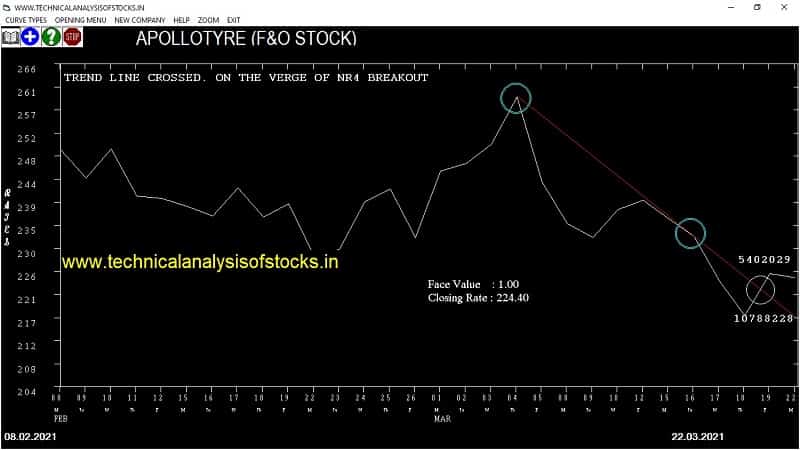

BUY APOLLOTYRE (NSE Symbol) Buy @ 225 or Above after cooling period. SIGNAL : TREND LINE CROSSED. ON THE VERGE OF NR4 BREAKOUT. Stop Loss : 206.75 Target : 240.10 (Short term)

HOT BUZZING STOCKS (23.03.2021)

NSE SYMBOL CLOSING RATE

BESTAGRO 507.95

FACT 114.45

KRISHANA 88.70

RCF 79.00

THEINVEST 96.65

NFL 57.55

ADANIGREEN 1252.20

VETO 131.35

ADANIPOWER 96.80

OLECTRA 222.10

ONMOBILE 103.15

VENUSREM 284.25

VISHNU 258.90

OPTIEMUS 145.85

GANESHHOUC 58.40

RAMKY 83.90

CGPOWER 61.85

ASHAPURMIN 99.45

RUSHIL 248.60

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| BANDHANBNK (F&O) | 83384 | 350.00 | 352.60 | 0.74 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| TORNTPOWER (F&O) | 22126 | 430.56 | 405.22 | 451.34 | 427.45 | 429.70 | -0.53 |

| CANFINHOME | 36445 | 606.39 | 576.29 | 630.95 | 602.40 | 607.70 | -0.88 |

| OBEROIRLTY | 11106 | 600.25 | 570.30 | 624.69 | 600.15 | 609.00 | -1.47 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| HDFC (F&O) | 118982 | 2525.06 | 2586.97 | 2476.30 | 2531.85 | 2496.05 | 1.41 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

BANDHANBNK,-0.74%

CANFINHOME,0.88%

M&M,1.05%

HDFC,1.43%

VEDL,1.52%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

TORNTPOWER,0.53%

EICHERMOT,0.83%

CANFINHOME,0.88%

M&M,1.05%

HDFC,1.43%

OBEROIRLTY,1.47%

VEDL,2.77%

GATI,3.96%

BEML,4.24%

HEG,4.71%

KPITTECH,4.72%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

APOLLOTYRE (F&O) Buy @ 225 or Above

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

SHK Buy @ 115.55 or Above

ABCAPITAL Buy @ 121 or Above

DBL Buy @ 606.40 or Above

BEML Buy @ 1387.55 or Above

NAVINFLUOR (F&O) Buy @ 2550.25 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AKG

BANCOINDIA

BEPL

DBL

DEEPAKFERT

EXIDEIND (F&O)

GEPIL

GHCL

HEROMOTOCO (F&O)

HINDOILEXP

MGL (F&O)

NIITLTD

PANAMAPET

PFC (F&O)

VISHWARAJ

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ERIS

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

CANTABIL

EICHERMOT (F&O)

NATCOPHARM

Higher Level Consolidation

BAJAJ-AUTO (F&O)

BHARTIARTL (F&O)

EICHERMOT (F&O)

M&M (F&O)

MINDTREE (F&O)

Lower Level Consolidation

CANTABIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ADANIGREEN

ATGL

BDL

IFGLEXPOR

GAP DOWN BREAKOUT STOCKS

EMAMIPAP

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

FLFL

FRETAIL

FSC

OPTIEMUS

BEARISH ENGULFING

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

ADANIPOWER

BEARISH MARUBOZU PATTERN

BIGBLOC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

ICIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

APTECHT

BAJAJFINSV (F&O)

BAJFINANCE (F&O)

CAMS

CHOLAHLDNG

COFORGE (F&O)

CSBBANK

CYIENT

HINDPETRO (F&O)

KAMDHENU

LT (F&O)

MINDACORP

OIL

RADICO

SHREDIGCEM

SWANENERGY

TNPL

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CESC

CHAMBLFERT

CHEMCON

EXIDEIND (F&O)

IRCON

ITI

KANSAINER

KOPRAN

MARICO (F&O)

MARKSANS

MARUTI (F&O)

MIDHANI

NLCINDIA

PVR (F&O)

STAR

SUNTECK

ZEEL (F&O)

ZENTEC

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ARVINDFASN | 153.85 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| HDFC (F&O) | 2531.85 | 2537.64 | 2525.06 | 2548.97 | 2561.61 | 2574.27 | 2586.97 |

| SUPRAJIT | 289.45 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| COROMANDEL | 757.05 | 763.14 | 756.25 | 769.68 | 776.63 | 783.61 | 790.62 |

| HDFCAMC (F&O) | 2882.55 | 2889.06 | 2875.64 | 2901.06 | 2914.54 | 2928.05 | 2941.59 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| LTI (F&O) | 4093.10 | 4080.02 | 4096.00 | 4066.09 | 4050.16 | 4034.27 | 4018.40 |

| COCHINSHIP | 361.30 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| ZEEL (F&O) | 214.30 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| POLYCAB | 1352.70 | 1350.56 | 1359.77 | 1342.06 | 1332.92 | 1323.80 | 1314.72 |

| SCHAND | 122.65 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| AMBUJACEM (F&O) | 11182565 | 295.60 | 297.56 | 293.27 | 301.74 | 306.10 | 310.49 | 314.90 |

| CHOLAFIN (F&O) | 9087183 | 570.40 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

| JINDALSTEL (F&O) | 7824327 | 320.95 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| SUNPHARMA (F&O) | 7033955 | 591.00 | 594.14 | 588.06 | 599.95 | 606.09 | 612.26 | 618.46 |

| PETRONET (F&O) | 5012225 | 228.75 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| TECHM (F&O) | 3873143 | 1013.55 | 1016.02 | 1008.06 | 1023.49 | 1031.50 | 1039.54 | 1047.62 |

| TATACONSUM (F&O) | 3154483 | 620.55 | 625.00 | 618.77 | 630.95 | 637.24 | 643.57 | 649.92 |

| TCS (F&O) | 2821646 | 3129.65 | 3136.00 | 3122.02 | 3148.44 | 3162.48 | 3176.55 | 3190.65 |

| INDIGO (F&O) | 2226951 | 1713.85 | 1722.25 | 1711.89 | 1731.77 | 1742.19 | 1752.64 | 1763.12 |

| GODREJCP (F&O) | 2005221 | 694.35 | 695.64 | 689.06 | 701.90 | 708.54 | 715.20 | 721.90 |

| NIACL | 1822396 | 169.10 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| ADANITRANS | 1802300 | 792.15 | 798.06 | 791.02 | 804.74 | 811.84 | 818.98 | 826.15 |

| GREAVESCOT | 1758243 | 136.35 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| INDIACEM | 1722090 | 165.55 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| BDL | 1695839 | 358.35 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| BEML | 1563755 | 1387.10 | 1387.56 | 1378.27 | 1396.19 | 1405.55 | 1414.93 | 1424.35 |

| KOLTEPATIL | 1517818 | 236.05 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| CANFINHOME | 1378357 | 602.40 | 606.39 | 600.25 | 612.26 | 618.46 | 624.69 | 630.95 |

| CAMLINFINE | 1269979 | 145.90 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| GATI | 1209969 | 109.95 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| NAM-INDIA (F&O) | 1056084 | 336.05 | 337.64 | 333.06 | 342.08 | 346.72 | 351.39 | 356.09 |

| MSTCLTD | 933330 | 313.15 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| PRESTIGE | 883644 | 299.40 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| BRITANNIA (F&O) | 820046 | 3564.40 | 3570.06 | 3555.14 | 3583.22 | 3598.20 | 3613.21 | 3628.25 |

| ORIENTREF | 767973 | 242.25 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ICICIBANK (F&O) | 21755401 | 573.45 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| POWERGRID (F&O) | 16414250 | 223.55 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| ASHOKLEY (F&O) | 16392169 | 113.75 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| INDUSINDBK (F&O) | 12692489 | 968.15 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| MOTHERSUMI (F&O) | 12683478 | 206.00 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| NMDC (F&O) | 12364505 | 128.20 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| RECLTD (F&O) | 4962230 | 139.20 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| IEX | 4146941 | 356.25 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| INDUSTOWER (F&O) | 3151619 | 257.85 | 256.00 | 260.02 | 252.14 | 248.19 | 244.26 | 240.37 |

| AARTIDRUGS | 3072899 | 733.95 | 729.00 | 735.77 | 722.63 | 715.92 | 709.25 | 702.60 |

| DHANI | 1507666 | 268.20 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| PVR (F&O) | 1367515 | 1328.80 | 1323.14 | 1332.25 | 1314.72 | 1305.67 | 1296.65 | 1287.66 |

| NOCIL | 769447 | 168.10 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| DMART | 652753 | 2880.10 | 2875.64 | 2889.06 | 2863.68 | 2850.32 | 2836.98 | 2823.68 |

| NIITLTD | 594983 | 149.80 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| INOXLEISUR | 578745 | 308.80 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| ASIANTILES | 533843 | 160.25 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| GABRIEL | 497007 | 108.35 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| MINDAIND | 485696 | 558.10 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| GREENPLY | 432515 | 169.30 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| SUNTECK | 349149 | 315.30 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| KAJARIACER | 295933 | 910.25 | 907.52 | 915.06 | 900.45 | 892.96 | 885.51 | 878.08 |

| SAFARI | 265499 | 626.30 | 625.00 | 631.27 | 619.08 | 612.87 | 606.69 | 600.55 |

| NAHARPOLY | 232358 | 119.45 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| PAISALO | 224366 | 770.90 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |