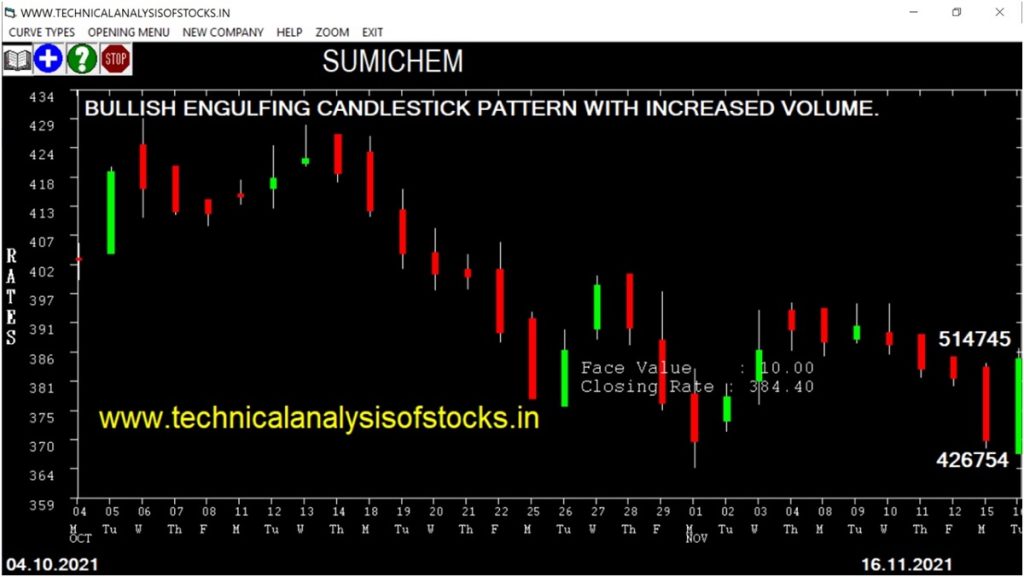

BUY SUMICHEM (NSE Symbol) Buy@ 385.15 or Above after cooling period. SIGNAL : BULLISH ENGULFING CANDLESTICK PATTERN WITH INCREASED VOLUME. Stop Loss : 361.20 Target : 404.80 (Short term)

HOT BUZZING STOCKS (17.11.2021)

NSE SYMBOL CLOSING RATE

BIGBLOC 48.20

SHARDAMOTR 729.45

SIMPLEXINF 42.90

AURUM 161.45

INDOTHAI 127.35

LFIC 131.25

63MOONS 117.60

JAIPURKURT 59.10

BARBEQUE 1533.60

BORORENEW 484.15

GLOBUSSPR 1208.15

OPTIEMUS 319.30

TANLA 1325.95

ASAL 138.95

AURIONPRO 225.30

BCG 98.90

DELTAMAGNT 70.50

JINDALPHOT 328.35

KOPRAN 245.95

SASTASUNDR 461.60

TEJASNET 463.80

TRIDENT 41.00

TTML 72.65

GOKEX 255.95

NDTV 86.45

NITINSPIN 258.05

EKC 144.75

LYKALABS 116.25

AXISCADES 85.90

APOLSINHOT 961.95

DBREALTY 44.05

IRIS 134.10

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| ZENSARTECH | 49262 | 499.00 | 499.85 | 0.17 |

| SONACOMS | 81541 | 705.40 | 712.60 | 1.01 |

| IRCTC (F&O) | 251460 | 906.45 | 921.05 | 1.59 |

| VIJAYA | 17375 | 574.90 | 590.05 | 2.57 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| IRB | 13399 | 221.30 | 218.90 | 1.10 |

| ARVIND | 20738 | 130.40 | 128.45 | 1.52 |

| PNCINFRA | 12018 | 331.95 | 324.65 | 2.25 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| TATAMTRDVR | 101178 | 293.27 | 272.39 | 310.49 | 290.25 | 292.90 | -0.91 |

| BAJAJFINSV (F&O) | 37100 | 18225.00 | 18065.67 | 18351.07 | 18209.75 | 18392.95 | -1.01 |

| KOTAKBANK (F&O) | 60874 | 2093.06 | 2037.28 | 2137.99 | 2082.85 | 2111.60 | -1.38 |

| TATAPOWER (F&O) | 279813 | 248.06 | 228.88 | 263.93 | 244.50 | 247.95 | -1.41 |

| CHEMPLASTS | 19351 | 656.64 | 625.31 | 682.17 | 653.00 | 662.50 | -1.45 |

| RELIGARE | 15634 | 172.27 | 156.33 | 185.55 | 170.70 | 174.40 | -2.17 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| OIL | 10764 | 221.27 | 240.13 | 206.74 | 222.95 | 219.35 | 1.61 |

| AXISBANK (F&O) | 180149 | 722.27 | 755.87 | 695.99 | 726.15 | 714.00 | 1.67 |

| AUROPHARMA (F&O) | 30570 | 682.52 | 715.20 | 656.97 | 686.80 | 673.75 | 1.90 |

| DIVISLAB (F&O) | 33662 | 4847.64 | 4932.59 | 4780.65 | 4852.60 | 4747.80 | 2.16 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| TATAPOWER (F&O) | 1.41% |

| WHIRLPOOL | 1.72% |

| DRREDDY (F&O) | 2.08% |

| SUNPHARMA (F&O) | 2.95% |

| AUBANK (F&O) | 3.38% |

| AUROPHARMA (F&O) | 3.89% |

| BRIGADE | 4.60% |

| ULTRACEMCO (F&O) | 4.90% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| BORORENEW | 0.71% |

| TATAMTRDVR | 0.91% |

| BAJAJFINSV (F&O) | 1.01% |

| BSOFT | 1.12% |

| SANDHAR | 1.30% |

| CHEMPLASTS | 1.45% |

| AUBANK (F&O) | 1.49% |

| BRIGADE | 1.74% |

| EXIDEIND (F&O) | 2.13% |

| TATACHEM (F&O) | 2.15% |

| KOTAKBANK (F&O) | 2.15% |

| RELIGARE | 2.17% |

| HOMEFIRST | 2.31% |

| LALPATHLAB (F&O) | 2.39% |

| HCLTECH (F&O) | 2.41% |

| EICHERMOT (F&O) | 2.46% |

| CUMMINSIND (F&O) | 2.52% |

| LUPIN (F&O) | 2.52% |

| OIL | 2.71% |

| JAMNAAUTO | 3.26% |

| SRTRANSFIN (F&O) | 3.51% |

| ZENTEC | 3.60% |

| SBICARD | 3.63% |

| WOCKPHARMA | 3.73% |

| DIVISLAB (F&O) | 3.86% |

| ORIENTELEC | 3.90% |

| RUPA | 4.42% |

| RBLBANK (F&O) | 4.55% |

| JUBLINGREA | 4.59% |

| SUNPHARMA (F&O) | 4.70% |

| PARAS | 4.81% |

| GLOBUSSPR | 4.93% |

| AXISBANK (F&O) | 4.94% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ASTRAL (F&O)

DEVYANI

DHANI

KIRIINDUS

KSCL

MANINDS

SHREYAS

SUULD

XCHANGING

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

COFORGE (F&O)

POONAWALLA

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

GLOBUSSPR

SUMICHEM

BEARISH ENGULFING

DRREDDY (F&O)

NTPC (F&O)

PHOENIXLTD

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

GLOBUSSPR

KOPRAN

NITINSPIN

SHARDAMOTR

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ASAL

AURIONPRO

AURUM

BEARISH BELLHOLD PATTERN

AKASH

HINDPETRO (F&O)

IZMO

VOLTAS (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

ASIANTILES

VERTOZ

BLISSGVS

UJJIVAN

STAR

IOLCP

APLLTD (F&O)

BIOCON (F&O)

RAMCOSYS

JUBLPHARMA

AARTIDRUGS

GRANULES (F&O)

AMARAJABAT (F&O)

CREDITACC

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

DEEPAKFERT

TORNTPHARM (F&O)

ABSLAMC

INDUSINDBK (F&O)

EQUITAS

HDFCAMC (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

EICHERMOT (F&O)

GREENPLY

RELIGARE

PIDILITIND (F&O)

MPHASIS (F&O)

MASTEK

MANINFRA

VIPIND

DIXON (F&O)

SONACOMS

SONATSOFTW

TATAMTRDVR

MAXHEALTH

SUNTECK

HOMEFIRST

KANSAINER

BRIGADE

LAOPALA

TATAPOWER (F&O)

LT (F&O)

JUBLFOOD (F&O)

CUMMINSIND (F&O)

SUPRAJIT

PRINCEPIPE

APTUS

MINDTREE (F&O)

DMART

KEI

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

BALAMINES

CYIENT

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

CIGNITITEC

FLUOROCHEM

INDIACEM

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

HINDALCO (F&O)