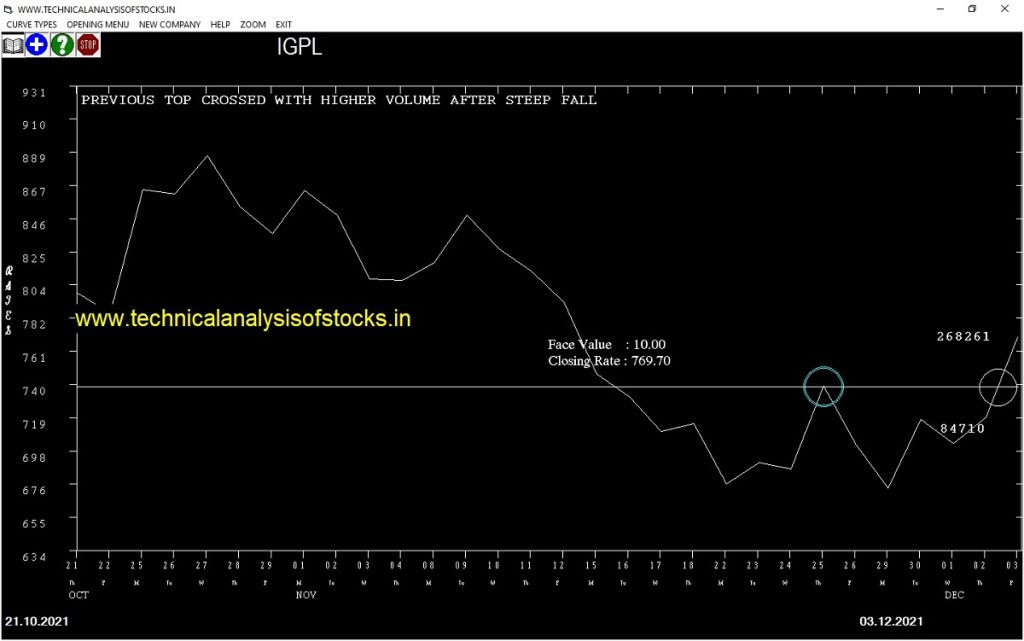

BUY IGPL (NSE Symbol) Buy@ 770 or Above after cooling period. SIGNAL : PREVIOUS TOP CROSSED WITH HIGHER VOLUME AFTER STEEP FALL. Stop Loss : 736.15 Target : 797.65 (Short term)

HOT BUZZING STOCKS (06.12.2021)

NSE SYMBOL CLOSING RATE

RAMCOSYS 470.40

UNIVPHOTO 654.55

SHREYAS 257.00

MINDTECK 138.25

GLOBUSSPR 1196.55

INDOTECH 192.30

MARATHON 81.95

MFL 772.90

RUSHIL 333.05

TANLA 1521.50

TTML 130.25

AURUM 181.90

EKC 160.85

ISMTLTD 45.20

KOPRAN 290.30

KPIGLOBAL 273.65

SUULD 261.10

LYKALABS 189.80

SANGAMIND 270.80

RAMKY 166.75

STLTECH 285.20

3IINFOLTD 102.60

63MOONS 121.70

PFOCUS 79.70

TRIDENT 44.65

MUKTAARTS 59.90

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| EMAMILTD | 38132 | 545.55 | 551.20 | 1.03 |

| STLTECH | 15778 | 280.80 | 285.20 | 1.54 |

| KIMS | 35194 | 1317.20 | 1339.45 | 1.66 |

| AEGISCHEM | 42510 | 242.55 | 247.50 | 2.00 |

| UNICHEMLAB | 43410 | 246.70 | 254.85 | 3.20 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| HDFCAMC (F&O) | 46698 | 2588.27 | 2526.33 | 2638.07 | 2579.35 | 2596.95 | -0.68 |

| AARTIIND (F&O) | 28842 | 961.00 | 923.10 | 991.75 | 959.00 | 969.00 | -1.04 |

| ESCORTS (F&O) | 29416 | 1870.56 | 1817.80 | 1913.11 | 1866.10 | 1889.75 | -1.27 |

| IBULHSGFIN (F&O) | 266181 | 260.02 | 240.37 | 276.25 | 256.45 | 259.80 | -1.31 |

| TATAMOTORS (F&O) | 212658 | 484.00 | 457.12 | 506.00 | 480.10 | 486.75 | -1.39 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| TATAMTRDVR | 29539 | 256.00 | 276.25 | 240.37 | 258.30 | 256.00 | 0.89 |

| MARUTI (F&O) | 61913 | 7203.77 | 7306.59 | 7122.70 | 7208.70 | 7130.00 | 1.09 |

| FORTIS | 13203 | 284.77 | 306.10 | 268.27 | 285.45 | 280.00 | 1.91 |

| UBL (F&O) | 11861 | 1511.27 | 1559.47 | 1473.38 | 1512.50 | 1483.20 | 1.94 |

| SUNTV (F&O) | 14952 | 523.27 | 551.97 | 500.89 | 528.00 | 517.65 | 1.96 |

| HINDALCO (F&O) | 79085 | 420.25 | 446.04 | 400.20 | 424.65 | 414.70 | 2.34 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ESCORTS (F&O) | 1.27% |

| RELIANCE (F&O) | 3.89% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HDFCAMC (F&O) | 0.68% |

| EIDPARRY | 0.90% |

| AARTIIND (F&O) | 1.04% |

| IBULHSGFIN (F&O) | 1.31% |

| SYNGENE (F&O) | 1.37% |

| TATAMOTORS (F&O) | 1.39% |

| BALKRISIND (F&O) | 1.46% |

| NATCOPHARM | 1.48% |

| BEL (F&O) | 1.79% |

| TATACOMM | 1.98% |

| SIEMENS (F&O) | 2.03% |

| WOCKPHARMA | 2.51% |

| NRBBEARING | 2.57% |

| GICRE | 2.58% |

| CHOLAFIN (F&O) | 2.65% |

| SUNTV (F&O) | 2.84% |

| FINCABLES | 2.86% |

| BSOFT | 2.95% |

| COFORGE (F&O) | 3.36% |

| TORNTPHARM (F&O) | 3.49% |

| UBL (F&O) | 3.67% |

| GSPL | 3.91% |

| TATACONSUM (F&O) | 3.96% |

| DLF (F&O) | 4.04% |

| TATAMTRDVR | 4.14% |

| HINDALCO (F&O) | 4.25% |

| MARUTI (F&O) | 4.32% |

| DIXON (F&O) | 4.60% |

| PHOENIXLTD | 4.84% |

| DRREDDY (F&O) | 4.86% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

63MOONS

ASTRAZEN

CCL

GLOBUSSPR

KABRAEXTRU

PFIZER (F&O)

POLICYBZR

RHIM

VIMTALABS

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ADANIENT (F&O)

BEL (F&O)

DELTACORP

DLF (F&O)

GLS

POLICYBZR

TATACONSUM (F&O)

TATAMOTORS (F&O)

VENUSREM

WSTCSTPAPR

ZEEL (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

FDC

HEMIPROP

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AMARAJABAT (F&O)

BPCL (F&O)

BURGERKING

CHENNPETRO

EKC

HINDZINC

IGL (F&O)

IRB

JUBLINGREA

LT (F&O)

MCDOWELL-N (F&O)

NMDC (F&O)

UNICHEMLAB

ZEEL (F&O)

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

AURUM

HDFCAMC (F&O)

BEARISH ENGULFING

HDFCLIFE (F&O)

RELIANCE (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

21STCENMGM

AURUM

SHREYAS

SUULD

BEARISH MARUBOZU PATTERN

MUKTAARTS

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ARROWGREEN

BCLIND

RAMCOSYS

BEARISH BELLHOLD PATTERN

MONTECARLO

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

IOLCP

STAR

CREDITACC

AMARAJABAT (F&O)

AARTIDRUGS

EPL

CUB (F&O)

AUROPHARMA (F&O)

APLLTD (F&O

GRANULES (F&O)

AARTIIND (F&O

UNICHEMLAB

DHANI

GEPIL

BANDHANBNK (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

TVSMOTOR (F&O)

HEROMOTOCO (F&O)

VIPIND

RECLTD (F&O)

INDIANB

SRTRANSFIN (F&O)

EPL

WHIRLPOOL

CANBK (F&O)

BHARATFORG (F&O)

JKLAKSHMI

GPIL

BALKRISIND (F&O)

SIEMENS (F&O)

GODREJPROP (F&O)

RAILTEL

MAITHANALL

KEC

KRBL

KAJARIACER

HINDCOPPER

MARICO (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

ADANIGREEN

KPITTECH

SYNGENE (F&O)

FINCABLES

MAXHEALTH

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ACE

AMIORG

ANGELONE

ASHOKA

BEPL

BIRLACORPN

BURGERKING

DECCANCE

FILATEX

GAEL

GRAVITA

GUJALKALI

HGINFRA

HINDOILEXP

INDIACEM

INTELLECT

JINDALSAW

MANINFRA

MOIL

NAHARPOLY

SHK

SHREYAS

SUDARSCHEM

TIRUMALCHM

UFO

ZODIACLOTH

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| GLAND | 3649.30 | 3660.25 | 3645.14 | 3673.55 | 3688.72 | 3703.91 | 3719.14 |

| GTPL | 274.95 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| ENDURANCE | 1732.30 | 1732.64 | 1722.25 | 1742.19 | 1752.64 | 1763.12 | 1773.63 |

| MAXHEALTH | 378.75 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| XPROINDIA | 896.95 | 900.00 | 892.52 | 907.06 | 914.60 | 922.18 | 929.78 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ATULAUTO | 212.10 | 210.25 | 213.89 | 206.74 | 203.16 | 199.62 | 196.10 |

| HEMIPROP | 132.60 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| RAMCOCEM (F&O) | 950.85 | 945.56 | 953.27 | 938.36 | 930.72 | 923.10 | 915.52 |

| DELTACORP | 252.65 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| NCLIND | 215.45 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZEEL (F&O) | 34508192 | 349.55 | 351.56 | 346.89 | 356.09 | 360.82 | 365.58 | 370.38 |

| NMDC (F&O) | 29920870 | 145.95 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| INDHOTEL (F&O) | 17321214 | 192.30 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| ABCAPITAL | 12743876 | 116.50 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| POONAWALLA | 12736111 | 205.75 | 206.64 | 203.06 | 210.14 | 213.78 | 217.45 | 221.15 |

| JAICORPLTD | 8980196 | 125.85 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| CHAMBLFERT | 6553121 | 405.40 | 410.06 | 405.02 | 414.93 | 420.04 | 425.18 | 430.35 |

| ASHOKA | 5866647 | 100.40 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| KIRLOSENG | 5192714 | 196.30 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| UPL (F&O) | 3981290 | 712.75 | 715.56 | 708.89 | 721.90 | 728.64 | 735.40 | 742.19 |

| HINDZINC | 3532515 | 347.65 | 351.56 | 346.89 | 356.09 | 360.82 | 365.58 | 370.38 |

| 3IINFOLTD | 3144328 | 102.60 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| PVR (F&O) | 2731969 | 1442.10 | 1444.00 | 1434.52 | 1452.79 | 1462.33 | 1471.90 | 1481.51 |

| UJJIVAN | 2341400 | 142.90 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| DEEPAKNTR (F&O) | 2303170 | 2309.30 | 2316.02 | 2304.00 | 2326.90 | 2338.97 | 2351.07 | 2363.21 |

| APEX | 1978957 | 305.55 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| KIMS | 1812927 | 1339.45 | 1341.39 | 1332.25 | 1349.89 | 1359.09 | 1368.32 | 1377.58 |

| AURUM | 1660397 | 181.90 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| TTML | 1544445 | 130.25 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| PAYTM | 1322036 | 1648.35 | 1650.39 | 1640.25 | 1659.73 | 1669.93 | 1680.16 | 1690.42 |

| LXCHEM | 1169129 | 435.40 | 435.77 | 430.56 | 440.78 | 446.04 | 451.34 | 456.66 |

| TRIVENI | 1100590 | 214.30 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| LYKALABS | 1073097 | 189.80 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| WOCKPHARMA | 946180 | 440.95 | 441.00 | 435.77 | 446.04 | 451.34 | 456.66 | 462.02 |

| KEI | 922219 | 1179.70 | 1181.64 | 1173.06 | 1189.65 | 1198.29 | 1206.96 | 1215.66 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| POWERGRID (F&O) | 35710637 | 206.10 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| ZOMATO | 26452896 | 144.90 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| RELIANCE (F&O) | 8871172 | 2408.25 | 2401.00 | 2413.27 | 2389.96 | 2377.75 | 2365.57 | 2353.43 |

| GREAVESCOT | 4096622 | 153.70 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| KOTAKBANK (F&O) | 3491724 | 1914.20 | 1914.06 | 1925.02 | 1904.09 | 1893.20 | 1882.33 | 1871.50 |

| WELCORP | 3446644 | 165.05 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| SCI | 3327561 | 153.75 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| DCAL | 2833918 | 247.20 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| TECHM (F&O) | 2400296 | 1593.30 | 1590.02 | 1600.00 | 1580.85 | 1570.93 | 1561.03 | 1551.17 |

| HDFCLIFE (F&O) | 1878712 | 690.95 | 689.06 | 695.64 | 682.86 | 676.34 | 669.85 | 663.39 |

| GUJGASLTD (F&O) | 1840133 | 662.40 | 656.64 | 663.06 | 650.58 | 644.21 | 637.88 | 631.58 |

| PARAGMILK | 1480640 | 116.20 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| INOXLEISUR | 1331355 | 357.35 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| ASIANPAINT (F&O) | 1216263 | 3110.45 | 3108.06 | 3122.02 | 3095.69 | 3081.79 | 3067.92 | 3054.09 |

| NYKAA | 897900 | 2324.70 | 2316.02 | 2328.06 | 2305.15 | 2293.16 | 2281.20 | 2269.27 |

| RELIGARE | 846135 | 158.45 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| APOLLOHOSP (F&O) | 844674 | 5432.40 | 5420.64 | 5439.06 | 5404.95 | 5386.58 | 5368.25 | 5349.94 |

| TARSONS | 808140 | 662.10 | 656.64 | 663.06 | 650.58 | 644.21 | 637.88 | 631.58 |

| PHILIPCARB | 789150 | 225.65 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| PRICOLLTD | 623304 | 116.65 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| BALRAMCHIN | 604267 | 323.25 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| SVPGLOB | 566299 | 107.60 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| PNBHOUSING | 497926 | 569.70 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| RAJESHEXPO | 459262 | 747.05 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| LALPATHLAB (F&O) | 455070 | 3710.00 | 3705.77 | 3721.00 | 3692.41 | 3677.23 | 3662.08 | 3646.96 |