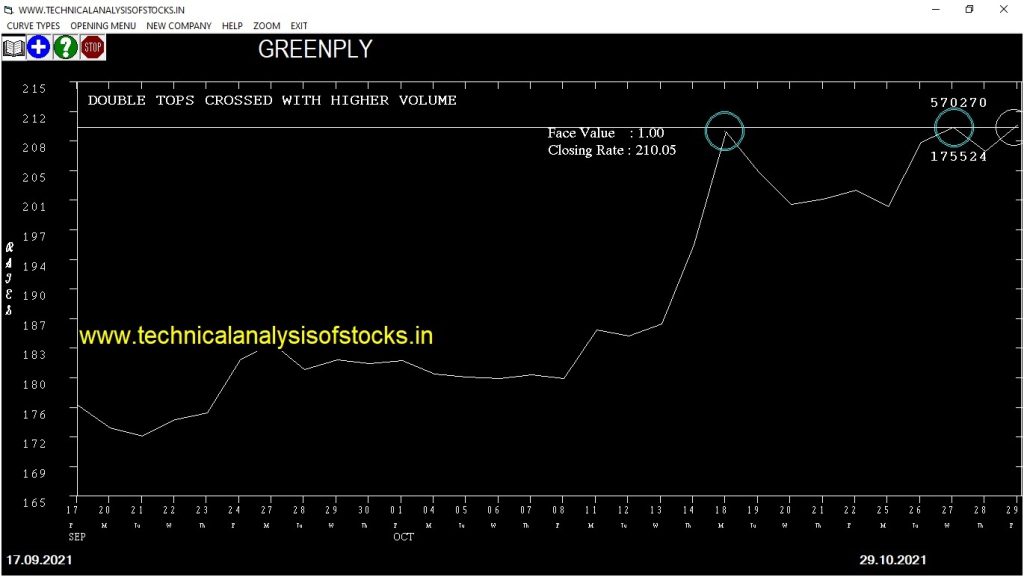

BUY GREENPLY (NSE Symbol) Buy@ 210.25 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 192.60 Target : 224.90 (Short term)

HOT BUZZING STOCKS (01.11.2021)

NSE SYMBOL CLOSING RATE

CREATIVE 367.80

GOKEX 215.45

NAHARCAP 304.55

NEULANDLAB 1669.90

ONEPOINT 57.90

SANGAMIND 285.30

XPROINDIA 568.80

DCM 73.20

TI 68.90

ARTNIRMAN 45.80

ARIHANT 61.45

GOKULAGRO 55.15

JINDALPHOT 210.10

PARAS 927.30

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| NCLIND | 18703 | 240.75 | 244.85 | 1.67 |

| INDIGO (F&O) | 216615 | 2136.00 | 2175.20 | 1.80 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| JUSTDIAL | 13829 | 798.05 | 797.55 | 0.06 |

| HDFC (F&O) | 162268 | 2856.00 | 2844.70 | 0.40 |

| CHEMPLASTS | 27427 | 656.60 | 650.60 | 0.92 |

| HINDZINC | 22994 | 315.70 | 311.35 | 1.40 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| MOTILALOFS | 44785 | 922.64 | 885.51 | 952.79 | 915.85 | 934.65 | -2.05 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| BALKRISIND (F&O) | 20190 | 2450.25 | 2511.26 | 2402.20 | 2460.10 | 2442.25 | 0.73 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| DEVYANI | 4.65% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| RAJESHEXPO | 1.94% |

| MOTILALOFS | 2.05% |

| HDFCLIFE (F&O) | 3.17% |

| TATASTEEL (F&O) | 3.18% |

| HDFC (F&O) | 3.29% |

| EQUITAS | 3.54% |

| EIHOTEL | 3.57% |

| WELCORP | 3.78% |

| JUBLPHARMA | 3.82% |

| OIL | 4.00% |

| PERSISTENT | 4.24% |

| INOXLEISUR | 4.26% |

| BEML | 4.65% |

| BALKRISIND (F&O) | 4.76% |

| DMART | 4.84% |

| MTARTECH | 4.89% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

ARVINDFASN Sell @ 295 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

IBREALEST Buy @ 153.15 or Above

COROMANDEL (F&O) Buy @ 791 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

PARAS

TCI

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ARVINDFASN

EIDPARRY

IOLCP

PERSISTENT

TATAMETALI

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

PRSMJOHNSN

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

AARTIDRUGS

MSTCLTD

RAILTEL

RBLBANK (F&O)

SCI

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BARBEQUE

GREENPLY

KRSNAA

SUPREMEIND

WELCORP

BEARISH ENGULFING

ARIHANT

PAR

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

ARIHANT

JINDALPHOT

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

WELCORP

BEARISH BELLHOLD PATTERN

ICICILIQ

NDL

PAR

SMSLIFE

VAIBHAVGBL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

SONACOMS

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS)

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASIANTILES

BLISSGVS

STAR

APLLTD (F&O)

JUBLPHARMA

GRANULES (F&O)

IOLCP

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

SHREEPUSHK

IOLCP

KSCL

HDFCLIFE (F&O)

DCAL

COALINDIA (F&O)

BRITANNIA (F&O)

TIRUMALCHM

INDUSTOWER (F&O)

INDIAGLYCO

CANFINHOME (F&O)

VINATIORGA

TNPETRO

MFSL (F&O)

TRENT (F&O)

KIRLFER

GRANULES (F&O)

ARVINDFASN

HAVELLS (F&O)

TATAELXSI

BODALCHEM

AMIORG

CAPLIPOINT

MIDHANI

DBL

DABUR (F&O)

SUNTECK

CONCOR (F&O)

MUTHOOTFIN (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

TATAMOTORS (F&O)

HOMEFIRST

MAHSEAMLES

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

JYOTHYLAB

KRSNAA

NCLIND

NUVOCO

OIL

SUPREMEIND

SWSOLAR

VBL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| JKLAKSHMI | 614.95 | 618.77 | 612.56 | 624.69 | 630.95 | 637.24 | 643.57 |

| HOMEFIRST | 705.25 | 708.89 | 702.25 | 715.20 | 721.90 | 728.64 | 735.40 |

| CAMS | 3012.10 | 3025.00 | 3011.27 | 3037.25 | 3051.04 | 3064.86 | 3078.71 |

| SONATSOFTW | 836.40 | 841.00 | 833.77 | 847.84 | 855.13 | 862.46 | 869.81 |

| PTC | 126.25 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ASTRAMICRO | 220.20 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| TCS (F&O) | 3397.75 | 3393.06 | 3407.64 | 3380.20 | 3365.68 | 3351.19 | 3336.73 |

| FLUOROCHEM | 1816.40 | 1806.25 | 1816.89 | 1796.54 | 1785.96 | 1775.40 | 1764.88 |

| GEPIL | 289.50 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| COALINDIA (F&O) | 164.45 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BEL (F&O) | 31765008 | 206.85 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| IBULHSGFIN (F&O) | 20090669 | 216.80 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| AMBUJACEM (F&O) | 10104769 | 404.80 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| MANAPPURAM (F&O) | 7601518 | 207.80 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| LUPIN (F&O) | 7118661 | 922.90 | 930.25 | 922.64 | 937.42 | 945.09 | 952.79 | 960.52 |

| BIOCON (F&O) | 5793111 | 351.10 | 351.56 | 346.89 | 356.09 | 360.82 | 365.58 | 370.38 |

| INDIACEM | 5738882 | 206.10 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| ABFRL (F&O) | 5282540 | 263.00 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| DEVYANI | 4978128 | 122.70 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| SUNTV (F&O) | 4705497 | 561.00 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| CADILAHC (F&O) | 3356396 | 502.80 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| FILATEX | 3324648 | 100.10 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| IGL (F&O) | 3063102 | 473.90 | 478.52 | 473.06 | 483.76 | 489.27 | 494.81 | 500.39 |

| GUJGASLTD (F&O) | 2814790 | 622.30 | 625.00 | 618.77 | 630.95 | 637.24 | 643.57 | 649.92 |

| ESCORTS (F&O) | 2651006 | 1569.40 | 1570.14 | 1560.25 | 1579.27 | 1589.22 | 1599.20 | 1609.21 |

| VOLTAS (F&O) | 2516853 | 1204.55 | 1207.56 | 1198.89 | 1215.66 | 1224.39 | 1233.15 | 1241.94 |

| OIL | 2424541 | 225.05 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| SWSOLAR | 2317864 | 434.45 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| CHAMBLFERT | 2136084 | 369.70 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| GRAVITA | 1772802 | 218.75 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| WELCORP | 1736236 | 133.50 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| TORNTPOWER (F&O) | 1308349 | 499.95 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| VBL | 1084029 | 849.35 | 855.56 | 848.27 | 862.46 | 869.81 | 877.20 | 884.62 |

| HAL | 1019876 | 1306.60 | 1314.06 | 1305.02 | 1322.48 | 1331.58 | 1340.72 | 1349.89 |

| GREENPANEL | 1016230 | 385.65 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| NTPC (F&O) | 29217522 | 132.65 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| AXISBANK (F&O) | 21343427 | 742.00 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| M&MFIN (F&O) | 14877495 | 179.50 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| ZOMATO | 12925877 | 131.55 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| BANDHANBNK (F&O) | 12331951 | 291.45 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| TATAMTRDVR | 8189325 | 246.00 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| LAURUSLABS | 7597665 | 515.80 | 511.89 | 517.56 | 506.50 | 500.89 | 495.31 | 489.76 |

| RELIANCE (F&O) | 6568539 | 2536.25 | 2525.06 | 2537.64 | 2513.77 | 2501.25 | 2488.76 | 2476.30 |

| IRB | 6565187 | 226.50 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| INFY (F&O) | 5875091 | 1667.75 | 1660.56 | 1670.77 | 1651.22 | 1641.07 | 1630.96 | 1620.87 |

| INDUSINDBK (F&O) | 5112475 | 1140.20 | 1139.06 | 1147.52 | 1131.21 | 1122.81 | 1114.45 | 1106.12 |

| KOTAKBANK (F&O) | 4666345 | 2031.15 | 2025.00 | 2036.27 | 2014.77 | 2003.56 | 1992.39 | 1981.24 |

| FSL | 4188360 | 197.65 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| HINDPETRO (F&O) | 4078422 | 310.40 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| LT (F&O) | 3984689 | 1766.65 | 1764.00 | 1774.52 | 1754.39 | 1743.93 | 1733.51 | 1723.11 |

| TECHM (F&O) | 3795495 | 1477.85 | 1472.64 | 1482.25 | 1463.79 | 1454.24 | 1444.72 | 1435.23 |

| SONACOMS | 2563167 | 647.70 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| JKTYRE | 2290458 | 143.55 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| BSOFT | 2268421 | 406.45 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| WELSPUNIND | 2028316 | 137.70 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| SCI | 1971162 | 128.15 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| RAILTEL | 1570127 | 125.15 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| PHILIPCARB | 1534933 | 219.80 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| SRTRANSFIN (F&O) | 1394463 | 1436.20 | 1434.52 | 1444.00 | 1425.78 | 1416.35 | 1406.95 | 1397.59 |

| GODREJCP (F&O) | 1341226 | 956.65 | 953.27 | 961.00 | 946.04 | 938.36 | 930.72 | 923.10 |