STOCKS WITH BUY SIGNAL

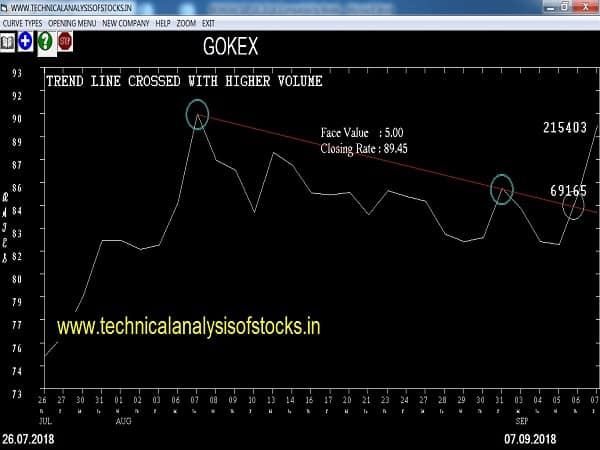

GOKEX (NSE Code) Signal : Trend line crossed with higher volume. Stop Loss : 85 Target : 95 (Short term) Also watch other Export related stocks such as RAJESHEXPO, SAKUMA, GAEL etc.

ADORWELD (NSE Code) Signal : Multiple tops crossed with very high volume. Stop Loss : 355 Target : 395 (Short term)

JINDALPOLY (NSE Code) Signal : Channel break out with higher volume. Stop Loss : 285 Target : 315 (Short term)

MOTHERSUMI (NSE Code) Signal : Bonus shares recommended. News driven stock. 13 days DMA curve crossed with higher volume. Stop Loss : 295 Target : 315 (Short term)

STOCKS WITH SELL SIGNAL

INDOCO (NSE Code) Signal : Gravestone formation near minor top short rally with higher volume. Stop Loss : 230 Target : 209 (Short term)

YESBANK (NSE Code) Signal : Triple bottoms breahed with higher volume. Stop Loss : 335 Target : 310 (Short term)

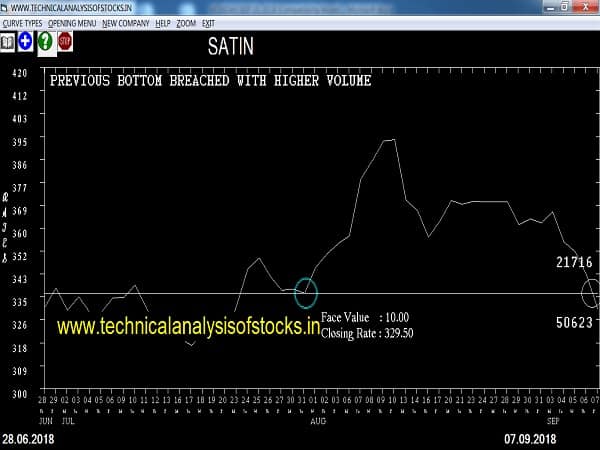

SATIN (NSE Code) Signal : Previous bottom breached with higher volume. Stop Loss : 340 Target : 315 (Short term)

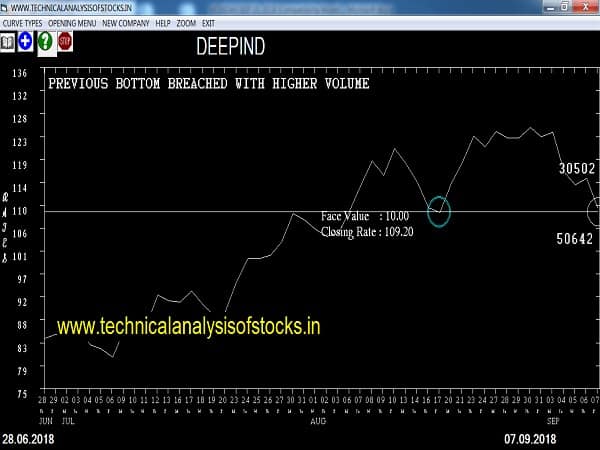

DEEPIND (NSE Code) Signal : Previous bottom breached with higher volume. Stop Loss : 115 Target : 101 (Short term)