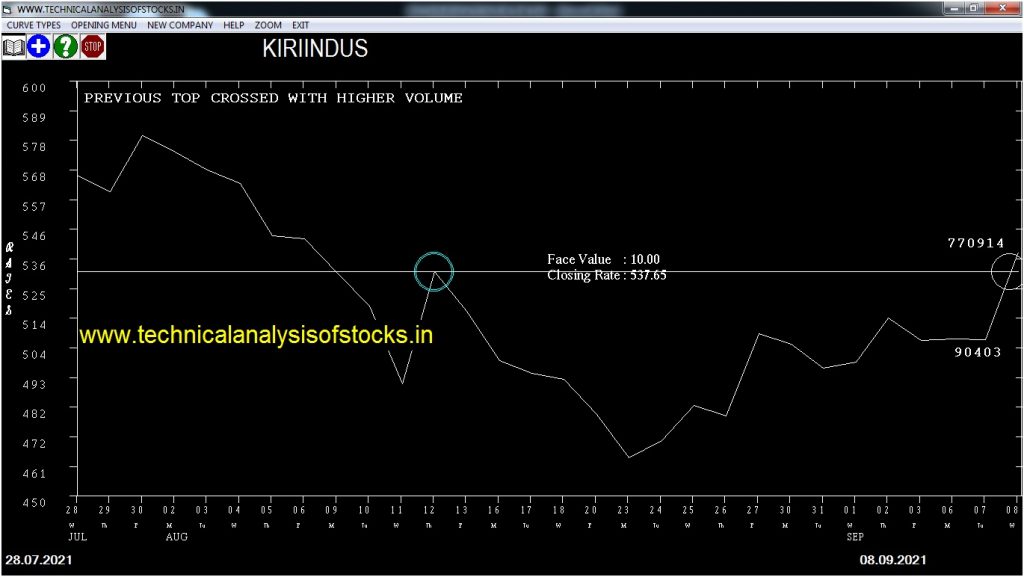

BUY KIRIINDUS (NSE Symbol) Buy@ 540.55 or Above after cooling period. SIGNAL : PREVIOUS TOP CROSSED WITH HIGHER VOLUME. Stop Loss : 512.15 Target : 563.80 (Short term)

HOT BUZZING STOCKS (09.09.2020)

NSE SYMBOL CLOSING RATE

SMARTLINK 123.35

ROML 78.50

BROOKS 131.15

NGIL 88.80

SHEMAROO 124.75

SORILINFRA 126.95

MCDHOLDING 49.95

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| ELGIEQUIP | 14561 | 202.75 | 203.00 | 0.12 |

| PFC (F&O) | 31143 | 130.80 | 132.20 | 1.06 |

| OIL | 31940 | 187.00 | 189.65 | 1.40 |

| CENTURYPLY | 17310 | 411.00 | 419.70 | 2.07 |

| GHCL | 25559 | 379.00 | 387.90 | 2.29 |

| PRINCEPIPE | 30812 | 678.80 | 696.10 | 2.49 |

| ELECON | 29646 | 175.40 | 180.40 | 2.77 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| GICRE | 12863 | 145.00 | 144.95 | 0.03 |

| LT (F&O) | 96978 | 1672.20 | 1666.55 | 0.34 |

| DIVISLAB (F&O) | 64711 | 5150.00 | 5085.05 | 1.28 |

| EMAMILTD | 11741 | 591.35 | 581.85 | 1.63 |

| SUMICHEM | 10439 | 414.20 | 407.45 | 1.66 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| SHOPERSTOP | 11784 | 252.02 | 232.68 | 268.01 | 251.85 | 254.90 | -1.21 |

| CREDITACC | 10612 | 702.25 | 669.85 | 728.64 | 698.00 | 710.00 | -1.72 |

| WINDLAS | 20855 | 400.00 | 375.58 | 420.04 | 396.65 | 404.80 | -2.05 |

| SCI | 20683 | 110.25 | 97.56 | 120.94 | 108.70 | 111.25 | -2.35 |

| SHOPERSTOP | 11784 | 252.02 | 232.68 | 268.01 | 251.85 | 257.80 | -2.36 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| HINDALCO (F&O) | 81135 | 451.56 | 478.28 | 430.78 | 456.30 | 455.05 | 0.27 |

| BSOFT | 38848 | 395.02 | 420.04 | 375.58 | 399.70 | 398.00 | 0.43 |

| PIIND (F&O) | 38975 | 3378.52 | 3449.84 | 3322.30 | 3380.80 | 3329.00 | 1.53 |

| TATASTEEL (F&O) | 114775 | 1425.06 | 1471.90 | 1388.26 | 1429.85 | 1407.00 | 1.60 |

| NBVENTURES | 10542 | 107.64 | 120.94 | 97.56 | 109.40 | 107.00 | 2.19 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| CREDITACC | 1.72% |

| SCI | 2.35% |

| BEML | 2.81% |

| NMDC (F&O) | 3.42% |

| MAXHEALTH | 3.61% |

| LAURUSLABS | 3.81% |

| ASTRAL (F&O) | 4.16% |

| LAURUSLABS | 4.18% |

| EIDPARRY | 4.57% |

| VENUSREM | 4.63% |

| RKFORGE | 4.94% |

| CARTRADE | 5.00% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| GUFICBIO | 0.05% |

| SCI | 0.23% |

| ZENSARTECH | 0.46% |

| MANAPPURAM (F&O) | 0.88% |

| DREDGECORP | 0.99% |

| TIINDIA | 1.07% |

| DMART | 1.19% |

| SHOPERSTOP | 1.21% |

| SRF (F&O) | 1.70% |

| EIDPARRY | 1.73% |

| TATASTEEL (F&O) | 1.79% |

| BAJFINANCE (F&O) | 1.82% |

| ICICIBANK (F&O) | 1.92% |

| JSWSTEEL (F&O) | 1.99% |

| WINDLAS | 2.05% |

| TATACOFFEE | 2.05% |

| REPCOHOME | 2.25% |

| PIIND (F&O) | 2.25% |

| AUBANK (F&O) | 2.34% |

| IOLCP | 2.56% |

| ABB | 2.57% |

| ADANIENT (F&O) | 2.63% |

| IBULHSGFIN (F&O) | 2.81% |

| MAXHEALTH | 2.83% |

| KSCL | 2.91% |

| LT (F&O) | 3.09% |

| UTIAMC | 3.30% |

| DIVISLAB (F&O) | 3.67% |

| INDIANB | 3.73% |

| SUNTV (F&O) | 3.74% |

| OBEROIRLTY | 3.76% |

| LALPATHLAB (F&O) | 3.82% |

| NBVENTURES | 3.84% |

| BAJAJFINSV (F&O) | 3.86% |

| HINDALCO (F&O) | 3.88% |

| COFORGE (F&O) | 3.90% |

| SAIL (F&O) | 4.33% |

| SBICARD | 4.74% |

| GATI | 4.78% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

FIEMIND

HIRECT

JAICORPLTD

MIDHANI

PANAMAPET

PRESTIGE

WONDERLA

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

HEMIPROP

SANDHAR

ZOTA

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMARAJABAT (F&O)

BAJFINANCE (F&O)

BDL

BERGEPAINT (F&O)

BURGERKING

CADILAHC (F&O)

DMART

GESHIP

GLS

GSPL

INOXLEISUR

KIRLOSENG

KPITTECH

M&M (F&O)

MCDOWELL-N (F&O)

MGL (F&O)

MON100

RADICO

SBIN (F&O)

TATACOMM

WELCORP

Higher Level Consolidation

ACC (F&O)

BAJAJFINSV (F&O)

BANDHANBNK (F&O)

BERGEPAINT (F&O)

CADILAHC (F&O)

CIPLA (F&O)

COLPAL (F&O)

DIVISLAB (F&O)

DMART

FINCABLES

GODREJCP (F&O)

HDFCBANK (F&O)

HINDUNILVR (F&O)

LAURUSLABS

MON100

NATCOPHARM

NIACL

SBILIFE (F&O)

SBIN (F&O)

UBL (F&O)

Lower Level Consolidation

BAJAJFINSV (F&O)

BAJFINANCE (F&O)

BERGEPAINT (F&O)

BURGERKING

CADILAHC (F&O)

CARTRADE

CHOLAFIN (F&O)

GESHIP

GLS

ITC (F&O)

JSWSTEEL (F&O)

KANSAINER

M&M (F&O)

MANINDS

MON100

SAIL (F&O)

SBIN (F&O)

TATAELXSI

UPL (F&O)

WINDLAS

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

APLAPOLLO

ZENTEC

GAP DOWN BREAKOUT STOCKS

ASIANTILES

INFY (F&O)

MHRIL

MOIL

NTPC (F&O)

ONGC (F&O)

PTC

VEDL (F&O)

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

GOLDENTOBC

SUPERHOUSE

UNIVCABLES

BEARISH ENGULFING

LUMAXTECH

MAHINDCIE

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

POWERGRID (F&O)

NIITLTD

IOLCP

GLS

HINDCOPPER

SEQUENT

SAIL (F&O)

GUJGASLTD (F&O)

RELAXO

SUNTV (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

HINDZINC

CIPLA (F&O)

METROPOLIS (F&O)

UTIAMC

CADILAHC (F&O)

ADANIPORTS (F&O)

ICICIGI (F&O)

VSTTILLERS

KAJARIACER

ASTERDM

UBL (F&O)

SWSOLAR

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

AEGISCHEM

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

APOLLO

GATI

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

EVEREADY

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

GOLDENTOBC

NGIL

SHEMAROO

BEARISH MARUBOZU PATTERN

VISHAL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NAUKRI (F&O)

BEARISH BELLHOLD PATTERN

MOIL

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BEPL

COALINDIA (F&O)

DHANUKA

ESCORTS (F&O)

GAIL (F&O)

HINDZINC

ICICIGI (F&O)

MIRZAINT

NATCOPHARM

REDINGTON

SEQUENT

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ENGINERSIN

ITI

L&TFH (F&O)

LUPIN (F&O)

MIDHANI

WELCORP

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BALKRISIND (F&O) | 2476.70 | 2487.52 | 2475.06 | 2498.75 | 2511.26 | 2523.80 | 2536.37 |

| IPL | 326.35 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| AARTIIND (F&O) | 910.30 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| MARICO (F&O) | 560.95 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| JBCHEPHARM | 1785.60 | 1795.64 | 1785.06 | 1805.35 | 1815.98 | 1826.65 | 1837.35 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| QUICKHEAL | 225.00 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| FDC | 349.15 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |

| FSL | 189.40 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| GATI | 140.10 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| STARCEMENT | 106.65 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| TATAPOWER (F&O) | 16351745 | 133.25 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| KOTAKBANK (F&O) | 15249557 | 1815.35 | 1816.89 | 1806.25 | 1826.65 | 1837.35 | 1848.08 | 1858.84 |

| IEX | 12678838 | 591.00 | 594.14 | 588.06 | 599.95 | 606.09 | 612.26 | 618.46 |

| IBREALEST | 11361503 | 148.50 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| UJJIVAN | 10004798 | 143.15 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| LXCHEM | 9112697 | 504.50 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| PFC (F&O) | 7015784 | 132.20 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| RECLTD (F&O) | 6665496 | 157.55 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| CANFINHOME | 6550645 | 639.90 | 643.89 | 637.56 | 649.92 | 656.31 | 662.73 | 669.18 |

| ICICIPRULI (F&O) | 5081027 | 717.15 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

| SCI | 3244068 | 108.70 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| NAM-INDIA (F&O) | 3205859 | 435.80 | 441.00 | 435.77 | 446.04 | 451.34 | 456.66 | 462.02 |

| BODALCHEM | 2439944 | 111.40 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| REDINGTON | 2322464 | 141.75 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| TRENT (F&O) | 2226426 | 1033.85 | 1040.06 | 1032.02 | 1047.62 | 1055.72 | 1063.86 | 1072.03 |

| EXXARO | 1857872 | 141.00 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| SBICARD | 1637527 | 1108.40 | 1113.89 | 1105.56 | 1121.69 | 1130.08 | 1138.49 | 1146.94 |

| TIRUMALCHM | 1551127 | 198.35 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| AEGISCHEM | 1540352 | 259.65 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| ZENSARTECH | 1484518 | 450.30 | 451.56 | 446.27 | 456.66 | 462.02 | 467.41 | 472.83 |

| STLTECH | 1411648 | 279.25 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| ELGIEQUIP | 1271695 | 203.00 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| ORIENTELEC | 1257356 | 344.20 | 346.89 | 342.25 | 351.39 | 356.09 | 360.82 | 365.58 |

| SUDARSCHEM | 1166281 | 670.25 | 676.00 | 669.52 | 682.17 | 688.72 | 695.29 | 701.90 |

| ZENTEC | 1047749 | 195.35 | 196.00 | 192.52 | 199.42 | 202.96 | 206.54 | 210.14 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| INDUSTOWER (F&O) | 17079606 | 235.85 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| VEDL (F&O) | 13318639 | 298.95 | 297.56 | 301.89 | 293.41 | 289.14 | 284.91 | 280.70 |

| JAICORPLTD | 2648930 | 137.00 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| MOL | 2255412 | 116.45 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| BSOFT | 1928870 | 399.70 | 395.02 | 400.00 | 390.26 | 385.33 | 380.44 | 375.58 |

| KOLTEPATIL | 1595681 | 293.40 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| PTC | 1519372 | 102.65 | 102.52 | 105.06 | 100.05 | 97.56 | 95.11 | 92.69 |

| OBEROIRLTY | 726451 | 774.20 | 770.06 | 777.02 | 763.52 | 756.63 | 749.77 | 742.93 |

| APTUS | 714841 | 360.45 | 356.27 | 361.00 | 351.74 | 347.06 | 342.42 | 337.81 |

| DIVISLAB (F&O) | 670825 | 5085.05 | 5076.56 | 5094.39 | 5061.30 | 5043.52 | 5025.78 | 5008.07 |

| MOIL | 546788 | 169.35 | 169.00 | 172.27 | 165.85 | 162.64 | 159.47 | 156.33 |

| NAVINFLUOR (F&O) | 423567 | 4008.05 | 4000.56 | 4016.39 | 3986.76 | 3970.98 | 3955.24 | 3939.53 |

| RIIL | 319232 | 692.75 | 689.06 | 695.64 | 682.86 | 676.34 | 669.85 | 663.39 |

| VSSL | 237094 | 266.80 | 264.06 | 268.14 | 260.15 | 256.13 | 252.14 | 248.19 |

| MFL | 206623 | 659.75 | 656.64 | 663.06 | 650.58 | 644.21 | 637.88 | 631.58 |

| MANINDS | 205526 | 116.10 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| RPGLIFE | 182231 | 609.70 | 606.39 | 612.56 | 600.55 | 594.44 | 588.36 | 582.31 |

| NESTLEIND (F&O) | 172373 | 19839.60 | 19810.56 | 19845.77 | 19785.28 | 19750.12 | 19714.99 | 19679.90 |

| PANACEABIO | 167974 | 308.95 | 306.25 | 310.64 | 302.04 | 297.71 | 293.41 | 289.14 |

| RUSHIL | 157411 | 246.70 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| BASF | 155655 | 3444.75 | 3436.89 | 3451.56 | 3423.96 | 3409.34 | 3394.76 | 3380.20 |

| SECURKLOUD | 154803 | 152.90 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |