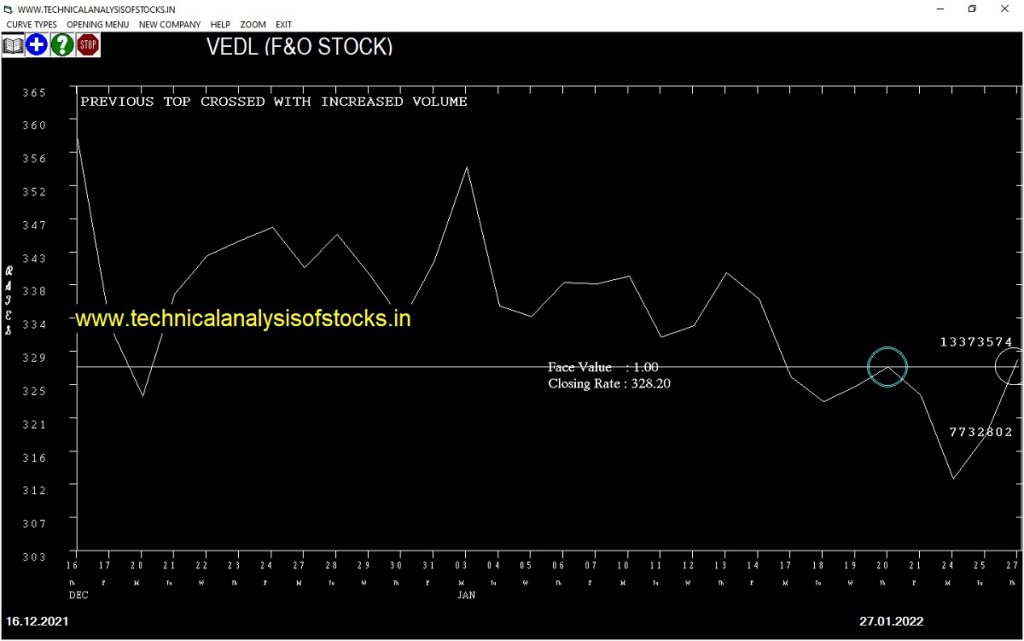

BUY VEDL (NSE Symbol) Buy @ 328.50 or Above after cooling period. SIGNAL : PREVIOUS TOP CROSSED WITH INCREASED VOLUME. Stop Loss : 306.40 Target : 346.70 (Short term)

HOT BUZZING STOCKS (28.01.2022)

NSE SYMBOL CLOSING RATE

TV18BRDCST 58.50

GMDCLTD 110.70

SHARDACROP 577.85

KHAICHEM 118.05

SIGIND 66.35

LOTUSEYE 53.75

MFL 924.65

NETWORK18 81.90

BDL 488.55

BLS 221.85

EKC 238.90

GLOBAL 92.55

KPIGLOBAL 474.20

PALREDTEC 303.85

PFOCUS 69.45

PREMEXPLN 315.40

RUSHIL 356.45

WINDMACHIN 45.75

FOODSIN 101.10

ADSL 137.05

KELLTONTEC 105.50

TANLA 1653.50

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| APARINDS | 2.81% |

| JUSTDIAL | 3.95% |

| APTUS | 4.37% |

| KALPATPOWR | 4.54% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

KNRCON Buy @ 301.90 or Above

KSL Buy @ 319.50 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ABSLAMC

ALPHAGEO

ANGELONE

ASHAPURMIN

ASTRAL (F&O)

ASTRAMICRO

BFUTILITIE

BODALCHEM

CAPACITE

CHEMBOND

DLINKINDIA

ELECON

GNA

GRASIM (F&O)

HEMIPROP

ICICILOVOL

INDOSTAR

INOXWIND

JINDALPHOT

JKIL

KABRAEXTRU

KOLTEPATIL

KPRMILL

LIBERTSHOE

MSTCLTD

NIITLTD

NRBBEARING

ONMOBILE

PTC

RAIN

RELIANCE (F&O)

RESPONIND

RSWM

SANGHVIMOV

SOBHA

SONATSOFTW

TANLA

TATAELXSI

UNICHEMLAB

VETO

XCHANGING

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DBL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

DCMSHRIRAM

EMKAY

KPIGLOBAL

MFL

TEAMLEASE

TV18BRDCST

GAP DOWN BREAKOUT STOCKS

APLAPOLLO

BGRENERGY

FINPIPE

FOODSIN

INDIGO (F&O)

MHLXMIRU

TORNTPHARM (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

EKC

HOMEFIRST

PRAXIS

RAMASTEEL

BEARISH ENGULFING PATTERN

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

PREMEXPLN

TV18BRDCST

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NETWORK18

RUSHIL

BEARISH BELLHOLD PATTERN

AFFLE

COFORGE (F&O)

DIXON (F&O)

NDL

ZOMATO

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

TRITURBINE

ZOMATO

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL,

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

ABCAPITAL

SUNTV (F&O)

HPAL

MAHINDCIE

AMIORG

RAILTEL

PAYTM

KIRLOSENG

SUNTECK

JUBLINGREA

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

HAL (F&O)

CHOLAFIN (F&O)

SHALPAINTS

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

BANSWRAS

CGPOWER

GANESHBE

KRSNAA

LAOPALA

NDTV

SCI

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| HDFC (F&O) | 2503.35 | 2512.52 | 2500.00 | 2523.80 | 2536.37 | 2548.97 | 2561.61 |

| TATACHEM (F&O) | 910.90 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| LT (F&O) | 1910.85 | 1914.06 | 1903.14 | 1924.05 | 1935.03 | 1946.04 | 1957.08 |

| AMBUJACEM (F&O) | 351.65 | 356.27 | 351.56 | 360.82 | 365.58 | 370.38 | 375.20 |

| HAL (F&O) | 1422.95 | 1425.06 | 1415.64 | 1433.80 | 1443.28 | 1452.79 | 1462.33 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| ELGIEQUIP | 319.25 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| KIRIINDUS | 508.45 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| KEI | 1102.15 | 1097.27 | 1105.56 | 1089.54 | 1081.31 | 1073.10 | 1064.92 |

| HIKAL | 377.85 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| RELAXO | 1267.50 | 1260.25 | 1269.14 | 1252.02 | 1243.18 | 1234.38 | 1225.61 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SBIN (F&O) | 35409230 | 528.95 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| AXISBANK (F&O) | 34927774 | 773.85 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| FEDERALBNK (F&O) | 31055664 | 100.10 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| VEDL (F&O) | 13373574 | 328.20 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| CIPLA (F&O) | 7859401 | 927.60 | 930.25 | 922.64 | 937.42 | 945.09 | 952.79 | 960.52 |

| POONAWALLA | 6086800 | 274.05 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| RECLTD (F&O) | 4532825 | 134.40 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| OIL | 4040568 | 229.85 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| TATAMTRDVR | 3036663 | 250.45 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| MARUTI (F&O) | 2899559 | 8820.20 | 8836.00 | 8812.52 | 8855.09 | 8878.62 | 8902.19 | 8925.78 |

| WELSPUNIND | 2006966 | 141.65 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| SCI | 1960174 | 124.35 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| AUBANK (F&O) | 1811988 | 1275.70 | 1278.06 | 1269.14 | 1286.37 | 1295.35 | 1304.36 | 1313.41 |

| IRB | 1762166 | 240.60 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| BDL | 1741926 | 488.55 | 489.52 | 484.00 | 494.81 | 500.39 | 506.00 | 511.63 |

| RUPA | 1650056 | 524.30 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| GREENPANEL | 1293245 | 496.50 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| EQUITAS | 1023079 | 108.55 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| DHAMPURSUG | 877969 | 368.70 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| DEEPAKFERT | 836869 | 516.85 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| ICICIGI (F&O) | 809958 | 1373.20 | 1378.27 | 1369.00 | 1386.87 | 1396.19 | 1405.55 | 1414.93 |

| PRECWIRE | 779494 | 116.85 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| KITEX | 754470 | 250.20 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| BLS | 751364 | 221.85 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| GOKEX | 713108 | 390.15 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| IEX (F&O) | 18001875 | 230.40 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| WIPRO (F&O) | 15675872 | 544.75 | 540.56 | 546.39 | 535.03 | 529.26 | 523.53 | 517.82 |

| INFY (F&O) | 11231734 | 1678.60 | 1670.77 | 1681.00 | 1661.39 | 1651.22 | 1641.07 | 1630.96 |

| IBULHSGFIN (F&O) | 9915177 | 208.45 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| LAURUSLABS (F&O) | 8426311 | 464.70 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| HCLTECH (F&O) | 8304735 | 1077.75 | 1072.56 | 1080.77 | 1064.92 | 1056.78 | 1048.66 | 1040.58 |

| TRITURBINE | 5900855 | 207.85 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| TCS (F&O) | 5718297 | 3649.25 | 3645.14 | 3660.25 | 3631.88 | 3616.82 | 3601.80 | 3586.81 |

| FSL (F&O) | 4769413 | 149.75 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| TECHM (F&O) | 4434890 | 1445.60 | 1444.00 | 1453.52 | 1435.23 | 1425.78 | 1416.35 | 1406.95 |

| ADANIENT (F&O) | 3549583 | 1686.00 | 1681.00 | 1691.27 | 1671.60 | 1661.39 | 1651.22 | 1641.07 |

| HINDCOPPER | 3537193 | 122.00 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| MCDOWELL-N (F&O) | 3179684 | 842.10 | 841.00 | 848.27 | 834.18 | 826.98 | 819.80 | 812.66 |

| SONACOMS | 3135738 | 602.90 | 600.25 | 606.39 | 594.44 | 588.36 | 582.31 | 576.29 |

| CADILAHC (F&O) | 2753356 | 384.40 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |

| TITAN (F&O) | 2460051 | 2310.05 | 2304.00 | 2316.02 | 2293.16 | 2281.20 | 2269.27 | 2257.38 |

| PAYTM | 2459507 | 893.70 | 892.52 | 900.00 | 885.51 | 878.08 | 870.69 | 863.32 |

| UPL (F&O) | 2436411 | 771.95 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |

| BIOCON (F&O) | 2404382 | 359.40 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| HAVELLS (F&O) | 2266013 | 1145.25 | 1139.06 | 1147.52 | 1131.21 | 1122.81 | 1114.45 | 1106.12 |

| CANFINHOME (F&O) | 2242844 | 576.25 | 576.00 | 582.02 | 570.30 | 564.34 | 558.42 | 552.53 |

| DABUR (F&O) | 2183776 | 529.05 | 529.00 | 534.77 | 523.53 | 517.82 | 512.15 | 506.50 |

| GRANULES (F&O) | 2053334 | 294.00 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| PIDILITIND (F&O) | 2000581 | 2460.90 | 2450.25 | 2462.64 | 2439.11 | 2426.78 | 2414.47 | 2402.20 |

| KPITTECH | 1879733 | 633.05 | 631.27 | 637.56 | 625.31 | 619.08 | 612.87 | 606.69 |