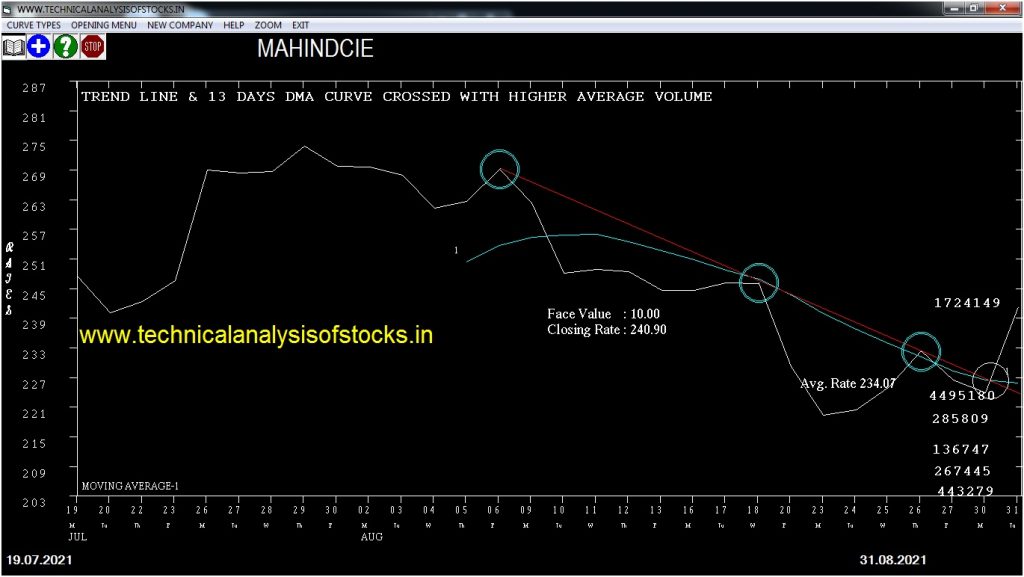

BUY MAHINDCIE (NSE Symbol) Buy@ 244.15 or Above after cooling period. SIGNAL : TREND LINE & 13 DAYS DMA CURVE CROSSED WITH HIGHER AVERAGE VOLUME. Stop Loss : 225.10 Target : 259.90 (Short term)

HOT BUZZING STOCKS (01.09.2021)

NSE SYMBOL CLOSING RATE

SECURKLOUD 164.40

MBAPL 206.75

ZOTA 386.00

KOTHARIPET 56.85

BPL 43.30

BESTAGRO 743.15

GOODLUCK 309.55

KRISHANA 161.95

NELCO 512.90

XPROINDIA 385.90

PFOCUS 68.60

HBSL 40.85

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| TORNTPHARM (F&O) | 18422 | 3105.00 | 3105.90 | 0.03 |

| GRASIM (F&O) | 36531 | 1499.25 | 1500.40 | 0.08 |

| AUROPHARMA (F&O) | 73324 | 726.20 | 727.30 | 0.15 |

| TATASTEEL (F&O) | 241285 | 1447.00 | 1450.25 | 0.22 |

| HCLTECH (F&O) | 148654 | 1178.20 | 1182.30 | 0.35 |

| CENTURYTEX | 10881 | 774.80 | 777.50 | 0.35 |

| TORNTPHARM (F&O) | 18422 | 3091.50 | 3105.90 | 0.46 |

| GLS | 11813 | 687.15 | 691.05 | 0.56 |

| CCL | 41309 | 400.00 | 402.85 | 0.71 |

| JKIL | 11094 | 199.15 | 200.95 | 0.90 |

| SUNPHARMA (F&O) | 82925 | 784.45 | 794.05 | 1.21 |

| BRIGADE | 25781 | 329.85 | 334.45 | 1.38 |

| IGL (F&O) | 72574 | 536.50 | 545.85 | 1.71 |

| TINPLATE | 13928 | 234.75 | 239.15 | 1.84 |

| BIOCON (F&O) | 35365 | 351.95 | 358.85 | 1.92 |

| IRCTC (F&O) | 94064 | 2684.95 | 2752.00 | 2.44 |

| INDOCO | 93565 | 467.80 | 479.75 | 2.49 |

| METROPOLIS (F&O) | 12942 | 2750.00 | 2823.55 | 2.60 |

| HEMIPROP | 15910 | 130.00 | 133.95 | 2.95 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| CHAMBLFERT | 18124 | 321.00 | 321.00 | 0.00 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SUNTECK | 40218 | 365.77 | 342.42 | 384.95 | 365.20 | 365.25 | -0.01 |

| APOLLOHOSP (F&O) | 175275 | 4970.25 | 4884.96 | 5038.48 | 4969.55 | 4974.00 | -0.09 |

| AARTIIND (F&O) | 18410 | 945.56 | 907.97 | 976.07 | 938.10 | 942.30 | -0.45 |

| COLPAL (F&O) | 45436 | 1701.56 | 1651.22 | 1742.19 | 1693.30 | 1702.35 | -0.53 |

| GUJALKALI | 10263 | 456.89 | 430.78 | 478.28 | 454.50 | 457.05 | -0.56 |

| CADILAHC (F&O) | 27640 | 558.14 | 529.26 | 581.72 | 554.15 | 558.00 | -0.69 |

| POLYPLEX | 25209 | 1521.00 | 1473.38 | 1559.47 | 1517.35 | 1529.00 | -0.77 |

| LGBBROSLTD | 12869 | 430.56 | 405.22 | 451.34 | 425.60 | 428.95 | -0.79 |

| BHARATFORG (F&O) | 70397 | 770.06 | 736.13 | 797.66 | 767.20 | 773.30 | -0.80 |

| BIOCON (F&O) | 35365 | 361.00 | 337.81 | 380.06 | 358.85 | 362.35 | -0.98 |

| LUPIN (F&O) | 35706 | 961.00 | 923.10 | 991.75 | 957.85 | 967.75 | -1.03 |

| PEL (F&O) | 40946 | 2613.77 | 2551.53 | 2663.81 | 2606.65 | 2640.00 | -1.28 |

| NIITLTD | 18668 | 319.52 | 297.71 | 337.47 | 316.10 | 320.30 | -1.33 |

| GNFC | 10489 | 333.06 | 310.80 | 351.39 | 332.60 | 337.45 | -1.46 |

| EASEMYTRIP | 19822 | 451.56 | 425.60 | 472.83 | 450.05 | 456.90 | -1.52 |

| MAITHANALL | 10968 | 968.77 | 930.72 | 999.64 | 965.20 | 983.50 | -1.90 |

| IBULHSGFIN (F&O) | 73745 | 225.00 | 206.74 | 240.13 | 224.00 | 228.95 | -2.21 |

| JSL | 16375 | 153.14 | 138.13 | 165.68 | 150.50 | 153.95 | -2.29 |

| LAURUSLABS | 46405 | 669.52 | 637.88 | 695.29 | 666.60 | 681.90 | -2.30 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| INDUSTOWER (F&O) | 27650 | 213.89 | 232.45 | 199.62 | 215.35 | 212.80 | 1.18 |

| SAIL (F&O) | 86368 | 121.00 | 135.07 | 110.31 | 121.60 | 120.05 | 1.27 |

| JUSTDIAL | 10463 | 953.27 | 991.75 | 923.10 | 953.45 | 941.10 | 1.30 |

| BAJAJ-AUTO (F&O) | 30974 | 3721.00 | 3795.74 | 3662.08 | 3727.85 | 3647.15 | 2.16 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ADVENZYMES | 0.96% |

| BIOCON (F&O) | 0.98% |

| BAJAJ-AUTO (F&O) | 1.61% |

| JINDALSTEL (F&O) | 2.27% |

| LAURUSLABS | 2.30% |

| LAURUSLABS | 2.66% |

| UBL (F&O) | 2.71% |

| JYOTHYLAB | 3.03% |

| KIMS | 3.87% |

| AEGISCHEM | 4.06% |

| MAITHANALL | 4.07% |

| EMAMILTD | 4.12% |

| JKTYRE | 4.13% |

| HINDCOPPER | 4.25% |

| JKIL | 4.35% |

| JKTYRE | 5.44% |

| MINDACORP | 5.68% |

| LGBBROSLTD | 5.76% |

| MINDACORP | 6.47% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SUNTECK | 0.01% |

| APOLLOHOSP (F&O) | 0.09% |

| THYROCARE | 0.18% |

| AARTIIND (F&O) | 0.45% |

| COLPAL (F&O) | 0.53% |

| GUJALKALI | 0.56% |

| CADILAHC (F&O) | 0.69% |

| LGBBROSLTD | 0.79% |

| BHARATFORG (F&O) | 0.80% |

| TATACHEM (F&O) | 0.99% |

| LUPIN (F&O) | 1.03% |

| MOIL | 1.05% |

| SAIL (F&O) | 1.07% |

| UBL (F&O) | 1.10% |

| BSOFT | 1.14% |

| JUSTDIAL | 1.15% |

| FINCABLES | 1.17% |

| JYOTHYLAB | 1.27% |

| GAIL (F&O) | 1.27% |

| NIITLTD | 1.33% |

| GNFC | 1.46% |

| PETRONET (F&O) | 1.49% |

| EASEMYTRIP | 1.52% |

| NUVOCO | 1.58% |

| GUJGASLTD (F&O) | 1.60% |

| GRANULES (F&O) | 1.65% |

| CENTURYPLY | 1.74% |

| POLYPLEX | 1.82% |

| MAITHANALL | 1.90% |

| MCDOWELL-N (F&O) | 1.91% |

| HAPPSTMNDS | 1.91% |

| JSWSTEEL (F&O) | 1.91% |

| RAILTEL | 2.08% |

| JSL | 2.29% |

| CUMMINSIND (F&O) | 2.33% |

| ASTRAL | 2.38% |

| RELAXO | 2.39% |

| IBULHSGFIN (F&O) | 2.43% |

| PEL (F&O) | 2.53% |

| MANAPPURAM (F&O) | 2.62% |

| RADICO | 2.73% |

| SHILPAMED | 2.90% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

FINPIPE Sell @ 166 or Below

CSBBANK Sell @ 295 or Below

KSCL Sell @ 575 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BRITANNIA (F&O) Sell @ 3984.75 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ATULAUTO

BANDHANBNK (F&O)

CAMLINFINE

GOODLUCK

KPITTECH

KSCL

MPHASIS (F&O)

PRINCEPIPE

TIRUMALCHM

WOCKPHARMA

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

ARIHANTSUP

ASIANTILES

WELCORP

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AVANTIFEED

BALRAMCHIN

GSPL

ICICIPRULI (F&O)

JUSTDIAL

MON100

RAILTEL

SPANDANA

Higher Level Consolidation

FINPIPE

PETRONET (F&O)

SPANDANA

Lower Level Consolidation

ARIHANTSUP

BAJAJ-AUTO (F&O)

EICHERMOT (F&O)

GUFICBIO

JKLAKSHMI

KCP

MON100

VGUARD

WIPRO (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

IEX

NELCO

TATACOFFEE

TRIVENI

VISHAL

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

PFOCUS

SPIC

BEARISH ENGULFING

CSBBANK

EXXARO

LAOPALA

MINDACORP

SHREYAS

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

CAPLIPOINT

KIOCL

GRANULES (F&O)

CAPACITE

VENUSREM

MANGLMCEM

VALIANTORG

IBULHSGFIN (F&O)

ZEEL (F&O)

GREAVESCOT

WOCKPHARMA

SUNTV (F&O)

ONMOBILE

WSTCSTPAPR

SEQUENT

GOKEX

BCLIND

GODREJPROP (F&O)

PPL

DOLLAR

FCL

EXIDEIND (F&O)

HINDCOPPER

JYOTHYLAB

GODREJIND

AVANTIFEED

NMDC (F&O)

SHK

ABCAPITAL

STLTECH

BANDHANBNK (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

HDFCAMC (F&O)

KPITTECH

TRENT (F&O)

AXISBANK (F&O)

BATAINDIA (F&O)

IPCALAB

TECHM (F&O)

VINYLINDIA

HDFC (F&O)

TATACONSUM (F&O)

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

TATAMTRDVR

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

ASIANPAINT (F&O)

BALKRISIND (F&O)

BATAINDIA (F&O)

CONCOR (F&O)

DELTACORP

IRB

LALPATHLAB (F&O)

METROPOLIS

PIDILITIND (F&O)

PIIND (F&O)

ULTRACEMCO (F&O)

VIDHIING

VIPIND

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

CENTURYPLY

FINCABLES

GALAXYSURF

GLS

GODREJAGRO

GSFC

HEMIPROP

JMCPROJECT

KRBL

LAURUSLABS

MUNJALSHOW

PALREDTEC

PRSMJOHNSN

STERTOOLS

WHIRLPOOL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

LINDEINDIA

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

SECURKLOUD

BEARISH BELLHOLD PATTERN

SHREYAS

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BERGEPAINT (F&O)

DBCORP

GAIL (F&O)

GLENMARK (F&O)

HDFC (F&O)

INDUSINDBK (F&O)

ITDCEM

JKTYRE

MAZDOCK

MGL (F&O)

MSTCLTD

SEQUENT

SYNGENE

VGUARD

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

GRANULES (F&O)

PVR (F&O)

VBL

WELCORP

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PIDILITIND (F&O) | 2280.35 | 2292.02 | 2280.06 | 2302.85 | 2314.86 | 2326.90 | 2338.97 |

| COROMANDEL (F&O) | 792.90 | 798.06 | 791.02 | 804.74 | 811.84 | 818.98 | 826.15 |

| HDFCAMC (F&O) | 3074.30 | 3080.25 | 3066.39 | 3092.59 | 3106.51 | 3120.45 | 3134.43 |

| SHRIRAMCIT | 2096.75 | 2104.52 | 2093.06 | 2114.94 | 2126.45 | 2137.99 | 2149.57 |

| AXISBANK (F&O) | 786.50 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ABFRL (F&O) | 208.10 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| NIITLTD | 316.10 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| JUSTDIAL | 953.45 | 953.27 | 961.00 | 946.04 | 938.36 | 930.72 | 923.10 |

| IOLCP | 559.10 | 558.14 | 564.06 | 552.53 | 546.66 | 540.83 | 535.03 |

| POWERGRID (F&O) | 175.35 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| CANBK (F&O) | 32668471 | 159.10 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| IOC (F&O) | 22323605 | 110.85 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| HINDALCO (F&O) | 20847646 | 468.30 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| DEVYANI | 16749260 | 125.10 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| ADANIPORTS (F&O) | 15419587 | 748.30 | 749.39 | 742.56 | 755.87 | 762.76 | 769.68 | 776.63 |

| ADANIENT (F&O) | 7234384 | 1587.60 | 1590.02 | 1580.06 | 1599.20 | 1609.21 | 1619.25 | 1629.33 |

| TECHM (F&O) | 6392991 | 1447.65 | 1453.52 | 1444.00 | 1462.33 | 1471.90 | 1481.51 | 1491.14 |

| HINDPETRO (F&O) | 5862402 | 266.60 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| APTUS | 5823315 | 369.45 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| MARICO (F&O) | 5014916 | 544.45 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| RAIN | 4411724 | 225.65 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| IGL (F&O) | 4255913 | 545.85 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| INDOCO | 3841820 | 479.75 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| INDIANB | 3398518 | 125.00 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| SBICARD | 3348741 | 1140.55 | 1147.52 | 1139.06 | 1155.42 | 1163.93 | 1172.48 | 1181.05 |

| PTC | 3310376 | 103.40 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| TCS (F&O) | 3207480 | 3786.45 | 3797.64 | 3782.25 | 3811.16 | 3826.60 | 3842.08 | 3857.59 |

| CCL | 3098163 | 402.85 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| APOLLOHOSP (F&O) | 2883159 | 4969.55 | 4970.25 | 4952.64 | 4985.40 | 5003.06 | 5020.75 | 5038.48 |

| LAURUSLABS | 2836964 | 666.60 | 669.52 | 663.06 | 675.66 | 682.17 | 688.72 | 695.29 |

| EICHERMOT (F&O) | 2381821 | 2679.25 | 2691.02 | 2678.06 | 2702.65 | 2715.66 | 2728.70 | 2741.77 |

| ASIANPAINT (F&O) | 2283290 | 3201.35 | 3206.39 | 3192.25 | 3218.95 | 3233.15 | 3247.38 | 3261.63 |

| IRCTC (F&O) | 2050223 | 2752.00 | 2756.25 | 2743.14 | 2768.01 | 2781.17 | 2794.37 | 2807.60 |

| OIL | 2025284 | 182.00 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| REDINGTON | 1932142 | 154.25 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| LXCHEM | 20384738 | 443.75 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| RBLBANK (F&O) | 7227276 | 165.50 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| IBREALEST | 5211033 | 136.40 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| TATAMTRDVR | 2899872 | 136.55 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| SONACOMS | 2502460 | 500.10 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| UJJIVAN | 2024124 | 153.80 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| SUDARSCHEM | 2001546 | 659.55 | 656.64 | 663.06 | 650.58 | 644.21 | 637.88 | 631.58 |

| JUBLINGREA | 1943752 | 745.50 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| GREAVESCOT | 1573345 | 136.00 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| SWSOLAR | 1191032 | 311.75 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| STOVEKRAFT | 848750 | 963.80 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| ALLCARGO | 787817 | 217.40 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| BEPL | 746446 | 183.90 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| NIACL | 744518 | 161.80 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| ICIL | 547548 | 234.80 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| BLS | 517230 | 202.20 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| XCHANGING | 501058 | 108.20 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| BODALCHEM | 467261 | 105.85 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| HIKAL | 434963 | 631.80 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |

| LIBERTSHOE | 304847 | 171.25 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| TRIGYN | 288984 | 111.60 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| SHK | 253434 | 147.50 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| SWANENERGY | 251693 | 135.85 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| BROOKS | 250060 | 119.15 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| LINDEINDIA | 236668 | 2290.55 | 2280.06 | 2292.02 | 2269.27 | 2257.38 | 2245.51 | 2233.68 |