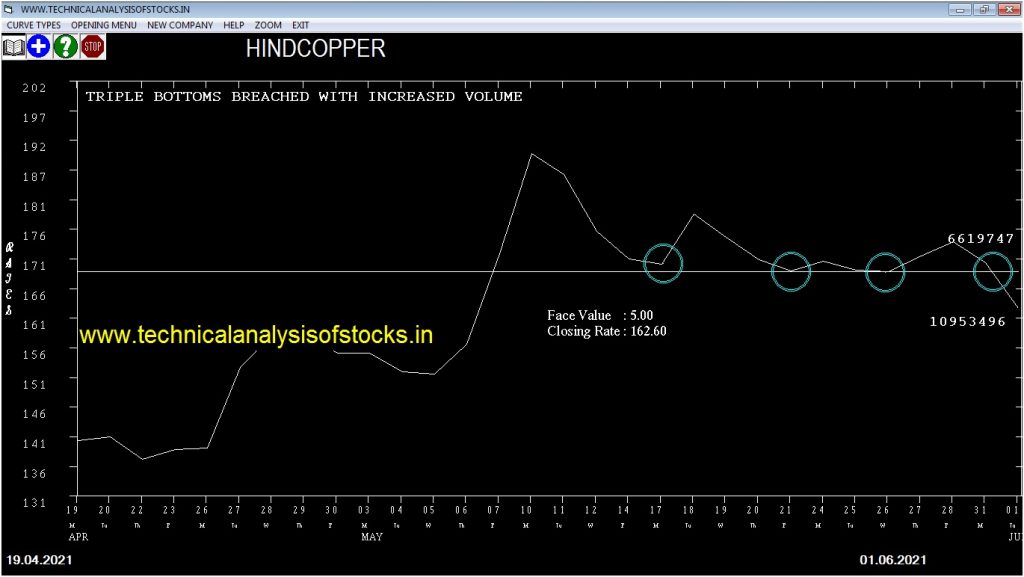

SELL HINDCOPPER (NSE Symbol) Sell @ 162.50 or Below after cooling period. SIGNAL : TRIPLE BOTTOMS BREACHED WITH INCREASED VOLUME. Stop Loss : 178.80 Target : 150.15 (Short term)

HOT BUZZING STOCKS (02.06.2021)

NSE SYMBOL CLOSING RATE

JAGSNPHARM 121.80

RUPA 476.15

TCIDEVELOP 515.40

PNBHOUSING 630.75

PNBGILTS 75.75

SHREYAS 193.65

TIDEWATER 10484.50

VENKEYS 2600.10

GANESHHOUC 71.95

SIGIND 58.70

MCDHOLDING 53.20

VISHNU 376.05

ALMONDZ 41.05

MAGMA 142.95

NAHARSPING 149.35

SASTASUNDR 208.15

IIFL 261.30

SHIVAMILLS 68.50

JSWISPL 56.00

LYKALABS 63.50

ADSL 62.45

BHAGYANGR 49.95

NDTV 69.85

SORILINFRA 166.50

VENUSREM 317.85

BASML 84.70

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| AARTIIND (F&O) | 71557 | 1708.50 | 1710.80 | 0.13 |

| ALKEM (F&O) | 34605 | 3038.85 | 3101.75 | 2.03 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| BEML | 16619 | 1294.35 | 1292.10 | 0.17 |

| PRINCEPIPE | 16603 | 712.85 | 711.30 | 0.22 |

| SPARC | 14509 | 221.30 | 220.05 | 0.57 |

| MOTILALOFS | 15787 | 802.50 | 785.90 | 2.11 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| BRITANNIA (F&O) | 24325 | 3451.56 | 3380.20 | 3508.81 | 3446.75 | 3459.00 | -0.36 |

| ONGC (F&O) | 200549 | 118.27 | 105.12 | 129.33 | 117.60 | 118.70 | -0.94 |

| RALLIS | 12690 | 310.64 | 289.14 | 328.35 | 310.60 | 314.90 | -1.38 |

| NMDC (F&O) | 31145 | 182.25 | 165.85 | 195.90 | 181.40 | 184.00 | -1.43 |

| APOLLOTYRE (F&O) | 34270 | 225.00 | 206.74 | 240.13 | 221.80 | 225.00 | -1.44 |

| AEGISCHEM | 16052 | 356.27 | 333.23 | 375.20 | 355.85 | 362.60 | -1.90 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| RAYMOND | 16430 | 361.00 | 384.95 | 342.42 | 365.75 | 365.55 | 0.05 |

| PRINCEPIPE | 16603 | 708.89 | 742.19 | 682.86 | 711.30 | 708.00 | 0.46 |

| SBILIFE (F&O) | 51172 | 961.00 | 999.64 | 930.72 | 966.30 | 961.20 | 0.53 |

| AMARAJABAT (F&O) | 33939 | 735.77 | 769.68 | 709.25 | 739.10 | 732.00 | 0.96 |

| HDFCLIFE (F&O) | 36682 | 663.06 | 695.29 | 637.88 | 665.25 | 657.10 | 1.23 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| AMARAJABAT (F&O) | 2.19% |

| ULTRACEMCO (F&O) | 2.33% |

| CYIENT | 3.31% |

| AARTIIND (F&O) | 3.46% |

| TORNTPHARM (F&O) | 3.82% |

| DEEPAKNTR (F&O) | 4.35% |

| GODREJCP (F&O) | 5.06% |

| NATCOPHARM | 5.66% |

| GODREJAGRO | 8.00% |

| BFUTILITIE | 11.73% |

| CSBBANK | 13.58% |

| GLAND | 14.11% |

| GODREJIND | 15.96% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| BRITANNIA (F&O) | 0.36% |

| ONGC (F&O) | 0.94% |

| HDFCLIFE (F&O) | 1.32% |

| RALLIS | 1.38% |

| FORTIS | 1.41% |

| NMDC (F&O) | 1.43% |

| APOLLOTYRE (F&O) | 1.44% |

| DRREDDY (F&O) | 1.54% |

| CEATLTD | 1.85% |

| AEGISCHEM | 1.90% |

| FINCABLES | 1.98% |

| LUPIN (F&O) | 2.03% |

| EXIDEIND (F&O) | 2.05% |

| BALKRISIND (F&O) | 2.09% |

| HINDALCO (F&O) | 2.27% |

| SBILIFE (F&O) | 2.33% |

| CYIENT | 2.39% |

| KEI | 2.40% |

| EMAMILTD | 2.46% |

| PRESTIGE | 2.59% |

| RAMCOCEM (F&O) | 2.60% |

| MOTHERSUMI (F&O) | 2.78% |

| DHAMPURSUG | 2.81% |

| TATAPOWER (F&O) | 3.20% |

| SCI | 3.23% |

| TATAMOTORS (F&O) | 3.58% |

| RAYMOND | 3.88% |

| DELTACORP | 4.65% |

| POWERGRID (F&O) | 4.72% |

| BEML | 4.84% |

| LXCHEM | 4.92% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

APOLLO Sell @ 109 or Below

KABRAEXTRU Sell @ 345 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BANCOINDIA

DBL

SUNPHARMA (F&O)

TVTODAY

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIGREEN

THANGAMAYL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMARAJABAT (F&O)

APOLLOTYRE (F&O)

EMAMILTD

ENDURANCE

HCLTECH (F&O)

INDUSTOWER (F&O)

INFY (F&O)

LT (F&O)

MAJESCO

NAVINFLUOR (F&O)

POLYCAB

PURVA

RAJESHEXPO

SWANENERGY

TCS (F&O)

Higher Level Consolidation

AARTIDRUGS

AMARAJABAT (F&O)

BRITANNIA (F&O)

CIPLA (F&O)

CYIENT

DCBBANK

EIDPARRY

IRCTC (F&O)

MAJESCO

MCX

POLYCAB

SBILIFE (F&O)

TATAMTRDVR

TITAN (F&O)

Lower Level Consolidation

AARTIDRUGS

AMARAJABAT (F&O)

BALKRISIND (F&O)

BPCL (F&O)

CYIENT

EICHERMOT (F&O)

EIDPARRY

GODREJAGRO

HINDZINC

IRCTC (F&O)

JSL

JUBLFOOD (F&O)

LUPIN (F&O)

MAJESCO

MFSL (F&O)

NLCINDIA

ORIENTELEC

PERSISTENT

PIDILITIND (F&O)

POLYCAB

RAJESHEXPO

SHREDIGCEM

TATAMETALI

TORNTPHARM (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BDL

EPL

MAGMA

PNBHOUSING

RUPA

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

BEML

JAMNAAUTO

KOKUYOCMLN

KPITTECH

TATASTLBSL

WABAG

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

SORILINFRA

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

MMTC

TNPL

SELL RECOMMENDATION AT HIGHER LEVELS

RUPA

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

APTECHT

BAJAJ-AUTO (F&O)

BDL

CASTROLIND

COALINDIA (F&O)

EMAMILTD

FDC

HDFCBANK (F&O)

HIMATSEIDE

HINDZINC

INFY (F&O)

MAHLOG

MUTHOOTFIN (F&O)

NH

NRBBEARING

PHILIPCARB

SADBHAV

SBICARD

SHOPERSTOP

SOBHA

STARCEMENT

WELCORP

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BRITANNIA (F&O)

COROMANDEL

EPL

EXIDEIND (F&O)

HDFCLIFE (F&O)

KIRIINDUS

ZEEL (F&O)

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| MPHASIS (F&O) | 1950.00 | 1958.06 | 1947.02 | 1968.16 | 1979.26 | 1990.39 | 2001.56 |

| TATACONSUM (F&O) | 665.80 | 669.52 | 663.06 | 675.66 | 682.17 | 688.72 | 695.29 |

| AMBIKCO | 1145.30 | 1147.52 | 1139.06 | 1155.42 | 1163.93 | 1172.48 | 1181.05 |

| SRF (F&O) | 6558.60 | 6561.00 | 6540.77 | 6577.97 | 6598.26 | 6618.58 | 6638.93 |

| SUNPHARMA (F&O) | 671.05 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CEATLTD | 1324.55 | 1323.14 | 1332.25 | 1314.72 | 1305.67 | 1296.65 | 1287.66 |

| COCHINSHIP | 376.90 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| GLENMARK (F&O) | 594.70 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| BURGERKING | 147.25 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| HAVELLS (F&O) | 1029.45 | 1024.00 | 1032.02 | 1016.52 | 1008.57 | 1000.64 | 992.75 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ONGC (F&O) | 51620011 | 117.60 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| IRB | 29186778 | 116.05 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| ADANIPORTS (F&O) | 17847137 | 798.20 | 805.14 | 798.06 | 811.84 | 818.98 | 826.15 | 833.35 |

| JAICORPLTD | 8274652 | 115.95 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| LICHSGFIN (F&O) | 5008157 | 477.60 | 478.52 | 473.06 | 483.76 | 489.27 | 494.81 | 500.39 |

| MAXHEALTH | 3646771 | 230.35 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| BAJFINANCE (F&O) | 2853451 | 5784.80 | 5795.02 | 5776.00 | 5811.16 | 5830.22 | 5849.32 | 5868.45 |

| OIL | 2597617 | 136.10 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| FINCABLES | 1468204 | 458.70 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| GESHIP | 1397007 | 424.70 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

| STLTECH | 1330298 | 256.05 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| GSPL | 1178101 | 277.05 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| CAMLINFINE | 1170237 | 180.50 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| WSTCSTPAPR | 1124646 | 228.35 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| STARPAPER | 1112572 | 139.85 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| VIPIND | 1058035 | 382.75 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| MAGMA | 1037681 | 142.95 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| TATACOMM | 836252 | 1122.95 | 1130.64 | 1122.25 | 1138.49 | 1146.94 | 1155.42 | 1163.93 |

| LIBERTSHOE | 825629 | 148.25 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| HERITGFOOD | 800830 | 350.30 | 351.56 | 346.89 | 356.09 | 360.82 | 365.58 | 370.38 |

| PARAGMILK | 792163 | 139.60 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| HUHTAMAKI | 777595 | 290.35 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| BFUTILITIE | 733540 | 307.35 | 310.64 | 306.25 | 314.90 | 319.36 | 323.84 | 328.35 |

| ALKEM (F&O) | 709879 | 3101.75 | 3108.06 | 3094.14 | 3120.45 | 3134.43 | 3148.44 | 3162.48 |

| SALASAR | 707643 | 713.65 | 715.56 | 708.89 | 721.90 | 728.64 | 735.40 | 742.19 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SAIL (F&O) | 110269080 | 121.20 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |

| TATASTEEL (F&O) | 17690925 | 1100.90 | 1097.27 | 1105.56 | 1089.54 | 1081.31 | 1073.10 | 1064.92 |

| TATAMTRDVR | 16553047 | 143.80 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| JSWSTEEL (F&O) | 14156453 | 694.50 | 689.06 | 695.64 | 682.86 | 676.34 | 669.85 | 663.39 |

| JINDALSTEL (F&O) | 13200999 | 396.50 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| VEDL (F&O) | 11911215 | 268.25 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| HINDCOPPER | 10953496 | 162.60 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| INDHOTEL | 8103937 | 135.95 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| AUROPHARMA (F&O) | 4967258 | 970.30 | 968.77 | 976.56 | 961.48 | 953.74 | 946.04 | 938.36 |

| RELIGARE | 4573494 | 112.50 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| CUB (F&O) | 3785119 | 167.05 | 165.77 | 169.00 | 162.64 | 159.47 | 156.33 | 153.22 |

| HAPPSTMNDS | 2976733 | 844.00 | 841.00 | 848.27 | 834.18 | 826.98 | 819.80 | 812.66 |

| VGUARD | 2973441 | 266.30 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| TATACOFFEE | 2952622 | 174.25 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| JUSTDIAL | 2911314 | 910.10 | 907.52 | 915.06 | 900.45 | 892.96 | 885.51 | 878.08 |

| INDIANB | 2847892 | 136.05 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| ABCAPITAL | 2702652 | 118.65 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| PRAJIND | 2350602 | 326.80 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| WOCKPHARMA | 2256663 | 620.65 | 618.77 | 625.00 | 612.87 | 606.69 | 600.55 | 594.44 |

| GSFC | 2256259 | 108.05 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| DCBBANK | 1983759 | 101.55 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| SUNTV (F&O) | 1798289 | 525.65 | 523.27 | 529.00 | 517.82 | 512.15 | 506.50 | 500.89 |

| ELECON | 1780910 | 113.60 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| PHILIPCARB | 1654784 | 211.40 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| ASIANTILES | 1601408 | 187.25 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |