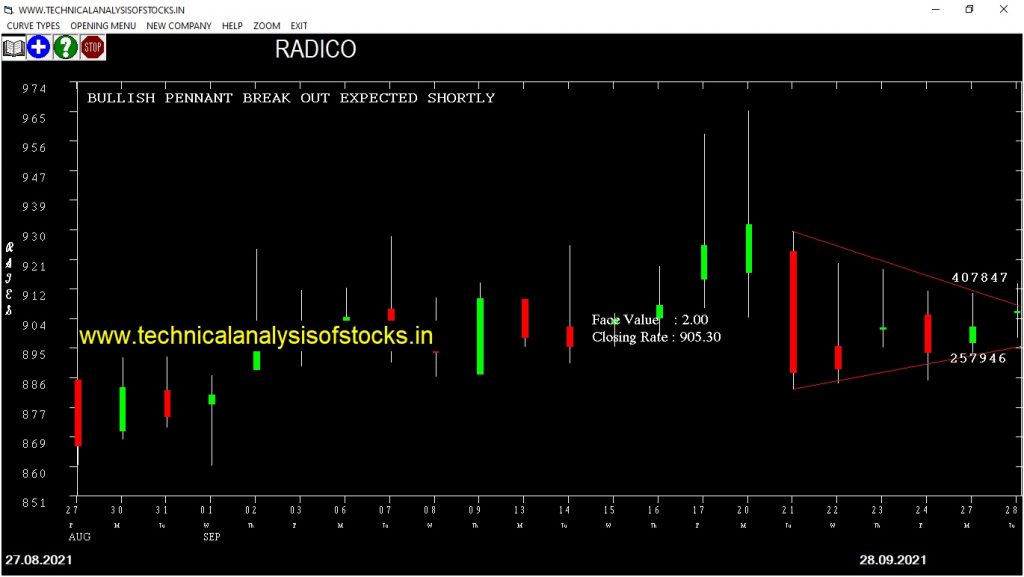

BUY RADICO (NSE Symbol) Buy@ 907.50 or Above after cooling period SIGNAL : BULLISH PENNANT BREAK OUT EXPECTED SHORTLY. Stop Loss : 870.70 Target : 937.40 (Short term)

HOT BUZZING STOCKS (29.09.2021)

NSE SYMBOL CLOSING RATE

FRETAIL 51.75

FSC 77.60

CONSOFINVT 143.95

NELCO 653.20

TEJASNET 482.10

GENESYS 188.35

GOLDENTOBC 135.75

BLS 253.80

PAR 190.95

SBCL 279.10

FLFL 58.10

JINDALPHOT 119.35

ANANTRAJ 77.30

AXISCADES 73.00

MANALIPETC 117.50

EMAMIREAL 74.10

KPRMILL 449.90

NDTV 86.95

BANSWRAS 141.80

V2RETAIL 153.35

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| SUPRAJIT | 18525 | 322.00 | 331.15 | 2.76 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| POLYCAB (F&O) | 36531 | 2352.00 | 2349.00 | 0.13 |

| KNRCON | 10472 | 289.15 | 287.85 | 0.45 |

| TCS (F&O) | 140925 | 3805.00 | 3779.15 | 0.68 |

| VAIBHAVGBL | 11913 | 710.00 | 704.80 | 0.74 |

| VBL | 17235 | 916.00 | 906.65 | 1.03 |

| SYNGENE (F&O) | 21774 | 626.05 | 616.30 | 1.58 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| TITAN (F&O) | 58033 | 2139.06 | 2082.68 | 2184.47 | 2129.30 | 2133.00 | -0.17 |

| IRB | 14115 | 178.89 | 162.64 | 192.42 | 175.75 | 176.95 | -0.68 |

| SAIL (F&O) | 74490 | 112.89 | 100.05 | 123.70 | 110.35 | 111.70 | -1.22 |

| SBIN (F&O) | 199169 | 446.27 | 420.46 | 467.41 | 444.90 | 453.50 | -1.93 |

| BODALCHEM | 12921 | 115.56 | 102.57 | 126.50 | 113.00 | 115.40 | -2.12 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| GLENMARK (F&O) | 28705 | 495.06 | 523.00 | 473.30 | 497.05 | 492.20 | 0.98 |

| GRAPHITE | 17658 | 594.14 | 624.69 | 570.30 | 598.50 | 592.25 | 1.04 |

| DRREDDY (F&O) | 27438 | 4830.25 | 4915.06 | 4763.38 | 4833.15 | 4748.20 | 1.76 |

| AUROPHARMA (F&O) | 77362 | 722.27 | 755.87 | 695.99 | 725.05 | 708.00 | 2.35 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| RADICO | 2.62% |

| CASTROLIND | 2.80% |

| IOLCP | 3.25% |

| FINCABLES | 4.87% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| TITAN (F&O) | 0.17% |

| BIRLACORPN | 0.67% |

| DRREDDY (F&O) | 1.08% |

| VGUARD | 1.12% |

| ISEC | 1.39% |

| DHANI | 1.65% |

| TRIVENI | 1.68% |

| IPL | 1.76% |

| LAOPALA | 1.90% |

| SBIN (F&O) | 1.93% |

| CSBBANK | 2.00% |

| BODALCHEM | 2.12% |

| RAIN | 2.26% |

| CARBORUNIV | 2.34% |

| CUB (F&O) | 2.39% |

| AUROPHARMA (F&O) | 2.57% |

| SAIL (F&O) | 2.63% |

| BAJAJCON | 2.65% |

| NAUKRI (F&O) | 2.66% |

| TNPETRO | 2.74% |

| VIJAYA | 2.76% |

| BRITANNIA (F&O) | 2.78% |

| ITDC | 2.94% |

| UPL (F&O) | 2.96% |

| GRAPHITE | 3.09% |

| ADANIGREEN | 3.12% |

| SUNDRMFAST | 3.66% |

| VBL | 3.90% |

| AEGISCHEM | 3.97% |

| GLENMARK (F&O) | 4.39% |

| TCS (F&O) | 4.39% |

| INDUSINDBK (F&O) | 4.56% |

| BIOCON (F&O) | 4.71% |

| JINDALSTEL (F&O) | 4.73% |

| KNRCON | 4.74% |

| IRB | 4.98% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

RAMCOCEM (F&O) Buy @ 984.40 or Above

LICHSGFIN (F&O) Sell @ 435.80 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ALEMBICLTD

MANALIPETC

TRIVENI

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

NEOGEN

VIJAYA

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

STARCEMENT

VIJAYA

Higher Level Consolidation

WELCORP

Lower Level Consolidation

DHANI

IOLCP

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BLS

BPCL (F&O)

GSFC

HINDOILEXP

INDIAGLYCO

MANALIPETC

NELCO

ONGC (F&O)

GAP DOWN BREAKOUT STOCKS

AWHCL

INFY (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BIRLACORPN

BEARISH ENGULFING

ICICIBANK (F&O)

ZENTEC

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

VAIBHAVGBL

PIIND (F&O)

JAICORPLTD

FORTIS

EXIDEIND (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

RAYMOND

MARUTI (F&O)

SWSOLAR

IRCTC (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

KIOCL

MANINDS

PARAGMILK

SIS

TRITURBINE

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

SUNTECK

ZENTEC

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

V2RETAIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ANANTRAJ

FINPIPE

IIFLSEC

BEARISH BELLHOLD PATTERN

BALMLAWRIE

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASHOKA

BERGEPAINT (F&O)

BPCL (F&O)

COLPAL (F&O)

HDFCLIFE (F&O)

INDIAMART

JYOTHYLAB

KSCL

MOIL

NLCINDIA

PRAKASH

PVR (F&O)

SRTRANSFIN (F&O)

STARCEMENT

SUVEN

TAJGVK

SELL RECOMMENDATION IF THE MARKET IS BEARISH

APLAPOLLO

COROMANDEL (F&O)

ITI

MIDHANI

POWERGRID (F&O)

TAKE

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ARIHANTSUP | 150.90 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| BANDHANBNK (F&O) | 286.65 | 289.00 | 284.77 | 293.12 | 297.41 | 301.74 | 306.10 |

| JUSTDIAL | 988.85 | 992.25 | 984.39 | 999.64 | 1007.56 | 1015.51 | 1023.49 |

| PIDILITIND (F&O) | 2411.00 | 2413.27 | 2401.00 | 2424.35 | 2436.67 | 2449.02 | 2461.41 |

| PVR (F&O) | 1599.40 | 1600.00 | 1590.02 | 1609.21 | 1619.25 | 1629.33 | 1639.43 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| GODFRYPHLP | 1058.85 | 1056.25 | 1064.39 | 1048.66 | 1040.58 | 1032.53 | 1024.51 |

| VAIBHAVGBL | 704.80 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| WHIRLPOOL | 2270.70 | 2268.14 | 2280.06 | 2257.38 | 2245.51 | 2233.68 | 2221.88 |

| EICHERMOT (F&O) | 2883.05 | 2875.64 | 2889.06 | 2863.68 | 2850.32 | 2836.98 | 2823.68 |

| BRITANNIA (F&O) | 4003.65 | 4000.56 | 4016.39 | 3986.76 | 3970.98 | 3955.24 | 3939.53 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| COALINDIA (F&O) | 41551332 | 174.55 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| NTPC (F&O) | 35900138 | 131.95 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| GAIL (F&O) | 32956454 | 159.50 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| POWERGRID (F&O) | 29155220 | 183.95 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| IOC (F&O) | 20386843 | 122.95 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| GSFC | 18373735 | 127.85 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| DELTACORP | 17653801 | 257.60 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| CANBK (F&O) | 15400565 | 163.70 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| HINDPETRO (F&O) | 10617222 | 291.60 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| BEL (F&O) | 9978002 | 210.35 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| BPCL (F&O) | 9133471 | 429.60 | 430.56 | 425.39 | 435.55 | 440.78 | 446.04 | 451.34 |

| WELSPUNIND | 8574722 | 163.90 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| RAYMOND | 4571704 | 457.45 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| INDIANB | 4194893 | 130.35 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| GNFC | 3971287 | 449.10 | 451.56 | 446.27 | 456.66 | 462.02 | 467.41 | 472.83 |

| INDIAGLYCO | 3884565 | 795.60 | 798.06 | 791.02 | 804.74 | 811.84 | 818.98 | 826.15 |

| TNPETRO | 2147962 | 131.35 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| MANALIPETC | 1922328 | 117.50 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| ESCORTS (F&O) | 1568084 | 1489.90 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| TEJASNET | 1090900 | 482.10 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| PARAGMILK | 1026120 | 126.50 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| MAXHEALTH | 983226 | 369.70 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| MAXVIL | 980792 | 109.10 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| CONSOFINVT | 976028 | 143.95 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| AMIORG | 897463 | 1308.95 | 1314.06 | 1305.02 | 1322.48 | 1331.58 | 1340.72 | 1349.89 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZEEL (F&O) | 29276423 | 309.15 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| BHARTIARTL (F&O) | 21944239 | 696.15 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| DLF (F&O) | 21272633 | 410.05 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| IBULHSGFIN (F&O) | 19014155 | 226.40 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| ZOMATO | 13489232 | 139.00 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| IBREALEST | 11306345 | 144.60 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| HCLTECH (F&O) | 8572321 | 1269.00 | 1260.25 | 1269.14 | 1252.02 | 1243.18 | 1234.38 | 1225.61 |

| WIPRO (F&O) | 8112462 | 639.60 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| INDIACEM | 4005451 | 190.00 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| TECHM (F&O) | 3995669 | 1414.05 | 1406.25 | 1415.64 | 1397.59 | 1388.26 | 1378.95 | 1369.68 |

| ZENTEC | 3836898 | 206.55 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| APOLLOTYRE (F&O) | 3598548 | 226.40 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| ADANIENT (F&O) | 3547971 | 1487.30 | 1482.25 | 1491.89 | 1473.38 | 1463.79 | 1454.24 | 1444.72 |

| ABCAPITAL | 3425104 | 113.80 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| SBICARD | 3334438 | 1015.05 | 1008.06 | 1016.02 | 1000.64 | 992.75 | 984.88 | 977.05 |

| PRESTIGE | 3030447 | 474.50 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| GODREJPROP (F&O) | 2750782 | 2234.20 | 2232.56 | 2244.39 | 2221.88 | 2210.10 | 2198.36 | 2186.66 |

| CADILAHC (F&O) | 2642505 | 544.35 | 540.56 | 546.39 | 535.03 | 529.26 | 523.53 | 517.82 |

| BHARATFORG (F&O) | 2304265 | 755.90 | 749.39 | 756.25 | 742.93 | 736.13 | 729.36 | 722.63 |

| DEVYANI | 2160490 | 116.40 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| EVEREADY | 2155730 | 386.40 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| MINDTREE (F&O) | 2040645 | 4207.90 | 4192.56 | 4208.77 | 4178.48 | 4162.33 | 4146.21 | 4130.13 |

| SUNTECK | 1953193 | 485.10 | 484.00 | 489.52 | 478.75 | 473.30 | 467.87 | 462.48 |

| CHOLAFIN (F&O) | 1920986 | 554.75 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| BAJFINANCE (F&O) | 1572301 | 7543.30 | 7525.56 | 7547.27 | 7507.64 | 7485.99 | 7464.37 | 7442.78 |