STOCKS WITH BUY SIGNAL

SAKUMA (NSE Code) Signal : Double tops crossed with very high volume. Stop Loss : 210 Target : 232 (Short term)

GPTINFRA (NSE Code) Signal : Doji formation after consolidation near minor bottom. Stop Loss : 90 Target : 115 (Short term)

KANSAINER (NSE Code) Signal : Doji formation after consolidation near minor bottom. Stop Loss : 440 Target : 480 (Short term)

DBCORP (NSE Code) Signal : Bullish channel break out with higher volume. Stop Loss : 205 Target : 225 (Short term)

STOCKS WITH SELL SIGNAL

INFIBEAM (NSE Code) Signal : 52 week low with higher volume. Stop Loss : 68 Target : 48 (Short term)

BODALCHEM (NSE Code) Signal : Long term double bottoms breached with higher volume. Stop Loss : 112 Target : 85 (Short term)

KARDA (NSE Code) Signal : Double tops & 13 days DMA curve crossed. Stop Loss : 171 Target : 150 (Short term)

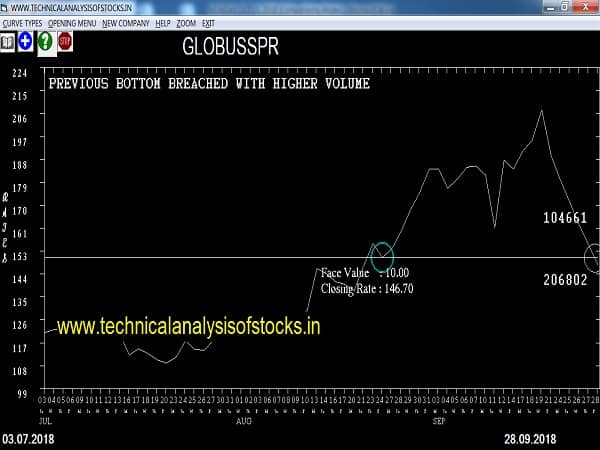

GLOBUSSPR (NSE Code) Signal : Previous bottom breached with higher volume. Stop Loss : 160 Target : 125 (Short term)