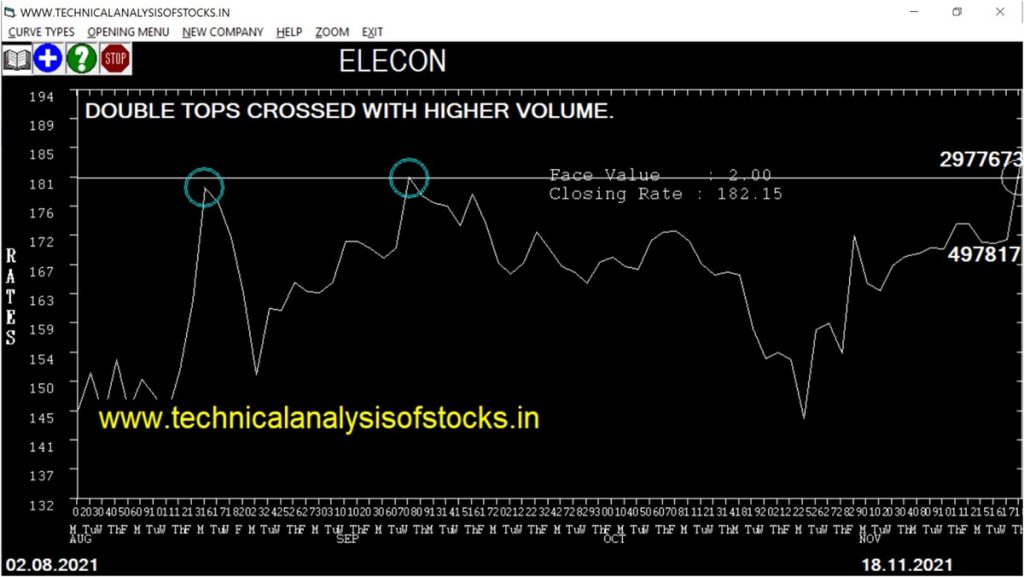

BUY ELECON (NSE Symbol) Buy@ 182.25 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 165.85 Target : 195.90 (Short term)

HOT BUZZING STOCKS (22.11.2021)

NSE SYMBOL CLOSING RATE

LFIC 156.35

3IINFOLTD 85.10

BORORENEW 533.75

OPTIEMUS 352.00

SUULD 341.55

TANLA 1461.80

MOLDTECH 81.05

TRIDENT 45.20

TTML 80.05

BCG 108.05

SUTLEJTEX 78.80

RTNINDIA 48.75

ISFT 184.25

PANACEABIO 181.25

POONAWALLA 196.55

63MOONS 122.90

PAR 187.55

BARBEQUE 1529.75

EKC 139.70

INDOTHAI 133.05

SBCL 380.95

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| KIMS | 17985 | 1226.45 | 1257.75 | 2.49 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| CUMMINSIND (F&O) | 18774 | 916.45 | 915.35 | 0.12 |

| MOTILALOFS | 12845 | 925.00 | 923.80 | 0.13 |

| JSWSTEEL (F&O) | 60391 | 652.20 | 650.55 | 0.25 |

| ASTERDM | 12441 | 197.10 | 196.40 | 0.36 |

| ULTRACEMCO (F&O) | 35098 | 7845.00 | 7767.70 | 1.00 |

| OIL | 18310 | 216.10 | 213.00 | 1.46 |

| LT (F&O) | 108392 | 1925.65 | 1897.00 | 1.51 |

| HDFCAMC (F&O) | 30430 | 2641.35 | 2601.40 | 1.54 |

| JSL | 25189 | 178.20 | 175.25 | 1.68 |

| OBEROIRLTY | 34741 | 949.00 | 921.50 | 2.98 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| SRTRANSFIN (F&O) | 35475 | 1600.00 | 1649.57 | 1561.03 | 1601.40 | 1581.05 | 1.27 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| VIMTALABS | 0.05% |

| PIDILITIND (F&O) | 1.66% |

| ICICIGI (F&O) | 2.16% |

| CUMMINSIND (F&O) | 2.58% |

| GICRE | 2.74% |

| TCIEXP | 3.04% |

| SETFNIF50 | 3.16% |

| TATAMTRDVR | 3.44% |

| ZENTEC | 3.61% |

| HDFCAMC (F&O) | 3.67% |

| TATACHEM (F&O) | 3.74% |

| AUBANK (F&O) | 3.81% |

| JSWSTEEL (F&O) | 3.92% |

| SUNPHARMA (F&O) | 3.97% |

| ORIENTELEC | 4.06% |

| BANDHANBNK (F&O) | 4.27% |

| LT (F&O) | 4.47% |

| TATAPOWER (F&O) | 4.58% |

| WHIRLPOOL | 4.64% |

| APEX | 4.75% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

TVSMOTOR (F&O) Sell @ 719 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BLISSGVS Buy @ 102.50 or Above

POLYPLEX Buy @ 1701.55 or Above

ROUTE Buy @ 1936. or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

THERMAX

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NATCOPHARM

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NTPC (F&O)

Lower Level Consolidation

EVEREADY

TORNTPHARM (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

LFIC

TANLA

GAP DOWN BREAKOUT STOCKS

LUPIN (F&O)

PAYTM

SAPPHIRE

ZENSARTECH

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

GULFOILLUB

BEARISH ENGULFING

AEGISCHEM

ARVIND

BARBEQUE

BECTORFOOD

CCL

GAEL

HINDZINC

ICIL

ISFT

JMFINANCIL

KALPATPOWR

MAFANG

MON100

NITINSPIN

PERSISTENT

SBCL

VEDL (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

LFIC

BEARISH MARUBOZU PATTERN

63MOONS

EKC

SBCL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

IRB

BEARISH BELLHOLD PATTERN

BDL

ISFT

KRSNAA

LOKESHMACH

MAFANG

POONAWALLA

RPGLIFE

TEJASNET

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

VERTOZ

BLISSGVS

UJJIVAN

STAR

IOLCP

APLLTD (F&O)

BIOCON (F&O)

RAMCOSYS

JUBLPHARMA

AARTIDRUGS

GRANULES (F&O)

AMARAJABAT (F&O)

CREDITACC

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

GABRIEL

RAIN

JINDALSAW

RECLTD (F&O)

NOCIL

CUB (F&O)

VENUSREM

INDIANB

LAURUSLABS

JINDALSTEL (F&O)

MSTCLTD

COALINDIA (F&O)

HINDCOPPER

INDOCO

GOLDIAM

CADILAHC (F&O)

GRAPHITE

GODREJCP (F&O)

JKPAPER

AMIORG

BAJAJ-AUTO (F&O)

PNBHOUSING

JUBLINGREA

PFC (F&O)

NAM-INDIA (F&O)

MARICO (F&O)

SHILPAMED

TIRUMALCHM

HINDALCO (F&O)

AUROPHARMA (F&O)

COLPAL (F&O)

WELSPUNIND

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

ASTRAL (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

CASTROLIND

DHANI

HIL

TATACOMM

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

CCL

KANSAINER

LODHA

MAHLOG

PERSISTENT

POONAWALLA

TATACOFFEE

TATAELXSI

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| JUBLPHARMA | 610.80 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| DABUR (F&O) | 608.75 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| HAVELLS (F&O) | 1372.95 | 1378.27 | 1369.00 | 1386.87 | 1396.19 | 1405.55 | 1414.93 |

| HINDUNILVR (F&O) | 2399.40 | 2401.00 | 2388.77 | 2412.06 | 2424.35 | 2436.67 | 2449.02 |

| PIDILITIND (F&O) | 2439.60 | 2450.25 | 2437.89 | 2461.41 | 2473.82 | 2486.27 | 2498.75 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| MTARTECH | 1892.75 | 1892.25 | 1903.14 | 1882.33 | 1871.50 | 1860.70 | 1849.92 |

| SWANENERGY | 120.80 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| BFUTILITIE | 410.40 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| EIDPARRY | 504.55 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| SHK | 158.55 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BCG | 13085682 | 108.05 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| SAPPHIRE | 8596126 | 1211.55 | 1216.27 | 1207.56 | 1224.39 | 1233.15 | 1241.94 | 1250.76 |

| GREAVESCOT | 6757910 | 153.00 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| IRB | 3124647 | 221.40 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| CHAMBLFERT | 2984308 | 365.35 | 365.77 | 361.00 | 370.38 | 375.20 | 380.06 | 384.95 |

| DHANI | 2478146 | 176.60 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| PRECAM | 2293997 | 120.90 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| ADANIGREEN | 2032876 | 1345.75 | 1350.56 | 1341.39 | 1359.09 | 1368.32 | 1377.58 | 1386.87 |

| BORORENEW | 1876778 | 533.75 | 534.77 | 529.00 | 540.29 | 546.12 | 551.97 | 557.86 |

| GICRE | 1832061 | 145.90 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| BSE | 1805529 | 1603.40 | 1610.02 | 1600.00 | 1619.25 | 1629.33 | 1639.43 | 1649.57 |

| TANLA | 839562 | 1461.80 | 1463.06 | 1453.52 | 1471.90 | 1481.51 | 1491.14 | 1500.81 |

| OPTIEMUS | 650292 | 352.00 | 356.27 | 351.56 | 360.82 | 365.58 | 370.38 | 375.20 |

| SVPGLOB | 631342 | 114.90 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| JINDWORLD | 587074 | 168.15 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| VBL | 478611 | 949.65 | 953.27 | 945.56 | 960.52 | 968.28 | 976.07 | 983.90 |

| SUULD | 472352 | 341.55 | 342.25 | 337.64 | 346.72 | 351.39 | 356.09 | 360.82 |

| KIMS | 380220 | 1257.75 | 1260.25 | 1251.39 | 1268.51 | 1277.42 | 1286.37 | 1295.35 |

| GOKEX | 289699 | 257.75 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| TCIEXP | 265442 | 2016.75 | 2025.00 | 2013.77 | 2035.25 | 2046.54 | 2057.86 | 2069.21 |

| WSTCSTPAPR | 244350 | 269.60 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| ARROWGREEN | 212112 | 130.10 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| VIMTALABS | 210954 | 364.80 | 365.77 | 361.00 | 370.38 | 375.20 | 380.06 | 384.95 |

| MAHSEAMLES | 199811 | 514.50 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| ASALCBR | 178152 | 568.15 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAMOTORS (F&O) | 47197742 | 509.70 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| SAIL (F&O) | 25723110 | 110.50 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| ASHOKLEY (F&O) | 20797964 | 139.40 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| ZEEL (F&O) | 14285918 | 313.70 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| IBREALEST | 11704089 | 173.40 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| GAIL (F&O) | 10222954 | 140.95 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| TATASTEEL (F&O) | 10108351 | 1186.60 | 1181.64 | 1190.25 | 1173.65 | 1165.10 | 1156.58 | 1148.09 |

| WELCORP | 9948186 | 154.85 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| BEL (F&O) | 9588714 | 208.85 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| HINDZINC | 9391701 | 322.95 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| POONAWALLA | 7812436 | 196.55 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| JINDALSTEL (F&O) | 7052933 | 370.05 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |

| MOTHERSUMI (F&O) | 6882529 | 237.65 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| RBLBANK (F&O) | 6377248 | 203.35 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| INDHOTEL (F&O) | 6209765 | 210.50 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| IEX | 6155811 | 785.75 | 784.00 | 791.02 | 777.40 | 770.45 | 763.52 | 756.63 |

| HCLTECH (F&O) | 5384530 | 1120.20 | 1113.89 | 1122.25 | 1106.12 | 1097.81 | 1089.54 | 1081.31 |

| BPCL (F&O) | 4995398 | 405.30 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| FSL | 4735107 | 173.55 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| AUROPHARMA (F&O) | 4597685 | 639.55 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| APOLLOTYRE (F&O) | 3721820 | 224.00 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| M&M (F&O) | 3463426 | 923.70 | 922.64 | 930.25 | 915.52 | 907.97 | 900.45 | 892.96 |

| MANAPPURAM (F&O) | 3341517 | 184.25 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| INDUSINDBK (F&O) | 3244457 | 1008.45 | 1008.06 | 1016.02 | 1000.64 | 992.75 | 984.88 | 977.05 |

| BIOCON (F&O) | 3134730 | 366.95 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |