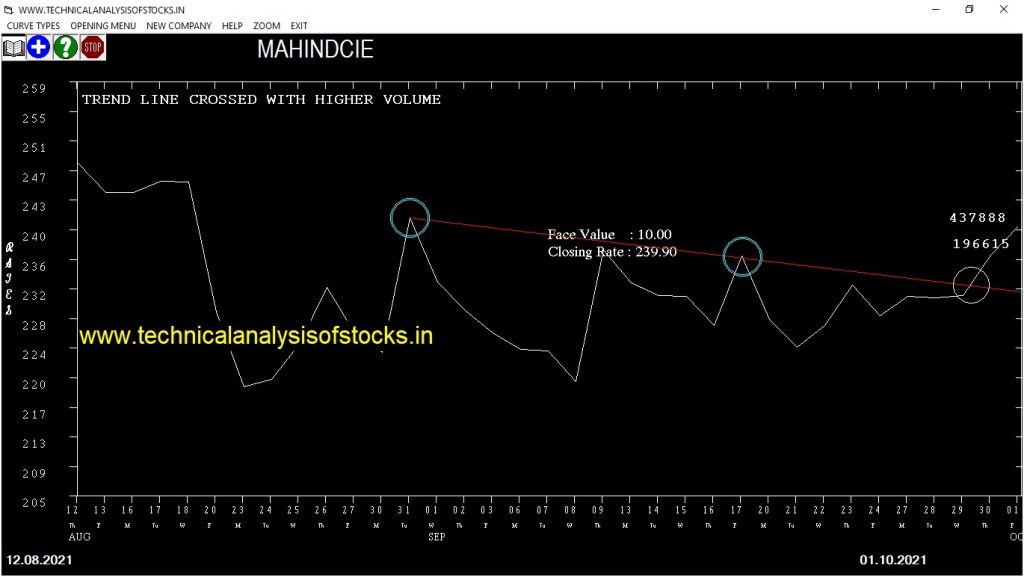

BUY MAHINDCIE (NSE Symbol) Buy@ 240.25 or Above after cooling period. SIGNAL : TREND LINE CROSSED WITH HIGHER VOLUME. Stop Loss : 221.40 Target : 255.90 (Short term)

HOT BUZZING STOCKS (04.10.2021)

NSE SYMBOL CLOSING RATE

DYNPRO 643.55

ALKALI 85.85

VINYLINDIA 269.90

MFL 856.00

VSTTILLERS 2962.50

AYMSYNTEX 112.85

EKC 117.65

JINDALPHOT 132.30

NELCO 756.10

TANLA 915.95

XPROINDIA 580.05

ZENTEC 215.45

AHLADA 148.30

DCMNVL 222.95

GDL 248.15

GENESYS 217.95

GREENPANEL 325.10

LAGNAM 47.30

PAR 220.95

TEJASNET 517.50

AXISCADES 84.45

CLEDUCATE 77.25

MANALIPETC 125.80

TRIGYN 113.15

MINDTECK 90.20

BASML 64.90

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| MAHINDCIE | 17138 | 239.00 | 239.90 | 0.38 |

| PURVA | 16951 | 136.90 | 137.80 | 0.65 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| INDIGO (F&O) | 53363 | 1983.55 | 1976.05 | 0.38 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| NMDC (F&O) | 53901 | 144.00 | 129.46 | 156.17 | 143.65 | 145.70 | -1.43 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| DHANI | 17530 | 178.89 | 195.90 | 165.85 | 180.65 | 179.55 | 0.61 |

| HAL (F&O) | 30738 | 1332.25 | 1377.58 | 1296.65 | 1338.00 | 1326.65 | 0.85 |

| AUROPHARMA (F&O) | 81890 | 715.56 | 749.02 | 689.41 | 717.30 | 708.00 | 1.30 |

| ORIENTCEM | 10502 | 156.25 | 172.18 | 144.07 | 157.15 | 154.10 | 1.94 |

| BIOCON (F&O) | 21636 | 361.00 | 384.95 | 342.42 | 365.30 | 358.00 | 2.00 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SBICARD | 0.58% |

| IBULHSGFIN (F&O) | 1.60% |

| TATASTEEL (F&O) | 2.01% |

| CASTROLIND | 2.07% |

| COROMANDEL (F&O) | 3.48% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| GLENMARK (F&O) | 1.11% |

| BIOCON (F&O) | 1.25% |

| NMDC (F&O) | 1.43% |

| SHREEPUSHK | 2.62% |

| PRINCEPIPE | 2.70% |

| BEPL | 2.77% |

| HAL (F&O) | 2.87% |

| TATAELXSI | 2.98% |

| KEI | 3.03% |

| APTECHT | 3.22% |

| EASEMYTRIP | 3.46% |

| VBL | 3.49% |

| UPL (F&O) | 3.56% |

| RADICO | 3.61% |

| AUROPHARMA (F&O) | 3.67% |

| LICHSGFIN (F&O) | 3.72% |

| DHANI | 3.79% |

| APCOTEXIND | 4.15% |

| TATASTEEL (F&O) | 4.16% |

| ORIENTCEM | 4.17% |

| VSSL | 4.25% |

| VARROC | 4.49% |

| GICRE | 4.58% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

SURYODAY Buy @ 182.25 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ARVINDFASN

ARVSMART

BLISSGVS

BLUESTARCO

CAMS

CHOLAFIN (F&O)

CUB (F&O)

DMART

GENESYS

LTTS (F&O)

MAXVIL

MOIL

NUCLEUS

REFEX

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

CHAMBLFERT

GLS

KIRIINDUS

SHILPAMED

UNIVCABLES

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

GATI

JUSTDIAL

KANSAINER

Higher Level Consolidation

KANSAINER

REDINGTON

Lower Level Consolidation

EXIDEIND (F&O)

GATI

JUSTDIAL

KANSAINER

KEC

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NELCO

TEJASNET

GAP DOWN BREAKOUT STOCKS

ICICIBANK (F&O)

MARUTI (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

AMARAJABAT (F&O)

ATULAUTO

DCAL

GRANULES (F&O)

GREENPANEL

JSL

KAMDHENU

LUPIN (F&O)

M&M (F&O)

METROPOLIS (F&O)

PSPPROJECT

BEARISH ENGULFING

GUJGASLTD (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

VINYLINDIA

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASHOKA

BPCL (F&O)

COLPAL (F&O)

HDFCLIFE (F&O)

ITDCEM

JTEKTINDIA

JYOTHYLAB

KOTAKBANK (F&O)

MIRZAINT

PVR (F&O)

SBICARD

STARCEMENT

SUVEN

SELL RECOMMENDATION IF THE MARKET IS BEARISH

APLAPOLLO

BIOCON (F&O)

COROMANDEL (F&O)

LUPIN (F&O)

MARUTI (F&O)

PETRONET (F&O)

WALCHANNAG

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

LIBERTSHOE

IPL

CONCOR (F&O)

EMAMILTD

TATACOFFEE

ADANIENT (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

EASEMYTRIP

GRASIM (F&O)

SWSOLAR

CHAMBLFERT

HATSUN

SCI

DLINKINDIA

INDHOTEL (F&O)

SEAMECLTD

PVR (F&O)

SUNTECK

FINPIPE

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

APLAPOLLO

CARTRADE

FCL

GOKEX

OAL

POLYMED

RUBYMILLS

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

OIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL