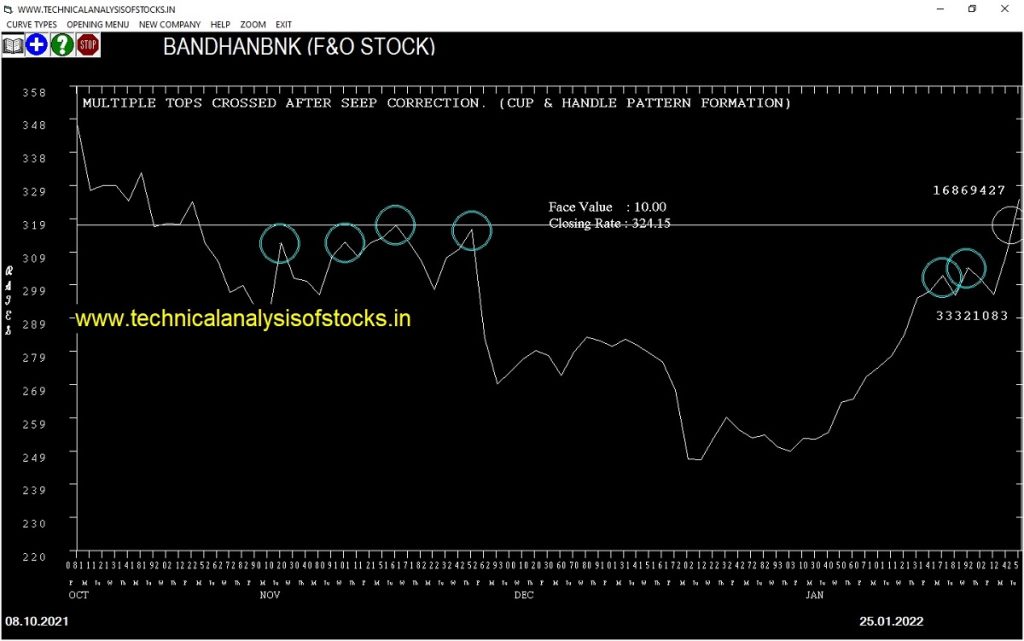

BUY BANDHANBNK (NSE Symbol) Buy @ 328.50 or Above after cooling period. SIGNAL : MULTIPLE TOPS CROSSED AFTER STEEP CORRECTION. (CUP & HANDLE PATTERN FORMATION). Stop Loss : 306.40 Target : 346.70 (Short term)

HOT BUZZING STOCKS (27.01.2022)

NSE SYMBOL CLOSING RATE

SALONA 327.00

SHARDACROP 525.35

KHAICHEM 107.35

GLOBAL 88.15

KOTHARIPET 103.65

ZOMATO 100.45

SIGIND 60.35

KPIGLOBAL 451.65

MFL 880.65

AURUM 144.15

GAEL 189.30

GULPOLY 398.35

ISFT 215.70

MARSHALL 53.65

PALREDTEC 289.40

RUSHIL 339.50

BIGBLOC 75.05

CGPOWER 181.50

GODHA 71.05

KELLTONTEC 111.05

NETWORK18 78.00

BGRENERGY 94.05

DIGJAMLMTD 289.00

GENESYS 391.50

NAZARA 2267.20

LUXIND 2813.70

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

|---|---|---|---|---|

| ICICIPRULI (F&O) | 56514 | 565.00 | 556.25 | 1.57 |

| TIINDIA | 20780 | 1748.40 | 1692.50 | 3.30 |

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| JINDWORLD | 40462 | 328.52 | 306.40 | 346.72 | 324.40 | 327.85 | -1.06 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| APARINDS | 2.11% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| JINDWORLD | 1.06% |

| PSPPROJECT | 3.39% |

| IPCALAB (F&O) | 3.78% |

| VEDL (F&O) | 3.90% |

| SPARC | 3.97% |

| KALPATPOWR | 4.44% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

FSL (F&O) Buy @ 156.25 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

SBILIFE (F&O)

SHOPERSTOP

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

ARCHIDPLY

BGRENERGY

DEEPAKNTR (F&O)

DONEAR

EKC

FOODSIN

GENESYS

IGPL

INDIAMART (F&O)

IZMO

KELLTONTEC

LUXIND

NAZARA

NETWORK18

PNBHOUSING

QUICKHEAL

RAMCOCEM (F&O)

RTNINDIA

SHEMAROO

SSWL

TANLA

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

CANFINHOME (F&O)

CUMMINSIND (F&O)

GANESHBE

NUCLEUS

POWERINDIA

SHK

UPL (F&O)

BEARISH ENGULFING PATTERN

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

GULPOLY

RUSHIL

SHARDACROP

BEARISH MARUBOZU PATTERN

LUXIND

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

AURUM

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

POWERINDIA

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

,APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL,

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

HDFCAMC (F&O)

AMBUJACEM (F&O)

GABRIEL

TATAMETALI

IEX (F&O)

HINDZINC

PAYTM

PEL (F&O)

BAJAJELEC

HEIDELBERG

GNA

GOCOLORS

DEVYANI

LAOPALA

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

CHOLAFIN (F&O)

ADANIGREEN

METROBRAND

TINPLATE

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ALLSEC

CGPOWER

PODDARMENT

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| TNPL | 119.20 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| ICICIBANKN | 376.35 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| GICRE | 133.75 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| BIRLACORPN | 1358.25 | 1359.77 | 1350.56 | 1368.32 | 1377.58 | 1386.87 | 1396.19 |

| UTIAMC | 982.90 | 984.39 | 976.56 | 991.75 | 999.64 | 1007.56 | 1015.51 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| RAMCOIND | 243.80 | 240.25 | 244.14 | 236.51 | 232.68 | 228.88 | 225.11 |

| FOODSIN | 106.40 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| AVANTIFEED | 611.25 | 606.39 | 612.56 | 600.55 | 594.44 | 588.36 | 582.31 |

| CADILAHC (F&O) | 395.65 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| SSWL | 712.30 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 39449718 | 238.80 | 240.25 | 236.39 | 244.02 | 247.94 | 251.89 | 255.87 |

| TATAMOTORS (F&O) | 22565698 | 490.55 | 495.06 | 489.52 | 500.39 | 506.00 | 511.63 | 517.30 |

| SBIN (F&O) | 21791739 | 514.65 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| POWERGRID (F&O) | 20541777 | 218.85 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| RBLBANK (F&O) | 19128754 | 144.00 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| BHARTIARTL (F&O) | 14128764 | 711.85 | 715.56 | 708.89 | 721.90 | 728.64 | 735.40 | 742.19 |

| GAIL (F&O) | 11055193 | 143.75 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| NTPC (F&O) | 10007486 | 135.30 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| BEL (F&O) | 9906114 | 204.20 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| IBREALEST | 9501288 | 150.45 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| ADANIPOWER | 9094276 | 107.15 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| DLF (F&O) | 7324240 | 380.25 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| COALINDIA (F&O) | 7267866 | 161.15 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| INDUSINDBK (F&O) | 5165597 | 884.25 | 885.06 | 877.64 | 892.07 | 899.55 | 907.06 | 914.60 |

| MANAPPURAM (F&O) | 5135410 | 153.05 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| HINDCOPPER | 5118615 | 124.65 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| IRCTC (F&O) | 5090144 | 829.90 | 833.77 | 826.56 | 840.58 | 847.84 | 855.13 | 862.46 |

| BPCL (F&O) | 4952650 | 382.55 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| INDIACEM (F&O) | 4718064 | 218.60 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| DELTACORP (F&O) | 4587378 | 277.35 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| SBICARD (F&O) | 4184737 | 850.00 | 855.56 | 848.27 | 862.46 | 869.81 | 877.20 | 884.62 |

| HINDPETRO (F&O) | 4044653 | 311.35 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| BSOFT (F&O) | 4044257 | 461.10 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| ABCAPITAL | 3656617 | 117.70 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| BOMDYEING | 3340102 | 104.40 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| GREAVESCOT | 6396152 | 201.85 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| MOTHERSUMI (F&O) | 5660887 | 176.10 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| SONACOMS | 3610984 | 627.25 | 625.00 | 631.27 | 619.08 | 612.87 | 606.69 | 600.55 |

| NYKAA | 3607291 | 1660.65 | 1660.56 | 1670.77 | 1651.22 | 1641.07 | 1630.96 | 1620.87 |

| RAMCOCEM (F&O) | 2679672 | 860.80 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| NIITLTD | 2622188 | 387.60 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| JAMNAAUTO | 2615025 | 105.75 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| KELLTONTEC | 2112385 | 111.05 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| DHANI | 1970080 | 136.35 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| ICICIPRULI (F&O) | 1496614 | 556.25 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| MFSL (F&O) | 1198055 | 884.85 | 877.64 | 885.06 | 870.69 | 863.32 | 855.99 | 848.69 |

| SOBHA | 1184660 | 860.25 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |

| TRENT (F&O) | 866941 | 1079.35 | 1072.56 | 1080.77 | 1064.92 | 1056.78 | 1048.66 | 1040.58 |

| ASTRAL (F&O) | 772069 | 2112.20 | 2104.52 | 2116.00 | 2094.11 | 2082.68 | 2071.29 | 2059.92 |

| EKC | 746524 | 227.55 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| TANLA | 695556 | 1740.50 | 1732.64 | 1743.06 | 1723.11 | 1712.75 | 1702.41 | 1692.11 |

| VBL | 692777 | 872.70 | 870.25 | 877.64 | 863.32 | 855.99 | 848.69 | 841.42 |

| MINDAIND | 593542 | 1023.60 | 1016.02 | 1024.00 | 1008.57 | 1000.64 | 992.75 | 984.88 |

| CYBERTECH | 565385 | 189.10 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| PIIND (F&O) | 560760 | 2427.90 | 2425.56 | 2437.89 | 2414.47 | 2402.20 | 2389.96 | 2377.75 |

| PNBHOUSING | 514776 | 418.35 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| ROUTE | 502550 | 1567.85 | 1560.25 | 1570.14 | 1551.17 | 1541.33 | 1531.53 | 1521.76 |

| LAOPALA | 482463 | 376.35 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| ELGIEQUIP | 451442 | 319.20 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| QUICKHEAL | 435612 | 207.85 | 206.64 | 210.25 | 203.16 | 199.62 | 196.10 | 192.61 |