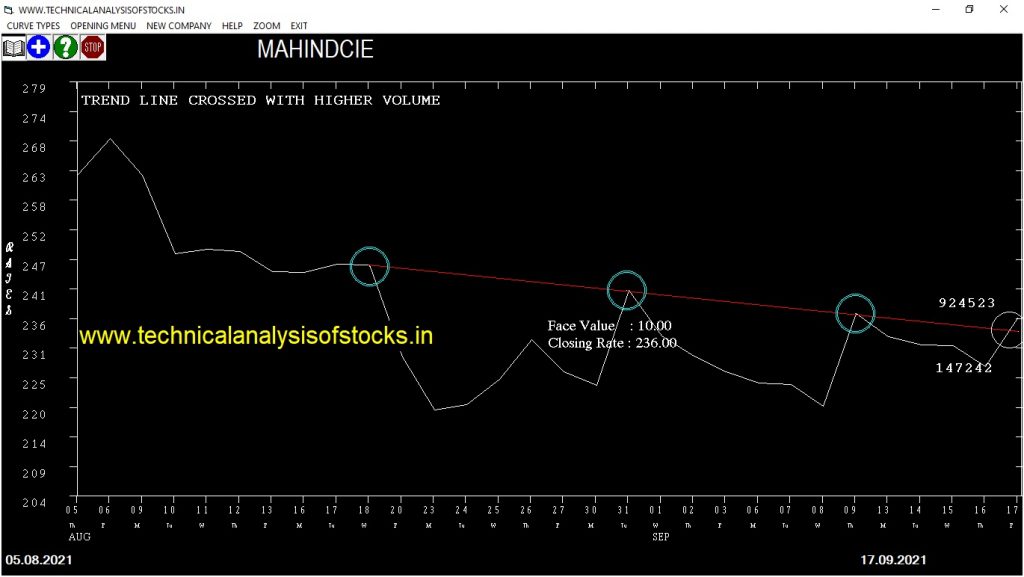

BUY MAHINDCIE (NSE Symbol) Buy@ 236.40 or Above after cooling period. SIGNAL : TREND LINE CROSSED WITH HIGHER VOLUME. Stop Loss : 217.70 Target : 251.90 (Short term)

HOT BUZZING STOCKS (20.09.2020)

NSE SYMBOL CLOSING RATE

| BUTTERFLY | 888.35 |

| NGIL | 103.95 |

| SUULD | 562.25 |

| XPROINDIA | 453.80 |

| PAR | 150.00 |

| JAIPURKURT | 59.35 |

| MCDHOLDING | 66.75 |

| BROOKS | 141.50 |

| KANORICHEM | 199.80 |

| LXCHEM | 539.80 |

| PITTIENG | 153.00 |

| SHREYAS | 383.20 |

| YAARII | 104.50 |

| ZENTEC | 193.90 |

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| POLYCAB (F&O) | 120620 | 2503 | 2506 | 0.11 |

| KEI | 65533 | 841 | 844.2 | 0.37 |

| MARUTI (F&O) | 93525 | 6958 | 7014 | 0.8 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| SOBHA | 10688 | 742 | 741.4 | 0.08 |

| AUBANK (F&O) | 72811 | 1118 | 1116 | 0.16 |

| ZOMATO | 150604 | 138.6 | 137.9 | 0.47 |

| FORTIS | 29635 | 269.4 | 268 | 0.54 |

| MUTHOOTFIN (F&O) | 58605 | 1524 | 1514 | 0.66 |

| UPL (F&O) | 74141 | 747.4 | 742.4 | 0.68 |

| ACC (F&O) | 31099 | 2413 | 2395 | 0.76 |

| PRESTIGE | 44095 | 415.7 | 410.6 | 1.23 |

| CANFINHOME (F&O) | 37954 | 616 | 608 | 1.32 |

| ALKYLAMINE | 43016 | 4015 | 3954 | 1.55 |

| ORIENTCEM | 14360 | 160.2 | 157.6 | 1.68 |

| VBL | 26592 | 910.1 | 882.1 | 3.17 |

| APTUS | 17835 | 359.1 | 346.9 | 3.5 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| MINDAIND | 33953 | 715.56 | 682.86 | 742.19 | 713.95 | 714.90 | -0.13 |

| SYMPHONY | 18030 | 1032.02 | 992.75 | 1063.86 | 1027.25 | 1035.90 | -0.84 |

| CIPLA (F&O) | 43860 | 961.00 | 923.10 | 991.75 | 954.05 | 963.00 | -0.94 |

| MAHINDCIE | 22327 | 236.39 | 217.67 | 251.89 | 236.00 | 239.45 | -1.46 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| WELSPUNIND | 25940 | 129.39 | 143.93 | 118.32 | 131.55 | 131.40 | 0.11 |

| JUSTDIAL | 11302 | 976.56 | 1015.51 | 946.04 | 984.35 | 981.00 | 0.34 |

| BANCOINDIA | 11109 | 203.06 | 221.15 | 189.16 | 203.40 | 202.00 | 0.69 |

| TATACONSUM (F&O) | 36062 | 870.25 | 907.06 | 841.42 | 874.15 | 864.95 | 1.05 |

| CROMPTON | 28599 | 484.00 | 511.63 | 462.48 | 486.10 | 480.00 | 1.25 |

| HDFCAMC (F&O) | 32118 | 3263.27 | 3333.39 | 3207.99 | 3268.80 | 3221.85 | 1.44 |

| DIVISLAB (F&O) | 30905 | 5112.25 | 5199.41 | 5043.52 | 5122.80 | 5048.05 | 1.46 |

| EXIDEIND (F&O) | 50140 | 182.25 | 199.42 | 169.08 | 184.45 | 181.15 | 1.79 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| LICHSGFIN (F&O) | 2.27% |

| GAEL | 3.44% |

| HDFCLIFE (F&O) | 3.73% |

| ANURAS | 4.03% |

| ALEMBICLTD | 4.09% |

| BODALCHEM | 4.15% |

| PNCINFRA | 4.31% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| MINDAIND | 0.13% |

| GAEL | 0.77% |

| SYMPHONY | 0.84% |

| EXIDEIND (F&O) | 0.87% |

| CIPLA (F&O) | 0.94% |

| MAHINDCIE | 1.46% |

| JUSTDIAL | 1.58% |

| TATACONSUM (F&O) | 1.70% |

| LICHSGFIN (F&O) | 1.76% |

| ASTRAL (F&O) | 1.85% |

| DIVISLAB (F&O) | 1.96% |

| ERIS | 1.99% |

| IPL | 2.09% |

| CROMPTON | 2.12% |

| BAJAJFINSV (F&O) | 2.14% |

| MAZDOCK | 2.14% |

| VGUARD | 2.29% |

| STLTECH | 2.57% |

| ICICIGI (F&O) | 2.58% |

| VRLLOG | 2.89% |

| HDFCAMC (F&O) | 2.94% |

| STOVEKRAFT | 2.96% |

| UTIAMC | 3.34% |

| MUTHOOTFIN (F&O) | 3.40% |

| WIPRO (F&O) | 3.52% |

| LINDEINDIA | 3.61% |

| TATACOFFEE | 3.77% |

| WELCORP | 3.95% |

| ICIL | 4.00% |

| UPL (F&O) | 4.06% |

| CARERATING | 4.17% |

| ACC (F&O) | 4.31% |

| EMAMILTD | 4.41% |

| ASHIANA | 4.65% |

| RAIN | 4.88% |

| WELSPUNIND | 4.94% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

INDUSTOWER (F&O) Sell @ 268.15 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

BHARTIARTL (F&O)

CESC

ZENTEC

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

NIL

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

CAMS

JUSTDIAL

Higher Level Consolidation

JUSTDIAL

PETRONET (F&O)

Lower Level Consolidation

COLPAL (F&O)

JUSTDIAL

MON100

RELIANCE (F&O)

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

DMART

KOTAKBANK (F&O)

MARUTI (F&O)

VGUARD

GAP DOWN BREAKOUT STOCKS

CHEMPLASTS

HEIDELBERG

LXCHEM

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

MSTCLTD

BEARISH ENGULFING

ASIANTILES

BANDHANBNK (F&O)

CHALET

DIVISLAB (F&O)

EMAMILTD

NAVINFLUOR (F&O)

PERSISTENT

SOBHA

SRTRANSFIN (F&O)

SUNPHARMA (F&O)

TORNTPOWER (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

SWANENERGY

AUBANK (F&O)

M&M (F&O)

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

POWERINDIA

BAJAJFINSV (F&O)

HDFC (F&O)

CIPLA (F&O)

RECLTD (F&O)

ICICIPRULI (F&O)

KEI

AXISBANK (F&O)

LICHSGFIN (F&O)

BIOCON (F&O)

MPHASIS (F&O)

HINDPETRO (F&O)

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

MOTILALOFS

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

ABCAPITAL

ASTRAMICRO

CASTROLIND

GNA

HEIDELBERG

HIKAL

HINDOILEXP

KRBL

LXCHEM

PERSISTENT

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

PITTIENG

SHREYAS

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

BROOKS

GET&D

NELCO

SHANKARA

TEXMOPIPES

VIMTALABS

YAARII

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

BERGEPAINT (F&O)

INDIACEM

ITDCEM

KOTAKBANK (F&O)

KTKBANK

MGL (F&O)

PARAGMILK

REDINGTON

STARCEMENT

TATAMOTORS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

COROMANDEL (F&O)

EPL

ITI

L&TFH (F&O)

MIDHANI

PETRONET (F&O)

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| DHAMPURSUG | 302.15 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| BEPL | 182.40 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| CIGNITITEC | 569.60 | 570.02 | 564.06 | 575.71 | 581.72 | 587.77 | 593.84 |

| RAMCOSYS | 504.85 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| TRIVENI | 178.25 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BAJAJFINSV (F&O) | 16840.20 | 16835.06 | 16867.52 | 16811.04 | 16778.64 | 16746.26 | 16713.92 |

| HINDCOPPER | 116.80 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| ASHIANA | 189.20 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| HCLTECH (F&O) | 1263.30 | 1260.25 | 1269.14 | 1252.02 | 1243.18 | 1234.38 | 1225.61 |

| JUBLFOOD (F&O) | 4102.80 | 4096.00 | 4112.02 | 4082.06 | 4066.09 | 4050.16 | 4034.27 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZEEL (F&O) | 76050862 | 255.45 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| M&MFIN (F&O) | 19994657 | 179.35 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| IRCTC (F&O) | 12324159 | 3863.40 | 3875.06 | 3859.52 | 3888.70 | 3904.30 | 3919.93 | 3935.59 |

| FSL | 9211305 | 207.80 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| EASEMYTRIP | 7829827 | 662.35 | 663.06 | 656.64 | 669.18 | 675.66 | 682.17 | 688.72 |

| BURGERKING | 4991657 | 164.65 | 165.77 | 162.56 | 168.92 | 172.18 | 175.47 | 178.80 |

| MSTCLTD | 4068606 | 322.60 | 324.00 | 319.52 | 328.35 | 332.90 | 337.47 | 342.08 |

| SWSOLAR | 3515034 | 363.55 | 365.77 | 361.00 | 370.38 | 375.20 | 380.06 | 384.95 |

| DABUR (F&O) | 2959141 | 653.95 | 656.64 | 650.25 | 662.73 | 669.18 | 675.66 | 682.17 |

| POLYCAB | 2205385 | 2505.75 | 2512.52 | 2500.00 | 2523.80 | 2536.37 | 2548.97 | 2561.61 |

| BLS | 2157711 | 304.85 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| BAJAJELEC | 1942534 | 1490.80 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| MANALIPETC | 1551046 | 103.15 | 105.06 | 102.52 | 107.59 | 110.19 | 112.83 | 115.50 |

| NBVENTURES | 1422018 | 119.95 | 121.00 | 118.27 | 123.70 | 126.50 | 129.33 | 132.18 |

| MOTILALOFS | 1243142 | 818.30 | 819.39 | 812.25 | 826.15 | 833.35 | 840.58 | 847.84 |

| CHENNPETRO | 1114699 | 118.25 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| MAHINDCIE | 924523 | 236.00 | 236.39 | 232.56 | 240.13 | 244.02 | 247.94 | 251.89 |

| UFO | 920192 | 100.75 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| UFLEX | 889925 | 559.25 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| VISHAL | 843811 | 126.70 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| INTELLECT | 825017 | 677.60 | 682.52 | 676.00 | 688.72 | 695.29 | 701.90 | 708.54 |

| ADVENZYMES | 806265 | 398.95 | 400.00 | 395.02 | 404.81 | 409.86 | 414.93 | 420.04 |

| DMART | 767511 | 4239.65 | 4241.27 | 4225.00 | 4255.43 | 4271.75 | 4288.10 | 4304.49 |

| GAEL | 631410 | 181.55 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| QUESS | 613230 | 972.20 | 976.56 | 968.77 | 983.90 | 991.75 | 999.64 | 1007.56 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SAIL (F&O) | 49076581 | 115.15 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| CANBK (F&O) | 44856907 | 162.75 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| SBIN (F&O) | 41529478 | 454.10 | 451.56 | 456.89 | 446.49 | 441.22 | 435.98 | 430.78 |

| ZOMATO | 23264091 | 137.90 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| NMDC (F&O) | 20729611 | 147.40 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| TATASTEEL (F&O) | 19572030 | 1385.90 | 1378.27 | 1387.56 | 1369.68 | 1360.45 | 1351.24 | 1342.06 |

| COALINDIA (F&O) | 17317065 | 156.70 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| VEDL (F&O) | 16865737 | 302.00 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| MAXHEALTH | 13751716 | 379.25 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| JINDALSTEL (F&O) | 12906039 | 386.60 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| HINDALCO (F&O) | 12113274 | 473.05 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| ASTERDM | 10316306 | 216.35 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| DLF (F&O) | 9901964 | 334.75 | 333.06 | 337.64 | 328.68 | 324.16 | 319.68 | 315.22 |

| IBREALEST | 8003229 | 134.70 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| BANDHANBNK (F&O) | 7805954 | 287.25 | 284.77 | 289.00 | 280.70 | 276.53 | 272.39 | 268.27 |

| FINPIPE | 7485261 | 189.40 | 189.06 | 192.52 | 185.73 | 182.34 | 178.98 | 175.65 |

| DELTACORP | 7383835 | 228.65 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| MANAPPURAM (F&O) | 6450126 | 163.75 | 162.56 | 165.77 | 159.47 | 156.33 | 153.22 | 150.14 |

| AMBUJACEM (F&O) | 5274442 | 419.80 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| DEVYANI | 5269773 | 115.80 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| ABCAPITAL | 4182186 | 109.40 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| IIFL | 4004440 | 280.50 | 276.39 | 280.56 | 272.39 | 268.27 | 264.19 | 260.15 |

| INDHOTEL (F&O) | 3971900 | 149.05 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| MFSL (F&O) | 3421832 | 1081.70 | 1080.77 | 1089.00 | 1073.10 | 1064.92 | 1056.78 | 1048.66 |

| CARBORUNIV | 3236651 | 859.15 | 855.56 | 862.89 | 848.69 | 841.42 | 834.18 | 826.98 |