F&O)

VIPIND

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ARVINDFASN

CUB (F&O)

ESCORTS (F&O)

GRANULES (F&O)

HDFCAMC (F&O)

STAR

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| JSWSTEEL (F&O) | 672.75 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| GSFC | 116.85 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| CHEMFAB | 160.65 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| HDFC (F&O) | 2494.90 | 2500.00 | 2487.52 | 2511.26 | 2523.80 | 2536.37 | 2548.97 |

| AXISBANK (F&O) | 760.35 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| APLLTD (F&O) | 993.05 | 992.25 | 1000.14 | 984.88 | 977.05 | 969.25 | 961.48 |

| RAJESHEXPO | 575.40 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| GREENPLY | 199.95 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| AAKASH | 205.10 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| KOLTEPATIL | 221.65 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 61606669 | 125.90 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| IBULHSGFIN (F&O) | 29041847 | 272.40 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| HINDALCO (F&O) | 12836172 | 389.55 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

| ONGC (F&O) | 12050022 | 120.95 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| ASHOKLEY (F&O) | 11745127 | 124.90 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| TATACOFFEE | 11386496 | 192.45 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| VEDL (F&O) | 9431913 | 272.45 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| DELTACORP | 9154922 | 195.15 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| CCL | 8035449 | 399.70 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| RAIN | 7584553 | 200.55 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| WELSPUNIND | 7470399 | 105.65 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| DLF (F&O) | 7189626 | 293.70 | 297.56 | 293.27 | 301.74 | 306.10 | 310.49 | 314.90 |

| MANAPPURAM (F&O) | 6096267 | 176.65 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| HINDCOPPER | 6085260 | 147.70 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| ASHOKA | 6058002 | 115.25 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| JKPAPER | 5772016 | 228.10 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| REDINGTON | 4866940 | 304.45 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| HINDPETRO (F&O) | 4835974 | 304.45 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| GODREJCP (F&O) | 3799078 | 925.00 | 930.25 | 922.64 | 937.42 | 945.09 | 952.79 | 960.52 |

| INDHOTEL | 3431552 | 146.75 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| PNCINFRA | 3291937 | 305.70 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| IEX | 3276468 | 390.55 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| BEPL | 3180621 | 186.35 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| ORIENTCEM | 3070740 | 143.80 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| KNRCON | 2796476 | 244.75 | 248.06 | 244.14 | 251.89 | 255.87 | 259.89 | 263.93 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| NMDC (F&O) | 25354321 | 175.25 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| JINDALSAW | 2911152 | 119.55 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| NIITLTD | 2535532 | 306.40 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| JSL | 1499097 | 106.30 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| FINPIPE | 1210858 | 179.75 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| INDOCO | 1021560 | 459.05 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| GPPL | 935339 | 110.85 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| INDIAGLYCO | 630229 | 681.25 | 676.00 | 682.52 | 669.85 | 663.39 | 656.97 | 650.58 |

| VERTOZ | 622499 | 165.80 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| GRAPHITE | 585731 | 650.05 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| GSPL | 508462 | 322.40 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| MAGADSUGAR | 443339 | 352.75 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| CREATIVE | 389496 | 190.05 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| CARBORUNIV | 359310 | 636.30 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |

| ERIS | 338876 | 739.90 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| SANGHVIMOV | 300420 | 212.55 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| SHARDAMOTR | 244548 | 682.45 | 676.00 | 682.52 | 669.85 | 663.39 | 656.97 | 650.58 |

| JAGSNPHARM | 237994 | 145.15 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| AJMERA | 222477 | 268.20 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| AVADHSUGAR | 207616 | 493.35 | 489.52 | 495.06 | 484.24 | 478.75 | 473.30 | 467.87 |

| ANDHRSUGAR | 202093 | 572.95 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| AHLADA | 185487 | 202.95 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| DALMIASUG | 180026 | 468.00 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| CYIENT | 172610 | 849.85 | 848.27 | 855.56 | 841.42 | 834.18 | 826.98 | 819.80 |