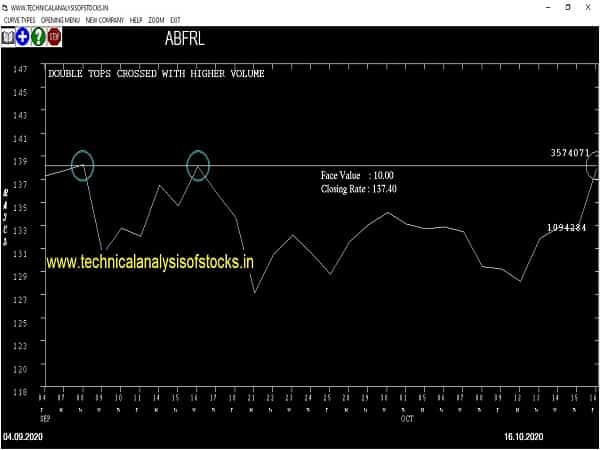

BUY ABFRL (NSE Symbol) Buy Above 138.05 after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 123.85 Target : 150 (Short term)

HOT BUZZING STOCKS (19.10.2020)

NSE SYMBOL CLOSING RATE

REFEX 53.40

ALPA 47.60

ASHAPURMIN 78.95

KOPRAN 107.85

INDSWFTLAB 51.25

SAGARDEEP 60.20

FMGOETZE 339.70

Strategy : TRIANGLE PATTERN (Intraday/Short term)

SRIPIPES Sell @ 109 or Below

BEML Sell @ 599 or Below

Strategy : INSIDE CANDLES(Intraday/Short term)

CROMPTON Buy @ 285 or Above

KEC Sell @ 325 or Below

HEXAWARE Sell @ 466 or Below

DMART Sell @ 1965 or Below

Strategy : NR4/NR7 BREKOUT (EITHER WAY) INTRADAY

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BFUTILITIE

FORTIS

GRSE

IBULHSGFIN (F&O)

TRENT

WATERBASE

PREVIOUS 6TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

MAJESCO

VGUARD

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

ALLCARGO

DABUR (F&O)

ESSELPACK

HEXAWARE

INFIBEAM

IRCTC

JINDALSAW

PIDILITIND (F&O)

PNCINFRA

UBL (F&O)

Higher Level Consolidation

HEXAWARE

VGUARD

Lower Level Consolidation

ALLCARGO

BAJAJ-AUTO (F&O)

BRITANNIA (F&O)

BSE

HDFCLIFE (F&O)

HEG

HEXAWARE

IRCON

IRCTC

NAM-INDIA

ORIENTCEM

PIDILITIND (F&O)

RAIN

SUMICHEM

TATAPOWER (F&O

Strategy : BREAK OUT STOCKS

GAP UP BREAKOUT STOCKS

AMBER

VISHAL

VOLTAS (F&O)

GAP DOWN BREAKOUT STOCKS

UPL (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

NIL

Strategy : MARUBOZU PATTERN STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELL HOLD PATTERN STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AARTIIND

ADANIGAS

CENTURYPLY

SELL RECOMMENDATION IF THE MARKET IS BEARISH

GODREJCP (F&O)

MARUTI (F&O)

VBL

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| IEX | 195.00 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| INOXLEISUR | 273.05 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| APOLLOHOSP (F&O) | 2210.55 | 2220.77 | 2209.00 | 2231.45 | 2243.27 | 2255.12 | 2267.01 |

| VGUARD | 167.05 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| BAJAJFINSV (F&O) | 5952.30 | 5967.56 | 5948.27 | 5983.90 | 6003.25 | 6022.63 | 6042.04 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| IRCTC | 1328.10 | 1323.14 | 1332.25 | 1314.72 | 1305.67 | 1296.65 | 1287.66 |

| GUJGASLTD | 291.80 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| AVANTIFEED | 501.85 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| SBILIFE (F&O) | 799.55 | 798.06 | 805.14 | 791.41 | 784.39 | 777.40 | 770.45 |

| HDFCLIFE (F&O) | 561.15 | 558.14 | 564.06 | 552.53 | 546.66 | 540.83 | 535.03 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| BPCL (F&O) | 13453185 | 339.95 | 342.25 | 337.64 | 346.72 | 351.39 | 356.09 | 360.82 |

| VOLTAS (F&O) | 8434698 | 700.50 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| PHILIPCARB | 3843725 | 135.85 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| ABFRL | 3574071 | 137.40 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| CYIENT | 3027553 | 389.50 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

| WELCORP | 2212301 | 115.15 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| PARAGMILK | 1251114 | 110.65 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| KAJARIACER | 1224076 | 533.15 | 534.77 | 529.00 | 540.29 | 546.12 | 551.97 | 557.86 |

| GPPL | 1176261 | 90.85 | 92.64 | 90.25 | 95.01 | 97.47 | 99.95 | 102.46 |

| AMBER | 833678 | 2180.65 | 2185.56 | 2173.89 | 2196.17 | 2207.90 | 2219.66 | 2231.45 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ZEEL (F&O) | 29518941 | 175.70 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| UPL (F&O) | 22982753 | 466.95 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| MINDTREE (F&O) | 9049480 | 1329.15 | 1323.14 | 1332.25 | 1314.72 | 1305.67 | 1296.65 | 1287.66 |

| ROUTE | 3319561 | 708.40 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| IOLCP | 504305 | 700.65 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

| MASTEK | 224594 | 803.30 | 798.06 | 805.14 | 791.41 | 784.39 | 777.40 | 770.45 |