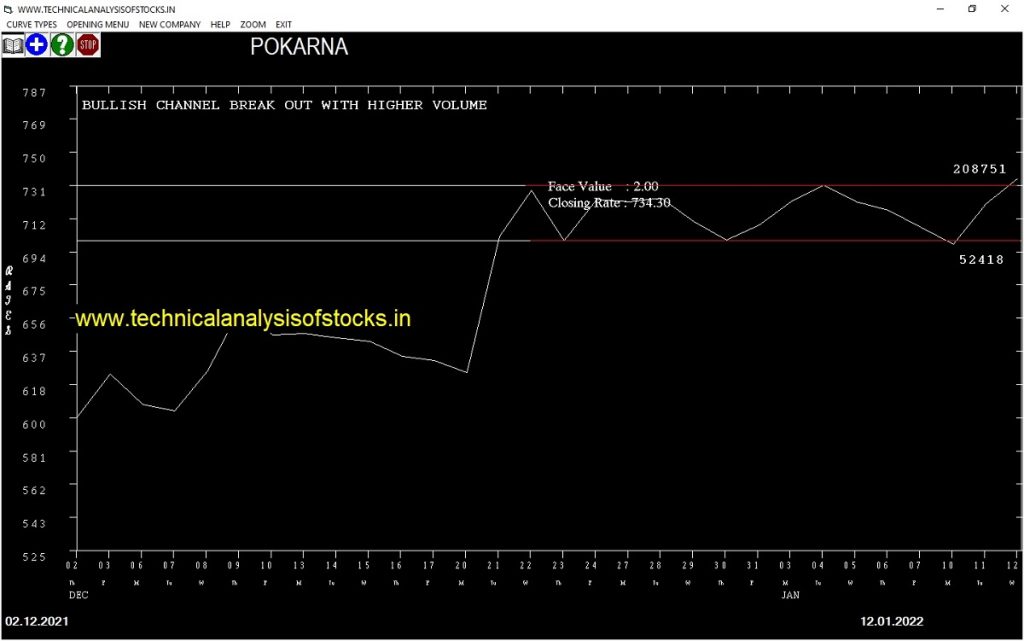

BUY POKARNA (NSE Symbol) 735.75 or Above after cooling period. SIGNAL : BULLISH CHANNEL BREAK OUT WITH HIGHER VOLUME. Stop Loss : 702.60 Target : 762.75 (Short term)

HOT BUZZING STOCKS (13.01.2022)

NSE SYMBOL CLOSING RATE

PGIL 479.75

SUNDRMBRAK 459.65

JMA 83.25

ADANIPOWER 119.40

NDRAUTO 432.95

TALBROAUTO 591.50

ARIHANTCAP 271.05

CREATIVE 650.00

NELCO 833.35

SSWL 798.25

TRIDENT 58.85

ARVSMART 249.35

GENESYS 362.70

HEXATRADEX 156.75

JINDALPHOT 299.00

V2RETAIL 160.95

ANANTRAJ 79.10

ZODIAC 88.55

GODHA 93.00

ROML 81.25

PRAXIS 53.15

CEBBCO 48.95

BANKA 80.65

BGRENERGY 101.50

RTNINDIA 60.30

JETFREIGHT 64.95

MUKANDLTD 128.20

DELTAMAGNT 101.05

EKC 261.95

DIGJAMLMTD 327.80

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NTPC (F&O) | 56703 | 133.30 | 133.85 | 0.41 |

| TATACOMM | 99219 | 1543.15 | 1557.70 | 0.93 |

| MEDPLUS | 40363 | 1100.00 | 1113.85 | 1.24 |

| HEG | 89047 | 1845.10 | 1883.95 | 2.06 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| IGL (F&O) | 51959 | 460.10 | 458.35 | 0.38 |

| MINDACORP | 17413 | 193.85 | 190.45 | 1.79 |

| RADICO | 14877 | 1225.80 | 1201.85 | 1.99 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| VRLLOG | 20740 | 489.52 | 462.48 | 511.63 | 484.90 | 485.00 | -0.02 |

| KIRLFER | 14310 | 217.56 | 199.62 | 232.45 | 215.90 | 216.85 | -0.44 |

| AMIORG | 18263 | 1122.25 | 1081.31 | 1155.42 | 1121.65 | 1134.70 | -1.16 |

| RAJESHEXPO | 10816 | 862.89 | 826.98 | 892.07 | 856.95 | 867.00 | -1.17 |

| TATACOFFEE | 18715 | 221.27 | 203.16 | 236.27 | 218.40 | 222.00 | -1.65 |

| GNFC | 44417 | 467.64 | 441.22 | 489.27 | 465.20 | 475.00 | -2.11 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| GOCOLORS | 10968 | 1024.00 | 1063.86 | 992.75 | 1029.35 | 1006.30 | 2.24 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| WELCORP | 0.92% |

| RAJESHEXPO | 1.17% |

| COCHINSHIP | 2.35% |

| HEG | 2.44% |

| DHAMPURSUG | 2.71% |

| SYNGENE (F&O) | 3.60% |

| ICIL | 4.07% |

| EIDPARRY | 4.46% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| VRLLOG | 0.02% |

| NUVOCO | 0.34% |

| KIRLFER | 0.44% |

| KABRAEXTRU | 0.49% |

| HDFCBANK (F&O) | 0.99% |

| AMIORG | 1.16% |

| CROMPTON (F&O) | 1.24% |

| COCHINSHIP | 1.52% |

| TATACOFFEE | 1.65% |

| TEGA | 1.72% |

| SUMICHEM | 1.74% |

| NIACL | 1.83% |

| IEX (F&O) | 1.98% |

| GNFC | 2.11% |

| MINDAIND | 2.32% |

| CARBORUNIV | 2.37% |

| GRANULES (F&O) | 2.39% |

| ZEEL (F&O) | 2.39% |

| APOLLOHOSP (F&O) | 2.48% |

| PTC | 2.54% |

| RAILTEL | 2.69% |

| AVADHSUGAR | 2.81% |

| INDIAGLYCO | 2.83% |

| RAIN | 2.86% |

| POWERGRID (F&O) | 3.15% |

| APTECHT | 3.63% |

| IGL (F&O) | 3.69% |

| SUPRIYA | 4.28% |

| ZENTEC | 4.58% |

| TNPETRO | 4.63% |

| DATAPATTNS | 4.65% |

| NRBBEARING | 4.65% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

ZENSARTECH BUY @ 500.65 or Above

PPL SELL @ 156.25 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BAJAJELEC

CUB (F&O)

ELGIEQUIP

INTELLECT

JKIL

KEI

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DCMSHRIRAM

FINOPB

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BAJAJCON

LIBERTSHOE

MARICO (F&O)

NATCOPHARM

NDTV

Higher Level Consolidation

DIVISLAB (F&O)

MARICO (F&O)

NATCOPHARM

Lower Level Consolidation

NATCOPHARM

NDTV

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AJMERA

CAMLINFINE

COFFEEDAY

CONTROLPR

CREATIVE

DIAMONDYD

DSSL

FEDERALBNK (F&O)

HERCULES

KANSAINER

LXCHEM

RUPA

SBIN (F&O)

TRIDENT

GAP DOWN BREAKOUT STOCKS

BGRENERGY

SOLARINDS

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

PONNIERODE

BEARISH ENGULFING PATTERN

BEDMUTHA

BIGBLOC

BIOFILCHEM

DELTAMAGNT

DIGJAMLMTD

EQUITAS

ISFT

JBMA

MARALOVER

NAHARINDUS

ORCHPHARMA

RTNINDIA

SARLAPOLY

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

ADANIPOWER

BEARISH MARUBOZU PATTERN

DELTAMAGNT

DIGJAMLMTD

EKC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ARIHANTCAP

ARVSMART

CHAMBLFERT (F&O)

HDFCLIFE (F&O)

JMA

PGIL

PONNIERODE

SUNDRMBRAK

BEARISH BELLHOLD PATTERN

DVL

EQUIPPP

ISFT

JBMA

KOTHARIPET

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

STAR (F&O)

UJJIVAN

SPANDANA

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

VERTOZ

IOLCP

AMARAJABAT (F&O)

BANDHANBNK (F&O)

HUHTAMAKI

MAHLIFE

CREDITACC

AARTIDRUGS

WHIRLPOOL (F&O)

MAHEPC

JAYBARMARU

INDOSTAR

DFMFOODS

APLLTD (F&O)

AUROPHARMA (F&O)

ASHAPURMIN

EPL

BIOCON (F&O)

KPRMILL

CUB (F&O)

M&MFIN (F&O)

MGL (F&O)

CHEMCON

HDFCAMC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

LAOPALA

BAJAJELEC

BLISSGVS

HAVELLS (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

POLYCAB (F&O)

FCL

DHAMPURSUG

IBREALEST

TVSMOTOR (F&O)

KPRMILL

TRIVENI

TARSONS

PHILIPCARB

LXCHEM

AARTIIND (F&O)

ACC (F&O)

GESHIP

APOLLOTYRE (F&O)

ASTRAL (F&O)

GRAPHITE

ARVIND

BALRAMCHIN

BAJAJ-AUTO (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

MAYURUNIQ

MEDPLUS

PHOENIXLTD

RELIGARE

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

EKC

NH

PRECAM

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| RESPONIND | 181.50 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| BERGEPAINT (F&O) | 788.90 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| NAM-INDIA (F&O) | 370.40 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| PIIND (F&O) | 2871.70 | 2875.64 | 2862.25 | 2887.62 | 2901.06 | 2914.54 | 2928.05 |

| HCLTECH (F&O) | 1352.15 | 1359.77 | 1350.56 | 1368.32 | 1377.58 | 1386.87 | 1396.19 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| DLINKINDIA | 171.30 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| NRBBEARING | 178.45 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| IOLCP | 457.60 | 456.89 | 462.25 | 451.79 | 446.49 | 441.22 | 435.98 |

| LIBERTSHOE | 160.40 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| DSSL | 200.30 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| RBLBANK (F&O) | 25606428 | 149.80 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| ONGC (F&O) | 21220614 | 164.95 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| NATIONALUM (F&O) | 18671986 | 111.30 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| DELTACORP (F&O) | 17169134 | 291.75 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| DLF (F&O) | 12818775 | 417.55 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| BHARTIARTL (F&O) | 12366953 | 730.20 | 735.77 | 729.00 | 742.19 | 749.02 | 755.87 | 762.76 |

| ASHOKLEY (F&O) | 11901175 | 138.90 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| NMDC (F&O) | 11254966 | 141.30 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| HINDALCO (F&O) | 9296587 | 497.95 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| M&M (F&O) | 9022415 | 880.55 | 885.06 | 877.64 | 892.07 | 899.55 | 907.06 | 914.60 |

| ABFRL (F&O) | 8332254 | 301.05 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| RELIANCE (F&O) | 6830402 | 2521.10 | 2525.06 | 2512.52 | 2536.37 | 2548.97 | 2561.61 | 2574.27 |

| BANDHANBNK (F&O) | 6627728 | 283.65 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| DEVYANI | 6021287 | 186.95 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| INDUSINDBK (F&O) | 5506622 | 941.55 | 945.56 | 937.89 | 952.79 | 960.52 | 968.28 | 976.07 |

| HINDCOPPER | 4845617 | 133.90 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| PRESTIGE | 4424048 | 471.15 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| ARVIND | 3858690 | 138.40 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| INDUSTOWER (F&O) | 3819111 | 275.80 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| TATACHEM (F&O) | 3612732 | 993.00 | 1000.14 | 992.25 | 1007.56 | 1015.51 | 1023.49 | 1031.50 |

| CHOLAFIN (F&O) | 3385873 | 598.45 | 600.25 | 594.14 | 606.09 | 612.26 | 618.46 | 624.69 |

| PVR (F&O) | 3007008 | 1555.75 | 1560.25 | 1550.39 | 1569.36 | 1579.27 | 1589.22 | 1599.20 |

| WELCORP | 2742237 | 184.80 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| OIL | 2641749 | 220.60 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| GSPL (F&O) | 2577718 | 326.20 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| MOTHERSUMI (F&O) | 13108208 | 243.45 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| PAYTM | 6400253 | 1082.70 | 1080.77 | 1089.00 | 1073.10 | 1064.92 | 1056.78 | 1048.66 |

| TWL | 2513139 | 113.35 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| FILATEX | 2149272 | 121.50 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| CGPOWER | 1952510 | 187.65 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| BGRENERGY | 1194701 | 101.50 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| EQUITAS | 1163716 | 118.70 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| RIIL | 1098030 | 958.75 | 953.27 | 961.00 | 946.04 | 938.36 | 930.72 | 923.10 |

| WEBELSOLAR | 917096 | 141.55 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| PRECAM | 851562 | 164.90 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| PRAJIND | 794182 | 364.85 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| LATENTVIEW | 742362 | 578.85 | 576.00 | 582.02 | 570.30 | 564.34 | 558.42 | 552.53 |

| RATEGAIN | 707263 | 414.05 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| NH | 683215 | 632.10 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |

| JUBLINGREA | 528357 | 593.65 | 588.06 | 594.14 | 582.31 | 576.29 | 570.30 | 564.34 |

| EKC | 464950 | 261.95 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

| HPAL | 458656 | 439.70 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |

| JBMA | 396838 | 1490.15 | 1482.25 | 1491.89 | 1473.38 | 1463.79 | 1454.24 | 1444.72 |

| JINDRILL | 387434 | 159.15 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| CYBERTECH | 364834 | 224.10 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| MAHINDCIE | 348805 | 225.80 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| ADSL | 336670 | 157.50 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| GPIL | 336637 | 262.35 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

| NCLIND | 323317 | 212.35 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| VRLLOG | 317535 | 484.90 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |