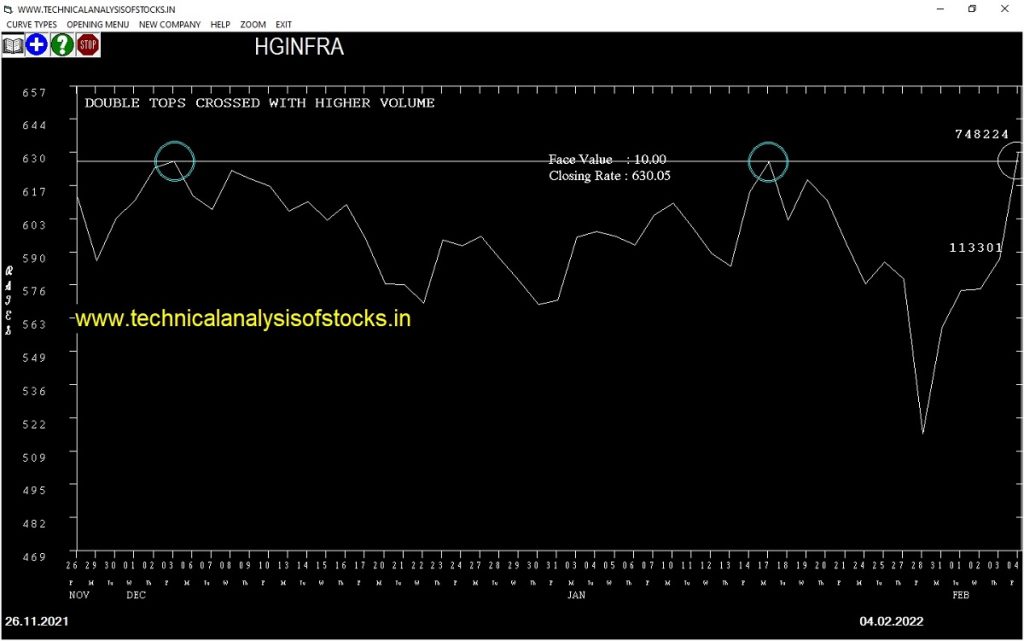

BUY HGINFRA (NSE Symbol) Buy 631.25 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. BULLISH GAP UP BREAK OUT. Stop Loss : 600.55 Target : 656.30 (Short term)

HOT BUZZING STOCKS (07.02.2022)

NSE SYMBOL CLOSING RATE

UNIVASTU 88.00

BSHSL 370.05

AUSOMENT 81.80

DEEPAKFERT 653.45

GULPOLY 421.45

NAHARINDUS 158.65

RUSHIL 379.20

GANESHHOUC 207.20

JETFREIGHT 69.45

PFOCUS 92.90

RELINFRA 121.35

RTNINDIA 57.00

V2RETAIL 162.60

FOCUS 83.65

SHAHALLOYS 54.25

FOODSIN 101.15

PANACEABIO 239.20

BRNL 54.20

JUBLINDS 636.50

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| VTL | 28956 | 2549.00 | 2551.55 | 0.10 |

| CHOLAFIN (F&O) | 104919 | 674.90 | 675.70 | 0.12 |

| MOIL | 19104 | 174.40 | 178.95 | 2.54 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| HAL (F&O) | 16071 | 1405.40 | 1400.20 | 0.37 |

| PRESTIGE | 22534 | 472.00 | 469.95 | 0.44 |

| MAXHEALTH | 15112 | 362.10 | 358.75 | 0.93 |

| JKTYRE | 11795 | 132.30 | 130.60 | 1.30 |

| JKLAKSHMI | 10445 | 559.00 | 551.60 | 1.34 |

| BATAINDIA (F&O) | 22272 | 1970.00 | 1942.25 | 1.43 |

| LUPIN (F&O) | 167718 | 889.20 | 872.20 | 1.95 |

| M&M (F&O) | 89041 | 860.40 | 841.70 | 2.22 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SUNTECK | 17771 | 529.00 | 500.89 | 551.97 | 523.60 | 526.45 | -0.54 |

| RAYMOND | 23438 | 784.00 | 749.77 | 811.84 | 782.05 | 790.00 | -1.02 |

| JINDWORLD | 19203 | 337.64 | 315.22 | 356.09 | 336.65 | 340.90 | -1.26 |

| MINDACORP | 11058 | 206.64 | 189.16 | 221.15 | 204.45 | 208.40 | -1.93 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| POWERGRID (F&O) | 66832 | 206.64 | 224.89 | 192.61 | 209.70 | 209.25 | 0.21 |

| ESCORTS (F&O) | 22707 | 1827.56 | 1880.45 | 1785.96 | 1835.50 | 1829.35 | 0.34 |

| JUSTDIAL | 17739 | 885.06 | 922.18 | 855.99 | 891.60 | 885.00 | 0.74 |

| HEG | 25534 | 1530.77 | 1579.27 | 1492.64 | 1538.30 | 1521.00 | 1.12 |

| EICHERMOT (F&O) | 30010 | 2626.56 | 2689.67 | 2576.85 | 2631.40 | 2598.90 | 1.24 |

| WOCKPHARMA | 11290 | 390.06 | 414.93 | 370.75 | 394.90 | 390.00 | 1.24 |

| PIDILITIND (F&O) | 44379 | 2475.06 | 2536.37 | 2426.78 | 2481.80 | 2447.70 | 1.37 |

| TATACOFFEE | 10338 | 210.25 | 228.65 | 196.10 | 213.55 | 210.00 | 1.66 |

| HINDUNILVR (F&O) | 74364 | 2304.00 | 2363.21 | 2257.38 | 2306.60 | 2266.70 | 1.73 |

| SUPRIYA | 13760 | 462.25 | 489.27 | 441.22 | 467.60 | 458.75 | 1.89 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HINDUNILVR (F&O) | 1.17% |

| TATACOMM (F&O) | 1.31% |

| ABB (F&O) | 2.98% |

| TWL | 3.51% |

| KITEX | 4.16% |

| HIKAL | 4.43% |

| GREENPANEL | 4.56% |

| BHARTIARTL (F&O) | 4.69% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| INDOSTAR | 0.39% |

| MEDPLUS | 1.02% |

| RAYMOND | 1.02% |

| JINDWORLD | 1.26% |

| ORIENTELEC | 1.28% |

| ESCORTS (F&O) | 1.28% |

| VTL | 1.51% |

| HINDUNILVR (F&O) | 1.66% |

| GSFC | 1.70% |

| PVR (F&O) | 1.85% |

| BERGEPAINT (F&O) | 1.89% |

| MINDACORP | 1.93% |

| EIDPARRY | 2.23% |

| HEROMOTOCO (F&O) | 2.47% |

| AARTIIND (F&O) | 2.55% |

| PETRONET (F&O) | 2.56% |

| CLEAN | 2.65% |

| BAJFINANCE (F&O) | 2.68% |

| INDUSTOWER (F&O) | 2.82% |

| ASAHIINDIA | 2.90% |

| CROMPTON (F&O) | 3.05% |

| RAILTEL | 3.16% |

| SONACOMS | 3.20% |

| GRASIM (F&O) | 3.26% |

| GATI | 3.27% |

| ANGELONE | 3.30% |

| WOCKPHARMA | 3.42% |

| LATENTVIEW | 3.58% |

| SRF (F&O) | 3.61% |

| POWERGRID (F&O) | 3.72% |

| SIS | 3.75% |

| CMSINFO | 3.81% |

| PIDILITIND (F&O) | 3.82% |

| NBVENTURES | 4.19% |

| SUNTECK | 4.28% |

| EICHERMOT (F&O) | 4.39% |

| HIKAL | 4.43% |

| HEG | 4.83% |

| MARUTI (F&O) | 4.92% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HSIL SELL @ 328.50 or BELOW

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ANMOL

APLAPOLLO

CUMMINSIND (F&O)

HDFCAMC (F&O)

INDOTECH

INGERRAND

LATENTVIEW

PARAGMILK

SIGACHI

TNPL

VIPIND

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

APEX

PERSISTENT (F&O)

PSPPROJECT

RATEGAIN

VENUSREM

VOLTAS (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AMBIKCO

ANMOL

BHAGYANGR

DEEPAKFERT

DHANUKA

HGINFRA

LUXIND

RELINFRA

SECURKLOUD

SHANTIGEAR

SUMICHEM

GAP DOWN BREAKOUT STOCKS

CAMS

GMMPFAUDLR

GODREJPROP (F&O)

GRINDWELL

JUBLINDS

PANACEABIO

TBZ

WELSPUNIND

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

MARICO (F&O)

BEARISH ENGULFING PATTERN

BGRENERGY

BRIGADE

CLEDUCATE

INDUSTOWER (F&O)

JINDALPHOT

KANSAINER

MARALOVER

PCBL

RCF

UNITEDPOLY

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

FOODSIN

UNITEDPOLY

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

BICARD (F&O)

WATERBASE

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

RALLIS

RELIANCE (F&O)

ZOMATO

RATEGAIN

DRREDDY (F&O)

TEGA

RAILTEL

ZENSARTECH

DATAMATICS

MFSL (F&O)

HEMIPROP

ZEEL (F&O)

SBILIFE (F&O)

FORTIS

SUNTECK

CHEMPLASTS

WIPRO (F&O)

RAJESHEXPO

MUTHOOTFIN (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

VIPIND

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ALLCARGO

BANARBEADS

CARBORUNIV

HIKAL

VAIBHAVGBL

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

LODHA

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| TCS (F&O) | 3814.90 | 3828.52 | 3813.06 | 3842.08 | 3857.59 | 3873.12 | 3888.70 |

| HINDUNILVR (F&O) | 2306.60 | 2316.02 | 2304.00 | 2326.90 | 2338.97 | 2351.07 | 2363.21 |

| INDIANB | 168.45 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| TVSMOTOR (F&O) | 653.00 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

| HCLTECH (F&O) | 1163.80 | 1164.52 | 1156.00 | 1172.48 | 1181.05 | 1189.65 | 1198.29 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| AYMSYNTEX | 132.20 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| HERCULES | 166.30 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| PETRONET (F&O) | 212.75 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| POONAWALLA | 264.25 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| CARTRADE | 727.30 | 722.27 | 729.00 | 715.92 | 709.25 | 702.60 | 695.99 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| VEDL (F&O) | 20184671 | 356.35 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| HINDALCO (F&O) | 12631663 | 525.15 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| JAMNAAUTO | 3486025 | 107.70 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| DABUR (F&O) | 2712529 | 569.00 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

| FCL | 2615781 | 173.70 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| DHAMPURSUG | 1966527 | 408.20 | 410.06 | 405.02 | 414.93 | 420.04 | 425.18 | 430.35 |

| TWL | 1931806 | 115.35 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| RELINFRA | 1577705 | 121.35 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| JSL | 1503570 | 216.45 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| MOIL | 1386791 | 178.95 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| AEGISCHEM | 1225148 | 228.20 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| ELGIEQUIP | 1137373 | 412.80 | 415.14 | 410.06 | 420.04 | 425.18 | 430.35 | 435.55 |

| BORORENEW | 1117653 | 695.80 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| CMSINFO | 1093712 | 273.25 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| NYKAA | 1025676 | 1878.35 | 1881.39 | 1870.56 | 1891.30 | 1902.19 | 1913.11 | 1924.05 |

| PIIND (F&O) | 1024598 | 2552.20 | 2562.89 | 2550.25 | 2574.27 | 2586.97 | 2599.70 | 2612.46 |

| IPL | 1010436 | 323.70 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| TRITURBINE | 891289 | 209.90 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| ASHAPURMIN | 849617 | 118.70 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| RAYMOND | 787938 | 782.05 | 784.00 | 777.02 | 790.62 | 797.66 | 804.74 | 811.84 |

| CHALET | 764905 | 260.30 | 264.06 | 260.02 | 268.01 | 272.11 | 276.25 | 280.42 |

| DEEPAKFERT | 705985 | 653.45 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

| TEJASNET | 703093 | 482.60 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| DLINKINDIA | 571857 | 175.50 | 175.56 | 172.27 | 178.80 | 182.16 | 185.55 | 188.97 |

| JSLHISAR | 551525 | 421.65 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BANKBARODA (F&O) | 45581685 | 106.55 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| M&MFIN (F&O) | 14291090 | 153.75 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| RBLBANK (F&O) | 13767817 | 149.65 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| ZEEL (F&O) | 10466445 | 278.30 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| LUPIN (F&O) | 7628986 | 872.20 | 870.25 | 877.64 | 863.32 | 855.99 | 848.69 | 841.42 |

| IBULHSGFIN (F&O) | 7621080 | 214.35 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| DEVYANI | 7131516 | 178.55 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| ABFRL (F&O) | 6354420 | 295.50 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| GREAVESCOT | 2190250 | 211.20 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| JAICORPLTD | 1816051 | 136.30 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| MCX (F&O) | 1709407 | 1427.85 | 1425.06 | 1434.52 | 1416.35 | 1406.95 | 1397.59 | 1388.26 |

| CHAMBLFERT (F&O) | 1596208 | 396.95 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| SBICARD (F&O) | 1566360 | 854.90 | 848.27 | 855.56 | 841.42 | 834.18 | 826.98 | 819.80 |

| OIL | 1444856 | 225.00 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| ZENSARTECH | 1396419 | 414.95 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| BRIGADE | 1234110 | 506.30 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| EIHOTEL | 1191572 | 140.65 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| FACT | 1069845 | 134.25 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| AGSTRA | 985376 | 165.60 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| GNFC (F&O) | 946615 | 455.20 | 451.56 | 456.89 | 446.49 | 441.22 | 435.98 | 430.78 |

| BLS | 920547 | 248.05 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| INOXLEISUR | 901255 | 405.95 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| AUBANK (F&O) | 881399 | 1343.90 | 1341.39 | 1350.56 | 1332.92 | 1323.80 | 1314.72 | 1305.67 |

| MOL | 854374 | 112.00 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| COROMANDEL (F&O) | 806749 | 793.55 | 791.02 | 798.06 | 784.39 | 777.40 | 770.45 | 763.52 |