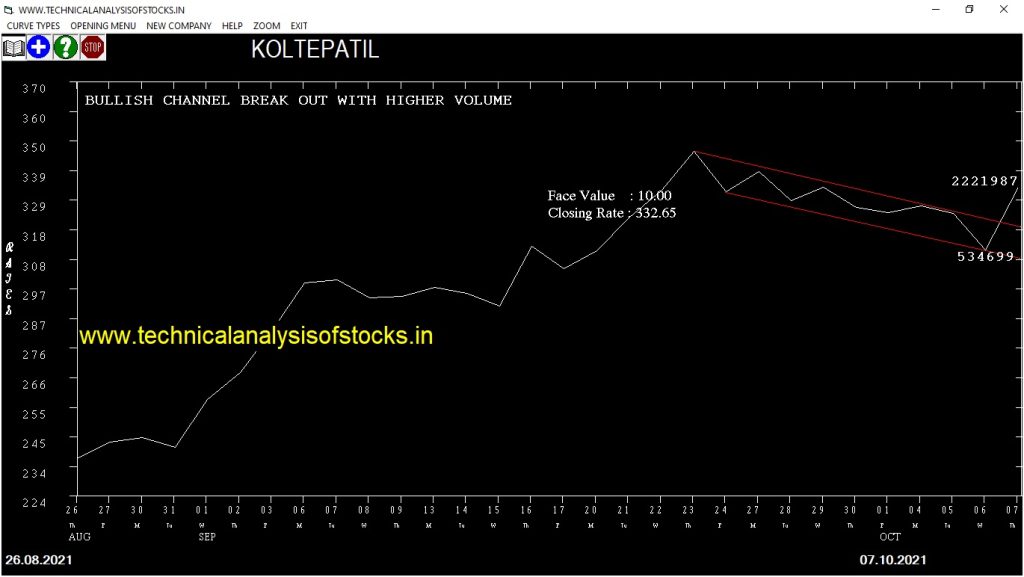

BUY KOLTEPATIL (NSE Symbol) Buy@ 333.05 or Above after cooling period. SIGNAL : BULLISH CHANNEL BREAK OUT WITH HIGHER VOLUME. Stop Loss : 310.80 Target : 351.40 (Short term)

HOT BUZZING STOCKS (08.10.2021)

NSE SYMBOL CLOSING RATE

NURECA 1985.00

ABAN 54.95

BANARBEADS 78.05

BESTAGRO 979.40

SANGINITA 42.05

MINDTECK 112.25

BSL 73.20

INTENTECH 78.30

CTE 60.30

GENESYS 264.80

MFL 986.20

TANLA 909.05

VISHNU 802.65

CONSOFINVT 163.05

GANESHHOUC 191.40

PITTIENG 179.30

SOUTHWEST 119.40

PRIMESECU 91.00

AUTOIND 60.65

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| DMART | 47971 | 4310.00 | 4311.70 | 0.04 |

| LODHA | 49456 | 1122.00 | 1123.05 | 0.09 |

| SUPRAJIT | 16242 | 334.30 | 341.15 | 2.01 |

| WABAG | 20669 | 342.95 | 350.80 | 2.24 |

| GODREJPROP (F&O) | 157170 | 2410.00 | 2476.80 | 2.70 |

| WOCKPHARMA | 57157 | 466.00 | 480.30 | 2.98 |

| SUVENPHAR | 22883 | 539.75 | 557.70 | 3.22 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| POWERGRID (F&O) | 47616 | 188.65 | 188.30 | 0.19 |

| HINDUNILVR (F&O) | 91833 | 2677.00 | 2669.40 | 0.28 |

| SHYAMMETL | 12465 | 365.00 | 359.00 | 1.67 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| BAJFINANCE (F&O) | 67268 | 7766.02 | 7660.08 | 7850.46 | 7747.90 | 7825.00 | -1.00 |

| NAUKRI (F&O) | 25483 | 6601.56 | 6503.64 | 6679.72 | 6600.85 | 6676.80 | -1.15 |

| GICRE | 12146 | 147.02 | 132.32 | 159.31 | 145.65 | 147.40 | -1.20 |

| HDFCBANK (F&O) | 179258 | 1620.06 | 1570.93 | 1659.73 | 1610.50 | 1632.00 | -1.33 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| BAJAJCON | 12254 | 252.02 | 272.11 | 236.51 | 253.05 | 251.95 | 0.43 |

| HINDZINC | 10409 | 310.64 | 332.90 | 293.41 | 313.45 | 310.10 | 1.07 |

| HDFCAMC (F&O) | 17467 | 2902.52 | 2968.76 | 2850.32 | 2908.85 | 2875.65 | 1.14 |

| AUROPHARMA (F&O) | 59223 | 715.56 | 749.02 | 689.41 | 719.60 | 708.00 | 1.61 |

| CUB (F&O) | 13587 | 159.39 | 175.47 | 147.09 | 160.00 | 157.00 | 1.88 |

| VBL | 36597 | 900.00 | 937.42 | 870.69 | 906.00 | 885.00 | 2.32 |

| TATASTEEL (F&O) | 100335 | 1287.02 | 1331.58 | 1252.02 | 1289.20 | 1258.45 | 2.39 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MINDTREE (F&O) | 1.78% |

| DMART | 1.95% |

| MAHLIFE | 2.10% |

| LTI (F&O) | 2.46% |

| SHANKARA | 3.62% |

| IRB | 4.22% |

| KPITTECH | 4.32% |

| LTTS (F&O) | 4.46% |

| NAVNETEDUL | 4.99% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| COFORGE (F&O) | 0.21% |

| BALKRISIND (F&O) | 0.64% |

| SUNTECK | 0.79% |

| TATAMTRDVR | 0.80% |

| HDFCAMC (F&O) | 0.96% |

| BAJFINANCE (F&O) | 1.00% |

| NAUKRI (F&O) | 1.15% |

| GICRE | 1.20% |

| HDFCBANK (F&O) | 1.33% |

| HOMEFIRST | 1.39% |

| KOLTEPATIL | 1.59% |

| CENTURYTEX | 1.62% |

| LTTS (F&O) | 1.68% |

| BAJAJCON | 2.17% |

| INDHOTEL (F&O) | 2.22% |

| HEMIPROP | 2.33% |

| CUB (F&O) | 2.47% |

| HINDZINC | 2.54% |

| PARAGMILK | 2.55% |

| MINDTREE (F&O) | 2.58% |

| GOLDIAM | 2.60% |

| STAR (F&O) | 2.62% |

| JSWSTEEL (F&O) | 2.66% |

| HINDUNILVR (F&O) | 2.81% |

| ACE | 2.85% |

| WELCORP | 2.93% |

| DALBHARAT | 3.20% |

| BFUTILITIE | 3.22% |

| CAMS | 3.25% |

| REPCOHOME | 3.26% |

| COALINDIA (F&O) | 3.30% |

| BALPHARMA | 3.32% |

| AUROPHARMA (F&O) | 3.34% |

| TORNTPOWER (F&O) | 3.39% |

| KSCL | 3.66% |

| LALPATHLAB (F&O) | 3.66% |

| GRAPHITE | 3.70% |

| VBL | 3.97% |

| POWERGRID (F&O) | 4.25% |

| APOLLOHOSP (F&O) | 4.55% |

| PRESTIGE | 4.68% |

| SEQUENT | 4.77% |

| TATASTEEL (F&O) | 4.86% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BIOCON (F&O) Buy @ 361or above

HIKAL Buy @ 546.30 or Above

ICICIPRULI (F&O) Buy @ 682.50 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BODALCHEM

EMAMIPAP

GDL

KIRIINDUS

PRSMJOHNSN

WELCORP

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

MOTILALOFS

MTARTECH

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BSOFT

CHAMBLFERT

FSL

GSPL

IRCTC (F&O)

LAURUSLABS

SBICARD

SOBHA

TITAN (F&O)

V2RETAIL

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

INDUSTOWER (F&O)

NUVOCO

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

PITTIENG

BEARISH MARUBOZU PATTERN

GOLDENTOBC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

BANARBEADS

MANAPPURAM (F&O)

NURECA

TANLA

BEARISH BELLHOLD PATTERN

NELCO

SEQUENT

SHIVATEX

UGROCAP

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BALMLAWRIE

BDL

BERGEPAINT (F&O)

COLPAL (F&O)

COROMANDEL (F&O)

HDFCLIFE (F&O)

JYOTHYLAB

KSCL

RITES

STARCEMENT

WELCORP

SELL RECOMMENDATION IF THE MARKET IS BEARISH

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

SHYAMMETL

ORIENTELEC

KNRCON

DALBHARAT

EMAMILTD

VIJAYA

ULTRACEMCO (F&O)

GLS

LALPATHLAB (F&O)

CONCOR (F&O)

EXXARO

HDFCLIFE (F&O)

BALAMINES

ICICIGI (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

BAJFINANCE (F&O)

MSTCLTD

KIRLFER

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

KRSNAA

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

GHCL

OIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SANSERA | 804.65 | 805.14 | 798.06 | 811.84 | 818.98 | 826.15 | 833.35 |

| KPRMILL | 452.80 | 456.89 | 451.56 | 462.02 | 467.41 | 472.83 | 478.28 |

| NAUKRI (F&O) | 6600.85 | 6601.56 | 6581.27 | 6618.58 | 6638.93 | 6659.31 | 6679.72 |

| VBL | 906.00 | 907.52 | 900.00 | 914.60 | 922.18 | 929.78 | 937.42 |

| TRF | 163.60 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ALLCARGO | 286.45 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| CENTURYTEX | 932.65 | 930.25 | 937.89 | 923.10 | 915.52 | 907.97 | 900.45 |

| SHOPERSTOP | 278.90 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| ITC (F&O) | 232.95 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| INDOCO | 444.10 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ASHOKLEY (F&O) | 42882284 | 135.85 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| DLF (F&O) | 16871779 | 422.60 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

| EXIDEIND (F&O) | 7475317 | 184.20 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| HINDPETRO (F&O) | 6573600 | 319.50 | 319.52 | 315.06 | 323.84 | 328.35 | 332.90 | 337.47 |

| APOLLOTYRE (F&O) | 6417957 | 228.15 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| IEX | 5794510 | 640.30 | 643.89 | 637.56 | 649.92 | 656.31 | 662.73 | 669.18 |

| AMBUJACEM (F&O) | 5508787 | 402.90 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| RBLBANK (F&O) | 5472521 | 189.40 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| TATACOFFEE | 5323927 | 218.35 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| DELTACORP | 5019084 | 269.65 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| LAURUSLABS | 4804002 | 650.65 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

| ASHOKA | 4723448 | 103.10 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| NOCIL | 4286530 | 310.20 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| JAICORPLTD | 4113736 | 136.70 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| SUNPHARMA (F&O) | 4089061 | 823.25 | 826.56 | 819.39 | 833.35 | 840.58 | 847.84 | 855.13 |

| INDUSINDBK (F&O) | 4002618 | 1166.70 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| BHARATFORG (F&O) | 3925051 | 741.50 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| DHANI | 3676043 | 196.25 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| MCDOWELL-N (F&O) | 3629362 | 902.70 | 907.52 | 900.00 | 914.60 | 922.18 | 929.78 | 937.42 |

| SWSOLAR | 2972838 | 404.85 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| BSOFT | 2936052 | 425.65 | 430.56 | 425.39 | 435.55 | 440.78 | 446.04 | 451.34 |

| TVSMOTOR (F&O) | 2873448 | 557.75 | 558.14 | 552.25 | 563.78 | 569.73 | 575.71 | 581.72 |

| SUNTECK | 2659952 | 497.65 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| CHOLAFIN (F&O) | 2592321 | 583.85 | 588.06 | 582.02 | 593.84 | 599.95 | 606.09 | 612.26 |

| HCLTECH (F&O) | 2421641 | 1306.30 | 1314.06 | 1305.02 | 1322.48 | 1331.58 | 1340.72 | 1349.89 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ONGC (F&O) | 59769140 | 160.40 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| GAIL (F&O) | 19095386 | 159.65 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| INDUSTOWER (F&O) | 8843692 | 306.25 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| PHILIPCARB | 2389730 | 253.15 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| OIL | 1309185 | 242.45 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| MANALIPETC | 1275368 | 124.20 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| SEQUENT | 1017346 | 211.85 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| MOIL | 952181 | 164.55 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| SPENCERS | 744297 | 129.40 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| ASIANTILES | 703616 | 164.75 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| NELCO | 676006 | 831.45 | 826.56 | 833.77 | 819.80 | 812.66 | 805.54 | 798.46 |

| CAMLINFINE | 613139 | 196.50 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| UGROCAP | 387556 | 127.95 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| SURYAROSNI | 345827 | 756.15 | 749.39 | 756.25 | 742.93 | 736.13 | 729.36 | 722.63 |

| INGERRAND | 223305 | 1177.95 | 1173.06 | 1181.64 | 1165.10 | 1156.58 | 1148.09 | 1139.63 |

| SHREEPUSHK | 220461 | 256.65 | 256.00 | 260.02 | 252.14 | 248.19 | 244.26 | 240.37 |

| TRITURBINE | 218186 | 174.25 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| GOLDENTOBC | 205593 | 172.70 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| CARTRADE | 196187 | 1391.25 | 1387.56 | 1396.89 | 1378.95 | 1369.68 | 1360.45 | 1351.24 |

| BHARATGEAR | 163757 | 166.05 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| AGARIND | 161373 | 384.10 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |