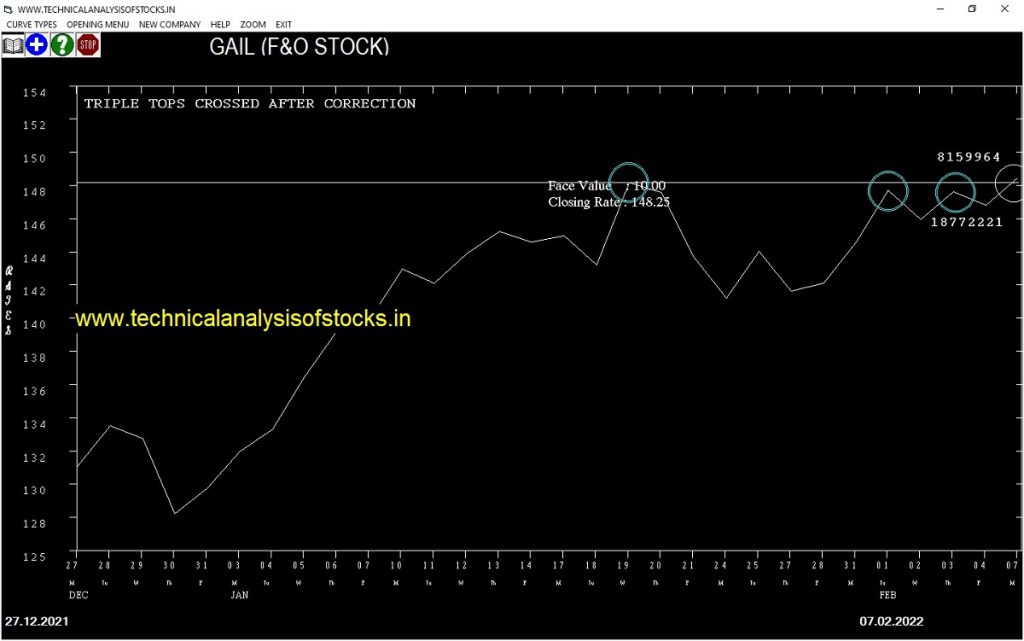

BUY GAIL (NSE Symbol) Buy 150 or Above after cooling period. SIGNAL : TRIPLE TOPS CROSSED AFTER CORRECTION. Stop Loss : 135.20 Target : 162.50 (Short term)

HOT BUZZING STOCKS (08.02.2022)

NSE SYMBOL CLOSING RATE

BSHSL 444.05

MBAPL 233.10

UGARSUGAR 41.40

KRISHANA 212.20

MHLXMIRU 89.15

NAHARINDUS 190.35

TIMESGTY 66.40

RELINFRA 133.45

SOMICONVEY 46.45

ARSHIYA 43.35

SHAHALLOYS 56.95

JETFREIGHT 72.90

PFOCUS 97.50

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| INDOSTAR | 14701 | 259.40 | 265.90 | 2.44 |

| ADANIGREEN | 37759 | 1964.90 | 2024.65 | 2.95 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| RBLBANK (F&O) | 45502 | 146.30 | 146.25 | 0.03 |

| HEROMOTOCO (F&O) | 52322 | 2652.85 | 2648.05 | 0.18 |

| HINDUNILVR (F&O) | 112445 | 2266.70 | 2257.60 | 0.40 |

| TATAMOTORS (F&O) | 183916 | 498.20 | 494.60 | 0.73 |

| SEQUENT | 10998 | 161.00 | 159.00 | 1.26 |

| IRCTC (F&O) | 119511 | 849.60 | 835.60 | 1.68 |

| TARSONS | 22098 | 658.30 | 645.05 | 2.05 |

| PRESTIGE | 15271 | 469.35 | 458.25 | 2.42 |

| EXIDEIND (F&O) | 55399 | 171.65 | 167.00 | 2.78 |

| ANGELONE | 23240 | 1379.95 | 1342.00 | 2.83 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| CHALET | 15010 | 268.14 | 248.19 | 284.62 | 265.55 | 266.00 | -0.17 |

| CMSINFO | 39409 | 284.77 | 264.19 | 301.74 | 281.10 | 284.60 | -1.25 |

| PVR (F&O) | 31946 | 1610.02 | 1561.03 | 1649.57 | 1604.60 | 1638.35 | -2.10 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| INDUSTOWER (F&O) | 24267 | 252.02 | 272.11 | 236.51 | 253.00 | 251.00 | 0.79 |

| BERGEPAINT (F&O) | 17244 | 715.56 | 749.02 | 689.41 | 719.10 | 707.35 | 1.63 |

| GRASIM (F&O) | 26684 | 1711.89 | 1763.12 | 1671.60 | 1712.35 | 1684.00 | 1.66 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| TATACOMM (F&O) | 4.16% |

| TWL | 4.28% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| CHALET | 0.17% |

| CMSINFO | 1.25% |

| CASTROLIND | 1.41% |

| POWERGRID (F&O) | 1.80% |

| PVR (F&O) | 2.10% |

| LATENTVIEW | 2.41% |

| CDSL | 2.78% |

| AARTIIND (F&O) | 2.87% |

| SRF (F&O) | 2.98% |

| TECHM (F&O) | 3.00% |

| VTL | 3.34% |

| INDUSTOWER (F&O) | 3.72% |

| SOBHA | 3.73% |

| CLEAN | 3.77% |

| HINDUNILVR (F&O) | 3.87% |

| CROMPTON (F&O) | 3.88% |

| TRITURBINE | 4.16% |

| BERGEPAINT (F&O) | 4.17% |

| PCBL | 4.61% |

| GRASIM (F&O) | 4.64% |

| RAYMOND | 4.74% |

| ASAHIINDIA | 4.77% |

| SUPRIYA | 4.97% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BOMDYEING SELL @ 123.75 or BELOW

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DHANI

GRAVITA

MHRIL

PANACEABIO

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

COROMANDEL (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ADANIGREEN

AFFLE

AUSOMENT

BSHSL

BUTTERFLY

CANTABIL

CREDITACC

FDC

GILLANDERS

GNFC (F&O)

NAHARINDUS

RATNAMANI

RELINFRA

SHAHALLOYS

TCPLPACK

UTTAMSUGAR

VGUARD

VRLLOG

GAP DOWN BREAKOUT STOCKS

ACE

ADVENZYMES

BANCOINDIA

BIGBLOC

BIRLACORPN

BRNL

CDSL

DFMFOODS

FOODSIN

GATI

JUBLINDS

JUBLPHARMA

MAHINDCIE

SARDAEN

TIMETECHNO

UJJIVAN

UMANGDAIRY

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

RELIGARE

TIMESGTY

BEARISH ENGULFING PATTERN

CHOLAHLDNG

DEEPAKFERT

INDOTECH

IZMO

RELAXO

TNPETRO

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BSHSL

KRISHANA

MHLXMIRU

TIMESGTY

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

MAANALU

BEARISH BELLHOLD PATTERN

ACE

AJMERA

ARIHANTCAP

BAJAJ-AUTO (F&O)

EDELWEISS

INTELLECT (F&O)

TANLA

TEJASNET

TNPETRO

VISAKAIND

Strategy : GARTLEY SIGNAL(W & M Patterns) (INTRADAY)

BUY RECOMMENDATION AT LOWER LEVELS

NAHARCAP

NAHARPOLY

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

CHAMBLFERT (F&O)

WELSPUNIND

RADICO

MAXHEALTH

TECHM (F&O)

DMART

ORIENTELEC

ASTRAL (F&O)

KEI

ZOMATO

PRSMJOHNSN

TEGA

IGL (F&O)

CENTURYTEX

LUPIN (F&O)

HEG

CYBERTECH

GREAVESCOT

KOLTEPATIL

PRESTIGE

ZENSARTECH

VTL

APTECHT

SEQUENT

ISEC

METROBRAND

TATAMTRDVR

HEMIPROP

CHEMPLASTS

ADANIENT (F&O)

CONTROLPR

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

NIL

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

CASTROLIND

MSTCLTD

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| ACC (F&O) | 2282.20 | 2292.02 | 2280.06 | 2302.85 | 2314.86 | 2326.90 | 2338.97 |

| PNCINFRA | 299.60 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| ELGIEQUIP | 418.35 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| MUTHOOTFIN (F&O) | 1422.90 | 1425.06 | 1415.64 | 1433.80 | 1443.28 | 1452.79 | 1462.33 |

| VARROC | 420.20 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| HPAL | 394.05 | 390.06 | 395.02 | 385.33 | 380.44 | 375.58 | 370.75 |

| EASEMYTRIP | 605.15 | 600.25 | 606.39 | 594.44 | 588.36 | 582.31 | 576.29 |

| RITES | 264.95 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| STARHEALTH | 772.60 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |

| DALMIASUG | 455.40 | 451.56 | 456.89 | 446.49 | 441.22 | 435.98 | 430.78 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ADANIPOWER | 18041803 | 111.70 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| HINDCOPPER (F&O) | 16060563 | 141.45 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| VEDL (F&O) | 15757583 | 365.35 | 365.77 | 361.00 | 370.38 | 375.20 | 380.06 | 384.95 |

| GSFC | 11282044 | 132.60 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| DWARKESH | 8981632 | 101.40 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| GODREJPROP (F&O) | 5441200 | 1561.55 | 1570.14 | 1560.25 | 1579.27 | 1589.22 | 1599.20 | 1609.21 |

| MASFIN | 3394099 | 680.55 | 682.52 | 676.00 | 688.72 | 695.29 | 701.90 | 708.54 |

| CMSINFO | 2388345 | 281.10 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| VIPIND | 2290935 | 670.85 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| TRIVENI | 2289840 | 291.15 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| DHAMPURSUG | 2191708 | 418.60 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| ORIENTCEM | 1901078 | 177.55 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| PRICOLLTD | 1791370 | 134.00 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| NBVENTURES | 1574711 | 136.30 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| TINPLATE | 1518628 | 379.40 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| VRLLOG | 1388336 | 553.40 | 558.14 | 552.25 | 563.78 | 569.73 | 575.71 | 581.72 |

| OIL | 1285820 | 231.20 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| JINDRILL | 1057242 | 215.95 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| RELIGARE | 1025669 | 136.90 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| AFFLE | 979408 | 1292.30 | 1296.00 | 1287.02 | 1304.36 | 1313.41 | 1322.48 | 1331.58 |

| FDC | 957618 | 306.00 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| VGUARD | 902150 | 222.65 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| CAMLINFINE | 873250 | 150.65 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| MINDAIND | 861393 | 1112.40 | 1113.89 | 1105.56 | 1121.69 | 1130.08 | 1138.49 | 1146.94 |

| EKC | 691350 | 262.90 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SAIL (F&O) | 41791347 | 102.45 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| ICICIBANK (F&O) | 14659368 | 786.40 | 784.00 | 791.02 | 777.40 | 770.45 | 763.52 | 756.63 |

| RBLBANK (F&O) | 11632649 | 146.25 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| IEX (F&O) | 9931957 | 225.65 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| RECLTD (F&O) | 8013447 | 137.20 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| IBULHSGFIN (F&O) | 7733436 | 209.10 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |

| WIPRO (F&O) | 7545679 | 557.00 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| HDFCBANK (F&O) | 6134021 | 1468.15 | 1463.06 | 1472.64 | 1454.24 | 1444.72 | 1435.23 | 1425.78 |

| FSL (F&O) | 5731075 | 145.85 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| DLF (F&O) | 4851736 | 387.15 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| POONAWALLA | 4460803 | 251.25 | 248.06 | 252.02 | 244.26 | 240.37 | 236.51 | 232.68 |

| CHOLAFIN (F&O) | 4384201 | 650.10 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

| CUB (F&O) | 4337671 | 139.85 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| IRCTC (F&O) | 4119747 | 835.60 | 833.77 | 841.00 | 826.98 | 819.80 | 812.66 | 805.54 |

| INDHOTEL (F&O) | 3697144 | 211.80 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| HDFC (F&O) | 3664108 | 2428.15 | 2425.56 | 2437.89 | 2414.47 | 2402.20 | 2389.96 | 2377.75 |

| INDIACEM (F&O) | 3524612 | 221.55 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| ABCAPITAL (F&O) | 3502998 | 120.35 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| EXIDEIND (F&O) | 3368057 | 167.00 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| HDFCLIFE (F&O) | 3030728 | 603.25 | 600.25 | 606.39 | 594.44 | 588.36 | 582.31 | 576.29 |

| LT (F&O) | 2641464 | 1884.50 | 1881.39 | 1892.25 | 1871.50 | 1860.70 | 1849.92 | 1839.18 |

| INDUSINDBK (F&O) | 2587054 | 933.05 | 930.25 | 937.89 | 923.10 | 915.52 | 907.97 | 900.45 |

| RADICO | 2374028 | 947.75 | 945.56 | 953.27 | 938.36 | 930.72 | 923.10 | 915.52 |

| KOTAKBANK (F&O) | 2053959 | 1828.45 | 1827.56 | 1838.27 | 1817.80 | 1807.15 | 1796.54 | 1785.96 |

| WELSPUNIND | 2020503 | 123.40 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |