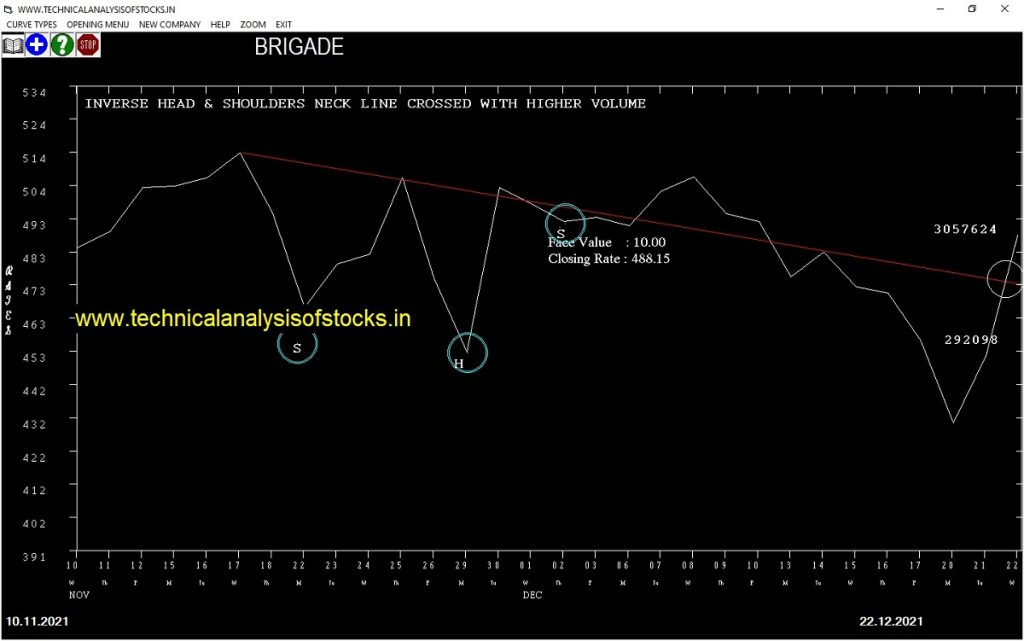

BUY BRIGADE (NSE Symbol) Buy@ 489.50 or Above after cooling period. SIGNAL : INVERSE HEAD & SHOULDERS NECK LINE CROSSED WITH HIGHER VOLUME. Stop Loss : 462.50 Target : 511.60 (Short term)

HOT BUZZING STOCKS (23.12.2021)

NSE SYMBOL CLOSING RATE

CTE 76.80

LOKESHMACH 58.80

SHAREINDIA 906.15

TRIGYN 138.40

VINYLINDIA 238.40

SMLT 123.40

STEELXIND 159.75

BIRLACABLE 91.10

63MOONS 195.30

AURIONPRO 265.70

AURUM 152.35

BEDMUTHA 65.10

JETFREIGHT 50.40

TANLA 1919.90

DCMNVL 266.05

EKC 194.80

AXISCADES 118.10

EQUIPPP 110.60

INDOTHAI 250.85

KOPRAN 298.10

LYKALABS 242.20

SUULD 305.50

HOVS 61.20

ANANTRAJ 74.00

DIGISPICE 40.30

ISMTLTD 61.45

TRIDENT 53.25

HUBTOWN 54.35

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| TCS (F&O) | 0.75% |

| MAXHEALTH | 2.48% |

| EXPLEOSOL | 3.62% |

| ABB | 3.96% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

APTUS Buy @ 351 or Above

PSPPROJECT Sell @ 448 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HEIDELBERG Buy @ 217.55 or Above

AWHCL Buy @ 293.25 or Above

ALKEM (F&O) Buy @ 3451.55 or Above

M&M (F&O) Buy @ 819.30 or Above

INDIAMART (F&O) Buy @ 6601.55 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AARTIDRUGS

ABSLAMC

ACC (F&O)

AMARAJABAT (F&O)

ANGELONE

AUBANK (F&O)

BEL (F&O)

BHARATFORG (F&O)

CASTROLIND

CHENNPETRO

DLINKINDIA

FACT

FINEORG

GATI

GODREJPROP (F&O)

GREENLAM

HCG

HDFCLIFE (F&O)

HEROMOTOCO (F&O)

HIKAL

INDOSTAR

ITI

JAGSNPHARM

JINDWORLD

LICHSGFIN (F&O)

LTTS (F&O)

MAXVIL

MGL (F&O)

MOL

NTPC (F&O)

PARAGMILK

PETRONET (F&O)

POLICYBZR

RAILTEL

RAIN

RITES

SBICARD (F&O)

SBIN (F&O)

SIS

SPANDANA

SRTRANSFIN (F&O)

TATAMTRDVR

TCI

TNPETRO

TRITURBINE

TTKPRESTIG

TVSELECT

WABAG

WOCKPHARMA

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

JINDRILL

RSWM

SATIN

SUBROS

TVSMOTOR (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

EKC

INDIACEM (F&O)

IRCTC (F&O)

KPITTECH

LYKALABS

TANLA

TRIGYN

ZOMATO

GAP DOWN BREAKOUT STOCKS

POWERGRID (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

AAKASH

BLISSGVS

LUMAXTECH

BEARISH ENGULFING

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

AURIONPRO

KOPRAN

SHAREINDIA

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

BHARTIARTL (F&O)

BIRLACABLE

CCL

SUULD

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

RAMKY

SURYAROSNI

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

UJJIVAN

STAR

BLISSGVS

IOLCP

GULFOILLUB

BANDHANBNK (F&O

JUBLPHARMA

AMARAJABAT (F&O)

AARTIDRUGS

INDOSTAR

DFMFOODS

APLLTD (F&O)

HEROMOTOCO (F&O

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

WOCKPHARMA

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

SUNPHARMA (F&O)

JINDALSTEL (F&O)

INFY (F&O)

SIEMENS (F&O)

ANGELONE

BAJAJCON

SAPPHIRE

BOROLTD

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

BRIGADE

GOCOLORS

HEG

JKPAPER

LINDEINDIA

PARAS

PNCINFRA

POWERINDIA

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| GRINDWELL | 1801.65 | 1806.25 | 1795.64 | 1815.98 | 1826.65 | 1837.35 | 1848.08 |

| JSLHISAR | 324.75 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| IGL (F&O) | 497.65 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| ASIANPAINT (F&O) | 3280.10 | 3291.89 | 3277.56 | 3304.60 | 3318.98 | 3333.39 | 3347.84 |

| TCS (F&O) | 3630.75 | 3645.14 | 3630.06 | 3658.42 | 3673.55 | 3688.72 | 3703.91 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SJS | 365.55 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| FINEORG | 3750.60 | 3736.27 | 3751.56 | 3722.86 | 3707.62 | 3692.41 | 3677.23 |

| GREENPLY | 198.05 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| BAJAJCON | 198.20 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| COCHINSHIP | 331.00 | 328.52 | 333.06 | 324.16 | 319.68 | 315.22 | 310.80 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| NATIONALUM (F&O) | 36341980 | 103.20 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| TATAMOTORS (F&O) | 22730750 | 470.50 | 473.06 | 467.64 | 478.28 | 483.76 | 489.27 | 494.81 |

| TATAPOWER (F&O) | 21655596 | 218.00 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| IEX (F&O) | 16551555 | 254.05 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| SBIN (F&O) | 13102553 | 455.85 | 456.89 | 451.56 | 462.02 | 467.41 | 472.83 | 478.28 |

| CANBK (F&O) | 12343053 | 197.70 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| BHARTIARTL (F&O) | 8522226 | 684.75 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| RELIANCE (F&O) | 8149415 | 2366.10 | 2376.56 | 2364.39 | 2387.57 | 2399.80 | 2412.06 | 2424.35 |

| HINDALCO (F&O) | 7765878 | 463.35 | 467.64 | 462.25 | 472.83 | 478.28 | 483.76 | 489.27 |

| RBLBANK (F&O) | 5971650 | 175.20 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| SUNPHARMA (F&O) | 5871235 | 797.50 | 798.06 | 791.02 | 804.74 | 811.84 | 818.98 | 826.15 |

| BPCL (F&O) | 5022622 | 372.45 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| TATASTEEL (F&O) | 4366917 | 1128.85 | 1130.64 | 1122.25 | 1138.49 | 1146.94 | 1155.42 | 1163.93 |

| MINDACORP | 4333464 | 171.65 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| BANDHANBNK (F&O) | 4215221 | 252.80 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| DELTACORP (F&O) | 4074720 | 273.85 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| HINDPETRO (F&O) | 3816836 | 288.15 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| IRCTC (F&O) | 3721795 | 839.75 | 841.00 | 833.77 | 847.84 | 855.13 | 862.46 | 869.81 |

| UPL (F&O) | 3623916 | 754.30 | 756.25 | 749.39 | 762.76 | 769.68 | 776.63 | 783.61 |

| ABCAPITAL | 3220968 | 116.80 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| BIOCON (F&O) | 3069556 | 360.10 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| MANAPPURAM (F&O) | 2973368 | 162.90 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| ABFRL (F&O) | 2768950 | 277.15 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| POONAWALLA | 2539340 | 199.30 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| CADILAHC (F&O) | 2421201 | 466.80 | 467.64 | 462.25 | 472.83 | 478.28 | 483.76 | 489.27 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| POWERGRID (F&O) | 11062674 | 201.55 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| WEBELSOLAR | 761277 | 100.75 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| PRAJIND | 556859 | 303.35 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| MINDTECK | 317466 | 159.20 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| RAMKY | 296043 | 200.45 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| PURVA | 276009 | 129.45 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| CARTRADE | 227297 | 831.35 | 826.56 | 833.77 | 819.80 | 812.66 | 805.54 | 798.46 |

| CHOLAHLDNG | 171114 | 642.50 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| SURYAROSNI | 165389 | 633.65 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |

| NDTV | 155524 | 126.00 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| JINDALPHOT | 152547 | 276.85 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |