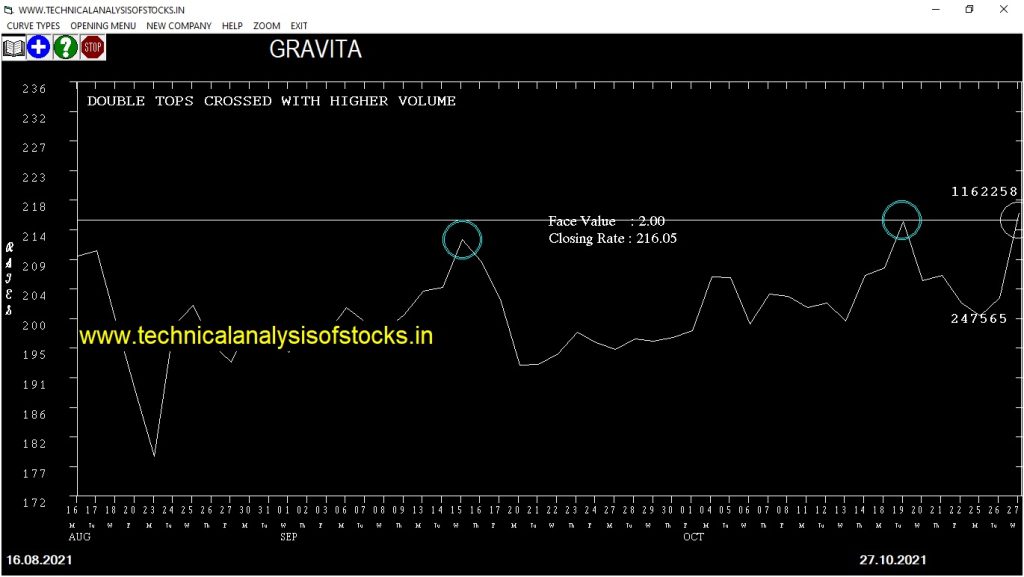

BUY GRAVITA (NSE Symbol) Buy@ 217.55 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 199.60 Target : 232.45 (Short term)

HOT BUZZING STOCKS (28.10.2021)

NSE SYMBOL CLOSING RATE

MGEL 88.85

GOKULAGRO 52.85

KPIGLOBAL 163.50

CTE 60.25

CREATIVE 345.65

GLOBUSSPR 1250.70

JUBLINDS 594.70

MFL 913.70

ONEPOINT 52.55

VISHNU 787.65

GREENPANEL 351.35

IIFL 320.65

NAHARSPING 482.55

PANACEABIO 223.90

SUULD 229.35

DCMNVL 256.05

BCG 72.85

MARALOVER 81.35

TI 62.55

ARIHANT 61.60

JISLJALEQS 45.95

TTML 55.55

PARAS 1027.45

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| ICIL | 22203 | 258.65 | 253.55 | 2.01 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| CHOLAFIN (F&O) | 83287 | 625.00 | 594.44 | 649.92 | 623.50 | 634.00 | -1.68 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| INTELLECT | 12561 | 656.64 | 688.72 | 631.58 | 661.85 | 656.45 | 0.82 |

| IOC (F&O) | 50203 | 129.39 | 143.93 | 118.32 | 130.80 | 129.65 | 0.88 |

| INDIGO (F&O) | 35247 | 2002.56 | 2057.86 | 1959.04 | 2010.25 | 1986.60 | 1.18 |

| BALKRISIND (F&O) | 16868 | 2475.06 | 2536.37 | 2426.78 | 2485.65 | 2442.25 | 1.75 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NIL

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ADANIGREEN | 0.69% |

| BHARTIARTL (F&O) | 1.64% |

| CHOLAFIN (F&O) | 1.68% |

| CONCOR (F&O) | 1.91% |

| NUVOCO | 2.03% |

| RELAXO | 2.50% |

| DMART | 2.68% |

| IOC (F&O) | 2.68% |

| GRASIM (F&O) | 2.70% |

| INDIGO (F&O) | 3.17% |

| JUBLINGREA | 3.46% |

| CENTURYPLY | 3.52% |

| KKCL | 3.58% |

| BALKRISIND (F&O) | 3.69% |

| METROPOLIS (F&O) | 3.95% |

| SCI | 4.01% |

| GRSE | 4.37% |

| INTELLECT | 4.46% |

| MUTHOOTFIN (F&O) | 4.57% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

POWERGRID (F&O) Buy @ 192.50 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AMIORG

APOLLOHOSP (F&O)

ARIHANTSUP

ASTRAL

CAMS

COFORGE (F&O)

CROMPTON

DEEPAKFERT

EIHOTEL

EXIDEIND (F&O)

GLAND

GTPL

IEX

INOXLEISUR

KNRCON

MAHINDCIE

MAHSEAMLES

MINDAIND

MOTHERSUMI (F&O)

NIITLTD

PGEL

POLYCAB

PVR (F&O)

RAILTEL

RITES

SCHNEIDER

SHK

SRF (F&O)

ZUARIGLOB

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

5PAISA

LTTS (F&O)

PETRONET (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

HEIDELBERG

RAJESHEXPO

Higher Level Consolidation

NIL

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

AKSHARCHEM

ARIHANTSUP

ASIANPAINT (F&O)

BCG

DCMNVL

GANESHHOUC

GLOBUSSPR

GOLDIAM

GPIL

GUJALKALI

HFCL

KIOCL

MARICO (F&O)

MGEL

PANACEABIO

TEJASNET

GAP DOWN BREAKOUT STOCKS

ICIL

OAL

PARAS

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

ICICIPHARM

SEQUENT

UFLEX

ZENSARTECH

BEARISH ENGULFING

CHEMBOND

GEPIL

IRB

MAWANASUG

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

KPIGLOBAL

MGEL

BEARISH BELLHOLD PATTERN

BANDHANBNK (F&O)

GEPIL

HDFCAMC (F&O)

RAILTEL

REDINGTON

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

ARVIND

KEI

MSTCLTD

MTARTECH

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASIANTILES

BLISSGVS

STAR

UJJIVAN

APLLTD (F&O)

JUBLPHARMA

BIOCON (F&O

GRANULES (F&O)

IOLCP

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

NIL

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ASIANTILES

BHAGERIA

BODALCHEM

CAPACITE

EMAMIPAP

EVEREADY

GEECEE

GESHIP

HARRMALAYA

IGPL

JKLAKSHMI

KSCL

LINCOLN

MAHLOG

MFL

NCLIND

RAIN

SEQUENT

SOBHA

VINYLINDIA

XCHANGING

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

KEC

MAHINDCIE

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| KHADIM | 304.00 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| GREENPLY | 209.65 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| TANLA | 1223.75 | 1225.00 | 1216.27 | 1233.15 | 1241.94 | 1250.76 | 1259.62 |

| CIPLA (F&O) | 922.50 | 922.64 | 915.06 | 929.78 | 937.42 | 945.09 | 952.79 |

| HCLTECH (F&O) | 1177.15 | 1181.64 | 1173.06 | 1189.65 | 1198.29 | 1206.96 | 1215.66 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| EKC | 112.50 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| PNCINFRA | 339.05 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |

| NEOGEN | 1210.65 | 1207.56 | 1216.27 | 1199.49 | 1190.85 | 1182.23 | 1173.65 |

| PETRONET (F&O) | 232.00 | 228.77 | 232.56 | 225.11 | 221.38 | 217.67 | 214.00 |

| WOCKPHARMA | 435.75 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| BANKBARODA (F&O) | 70719485 | 102.60 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| CANBK (F&O) | 41964959 | 200.80 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| M&MFIN (F&O) | 8096872 | 192.00 | 192.52 | 189.06 | 195.90 | 199.42 | 202.96 | 206.54 |

| RECLTD (F&O) | 6546448 | 156.15 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| PFC (F&O) | 6344489 | 139.95 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| UPL (F&O) | 4677615 | 741.50 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| ASIANPAINT (F&O) | 4609951 | 3094.65 | 3108.06 | 3094.14 | 3120.45 | 3134.43 | 3148.44 | 3162.48 |

| GODREJCP (F&O) | 4206753 | 1009.90 | 1016.02 | 1008.06 | 1023.49 | 1031.50 | 1039.54 | 1047.62 |

| CHOLAFIN (F&O) | 3816610 | 623.50 | 625.00 | 618.77 | 630.95 | 637.24 | 643.57 | 649.92 |

| FSL | 3526804 | 208.75 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| MINDACORP | 2793219 | 144.65 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| MARICO (F&O) | 2189903 | 575.45 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

| RAIN | 2059271 | 237.90 | 240.25 | 236.39 | 244.02 | 247.94 | 251.89 | 255.87 |

| GREAVESCOT | 1904313 | 137.40 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| IIFL | 1695203 | 320.65 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| ORIENTCEM | 1607276 | 161.10 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| TANLA | 1605580 | 1223.75 | 1225.00 | 1216.27 | 1233.15 | 1241.94 | 1250.76 | 1259.62 |

| POONAWALLA | 1563373 | 164.65 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| CUMMINSIND (F&O) | 1374702 | 894.60 | 900.00 | 892.52 | 907.06 | 914.60 | 922.18 | 929.78 |

| GREENPANEL | 1183711 | 351.35 | 351.56 | 346.89 | 356.09 | 360.82 | 365.58 | 370.38 |

| PSPPROJECT | 1114450 | 528.35 | 529.00 | 523.27 | 534.50 | 540.29 | 546.12 | 551.97 |

| JKTYRE | 1079504 | 154.90 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| TATVA | 1015192 | 2649.45 | 2652.25 | 2639.39 | 2663.81 | 2676.72 | 2689.67 | 2702.65 |

| ITI | 952177 | 122.50 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| EVEREADY | 932040 | 367.70 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| SAIL (F&O) | 34383061 | 117.00 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| NATIONALUM (F&O) | 33353337 | 101.90 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| TATAMOTORS (F&O) | 30361263 | 497.90 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| ONGC (F&O) | 21652522 | 157.90 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| ZEEL (F&O) | 17194768 | 303.30 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| VEDL (F&O) | 16987345 | 315.35 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| IBULHSGFIN (F&O) | 9426306 | 222.15 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| BANDHANBNK (F&O) | 9366556 | 296.15 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| ARVIND | 8813951 | 130.65 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| INDUSTOWER (F&O) | 8287553 | 274.95 | 272.25 | 276.39 | 268.27 | 264.19 | 260.15 | 256.13 |

| JINDALSTEL (F&O) | 4966436 | 430.40 | 425.39 | 430.56 | 420.46 | 415.35 | 410.27 | 405.22 |

| ABFRL (F&O) | 3484769 | 254.60 | 252.02 | 256.00 | 248.19 | 244.26 | 240.37 | 236.51 |

| BAJFINANCE (F&O) | 3112233 | 7482.15 | 7460.64 | 7482.25 | 7442.78 | 7421.22 | 7399.70 | 7378.20 |

| CUB (F&O) | 2559104 | 175.05 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| SONACOMS | 1718860 | 615.05 | 612.56 | 618.77 | 606.69 | 600.55 | 594.44 | 588.36 |

| DHANI | 1465719 | 190.00 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| SWSOLAR | 1441040 | 409.20 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| REDINGTON | 1299846 | 145.40 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| KEI | 1070596 | 931.25 | 930.25 | 937.89 | 923.10 | 915.52 | 907.97 | 900.45 |

| ABSLAMC | 1043401 | 623.35 | 618.77 | 625.00 | 612.87 | 606.69 | 600.55 | 594.44 |

| GDL | 888683 | 266.40 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| PARAS | 816381 | 1027.45 | 1024.00 | 1032.02 | 1016.52 | 1008.57 | 1000.64 | 992.75 |

| WELCORP | 776825 | 130.90 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| MSTCLTD | 699886 | 432.70 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| FCL | 659235 | 121.10 | 121.00 | 123.77 | 118.32 | 115.62 | 112.95 | 110.31 |