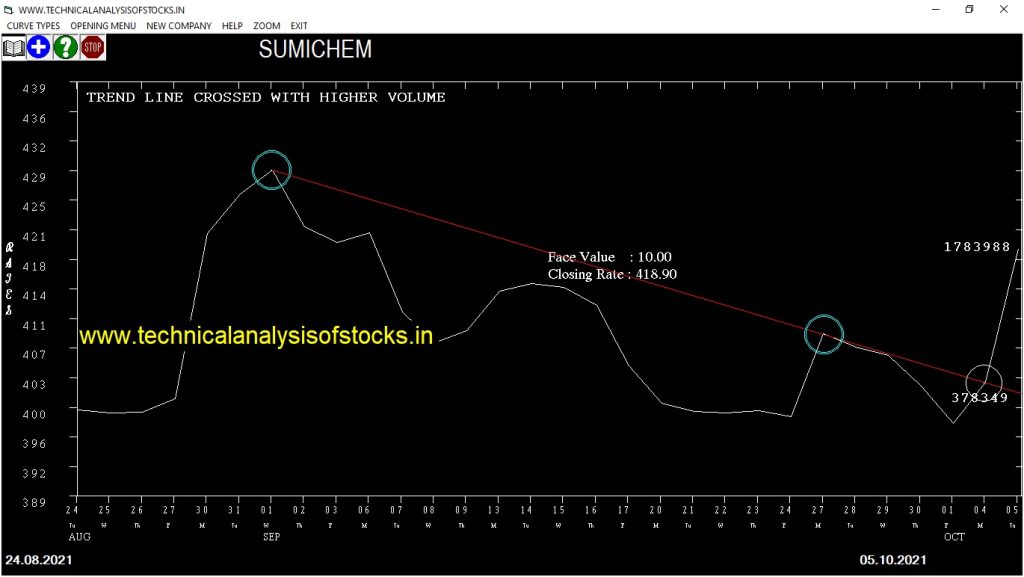

BUY SUMICHEM (NSE Symbol) Buy@ 420.25 or Above after cooling period. SIGNAL : TREND LINE CROSSED WITH HIGHER VOLUME. Stop Loss : 395.20 Target : 440.80 (Short term)

HOT BUZZING STOCKS (06.10.2021)

NSE SYMBOL CLOSING RATE

SYMBOL RATE

GMBREW 744.15

ARVINDFASN 344.00

SHIVATEX 229.85

ABAN 47.35

MACPOWER 203.80

SECURKLOUD 214.35

ADSL 82.80

AGARIND 373.80

BORORENEW 337.05

FAIRCHEMOR 2135.55

JUBLINDS 532.50

KHAICHEM 65.15

MFL 988.65

EKC 121.05

ASHAPURMIN 138.15

GENESYS 240.20

PAR 243.50

BANSWRAS 177.25

CONSOFINVT 147.95

GOLDENTOBC 173.10

IZMO 96.05

MARATHON 102.50

SIGIND 44.35

JPOLYINVST 88.95

MINDTECK 99.40

INTENTECH 67.85

NDL 75.35

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| HCLTECH (F&O) | 111886 | 1304.95 | 1305.15 | 0.02 |

| SUMICHEM | 33598 | 417.45 | 418.90 | 0.35 |

| CENTUM | 20118 | 540.00 | 546.95 | 1.27 |

| ATULAUTO | 13263 | 225.80 | 229.05 | 1.42 |

| KANSAINER | 23247 | 640.50 | 651.35 | 1.67 |

| GATI | 17074 | 140.65 | 144.80 | 2.87 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| INTELLECT | 20581 | 697.55 | 689.75 | 1.13 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| ALKYLAMINE | 26841 | 4000.56 | 3923.85 | 4062.03 | 3991.20 | 3994.00 | -0.07 |

| AMIORG | 32997 | 1332.25 | 1287.66 | 1368.32 | 1328.30 | 1332.00 | -0.28 |

| TATASTEEL (F&O) | 113241 | 1323.14 | 1278.70 | 1359.09 | 1316.85 | 1324.00 | -0.54 |

| BSE | 27046 | 1269.14 | 1225.61 | 1304.36 | 1263.45 | 1272.50 | -0.72 |

| ROSSARI | 14488 | 1511.27 | 1463.79 | 1549.62 | 1506.95 | 1521.95 | -1.00 |

| ACE | 21998 | 272.25 | 252.14 | 288.86 | 271.35 | 274.10 | -1.01 |

| CASTROLIND | 11820 | 144.00 | 129.46 | 156.17 | 141.20 | 143.00 | -1.27 |

| APTECHT | 16368 | 315.06 | 293.41 | 332.90 | 311.30 | 319.00 | -2.47 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| FSL | 16569 | 192.52 | 210.14 | 178.98 | 194.00 | 193.15 | 0.44 |

| HDFCBANK (F&O) | 154894 | 1590.02 | 1639.43 | 1551.17 | 1595.45 | 1582.00 | 0.84 |

| BIOCON (F&O) | 18056 | 361.00 | 384.95 | 342.42 | 362.00 | 358.00 | 1.10 |

| CHOLAFIN (F&O) | 31751 | 558.14 | 587.77 | 535.03 | 558.75 | 551.05 | 1.38 |

| ADANIPORTS (F&O) | 48463 | 742.56 | 776.63 | 715.92 | 743.95 | 733.00 | 1.47 |

| CONCOR (F&O) | 28030 | 708.89 | 742.19 | 682.86 | 709.10 | 697.45 | 1.64 |

| ORIENTCEM | 14025 | 156.25 | 172.18 | 144.07 | 157.10 | 154.10 | 1.91 |

| KPITTECH | 30385 | 337.64 | 360.82 | 319.68 | 341.65 | 335.00 | 1.95 |

| CYIENT | 19519 | 1048.14 | 1088.46 | 1016.52 | 1054.70 | 1032.65 | 2.09 |

| VARROC | 14845 | 297.56 | 319.36 | 280.70 | 300.60 | 294.05 | 2.18 |

| AUROPHARMA (F&O) | 87763 | 722.27 | 755.87 | 695.99 | 724.00 | 708.00 | 2.21 |

| PRESTIGE | 11194 | 473.06 | 500.39 | 451.79 | 477.00 | 465.60 | 2.39 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| CASTROLIND | 1.27% |

| BAJFINANCE (F&O) | 1.30% |

| SUNTECK | 1.59% |

| APTUS | 1.64% |

| CENTURYTEX | 1.65% |

| APOLLOHOSP (F&O) | 3.29% |

| INDHOTEL (F&O) | 3.56% |

| LODHA | 3.66% |

| HEMIPROP | 3.83% |

| CHAMBLFERT | 3.94% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ALKYLAMINE | 0.07% |

| COROMANDEL (F&O) | 0.08% |

| AMIORG | 0.28% |

| MARICO (F&O) | 0.55% |

| BSE | 0.72% |

| FINCABLES | 0.73% |

| NIACL | 0.82% |

| NUVOCO | 0.97% |

| ROSSARI | 1.00% |

| ACE | 1.01% |

| CCL | 1.02% |

| PERSISTENT | 1.28% |

| EXIDEIND (F&O) | 1.30% |

| VARROC | 1.40% |

| CAPLIPOINT | 1.46% |

| INDUSINDBK (F&O) | 1.53% |

| ADANIPORTS (F&O) | 1.74% |

| MFSL (F&O) | 1.93% |

| MINDTREE (F&O) | 1.96% |

| LODHA | 2.00% |

| LTTS (F&O) | 2.15% |

| BIOCON (F&O) | 2.17% |

| FSL | 2.24% |

| HDFCBANK (F&O) | 2.29% |

| VIJAYA | 2.31% |

| BURGERKING | 2.37% |

| APTECHT | 2.47% |

| GOLDIAM | 2.52% |

| MARUTI (F&O) | 2.61% |

| KEC | 2.65% |

| TATASTEEL (F&O) | 2.66% |

| AUROPHARMA (F&O) | 2.71% |

| TATVA | 2.93% |

| CONCOR (F&O) | 2.95% |

| EVEREADY | 3.05% |

| VBL | 3.07% |

| MPHASIS (F&O) | 3.24% |

| CHOLAFIN (F&O) | 3.25% |

| REPCOHOME | 3.32% |

| KPITTECH | 3.38% |

| CYIENT | 3.38% |

| GICRE | 4.11% |

| ORIENTCEM | 4.20% |

| PARAGMILK | 4.68% |

| UFLEX | 4.71% |

| EASEMYTRIP | 4.83% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

GRANULES (F&O) Buy @ 333.05 or Above

GUJGASLTD (F&O) Buy @ 631.25 or Above

PIIND (F&O) Buy @ 3178.15 or Above

CLEAN Sell @ 2127.50 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BATAINDIA (F&O)

CUMMINSIND (F&O)

DELTACORP

FINPIPE

HDFCAMC (F&O)

JINDALSTEL (F&O)

M&M (F&O)

NELCO

ORIENTELEC

VAIBHAVGBL

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BALKRISIND (F&O)

PRESTIGE

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BLISSGVS

DMART

LTI (F&O)

PRSMJOHNSN

SCHNEIDER

Higher Level Consolidation

HDFCAMC (F&O)

Lower Level Consolidation

HINDUNILVR (F&O)

JTEKTINDIA

SCHNEIDER

STARCEMENT

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

ADANIGREEN

BORORENEW

LXCHEM

MANALIPETC

ONGC (F&O)

GAP DOWN BREAKOUT STOCKS

NIL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BEML

HCLTECH (F&O)

BEARISH ENGULFING

TEJASNET

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

IZMO

KHAICHEM

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ADSL

ARVINDFASN

GMBREW

IGPL

INTENTECH

JUBLINDS

NDL

SHIVATEX

BEARISH BELLHOLD PATTERN

APLLTD (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BALMLAWRIE

BERGEPAINT (F&O)

COLPAL (F&O)

DHANUKA

HDFCLIFE (F&O)

JYOTHYLAB

KIRIINDUS

KTKBANK

M&M (F&O)

MIRZAINT

PARAGMILK

STARCEMENT

TNPL

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BANDHANBNK (F&O)

EPL

PETRONET (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

IGL (F&O)

MAXHEALTH

COLPAL (F&O)

HAVELLS (F&O)

BALAMINES

BAJAJCON

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

IEX (F&O)

APTECHT

OIL

HGINFRA

CAMLINFINE

TITAN (F&O)

PHOENIXLTD

AMIORG

SUNTECK

TATAMOTORS (F&O)

ASTRAL (F&O)

M&M (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

APTUS

AWHCL

BORORENEW

GATI

RALLIS

SEQUENT

VIJAYA

XCHANGING

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

TEJASNET

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| GLENMARK (F&O) | 519.80 | 523.27 | 517.56 | 528.74 | 534.50 | 540.29 | 546.12 |

| DRREDDY (F&O) | 5034.60 | 5041.00 | 5023.27 | 5056.24 | 5074.02 | 5091.84 | 5109.69 |

| GDL | 255.30 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| LTI (F&O) | 5765.40 | 5776.00 | 5757.02 | 5792.12 | 5811.16 | 5830.22 | 5849.32 |

| ALKEM (F&O) | 3970.40 | 3984.77 | 3969.00 | 3998.56 | 4014.38 | 4030.23 | 4046.12 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| PAISALO | 939.80 | 937.89 | 945.56 | 930.72 | 923.10 | 915.52 | 907.97 |

| APCOTEXIND | 431.40 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| ADANIPORTS (F&O) | 743.95 | 742.56 | 749.39 | 736.13 | 729.36 | 722.63 | 715.92 |

| GAEL | 170.85 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| GSPL | 309.90 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| COALINDIA (F&O) | 42359592 | 197.95 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| BHARTIARTL (F&O) | 25598885 | 699.25 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| IOC (F&O) | 20207254 | 129.90 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| ADANIPOWER | 18388056 | 106.50 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| INDHOTEL (F&O) | 11041670 | 193.60 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

| HINDPETRO (F&O) | 10612386 | 314.45 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| IRCTC (F&O) | 7369295 | 4166.10 | 4176.39 | 4160.25 | 4190.47 | 4206.66 | 4222.89 | 4239.14 |

| WELCORP | 7129284 | 148.45 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| RELIANCE (F&O) | 6245770 | 2609.20 | 2613.77 | 2601.00 | 2625.25 | 2638.07 | 2650.92 | 2663.81 |

| LXCHEM | 5557228 | 591.30 | 594.14 | 588.06 | 599.95 | 606.09 | 612.26 | 618.46 |

| INDUSINDBK (F&O) | 5270013 | 1168.60 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| GUJGASLTD (F&O) | 4791343 | 627.80 | 631.27 | 625.00 | 637.24 | 643.57 | 649.92 | 656.31 |

| AARTIIND (F&O) | 4383093 | 1066.20 | 1072.56 | 1064.39 | 1080.23 | 1088.46 | 1096.72 | 1105.01 |

| DEEPAKNTR (F&O) | 3829744 | 2670.55 | 2678.06 | 2665.14 | 2689.67 | 2702.65 | 2715.66 | 2728.70 |

| HCLTECH (F&O) | 3710314 | 1305.15 | 1314.06 | 1305.02 | 1322.48 | 1331.58 | 1340.72 | 1349.89 |

| CHEMPLASTS | 3582316 | 698.20 | 702.25 | 695.64 | 708.54 | 715.20 | 721.90 | 728.64 |

| NOCIL | 3543669 | 306.15 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| PEL (F&O) | 3292971 | 2922.45 | 2929.52 | 2916.00 | 2941.59 | 2955.16 | 2968.76 | 2982.40 |

| SUVEN | 3185410 | 104.10 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| MANALIPETC | 2860646 | 136.30 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| TIRUMALCHM | 2399914 | 324.85 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| CONSOFINVT | 2338781 | 147.95 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| SBILIFE (F&O) | 2282814 | 1261.95 | 1269.14 | 1260.25 | 1277.42 | 1286.37 | 1295.35 | 1304.36 |

| SWSOLAR | 2193878 | 411.25 | 415.14 | 410.06 | 420.04 | 425.18 | 430.35 | 435.55 |

| KANSAINER | 2007949 | 651.35 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| NATIONALUM (F&O) | 53938440 | 102.40 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| IBREALEST | 9320644 | 154.85 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| HINDALCO (F&O) | 8162109 | 495.30 | 495.06 | 500.64 | 489.76 | 484.24 | 478.75 | 473.30 |

| DLF (F&O) | 6736683 | 415.65 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| DEVYANI | 5977801 | 112.50 | 110.25 | 112.89 | 107.69 | 105.12 | 102.57 | 100.05 |

| CIPLA (F&O) | 4986700 | 934.55 | 930.25 | 937.89 | 923.10 | 915.52 | 907.97 | 900.45 |

| SCI | 3875912 | 128.25 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| INDIACEM | 3814390 | 195.40 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| FILATEX | 2885708 | 105.70 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| BHARATFORG (F&O) | 2455538 | 722.90 | 722.27 | 729.00 | 715.92 | 709.25 | 702.60 | 695.99 |

| MANINFRA | 1991552 | 108.60 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| JINDALSAW | 1886555 | 117.80 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| GODREJPROP (F&O) | 1527266 | 2285.45 | 2280.06 | 2292.02 | 2269.27 | 2257.38 | 2245.51 | 2233.68 |

| BALRAMCHIN | 1514770 | 384.50 | 380.25 | 385.14 | 375.58 | 370.75 | 365.95 | 361.18 |

| TEJASNET | 1465268 | 516.20 | 511.89 | 517.56 | 506.50 | 500.89 | 495.31 | 489.76 |

| TRIVENI | 1239227 | 199.75 | 199.52 | 203.06 | 196.10 | 192.61 | 189.16 | 185.73 |

| OBEROIRLTY | 1192687 | 886.70 | 885.06 | 892.52 | 878.08 | 870.69 | 863.32 | 855.99 |

| ISEC | 926237 | 759.00 | 756.25 | 763.14 | 749.77 | 742.93 | 736.13 | 729.36 |

| SPENCERS | 911046 | 129.55 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| TRITURBINE | 792986 | 178.10 | 175.56 | 178.89 | 172.35 | 169.08 | 165.85 | 162.64 |

| SHOPERSTOP | 726934 | 282.15 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| GABRIEL | 620028 | 154.90 | 153.14 | 156.25 | 150.14 | 147.09 | 144.07 | 141.09 |

| NIITLTD | 568373 | 353.10 | 351.56 | 356.27 | 347.06 | 342.42 | 337.81 | 333.23 |

| APLAPOLLO | 503854 | 853.00 | 848.27 | 855.56 | 841.42 | 834.18 | 826.98 | 819.80 |

| IPCALAB | 341012 | 2348.55 | 2340.14 | 2352.25 | 2329.23 | 2317.17 | 2305.15 | 2293.16 |