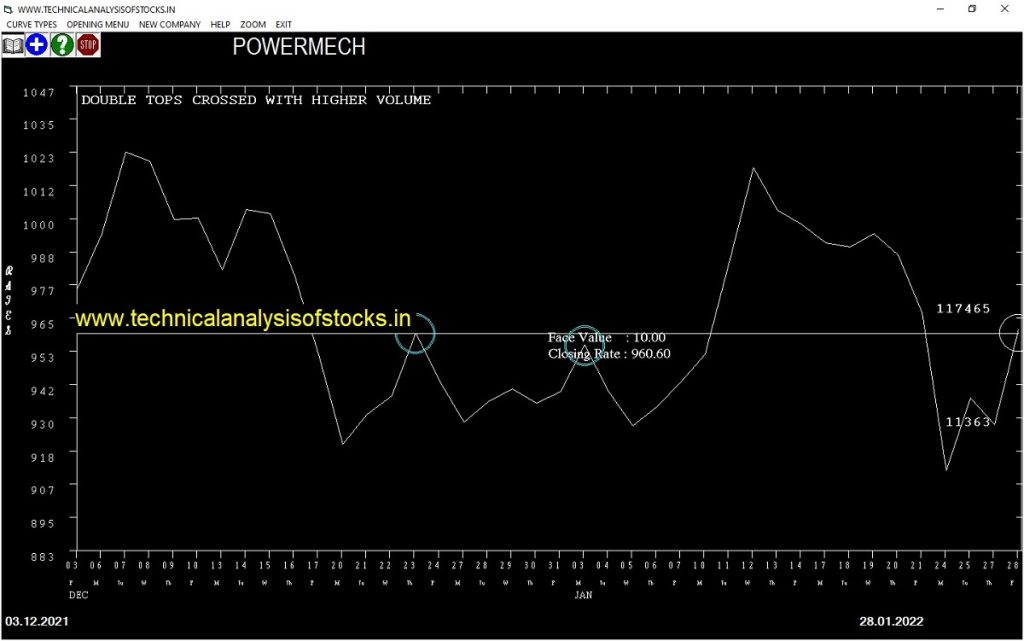

BUY POWERMECH (NSE Symbol) Buy @ 961 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 923.10 Target : 991.75 (Short term)

HOT BUZZING STOCKS (31.01.2022)

NSE SYMBOL CLOSING RATE

DSSL 236.00

LOTUSEYE 59.10

CINELINE 91.35

DPWIRES 350.85

KPIGLOBAL 497.90

OLECTRA 800.15

PANACEABIO 228.95

BCONCEPTS 70.50

DEEPAKFERT 542.65

WEBELSOLAR 137.70

BLS 232.90

MGEL 148.95

NITIRAJ 77.10

PFOCUS 72.90

SIGIND 63.05

DIGJAMLMTD 267.90

GENESYS 355.90

JINDALPHOT 332.15

JPOLYINVST 357.20

PREMEXPLN 299.65

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| JUSTDIAL | 4.78% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ACE

ADANIGREEN

ANGELONE

APLAPOLLO

CDSL

GOKEX

HINDZINC

KALPATPOWR

MAXHEALTH

POWERINDIA

RESPONIND

SHYAMMETL

TRITURBINE

VGUARD

WEBELSOLAR

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DBL

PCBL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BALRAMCHIN

DEEPAKFERT

DELTACORP (F&O)

INDUSINDBK (F&O)

JINDALSTEL (F&O)

LICHSGFIN (F&O)

MSTCLTD

NTPC (F&O)

RAIN

TATACHEM (F&O)

TATAPOWER (F&O)

GAP DOWN BREAKOUT STOCKS

MAPMYINDIA

MOTILALOFS

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

BCONCEPTS

KELLTONTEC

BEARISH ENGULFING PATTERN

CHAMBLFERT (F&O)

JUBLPHARMA

VENUSREM

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BCONCEPTS

CINELINE

OLECTRA

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

DSSL

KEC

WEBELSOLAR

BEARISH BELLHOLD PATTERN

AURUM

LICNFNHGP

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

HDFCBANK (F&O)

SCI

RADICO

GOLDIAM

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

ANGELONE

TATAELXSI

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

APTUS

BURGERKING

CARBORUNIV

GRSE

HIKAL

KIRLFER

MAHSEAMLES

MIRZAINT

NCLIND

SPENCERS

TATASTLLP

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

TINPLATE

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| RESPONIND | 198.20 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| SHYAMMETL | 334.20 | 337.64 | 333.06 | 342.08 | 346.72 | 351.39 | 356.09 |

| NUCLEUS | 579.90 | 582.02 | 576.00 | 587.77 | 593.84 | 599.95 | 606.09 |

| ARIHANTSUP | 176.35 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| PANAMAPET | 297.50 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| PURVA | 138.00 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| UFO | 101.25 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| DIVISLAB (F&O) | 3940.70 | 3937.56 | 3953.27 | 3923.85 | 3908.20 | 3892.59 | 3877.00 |

| CAMS | 2684.75 | 2678.06 | 2691.02 | 2666.47 | 2653.58 | 2640.71 | 2627.88 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| NTPC (F&O) | 34009553 | 140.15 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| NATIONALUM (F&O) | 23770677 | 108.80 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| NMDC (F&O) | 9852710 | 138.10 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| ARVIND | 9665943 | 143.20 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| M&MFIN (F&O) | 7164920 | 161.80 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| INDHOTEL (F&O) | 7077893 | 207.30 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| BOMDYEING | 6041214 | 110.45 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| INDIANB | 5673629 | 150.10 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| IRCTC (F&O) | 5541007 | 844.60 | 848.27 | 841.00 | 855.13 | 862.46 | 869.81 | 877.20 |

| MANAPPURAM (F&O) | 4667236 | 157.10 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| UPL (F&O) | 4007799 | 790.25 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| SONACOMS | 3524513 | 625.45 | 631.27 | 625.00 | 637.24 | 643.57 | 649.92 | 656.31 |

| SHARDACROP | 3460166 | 601.70 | 606.39 | 600.25 | 612.26 | 618.46 | 624.69 | 630.95 |

| RELINFRA | 3224151 | 102.30 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| AMBUJACEM (F&O) | 3157848 | 360.70 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| CADILAHC (F&O) | 2993091 | 396.00 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| GREAVESCOT | 2936291 | 209.45 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| AUROPHARMA (F&O) | 2307397 | 623.90 | 625.00 | 618.77 | 630.95 | 637.24 | 643.57 | 649.92 |

| TATACHEM (F&O) | 2235105 | 944.05 | 945.56 | 937.89 | 952.79 | 960.52 | 968.28 | 976.07 |

| GSFC | 1820536 | 127.45 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| CONCOR (F&O) | 1564122 | 634.40 | 637.56 | 631.27 | 643.57 | 649.92 | 656.31 | 662.73 |

| CASTROLIND | 1483160 | 125.60 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| GRANULES (F&O) | 1461260 | 300.70 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| MINDTREE (F&O) | 1446671 | 3724.20 | 3736.27 | 3721.00 | 3749.69 | 3765.01 | 3780.36 | 3795.74 |

| SBICARD (F&O) | 1267768 | 868.25 | 870.25 | 862.89 | 877.20 | 884.62 | 892.07 | 899.55 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| RBLBANK (F&O) | 34757591 | 147.55 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| POWERGRID (F&O) | 14199037 | 210.20 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| TECHM (F&O) | 7080683 | 1410.65 | 1406.25 | 1415.64 | 1397.59 | 1388.26 | 1378.95 | 1369.68 |

| TVSMOTOR (F&O) | 6413288 | 601.95 | 600.25 | 606.39 | 594.44 | 588.36 | 582.31 | 576.29 |

| GAEL | 3886016 | 208.65 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| CHOLAFIN (F&O) | 3577840 | 640.05 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| REDINGTON | 3161042 | 157.75 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| CMSINFO | 1456079 | 263.45 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

| ONMOBILE | 1330696 | 140.15 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| TINPLATE | 1216192 | 370.65 | 370.56 | 375.39 | 365.95 | 361.18 | 356.44 | 351.74 |

| CGPOWER | 1152122 | 180.75 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| SUPRIYA | 1144089 | 463.40 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| MARUTI (F&O) | 1045088 | 8550.95 | 8533.14 | 8556.25 | 8514.32 | 8491.26 | 8468.23 | 8445.24 |

| GATI | 1002107 | 207.40 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| MINDACORP | 976181 | 201.00 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| VOLTAS (F&O) | 929704 | 1157.15 | 1156.00 | 1164.52 | 1148.09 | 1139.63 | 1131.21 | 1122.81 |

| FCL | 923266 | 156.00 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| CHEMPLASTS | 654054 | 505.25 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| PRESTIGE | 643136 | 478.70 | 478.52 | 484.00 | 473.30 | 467.87 | 462.48 | 457.12 |

| RUPA | 534719 | 512.20 | 511.89 | 517.56 | 506.50 | 500.89 | 495.31 | 489.76 |

| MOTILALOFS | 525337 | 860.15 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| LAOPALA | 475454 | 395.10 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| CARTRADE | 464855 | 653.25 | 650.25 | 656.64 | 644.21 | 637.88 | 631.58 | 625.31 |

| KOTHARIPET | 458531 | 104.35 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| GESHIP | 452265 | 311.75 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |