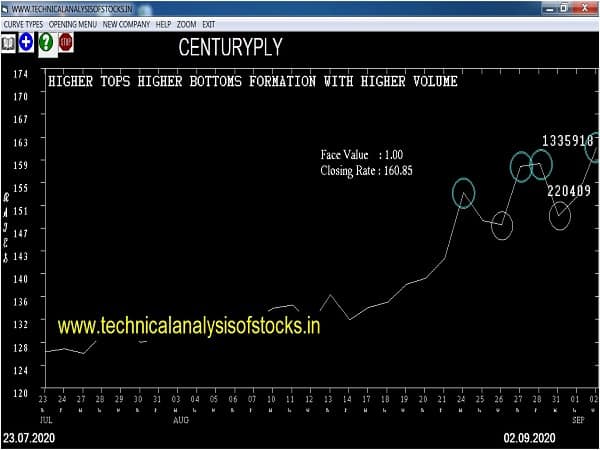

BUY CENTURYPLY (NSE Code) Buy Above 162.55 after cooling period. SIGNAL : HIGHER TOPS HIGHER BOTTOMS FORMATION WITH HIGHER VOLUME. Stop Loss : 147.10 Target : 175.45 (Short term)

HOT BUZZING STOCKS (03.09.2020)

NSE SYMBOL CLOSING RATE

WORTH 48.15

ADANIGREEN 544.10

AARTIDRUGS 2923.60

WELSPUNIND 55.65

KIOCL 134.60

RAMCOSYS 249.50

ESTER 67.40

SCHAND 79.05

BLS 98.15

KOPRAN 68.90

ASHAPURMIN 63.70

OPTIEMUS 49.80

FSC 158.50

SORILINFRA 63.85

TANLA 206.70

FLFL 140.65

FRETAIL 131.55

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES (Intraday/Short term)

NIL

Strategy : NR4 BREKOUT (EITHER WAY) INTRADAY

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

APOLLOTYRE (F&O)

AUROPHARMA (F&O)

BAJAJFINSV (F&O)

CIPLA (F&O)

COROMANDEL

DCMSHRIRAM

IBULHSGFIN (F&O)

IOLCP

KOTAKBANK (F&O)

TITAN (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

WIPRO (F&O)

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAK OUT STOCKS

GAP UP BREAKOUT STOCKS

ADANIGREEN

SBILIFE (F&O)

GAP DOWN BREAKOUT STOCKS

FLFL

FRETAIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

FSC

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELL HOLD PATTERN STOCKS

BULLISH BELLHOLD PATTERN

ADANIGREEN

TATACONSUM (F&O)

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL (W & M Patterns) (INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

RESPONIND

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

APOLLOHOSP (F&O)

BEL (F&O)

IRB

SWANENERGY

TCS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CENTURYPLY

GODREJPROP (F&O)

JAICORPLTD

JYOTHYLAB

MARUTI (F&O)

TATASTEEL (F&O)

TITAN (F&O)

TVSMOTOR (F&O)

VOLTAS (F&O)

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BALKRISIND (F&O) | 1319.85 | 1323.14 | 1314.06 | 1331.58 | 1340.72 | 1349.89 | 1359.09 |

| VGUARD | 169.85 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| CHOLAFIN (F&O) | 242.70 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| BRITANNIA (F&O) | 3799.20 | 3813.06 | 3797.64 | 3826.60 | 3842.08 | 3857.59 | 3873.12 |

| TITAN (F&O) | 1121.30 | 1122.25 | 1113.89 | 1130.08 | 1138.49 | 1146.94 | 1155.42 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| THERMAX | 773.65 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |

| CENTURYTEX | 332.70 | 328.52 | 333.06 | 324.16 | 319.68 | 315.22 | 310.80 |

| POWERINDIA | 905.90 | 900.00 | 907.52 | 892.96 | 885.51 | 878.08 | 870.69 |

| CEATLTD | 890.30 | 885.06 | 892.52 | 878.08 | 870.69 | 863.32 | 855.99 |

| BERGEPAINT (F&O) | 554.60 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ZEEL (F&O) | 64987080 | 218.15 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| ADANIENT (F&O) | 17406700 | 293.05 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| CDSL | 13126221 | 483.30 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| ADANIGAS | 5335439 | 189.95 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| HEXAWARE | 3534579 | 413.50 | 415.14 | 410.06 | 420.04 | 425.18 | 430.35 | 435.55 |

| ALEMBICLTD | 3223471 | 94.60 | 95.06 | 92.64 | 97.47 | 99.95 | 102.46 | 105.01 |

| JUBLFOOD (F&O) | 3116086 | 2250.75 | 2256.25 | 2244.39 | 2267.01 | 2278.92 | 2290.87 | 2302.85 |

| UBL (F&O) | 3099043 | 1084.50 | 1089.00 | 1080.77 | 1096.72 | 1105.01 | 1113.33 | 1121.69 |

| BSE | 2398454 | 541.05 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| JMFINANCIL | 2135233 | 79.70 | 81.00 | 78.77 | 83.22 | 85.52 | 87.85 | 90.20 |

| ROSSARI | 2095168 | 815.75 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| STAR | 1581623 | 611.75 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| TORNTPHARM (F&O) | 1338343 | 2761.80 | 2769.39 | 2756.25 | 2781.17 | 2794.37 | 2807.60 | 2820.85 |

| CENTURYPLY | 1335918 | 160.85 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| IEX | 1276588 | 193.00 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| INDIAMART | 972053 | 4561.80 | 4573.14 | 4556.25 | 4587.77 | 4604.71 | 4621.69 | 4638.70 |

| NAUKRI (F&O) | 731658 | 3473.75 | 3481.00 | 3466.27 | 3494.02 | 3508.81 | 3523.63 | 3538.48 |

| CSBBANK | 587310 | 234.55 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| SATIN | 416792 | 77.10 | 78.77 | 76.56 | 80.96 | 83.22 | 85.52 | 87.85 |

| MAHEPC | 340280 | 168.75 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| POLYMED | 326192 | 434.45 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| HEIDELBERG | 322717 | 187.50 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| GUJALKALI | 281258 | 356.85 | 361.00 | 356.27 | 365.58 | 370.38 | 375.20 | 380.06 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| HEROMOTOCO (F&O) | 2809547 | 2943.55 | 2943.06 | 2956.64 | 2930.98 | 2917.46 | 2903.97 | 2890.51 |

| BAJAJ-AUTO (F&O) | 1946354 | 2880.55 | 2875.64 | 2889.06 | 2863.68 | 2850.32 | 2836.98 | 2823.68 |

| CAMLINFINE | 1092388 | 88.60 | 87.89 | 90.25 | 85.61 | 83.31 | 81.04 | 78.81 |

| KALPATPOWR | 847743 | 254.65 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| ORIENTELEC | 756395 | 198.55 | 196.00 | 199.52 | 192.61 | 189.16 | 185.73 | 182.34 |

| GPPL | 488574 | 79.00 | 78.77 | 81.00 | 76.60 | 74.43 | 72.29 | 70.18 |