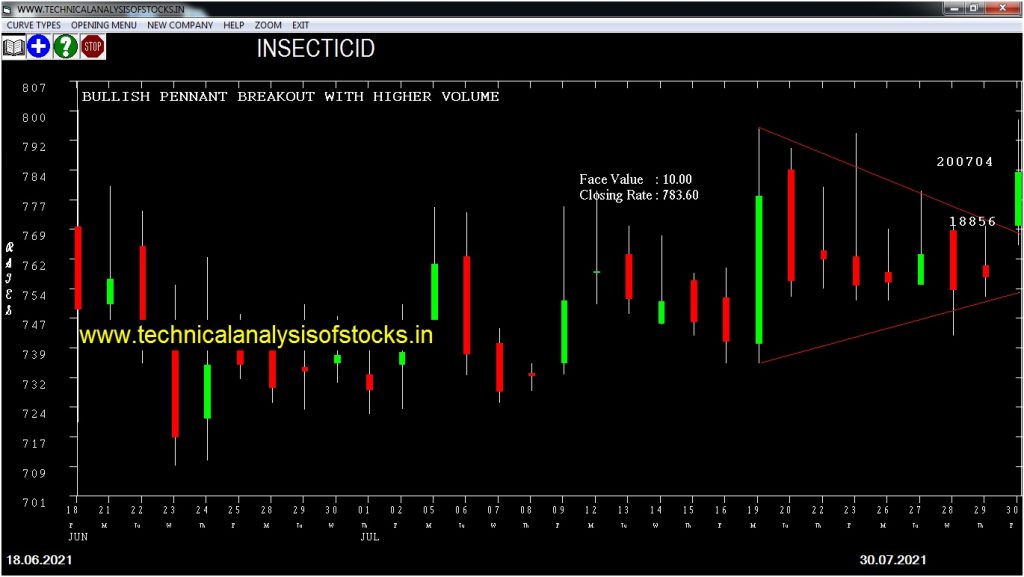

BUY INSECTICID (NSE Symbol) Buy@ 784 or Above after cooling period. SIGNAL : BULLISH PENNANT BREAKOUT WITH HIGHER VOLUME. Stop Loss : 749.75 Target : 811.85 (Short term)

HOT BUZZING STOCKS (02.08.2021)

NSE SYMBOL CLOSING RATE

GOLDENTOBC 82.25

NAHARCAP 312.00

KPIGLOBAL 134.50

VENUSREM 467.60

AGRITECH 47.35

CTE 89.50

GOODLUCK 287.45

IZMO 142.10

MCL 41.05

BSL 73.05

JAIBALAJI 67.70

TOUCHWOOD 111.10

AUTOIND 69.00

SHIVAMILLS 103.50

INTENTECH 108.85

Strategy : TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| CROMPTON | 68120 | 484.90 | 487.10 | 0.45 |

| ASTERDM | 19630 | 162.65 | 163.40 | 0.46 |

| NBVENTURES | 20053 | 123.45 | 124.25 | 0.64 |

| CENTENKA | 27267 | 477.40 | 483.80 | 1.32 |

| BANCOINDIA | 15939 | 167.75 | 171.15 | 1.99 |

| BDL | 25156 | 408.65 | 420.05 | 2.71 |

| VAIBHAVGBL | 29812 | 805.80 | 829.75 | 2.89 |

| DEEPAKNTR (F&O) | 255744 | 1969.00 | 2039.20 | 3.44 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| PIDILITIND (F&O) | 26016 | 2287.40 | 2278.80 | 0.38 |

| CHOLAFIN (F&O) | 73699 | 479.00 | 475.75 | 0.68 |

| ASIANPAINT (F&O) | 80514 | 2979.55 | 2958.45 | 0.71 |

| HSIL | 12909 | 253.30 | 249.25 | 1.62 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| INSECTICID | 11350 | 784.00 | 749.77 | 811.84 | 783.60 | 794.70 | -1.42 |

| JTEKTINDIA | 27780 | 121.00 | 107.69 | 132.18 | 118.60 | 120.70 | -1.77 |

| CROMPTON | 68120 | 489.52 | 462.48 | 511.63 | 487.10 | 496.70 | -1.97 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| UPL (F&O) | 121843 | 805.14 | 840.58 | 777.40 | 808.55 | 803.75 | 0.59 |

| BSOFT | 28614 | 400.00 | 425.18 | 380.44 | 401.65 | 397.00 | 1.16 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| BEML | 1.43% |

| CSBBANK | 1.99% |

| HAL | 3.28% |

| ISGEC | 3.75% |

| SONACOMS | 4.02% |

| ICICIPRULI (F&O) | 4.43% |

| STOVEKRAFT | 5.30% |

| HIKAL | 7.03% |

| VSSL | 7.18% |

| ATULAUTO | 9.37% |

| CYIENT | 10.67% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ERIS | 0.28% |

| INSECTICID | 1.42% |

| JTEKTINDIA | 1.77% |

| ASHOKA | 1.96% |

| CROMPTON | 1.97% |

| UBL (F&O) | 2.05% |

| GODREJIND | 2.07% |

| PIDILITIND (F&O) | 2.42% |

| WIPRO (F&O) | 2.50% |

| CESC | 2.89% |

| MPHASIS (F&O) | 2.97% |

| INDHOTEL (F&O) | 3.10% |

| PNCINFRA | 3.46% |

| TECHNOE | 3.49% |

| UPL (F&O) | 3.58% |

| IOLCP | 3.58% |

| MUTHOOTFIN (F&O) | 3.68% |

| JMFINANCIL | 4.20% |

| CARERATING | 4.56% |

| EASEMYTRIP | 4.97% |

Strategy : TRIANGLE PATTERN (Intraday / Short term)

NIL

Strategy : INSIDE CANDLES (Intraday / Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

GUFICBIO Buy @ 185.65 or Above

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

ASPINWALL

BOMDYEING

CENTURYTEX

DALBHARAT

GICRE

HEXATRADEX

ICIL

IZMO

JOCIL

KABRAEXTRU

KITEX

MAHEPC

RAJESHEXPO

RIIL

SYMPHONY

TATACOFFEE

UNIDT

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

HEXATRADEX

JUBLFOOD (F&O)

MUTHOOTCAP

WIPRO (F&O)

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMBUJACEM (F&O)

ASIANTILES

BERGEPAINT (F&O)

DMART

HINDUNILVR (F&O)

LT (F&O)

MFSL (F&O)

MUTHOOTFIN (F&O)

ONGC (F&O)

THYROCARE

WIPRO (F&O)

Higher Level Consolidation

ASIANTILES

BERGEPAINT (F&O)

CESC

DIVISLAB (F&O)

EMAMILTD

HINDUNILVR (F&O)

ICICIBANK (F&O)

INFY (F&O)

ROSSARI

TCS (F&O)

Lower Level Consolidation

CYIENT

HDFCLIFE (F&O)

HEG

HIKAL

INDUSTOWER (F&O)

MUTHOOTFIN (F&O)

ONGC (F&O)

RITES

SUMICHEM

THYROCARE

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ASHOKLEY (F&O)

BDL

DEEPAKNTR (F&O)

GOODLUCK

HCLTECH (F&O)

HEIDELBERG

IMFA

TECHM (F&O)

NRAIL

VAIBHAVGBL

GAP DOWN BREAKOUT STOCKS

MOTILALOFS

RAYMOND

SBILIFE (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

SPIC

SUNDRMBRAK

BEARISH ENGULFING

ICICIGI (F&O)

METROPOLIS (F&O)

ULTRACEMCO (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

INTENTECH

SHIVAMILLS

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

CROMPTON

PRIVISCL

BEARISH BELLHOLD PATTERN

BAJFINANCE (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BANKBARODA (F&O)

GRANULES (F&O)

INDUSINDBK (F&O)

IOC (F&O)

LUPIN (F&O)

MUNJALAU

NH

SBICARD

SWSOLAR

SYNGENE

SELL RECOMMENDATION IF THE MARKET IS BEARISH

AARTIDRUGS

EICHERMOT (F&O)

HDFCAMC (F&O)

HDFCLIFE (F&O)

TAJGVK

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HINDCON | 74.55 | 76.56 | 74.39 | 78.73 | 80.96 | 83.22 | 85.52 |

| COLPAL (F&O) | 1704.40 | 1711.89 | 1701.56 | 1721.39 | 1731.77 | 1742.19 | 1752.64 |

| RBLBANK (F&O) | 192.95 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| HDFCBANK (F&O) | 1426.45 | 1434.52 | 1425.06 | 1443.28 | 1452.79 | 1462.33 | 1471.90 |

| TORNTPOWER (F&O) | 455.20 | 456.89 | 451.56 | 462.02 | 467.41 | 472.83 | 478.28 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TATAMOTORS (F&O) | 293.95 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| CUB (F&O) | 150.25 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| BATAINDIA (F&O) | 1619.20 | 1610.02 | 1620.06 | 1600.80 | 1590.81 | 1580.85 | 1570.93 |

| GABRIEL | 139.40 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| STOVEKRAFT | 772.95 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| VEDL (F&O) | 34614433 | 301.85 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| POWERGRID (F&O) | 25606627 | 171.15 | 172.27 | 169.00 | 175.47 | 178.80 | 182.16 | 185.55 |

| CANBK (F&O) | 19185850 | 153.20 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| ADANIPORTS (F&O) | 13440904 | 674.50 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| TVSMOTOR (F&O) | 9883338 | 579.30 | 582.02 | 576.00 | 587.77 | 593.84 | 599.95 | 606.09 |

| GSFC | 8750937 | 122.25 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| MARICO (F&O) | 7140990 | 546.70 | 552.25 | 546.39 | 557.86 | 563.78 | 569.73 | 575.71 |

| EXIDEIND (F&O) | 6657246 | 178.65 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| CONCOR (F&O) | 6602645 | 643.90 | 650.25 | 643.89 | 656.31 | 662.73 | 669.18 | 675.66 |

| CIPLA (F&O) | 6280365 | 920.05 | 922.64 | 915.06 | 929.78 | 937.42 | 945.09 | 952.79 |

| JSL | 5950279 | 162.30 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| APOLLOTYRE (F&O) | 5767529 | 223.45 | 225.00 | 221.27 | 228.65 | 232.45 | 236.27 | 240.13 |

| ALLCARGO | 5148430 | 197.60 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| PHILIPCARB | 4337192 | 271.50 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| GRANULES (F&O) | 3825602 | 379.40 | 380.25 | 375.39 | 384.95 | 389.87 | 394.82 | 399.80 |

| MINDACORP | 3246862 | 138.80 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| CADILAHC (F&O) | 3187410 | 586.10 | 588.06 | 582.02 | 593.84 | 599.95 | 606.09 | 612.26 |

| DABUR (F&O) | 3145307 | 600.70 | 606.39 | 600.25 | 612.26 | 618.46 | 624.69 | 630.95 |

| IRB | 2646127 | 164.35 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| JSLHISAR | 2277478 | 294.85 | 297.56 | 293.27 | 301.74 | 306.10 | 310.49 | 314.90 |

| GLENMARK (F&O) | 2224480 | 607.45 | 612.56 | 606.39 | 618.46 | 624.69 | 630.95 | 637.24 |

| NBVENTURES | 2202364 | 124.25 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| ORIENTCEM | 2171728 | 159.75 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| ITI | 2149885 | 128.10 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| PVR (F&O) | 1960842 | 1400.20 | 1406.25 | 1396.89 | 1414.93 | 1424.35 | 1433.80 | 1443.28 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SBIN (F&O) | 35196813 | 431.80 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| HINDALCO (F&O) | 12987115 | 444.80 | 441.00 | 446.27 | 435.98 | 430.78 | 425.60 | 420.46 |

| BEL (F&O) | 9585592 | 184.65 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| FSL | 8039271 | 194.80 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| NIITLTD | 5412042 | 323.90 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| WELCORP | 4442103 | 138.45 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| CHOLAFIN (F&O) | 4265725 | 475.75 | 473.06 | 478.52 | 467.87 | 462.48 | 457.12 | 451.79 |

| JINDALSAW | 3476547 | 139.10 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| SCHNEIDER | 3411809 | 139.45 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| WELSPUNIND | 2457398 | 133.45 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| LALPATHLAB (F&O) | 2174757 | 3556.35 | 3555.14 | 3570.06 | 3542.02 | 3527.15 | 3512.32 | 3497.51 |

| JTEKTINDIA | 2015149 | 118.60 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| ARVIND | 1749886 | 104.00 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| SUNTECK | 1712167 | 380.70 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |

| GHCL | 1455786 | 373.05 | 370.56 | 375.39 | 365.95 | 361.18 | 356.44 | 351.74 |

| DLINKINDIA | 1451762 | 158.80 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| BAJFINANCE (F&O) | 1406885 | 6228.10 | 6221.27 | 6241.00 | 6204.66 | 6184.98 | 6165.33 | 6145.71 |

| KNRCON | 1367095 | 270.85 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| BODALCHEM | 1327798 | 119.10 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| SBILIFE (F&O) | 1238229 | 1098.60 | 1097.27 | 1105.56 | 1089.54 | 1081.31 | 1073.10 | 1064.92 |

| ORIENTELEC | 1224182 | 321.80 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| TINPLATE | 1146207 | 259.70 | 256.00 | 260.02 | 252.14 | 248.19 | 244.26 | 240.37 |

| SWSOLAR | 1145881 | 285.40 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| KPITTECH | 944827 | 281.75 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| RAYMOND | 915171 | 440.70 | 435.77 | 441.00 | 430.78 | 425.60 | 420.46 | 415.35 |