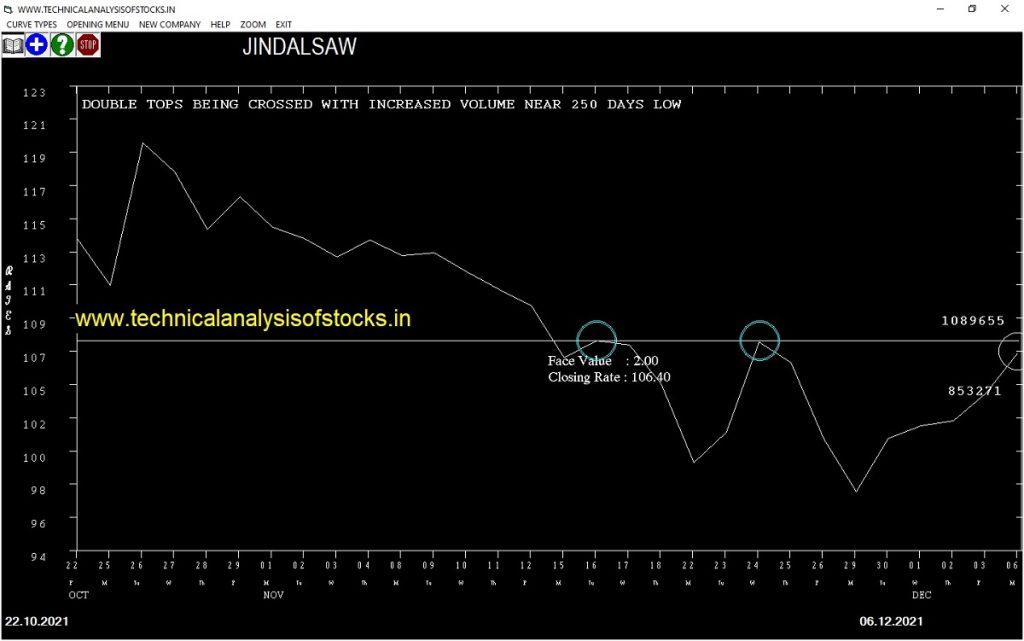

BUY JINDALSAW (NSE Symbol) Buy@ 107.65 or Above after cooling period. SIGNAL : DOUBLE TOPS BEING CROSSED WITH INCREASED VOLUME NEAR 250 DAYS LOW. Stop Loss : 95.10 Target : 118.20 (Short term)

HOT BUZZING STOCKS (07.12.2021)

NSE SYMBOL CLOSING RATE

UNIVPHOTO 720.00

HFCL 78.30

TEXMOPIPES 75.55

ALMONDZ 128.20

CREST 158.60

GENESYS 330.80

RUSHIL 349.70

MINDTECK 145.15

TTML 136.75

ANANTRAJ 69.60

AURUM 190.95

EQUIPPP 97.05

ISMTLTD 47.45

LYKALABS 199.25

POONAWALLA 216.00

RAMKY 175.05

WEIZMANIND 56.90

3IINFOLTD 107.70

63MOONS 127.75

TRF 145.70

TRIDENT 46.85

INSPIRISYS 55.50

INDORAMA 53.45

AROGRANITE 78.85

EKC 152.85

AURIONPRO 263.75

JINDALPHOT 341.85

KOPRAN 275.80

PANACEABIO 212.05

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| CARBORUNIV | 12898 | 916.3 | 918.2 | 0.21 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| INDUSTOWER (F&O) | 50112 | 269 | 268.5 | 0.17 |

| COFORGE (F&O) | 30836 | 5202 | 5125 | 1.5 |

| RELIANCE (F&O) | 210176 | 2399 | 2363 | 1.54 |

| DRREDDY (F&O) | 32652 | 4576 | 4499 | 1.72 |

| SYNGENE (F&O) | 19113 | 579.8 | 569.9 | 1.75 |

| KOTAKBANK (F&O) | 107358 | 1937 | 1885 | 2.76 |

| TATAMTRDVR | 41881 | 254.5 | 247.3 | 2.91 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| BEL (F&O) | 44094 | 210.25 | 192.61 | 224.89 | 207.85 | 210.35 | -1.20 |

| UNICHEMLAB | 12541 | 244.14 | 225.11 | 259.89 | 242.25 | 246.70 | -1.84 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| ASHOKLEY (F&O) | 97373 | 118.27 | 132.18 | 107.69 | 119.25 | 118.75 | 0.42 |

| TRENT (F&O) | 14534 | 992.25 | 1031.50 | 961.48 | 998.00 | 992.40 | 0.56 |

| NAM-INDIA (F&O) | 15756 | 361.00 | 384.95 | 342.42 | 363.20 | 360.80 | 0.66 |

| AUROPHARMA (F&O) | 25402 | 656.64 | 688.72 | 631.58 | 661.80 | 652.00 | 1.48 |

| HINDALCO (F&O) | 82504 | 420.25 | 446.04 | 400.20 | 421.35 | 414.70 | 1.58 |

| BANDHANBNK (F&O) | 49667 | 268.14 | 288.86 | 252.14 | 271.35 | 266.85 | 1.66 |

| SUNTECK | 14143 | 425.39 | 451.34 | 405.22 | 429.50 | 421.65 | 1.83 |

| SUNTV (F&O) | 16905 | 523.27 | 551.97 | 500.89 | 527.45 | 517.65 | 1.86 |

| MOTHERSUMI (F&O) | 31856 | 210.25 | 228.65 | 196.10 | 212.85 | 208.40 | 2.09 |

| TATACOMM | 16927 | 1287.02 | 1331.58 | 1252.02 | 1292.35 | 1265.25 | 2.10 |

| COROMANDEL (F&O) | 41736 | 742.56 | 776.63 | 715.92 | 746.15 | 730.30 | 2.12 |

| DIXON (F&O) | 30296 | 5094.39 | 5181.41 | 5025.78 | 5112.10 | 5000.00 | 2.19 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ESCORTS (F&O) | 2.36% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| BEL (F&O) | 1.20% |

| INDIANB | 1.52% |

| HCG | 1.78% |

| UNICHEMLAB | 1.84% |

| BURGERKING | 1.86% |

| RAMCOCEM (F&O) | 2.03% |

| SHYAMMETL | 2.27% |

| SIEMENS (F&O) | 2.28% |

| COROMANDEL (F&O) | 2.28% |

| MOTHERSUMI (F&O) | 2.28% |

| SUNTECK | 2.44% |

| GLAXO | 2.46% |

| COLPAL (F&O) | 2.62% |

| SBIN (F&O) | 2.68% |

| TATACOMM | 2.84% |

| SUNTV (F&O) | 2.95% |

| HAL (F&O) | 2.97% |

| WELSPUNIND | 3.14% |

| KEC | 3.31% |

| KALPATPOWR | 3.35% |

| BIOCON (F&O) | 3.39% |

| NAM-INDIA (F&O) | 3.50% |

| GRASIM (F&O) | 3.57% |

| AUROPHARMA (F&O) | 3.80% |

| CUB (F&O) | 3.82% |

| TATAMOTORS (F&O) | 4.18% |

| CROMPTON | 4.33% |

| SAPPHIRE | 4.35% |

| GRANULES (F&O) | 4.37% |

| UBL (F&O) | 4.56% |

| APTUS | 4.58% |

| PHOENIXLTD | 4.60% |

| BANDHANBNK (F&O) | 4.66% |

| CHOLAFIN (F&O) | 4.92% |

| HERITGFOOD | 4.98% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

CADILAHC (F&O) Sell @ 451 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

VIPIND Buy @ 529 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

MON100

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

JKLAKSHMI

LODHA

OIL

RALLIS

ZENSARTECH

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ABSLAMC

Higher Level Consolidation

HEMIPROP

IPL

ORIENTCEM

SUMICHEM

Lower Level Consolidation

PIDILITIND (F&O)

SUVENPHAR

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ICIL

LYKALABS

TTML

GAP DOWN BREAKOUT STOCKS

COALINDIA (F&O)

DATAMATICS

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

ATULAUTO

BAJAJELEC

COLPAL (F&O)

EKC

IGL (F&O)

KOPRAN

MAXHEALTH

TAJGVK

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

GENESYS

BEARISH MARUBOZU PATTERN

JINDALPHOT

KOPRAN

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

DABUR (F&O)

GSPL

HDFCAMC (F&O)

ICICIPRULI (F&O)

INDUSINDBK (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

KDDL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

IOLCP

STAR

CREDITACC

AMARAJABAT (F&O)

AARTIDRUGS

EPL

CUB (F&O)

AUROPHARMA (F&O)

APLLTD (F&O

GRANULES (F&O)

AARTIIND (F&O

UNICHEMLAB

DHANI

GEPIL

BANDHANBNK (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

PFC (F&O)

INDIACEM

MANINFRA

IOLCP

CHOLAFIN (F&O)

TATASTEEL (F&O)

AMARAJABAT (F&O)

VIPIND

EICHERMOT (F&O)

SAIL (F&O)

ISGEC

GNFC

PRINCEPIPE

SUNTV (F&O)

ARVIND

APTUS

FINPIPE

FINOPB

HEMIPROP

MCDOWELL-N (F&O)

SHK

HINDALCO (F&O)

JINDALSTEL (F&O)

MOTHERSUMI (F&O)

DBL

GSFC

GPIL

SVPGLOB

MSTCLTD

SWSOLAR

GODREJIND

INTELLECT

AVANTIFEED

QUESS

RBLBANK (F&O)

KAJARIACER

BALRAMCHIN

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

ZEEL (F&O)

LODHA

AURUM

HINDZINC

JINDWORLD

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

AMIORG

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| NUVOCO | 521.10 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

| NDL | 100.55 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SRTRANSFIN (F&O) | 1450.15 | 1444.00 | 1453.52 | 1435.23 | 1425.78 | 1416.35 | 1406.95 |

| SIEMENS (F&O) | 2180.55 | 2173.89 | 2185.56 | 2163.33 | 2151.72 | 2140.13 | 2128.58 |

| MOIL | 169.85 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| KSCL | 500.65 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| CYBERTECH | 152.15 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| POONAWALLA | 5458182 | 216.00 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| 3IINFOLTD | 3375284 | 107.70 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| RIIL | 3361002 | 812.25 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| ELGIEQUIP | 2050455 | 304.30 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| LYKALABS | 1355591 | 199.25 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| TTML | 1344225 | 136.75 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| KEI | 1269351 | 1223.80 | 1225.00 | 1216.27 | 1233.15 | 1241.94 | 1250.76 | 1259.62 |

| JINDALSAW | 1089655 | 106.40 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| WELENT | 952862 | 100.30 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| KRSNAA | 662975 | 740.95 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| TANLA | 532241 | 1595.50 | 1600.00 | 1590.02 | 1609.21 | 1619.25 | 1629.33 | 1639.43 |

| GLOBUSSPR | 530154 | 1232.90 | 1233.77 | 1225.00 | 1241.94 | 1250.76 | 1259.62 | 1268.51 |

| AURUM | 504360 | 190.95 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| INDOCO | 467712 | 418.10 | 420.25 | 415.14 | 425.18 | 430.35 | 435.55 | 440.78 |

| AMIORG | 454654 | 981.20 | 984.39 | 976.56 | 991.75 | 999.64 | 1007.56 | 1015.51 |

| GICHSGFIN | 412023 | 151.65 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| UGROCAP | 363460 | 196.00 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| BCLIND | 362183 | 249.15 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| GLAXO | 310767 | 1780.15 | 1785.06 | 1774.52 | 1794.74 | 1805.35 | 1815.98 | 1826.65 |

| ZOTA | 274546 | 399.05 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| MFL | 204398 | 788.95 | 791.02 | 784.00 | 797.66 | 804.74 | 811.84 | 818.98 |

| EMMBI | 190750 | 103.25 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| GET&D | 150387 | 121.05 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| TATAPOWER (F&O) | 34399066 | 220.85 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| ZOMATO | 33244501 | 138.55 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| GAIL (F&O) | 24820032 | 128.85 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| NMDC (F&O) | 23988384 | 142.95 | 141.02 | 144.00 | 138.13 | 135.21 | 132.32 | 129.46 |

| IBULHSGFIN (F&O) | 22230305 | 243.75 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| TATAMOTORS (F&O) | 17473075 | 467.20 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| BHARTIARTL (F&O) | 8804487 | 697.60 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| NTPC (F&O) | 8158812 | 124.35 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| INDHOTEL (F&O) | 7362776 | 187.00 | 185.64 | 189.06 | 182.34 | 178.98 | 175.65 | 172.35 |

| DLF (F&O) | 6437207 | 376.50 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| WIPRO (F&O) | 4704953 | 624.50 | 618.77 | 625.00 | 612.87 | 606.69 | 600.55 | 594.44 |

| INDUSINDBK (F&O) | 4617346 | 915.65 | 915.06 | 922.64 | 907.97 | 900.45 | 892.96 | 885.51 |

| IRCTC (F&O) | 4473930 | 801.40 | 798.06 | 805.14 | 791.41 | 784.39 | 777.40 | 770.45 |

| BANDHANBNK (F&O) | 4460630 | 271.35 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| INFY (F&O) | 3991449 | 1695.30 | 1691.27 | 1701.56 | 1681.84 | 1671.60 | 1661.39 | 1651.22 |

| INDUSTOWER (F&O) | 3947420 | 268.50 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| CHAMBLFERT | 3945426 | 393.75 | 390.06 | 395.02 | 385.33 | 380.44 | 375.58 | 370.75 |

| REDINGTON | 3602096 | 147.20 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| DELTACORP | 3229230 | 244.50 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| TATAMTRDVR | 3135182 | 247.30 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| DEVYANI | 2953002 | 147.70 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| TECHM (F&O) | 2911781 | 1551.75 | 1550.39 | 1560.25 | 1541.33 | 1531.53 | 1521.76 | 1512.02 |

| SCI | 2768818 | 149.15 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| GODREJPROP (F&O) | 2610898 | 1961.45 | 1958.06 | 1969.14 | 1947.99 | 1936.97 | 1925.98 | 1915.02 |

| HCLTECH (F&O) | 2493755 | 1136.55 | 1130.64 | 1139.06 | 1122.81 | 1114.45 | 1106.12 | 1097.81 |