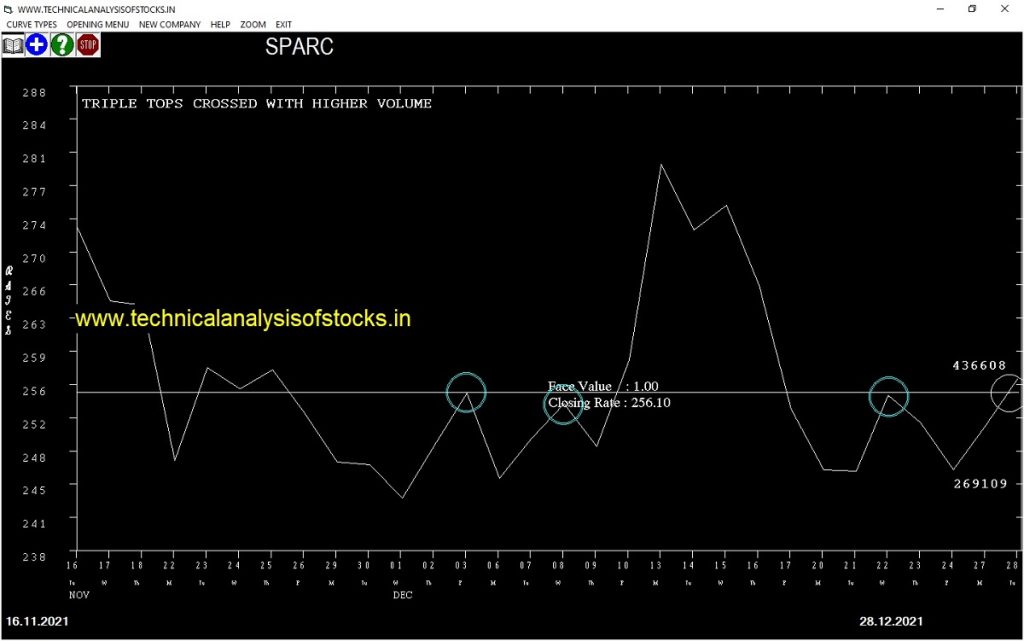

BUY SPARC (NSE Symbol) Buy@ 260 or Above after cooling period. SIGNAL : TRIPLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 240.35 Target : 276.25 (Short term)

HOT BUZZING STOCKS (29.12.2021)

NSE SYMBOL CLOSING RATE

HINDCON 70.20

JUBLINDS 643.25

ALPHAGEO 389.30

DPABHUSHAN 413.20

ELECTHERM 141.95

UNIENTER 142.85

SHIVAMILLS 131.55

HBSL 44.80

BARBEQUE 1324.80

GOKEX 342.10

KILITCH 221.10

DPWIRES 227.40

INDIANCARD 258.20

JISLJALEQS 42.40

KOTHARIPRO 99.60

SMARTLINK 188.85

DAMODARIND 61.20

RAMASTEEL 257.70

PREMIERPOL 100.00

63MOONS 217.50

AURIONPRO 274.25

KOPRAN 352.85

AURUM 163.00

GOODLUCK 354.45

IRB 212.35

RTNINDIA 48.35

MINDTECK 184.45

SERVOTECH 65.40

NAHARINDUS 121.50

TRIDENT 53.90

AARVI 99.55

DIGISPICE 48.90

TEXMOPIPES 72.35

HUBTOWN 57.55

MARALOVER 102.75

MARATHON 113.35

ISMTLTD 67.50

Strategy : TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF | |

| JUBLINGREA | 16164 | 547.40 | 548.20 | 0.15 | |

| CARERATING | 10511 | 603.05 | 604.60 | 0.26 | |

| HDFCAMC (F&O) | 13696 | 2397.00 | 2417.90 | 0.86 | |

| MPHASIS (F&O) | 43047 | 3247.85 | 3329.85 | 2.46 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| AUBANK (F&O) | 34476 | 996.30 | 986.10 | 1.03 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| MFSL (F&O) | 19628 | 976.56 | 938.36 | 1007.56 | 969.50 | 970.00 | -0.05 |

| BPCL (F&O) | 40129 | 385.14 | 361.18 | 404.81 | 380.40 | 380.85 | -0.12 |

| RAMCOSYS | 11303 | 484.00 | 457.12 | 506.00 | 483.00 | 483.70 | -0.14 |

| OIL | 20740 | 189.06 | 172.35 | 202.96 | 187.00 | 187.40 | -0.21 |

| MOTILALOFS | 10319 | 930.25 | 892.96 | 960.52 | 928.65 | 933.55 | -0.53 |

| BSE | 107675 | 1936.00 | 1882.33 | 1979.26 | 1934.00 | 1944.70 | -0.55 |

| TALBROAUTO | 12546 | 405.02 | 380.44 | 425.18 | 404.65 | 406.90 | -0.56 |

| SBIN (F&O) | 111561 | 462.25 | 435.98 | 483.76 | 461.20 | 464.00 | -0.61 |

| HEROMOTOCO (F&O) | 23619 | 2425.56 | 2365.57 | 2473.82 | 2417.80 | 2435.00 | -0.71 |

| HDFC (F&O) | 64656 | 2575.56 | 2513.77 | 2625.25 | 2565.35 | 2594.00 | -1.12 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| WOCKPHARMA | 10268 | 390.06 | 414.93 | 370.75 | 393.30 | 388.50 | 1.22 |

| SUNTV (F&O) | 14474 | 489.52 | 517.30 | 467.87 | 491.90 | 483.30 | 1.75 |

| POLICYBZR | 35762 | 968.77 | 1007.56 | 938.36 | 969.80 | 950.00 | 2.04 |

| MOTILALOFS | 10319 | 922.64 | 960.52 | 892.96 | 928.65 | 908.20 | 2.20 |

| REDINGTON | 20441 | 144.00 | 159.31 | 132.32 | 144.95 | 141.70 | 2.24 |

| HDFCLIFE (F&O) | 41964 | 637.56 | 669.18 | 612.87 | 642.30 | 627.00 | 2.38 |

| TORNTPOWER (F&O) | 17263 | 540.56 | 569.73 | 517.82 | 544.95 | 531.45 | 2.48 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HEROMOTOCO (F&O) | 0.71% |

| NTPC (F&O) | 1.09% |

| HDFC (F&O) | 1.12% |

| MGL (F&O) | 1.54% |

| OIL | 1.60% |

| SPANDANA | 1.76% |

| HDFCLIFE (F&O) | 1.82% |

| ACC (F&O) | 2.25% |

| RAIN | 2.44% |

| CUB (F&O) | 3.48% |

| GABRIEL | 3.69% |

| SUNTV (F&O) | 3.97% |

| SIGACHI | 4.28% |

| WOCKPHARMA | 4.35% |

| IBULHSGFIN (F&O) | 4.63% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MFSL (F&O) | 0.05% |

| BPCL (F&O) | 0.12% |

| RAMCOSYS | 0.14% |

| IOC (F&O) | 0.18% |

| OIL | 0.21% |

| HDFCLIFE (F&O) | 0.26% |

| RELIANCE (F&O) | 0.40% |

| BSE | 0.55% |

| TALBROAUTO | 0.56% |

| TORNTPOWER (F&O) | 0.60% |

| SBIN (F&O) | 0.61% |

| ACC (F&O) | 1.29% |

| REDINGTON | 1.52% |

| NMDC (F&O) | 1.58% |

| GODREJPROP (F&O) | 1.62% |

| VGUARD | 1.85% |

| DALBHARAT (F&O) | 2.10% |

| ZOMATO | 2.18% |

| MOTILALOFS | 2.19% |

| TEGA | 2.21% |

| CDSL | 2.58% |

| IBULHSGFIN (F&O) | 2.61% |

| WOCKPHARMA | 2.90% |

| GRAPHITE | 3.19% |

| BURGERKING | 3.43% |

| RIIL | 3.44% |

| ANGELONE | 3.56% |

| SONACOMS | 3.63% |

| POLICYBZR | 3.63% |

| BANDHANBNK (F&O) | 4.04% |

| SRTRANSFIN (F&O) | 4.26% |

| MAHLIFE | 4.80% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

KEC Sell @ 463 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

HDFCBANK (F&O) Buy @ 14630 or Above

MARICO (F&O) Buy @ 506.25 or Above

HINDUNILVR (F&O) Buy @ 2316 or Above

TCS (F&O) Sell @ 3705.75 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ASTERDM

CONCOR (F&O)

GODREJAGRO

HEMIPROP

IOC (F&O)

LUPIN (F&O)

M&MFIN (F&O)

PAYTM

PERSISTENT (F&O)

POKARNA

SAIL (F&O)

TATACOMM

UBL (F&O)

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

IIFLWAM

INDUSTOWER (F&O)

MINDTECK

SHALBY

WIPRO (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

HINDUNILVR (F&O)

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

63MOONS

BSE

CDSL

DEEPAKNTR (F&O)

EICHERMOT (F&O)

GAIL (F&O)

HINDCOPPER

HINDOILEXP

INFY (F&O)

INOXWIND

IOC (F&O)

IRCTC (F&O)

KOPRAN

KPITTECH

MPHASIS (F&O)

NIITLTD

OIL

ONGC (F&O)

PRSMJOHNSN

SHYAMMETL

TATACHEM (F&O)

TATAMOTORS (F&O)

TATAPOWER (F&O)

TRIVENI

WIPRO (F&O)

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

KILITCH

SBCL

ZUARIGLOB

BEARISH ENGULFING

GLOBAL

ISMTLTD

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

ALPHAGEO

DPABHUSHAN

GOKEX

IRB

KOPRAN

TEXMOPIPES

TRIDENT

UNIENTER

BEARISH MARUBOZU PATTERN

GLOBAL

ISMTLTD

MARATHON

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ELECTHERM

GANESHHOUC

HINDCON

JUBLINDS

KILITCH

NAHARINDUS

RAMASTEEL

SHIVAMILLS

ULTRACEMCO (F&O)

BEARISH BELLHOLD PATTERN

NUVOCO

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

TRIGYN

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

ASIANTILES

STAR (F&O)

BLISSGVS

SPANDANA

IOLCP

GULFOILLUB

BANDHANBNK (F&O

JUBLPHARMA

AMARAJABAT (F&O)

AARTIDRUGS

INDOSTAR

DFMFOODS

APLLTD (F&O)

HEROMOTOCO (F&O

EPL

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

STARHEALTH

SRTRANSFIN (F&O)

POLICYBZR

INDUSTOWER (F&O)

JUBLFOOD (F&O)

AARTIDRUGS

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

BAJAJELEC

KEC

MINDAIND

WIPRO (F&O)

TECHM (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ACRYSIL

AMIORG

EIDPARRY

GRAPHITE

HEG

IRB

JINDALPOLY

JUBLINGREA

OIL

QUESS

RAIN

REDINGTON

SONACOMS

TARSONS

TRITURBINE

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

WATERBASE

STAR (F&O)

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CIPLA (F&O) | 933.30 | 937.89 | 930.25 | 945.09 | 952.79 | 960.52 | 968.28 |

| TORNTPOWER (F&O) | 544.95 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| HINDALCO (F&O) | 458.15 | 462.25 | 456.89 | 467.41 | 472.83 | 478.28 | 483.76 |

| CANBK (F&O) | 197.85 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| JKLAKSHMI | 570.15 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HERITGFOOD | 400.00 | 400.00 | 405.02 | 395.21 | 390.26 | 385.33 | 380.44 |

| KITEX | 192.95 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| TNPETRO | 103.35 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| ASAHIINDIA | 464.30 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| ZENTEC | 216.75 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| RBLBANK (F&O) | 63398730 | 145.70 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| IRCTC (F&O) | 8220616 | 863.50 | 870.25 | 862.89 | 877.20 | 884.62 | 892.07 | 899.55 |

| BSOFT (F&O) | 6030178 | 540.00 | 540.56 | 534.77 | 546.12 | 551.97 | 557.86 | 563.78 |

| SUNPHARMA (F&O) | 5477769 | 815.10 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| INDHOTEL (F&O) | 4824090 | 182.80 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| DEVYANI | 4279356 | 171.75 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| WELSPUNIND | 3617861 | 148.95 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| EXIDEIND (F&O) | 3543245 | 168.45 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| CUB (F&O) | 3504063 | 135.10 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| KPITTECH | 3277276 | 581.20 | 582.02 | 576.00 | 587.77 | 593.84 | 599.95 | 606.09 |

| WEBELSOLAR | 3079941 | 123.25 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| TATAMTRDVR | 2669705 | 236.35 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| ITI | 2553588 | 122.85 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| AMBUJACEM (F&O) | 2526008 | 380.20 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| APOLLOTYRE (F&O) | 2419860 | 215.05 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| WELCORP | 2354794 | 179.00 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| INDIANB | 2234026 | 141.00 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| SEQUENT | 2009976 | 162.80 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| GSFC | 1913295 | 122.10 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| DEEPAKNTR (F&O) | 1858822 | 2442.35 | 2450.25 | 2437.89 | 2461.41 | 2473.82 | 2486.27 | 2498.75 |

| RAIN | 1851608 | 206.95 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| BALRAMCHIN | 1677868 | 343.00 | 346.89 | 342.25 | 351.39 | 356.09 | 360.82 | 365.58 |

| M&M (F&O) | 1677680 | 838.70 | 841.00 | 833.77 | 847.84 | 855.13 | 862.46 | 869.81 |

| TATACHEM (F&O) | 1673007 | 907.65 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| STEELXIND | 1669022 | 175.80 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| FSL (F&O) | 5631899 | 180.75 | 178.89 | 182.25 | 175.65 | 172.35 | 169.08 | 165.85 |

| BLISSGVS | 3443114 | 110.30 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| TATACOFFEE | 2869999 | 212.35 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| PVR (F&O) | 2398260 | 1285.20 | 1278.06 | 1287.02 | 1269.78 | 1260.88 | 1252.02 | 1243.18 |

| GATI | 2071004 | 192.25 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| MAXHEALTH | 1533898 | 415.05 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| RELIGARE | 1315012 | 127.70 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| LYKALABS | 1305279 | 229.30 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| GRAVITA | 1257163 | 285.85 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| BORORENEW | 1148550 | 596.20 | 594.14 | 600.25 | 588.36 | 582.31 | 576.29 | 570.30 |

| CAMLINFINE | 793093 | 118.55 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| TRIGYN | 657296 | 154.60 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| SHALPAINTS | 636022 | 111.00 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| MEDPLUS | 556747 | 1002.65 | 1000.14 | 1008.06 | 992.75 | 984.88 | 977.05 | 969.25 |

| ASIANTILES | 352383 | 147.95 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| ACE | 336779 | 218.65 | 217.56 | 221.27 | 214.00 | 210.36 | 206.74 | 203.16 |

| MARALOVER | 189370 | 102.75 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| VSSL | 179699 | 247.65 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |